The Deloitte view for non-life insurers

Welcome to the July edition of the Insurance Market Update in which we focus upon issues in the non-life insurance sector.

The motor insurance industry is facing a challenging environment in which pressure is coming from an increasing cost of claims, despite premium increases. After the unprecedented level of loss experienced by the UK motor insurance market in 2009, this trend continued into 2010 with insurers losing 20p for each £1 premium earned.

Although premium increases of up to 40% for private motor policies have been widely reported in the press we estimate the motor insurance market increased its premium base by 10% reflecting selective underwriting for policy renewals and the lower increases in the commercial market. When the results are announced for 2011, we expect to a see a greater increase in premiums as the ratings action which commenced in 2010 takes full effect. We also gaze into the crystal ball and consider possible scenarios of where the market will go next.

In this edition James Rakow reviews the state of the motor insurance market, in particular commenting upon the underwriting results and the main drivers impacting those results. We also examine the reasons for the dramatic increase in personal injury claims and comment on how insurers are looking to quantify risks and identify better customers for targeting. As always we look forward to receiving your feedback: your views, comments and suggestions for future themes or topics are most welcome.

Who's reading the map?

The 2010 underwriting results were always going to be interesting after the unprecedented level of loss experienced by the UK motor insurance market in 2009. With premium increases of up to 40% widely reported in the press it appeared that the UK market was driving very quickly in response to rising claim costs. However, the 2010 results suggest that the upward pressure on motor premiums is still very much there.

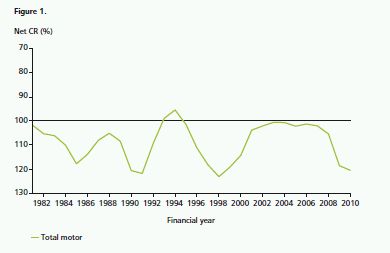

The 2010 results, based on data submitted to the Financial Services Authority, show that collectively the industry is a long way from declaring an underwriting profit. Insurers lost 20p for every pound of premium earned, posting a net combined ratio of 120%, slightly worse than the figure for 2009 of 119%. Figure 1 shows that when a similar double dip was last experienced in 1990 to 1991 it only took the market two years to move from the bottom of the cycle to the top. Is the market now in a position to replicate this turn-around?

Promising signs?

The motor insurance market increased its premiums by an estimated 10% between 2009 and 2010. 2011 is likely to see a greater increase as the rating actions started in 2010 take full effect and further rate adjustments are made in light of the evolving sociolegal environment.

At a market level the reserves established by insurers were topped up in 2010, the first significant strengthening since the last recession in the early nineties. This ended a period of unprecedented reserve releases, which had served to prop up the headline market results for the last seven years. This prior year reserve strengthening masks the encouraging signs from 'the pure' year result which, as figure 2 shows, has seen the first improvement since 2002 and reflects the rating actions already being taken.

Where next?

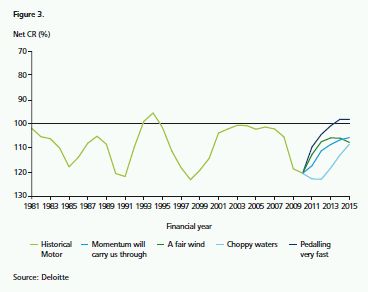

So, from these underwriting loss levels, where will the market result go next? Depending on a number of factors, the market could follow any of several different paths. We have identified four potential scenarios, as follows:

- Momentum will carry us through: a slow movement back towards profitability over the next few years based on moderate premium growth in the market and continued reserve strengthening.

- A fair wind: an initial movement back towards profitability over the next few years, based on more substantial premium growth in the market and no reserve adjustments, followed by another fall in profitability.

- Choppy waters: a continued decline for the next couple of years, followed by a move back to profitability based on low initial premium growth in the market, continued reserve strengthening and higher levels of claims inflation.

- Pedalling very fast: substantial premium growth in the market, low levels of reserve strengthening and reduced operating expenses.

Figure 3 shows how each of these different scenarios could play out over the next five years.

The claims environment

One key area in efforts to move the UK motor insurance market back to profitability is the claims environment. The word cloud in Figure 4 summarises the perception of attendees of this year's Annual Deloitte Motor Insurance Seminars1 when asked "what are the main issues facing the UK motor insurance industry". The relative size of the word corresponds to the frequency of its occurrence. It is clear that the market's main focus is on claims related activities.

Set in the overall context of high losses in the market, it is perhaps unsurprising that claims-related issues dominate people's thoughts. Although, the overall frequency of motor claims has reduced since 2001 the number of personal injury claims has increased dramatically, as has their average cost. The speed of this change can in part be attributed to the unintended consequences of historical legislation.

Conditional fee arrangements (CFAs) were brought in as part of the 1999 Woolf reforms with the aim of allowing 'economically disadvantaged' individuals access to the legal system by enabling lawyers to pursue cases on legal merit. In reality a new industry was born, no win-no fee. This, coupled with a growing compensation culture and commercialisation of the civil litigation market has led to spiralling claims costs.

