Smart is the new beige – the evolution of mainstream computing

Computing devices are everywhere. What used to be a beige box on your desk is now in your pocket, on your coffee table and inside your TV. But these are very different computers to those that have gone before – more tactile, more customisable and above all, more personal than any device in history.

Their proliferation has been so explosive that 2010 could well be the last year where traditional PCs form the majority of computers sold worldwide. By 2014 smart devices will be the mainstream. As Figure 1 outlines, Deloitte estimates that 700 million smartphones will find their way into the world's pockets in that year alone, not to mention 10's, even 100's of millions of connected TVs, tablets, media centres, even cars. Forget the Web, this is the new global channel.

Needless to say, part of the reason for the success of these smart computing platforms has been the rapid growth of a base of applications (aka apps), enabling customisation of the device to suit the users' preferred modus operendi. At the time of writing, around 350,000 apps were available on Apple's iTunes based store and over 200,000 on the competing Android Market.

Deloitte research into mobile consumption reveals that, on average, 45% of the 34% of consumers who have a smartphone download an app at least once a week.iii So whilst it is clear that it has some way to go before it rivals TV or the web for penetration, the smartphone app market is becoming a noticeable player.

The promises and pitfalls of a smarter world

So far, so Star Trek; it is wholly understandable why global brands have indulged in a mad scramble to launch "an iPhone app" to take advantage of the new frontier. And, akin to many new frontiers, the mobile app market has gold aplenty. Clearly there are sales opportunities – eBay is expected to make $1.5B from smartphone users in 2010 – but the customisability, connectivity and interactivity of smart devices promises to make them the ultimate advertising platform.

Why do we say this? For one, because they are software driven and the software is easily and cheaply customisable, smart devices inherently segment the base of consumers. You can tell a lot about a person from the apps on their iPhone. Furthermore, handheld smart devices offer a lean forward experience where the user is concentrated on what they are doing and have only a small amount of screen real estate to focus on. The invisibility of full screen browser advertising is less of a problem on mobile platforms in general and apps in particular. All of the above is accentuated by the potential of a rich flow of user data – location today, but also potentially motion, temperature, light levels and increasingly images. It is fair to say that the ultimate cultural and economic impact of smart devices has yet to be felt.

For brands, this feels like a golden opportunity to reach consumers directly and in a more meaningful, long term manner. Both brands and their customers are in an experimentation phase, with interesting new possibilities, whether this be teaching people to cook (using a particular brand of ingredients, of course), helping them order a pizza or configuring the car of their dreams (and then arranging a test drive).

As with every gold rush, reality is more challenging than the theoretical winnings. Deloitte has conducted research into app stores to understand quantitatively the success of apps on the main platforms. Unsuprisingly, the main challenge to global brands is to stand out from the crowd; such is the popularity of the devices and their apps. As with any multichannel environment, the key to success is to be noticed. And this is really hard for brands and advertisers.

The trouble is that in traditional media and on the browser-based Web, someone else does the tough job of attracting customers to a channel where an advertisement, be it banner, print, insert, video or audio then does the job of selling the brand. On the app platform it is the brand's job to be noticed upfront.

The returns for success are potentially huge – Volkswagen's Touareg game was downloaded over a million times, with an average playing time of eight minutes, 3,500 test drive requests, and an average player age of 35v. All for the few tens of thousands of dollars cost of an app. But our research suggests that this kind of success is fleetingly rare. Only 20% of the apps published by major consumer and healthcare brands globally were downloaded enough times to appear in our figures and of that 20%, less than 1% were downloaded more than a million times.

And this situation is likely to get worse. As app stores become more popular and users become more mature, getting noticed will become ever-harder. Gone are the days when a pint of beer sliding along a bar will catch the interest of users enough to be downloaded, let alone used regularly.

However, non-participation in the app world does not appear to be an option either. More than three-quarters of mobile app users said they expected all brand name companies to have a mobile app and nearly as many said they expected the app to be easier to use than the company's website.iv

In summary, then, if non-participation in app stores is not an option and effective participation is increasingly challenging, how can brands succeed? Our research indicates that there are a number of key characteristics for apps, which if followed significantly increase the chances of success.

Success factors

Playtime is over(a.k.a. 'utility is king')

A common mistake that brand owners make is to assume that to get consumers to interact with their brands on mobile requires an app. We suggest that the first test of whether an app is needed in lieu of a mobile website is whether that app will offer the user some functionality that is desirable to them. If not, then stick with the website as informational or ad-serving apps combine poor download volumes with poor reviews and may in fact be brand damaging.