Capturing the First Notification of Loss is now key to many business models as this means more control over claims and also the ability to maximise the revenue from the non fault component. The non fault component has led to a second new industry, claims farming, where referral and success fees can be generated at all stages of the claims process. Any costs are passed on to the insurer of the at fault driver, including the costs of afterthe- event (ATE) insurance, designed to protect the claimant.

We see this most starkly in TV advertising aimed at new claimants, which make clear the potential to claim for injuries, including relatively minor whiplash, as well as claiming for additional services such as the cost of a replacement car while the damage to their own vehicle is repaired. In the vast majority of cases these costs are picked up by the insurer of the at fault driver. All of this is offered to the non fault party on a no win-no fee basis with the promise that they would not have to pay any of the costs regardless of whether they are subsequently unsuccessful in their claim.

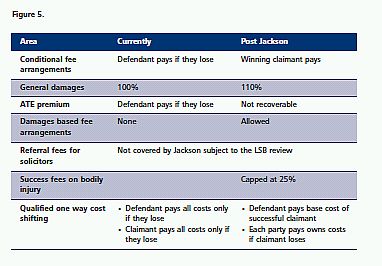

The response to this was the Jackson Report, published in January 2010. In this, Jackson recommended significant changes to the existing CFA system, and in July 2010, the Coalition government announced a consultation on the recommendations of the report. This consultation ran until February 2011, during which time over 600 responses were submitted. On 29 March 2011, the Ministry of Justice published its response and proposed implementation of the majority of reforms. The unusually speedy response possibly reflects the level of appetite for reform.

The future of the reforms are subject to parliamentary process and assuming it proceeds it is expected to be implemented by 2013. The potential impact on the industry of Jackson's key recommendations are summarised in Figure 5.

We will have to wait for the dust to settle to see what is going to happen but it is against a background of upheaval with several different forces acting upon the insurance industry. The claims environment looks set to remain challenging until at least 2013 but from the insurers' perspective they can see a light at the end of what has seemed a very long tunnel.

The customer

While insurers would like to see the market as a whole move back to profitability, most will be looking more closely at their own results, and seeking to find ways to improve their own combined ratio. The ability to access and compare quotes from a number of insurers in one place has made price the number one concern for consumers when choosing a policy, as evidenced by the results of a YouGov survey commissioned by Deloitte in early June2. This survey identified price as the feature most likely to influence a customer when buying a policy, ahead of brand and reputation, a finding which is unlikely to surprise many in the industry.

This price sensitivity means insurers need to think more carefully about their risks. As a result, some insurers are already looking for new ways to quantify risks and identify better customers for targeting. To achieve this, insurers first need to learn more about their customers in order to be able to segment them effectively.

For example, one of the most important pieces of information that an insurer collects for a motor policy is the address of the prospective policyholder. But are insurers certain that their rating model takes into account how much they know about the area? Using techniques such as geospatial mapping, insurers can identify how much they know about the area in which the proposer lives, asking questions such as "Is this an area in which we already have a large number of policies and claims, or is it a new area for us?", or "Do we have enough internal data to price risks in this area accurately, or do we need to access external data?".

Understanding customers better provides insurers with further opportunities to utilise geospatial mapping technologies to create more accurate risk models for customers. This provides an opportunity to influence customer behaviours to reduce risk, examples of which can already be seen around the world. For example, in Australia, statistics on the 'riskiness of roads' are shared with motorcyclists, and in the United States, renewal documentation contains lists of risk factors near to the policyholder's home. Additionally, telemetric data and geospatial analysis can be used together to help investigate both application and claims fraud. There is also scope to use street level mapping to quickly determine whether a property is as described, for example to check whether the customer's property has viable off-street parking.

Traditionally, rating has focused on understanding the vehicle, who is driving it and where. However, in an effort to better understand customers some insurers are looking to use behavioural information in addition to traditional insurance data, which may be far more informative in terms of assessing risk.

Conclusion

As we have addressed; the 2010 underwriting results were always going to be interesting.

2010 gave us some clear signs of the direction the market is likely to move in the next few years. If the momentum gained through premium increases and the potential for improvements in the claims experience heralded by the Jackson review crystallises, the market could return to overall profitability by 2012.

However, there are also some signs that may make the road ahead more challenging. Will we see a sustained period of reserve strengthening, or was 2010 a 'oneoff'; will premiums continue to increase through 2012 or will we start to see rate cuts? We eagerly await the results of 2011 to get a clearer indication of where we are in the underwriting cycle, which could prove to be even more interesting than 2010.

Footnotes

1. 250 respondents, Annual Deloitte Motor Seminar, June 2011

2. Fieldwork undertaken online between 1st-3rd June 2011 on sample size of 2,025 adults. Sample representative of all GB adults (aged 18+).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.