Successful branded apps appear to fall into two broad categories – time-killers and utilities. Whilst research shows that games are the most popular category, a branded game must rely on its intrinsic entertainment value to drive downloads rather than the underlying brand. VW and Audi have achieved great results with driving games on the iPhone, however these were the only examples our research uncovered where a major brand had achieved significant downloads with a gaming app.

It is also worth remembering that the mobile app platform is only four years old and its rate of change is extraordinarily fast. At the time that Volkswagen Group succeeded with simulation games there were relatively few similar games on the market. That is no longer as true and competition is forcing up the cost to produce a hit. For example, Firemint's "Real Racing 2", released in early 2011, cost $2M to developvi – a far cry from the estimated $100k cost of an advanced app in early 2010. With games receding as a realistic option for brands seeking to advertise on mobile, the other option is to provide utility apps. Kraft's iFood Assistant is a good example of the type, having been downloaded by around half a million consumers. Kraft's app provides recipes indexed by ingredients, meal type and preparation time as well as a shopping list feature and instructional videos.

In our view, iFood Assistant has been successful because it bundles together a number of characteristics that have driven success for other brands:

- The app harnesses the power of network effects, allowing customers to upload and share their own recipes, improving the experience for all users

- The brand is prominent throughout the content, driving brand awareness

- The app acts as a loyalty programme, offering coupons and discounts

- The app gathers invaluable data on user habits and allows for targeted recipes and coupons to encourage repeat usage

- The app uses the hardware features of the device to offer enhanced experience (in the case of iFood Assistant, a GPS store finder)

The latter is very important. Mobile apps represent an opportunity for users to fully engage and experience a brand, thanks to specific functionality available on smartphones, for example: touch screens, accelerometers, microphones and GPS. In our view, companies should consider whether they can develop an app that creates value for users using these functions, rather than just creating a stripped out version of their website or mobile microsite.

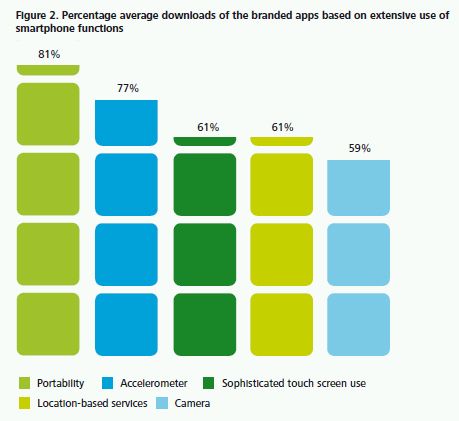

Our research found that, out of the functionality available on smartphones, extensive use of some specific functions is likely to give a branded app significantly higher likelihood of success (see Figure 2).

Playing the app store ratings game

As the number of apps available increases and users become more targeted in their acquisition of apps, the methods used by consumers to discover apps will become more sophisticated and therefore more open to manipulation. The "search" function is now the most common means by which consumers discover apps, so it is crucial that brands understand how to maximise their chances of appearing at the top of search results.

Positive feedback ensures that those apps successful enough to make their way into the top rankings continue to receive the most new downloads; however, Apple prohibits developers and companies from paying to promote their apps directly on the app store – hence it is hugely important to understand how to influence ratings in order to get noticed.

Apple app store rankings tend to be based on a 24-hour rolling window, so bursts of promotional effort will have a greater effect than a longer campaign at regular intervals.

Similarly to search engine optimisation ("SEO") for traditional web search, there are a number of effective ways to promote products on an app store, for example:

- Use keywords in the app name

- Use the keyword in the name of the developer

- Encourage users to write reviews

- Spread the word to app communities, writers and bloggers

- Mention popular related apps as keywords

- Make use of incentivised downloads to drive traffic to the store

The lesson here is to treat app store ratings in the same way as web search – optimisation of the metadata that drives them is an important part of the development and release process. Similarly, the now common subtext to advertising on other media to "download the smartphone app" must remain, even if it is already becoming as ubiquitous and therefore forgettable as the disclaimer.

(Plat)form over function

Equally important as playing the ratings game is deciding which platform to play it on. Although Apple set the trend and developed as the main platform and richest, most populated, platform, its market leading share has been eroded by Google's Android (see Figure 3). With Nokia and Microsoft now cooperating and RIM taking the Blackberry ever more mainstream, the platform aspect of branded apps is becoming more complex.

This is important because the synergies realised by developing apps for multiple platforms are relatively insignificant – Deloitte estimates that the cost of developing the same application for two platforms is 160% of the cost of developing for one.

It is therefore important to target apps to a platform in the same way that advertisements are targeted at a TV channel, newspaper or website. As previously stated, iTunes is the richest platform for apps and iPhone has a significant market share, however its user base is relatively concentrated. Deloitte research shown in Figure 4 shows that the iPhone is typically a professional, white collar device. Targeting apps intended for users outside this group using the iPhone may therefore prove an unsuccessful strategy.

To be successful at treating each platform as a different channel, with different levels of engagement and demographics, businesses must keep the organisation's collective ear to the ground on new technology releases and the ranging strategies of operators to ensure that mobile campaigns take best advantage of the huge marketing spends of carriers and co-incident handset acquisition by consumers, which enable new features to be exploited.

The next chapter ...

The integration of app functionality and platform features is likely to dominate the next phase of exploitation of mobile platforms by advertisers and brands. To date, apps use features locally in a closed manner – an app might ask to use location data, but we have seen no evidence of apps really doing anything monetisable with it yet.

But if data gathered locally could be exchanged with information from the cloud, be that contextual information about location, environment and motion or individual-specific data, then targeted advertising can be taken to a new level.

Here is an example of a scenario that could illustrate the experience of brand engagement for mobile users in a future of targeted contextual advertising: Let's imagine a consumer who has accepted to receive ads in order to benefit from a free Premiership Football video goal alerts (or any other application/content that is ad funded).

The consumer's phone holds lots of valuable insight:

- It is near the King's Head pub (and that the consumer has been walking around the high street for the last 20 min)

- That it is in proximity to a phone that it has paired with in the past (in this case, owned by the consumer's wife)

- It's fairly warm (the phone knows this because it has a weather feed from Yahoo and a sensor that monitors the temperature)

- It's 4.30pm (time for a drink!)

- That the consumer is registered with the Barclaycard contactless mobile payment service

Having analysed all this data in real time, the app decides to serve an offer for a cold branded drink, which gives the owner a 'buy-one-get-one-free' coupon that he can redeem immediately, paying by contactless payment at the King's Head. The rules for serving these adverts can be relatively simple – had it been a cold day at 8.30am near a Starbucks, a coupon for a coffee in return for registration details into the Starbucks' loyalty scheme would have been served.

And as more devices become computers, the possibilities for such an ecosystem expand exponentially. For example, the commercial being served to the TV could be matched by a commercial or offer being pushed to the tablet computer that's in your lap. Apps allow this kind of functionality to be considered, but they are only possible in concert with a commercial model that enables all the participants to benefit.

Consumers clearly need to see the benefits, financial or otherwise, of receiving more personalised advertising on devices that have hitherto been advert-free, and consent to let their personal data being used in this manner. Likewise, brands need to ensure that they can monetise larger and more complex investments in platforms – that may mean co-operating with traditional advertising vendors, companies with similar ambitions in other industries or even competitors.

Crucially, hardware vendors and network service companies, in particular mobile operators, need to see the benefits of such schemes. Today, the feed of data from handsets to media planners is still inconsistent across operators and platforms and as a result, difficult to use on any scale by advertisers.

The success or failure of apps advertising will be largely determined by the ability of players in different parts of the value chain to collaborate and agree a means to sharing benefits created in the ecosystem as a whole.

Summary

Our research has shown that apps, (and more generally non-PC computing experiences) are likely to become more significant to businesses in the next five years. Brands seeking to advertise on these channels need to understand how to create apps that meet their goals – brand engagement or direct enhancement of their products and services – and make best use of the technological capabilities of the platforms that enable them.

We have found that brands succeed by:

- Simply offering the consumer useful functionality

- Understanding how to manipulate app store ratings to gain prominence

- Targeting apps at the platforms that are most likely to be used by their audience

- Make use of handset functionality to offer something relevant and targeted to the individual and their immediate environment

In the future, we believe that apps can offer a compelling advertising medium for brands, provided they are willing to work with service and technology providers to create an ecosystem that is beneficial for businesses and consumers

Footnotes

i. Deloitte analysis based on vendor actual shipments & Deloitte forecast

ii. 148apps.biz; The official Google blog

iii. Deloitte "Addicted to Connectivity" survey of 31,000 global mobile users

iv. EffectiveUI survey conducted by Harris Interactive, Nov 2010

v. http://press.fishlabs.net/en/target-group-thrilled-withvolkswagen-touaregchallenge /

vii. Deloitte "Addicted toConnectivity" survey of 31,000 global mobile users

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.