KEY FACTS:

- Number of companies trading on AIM as at 30 June 2011 – 1,151

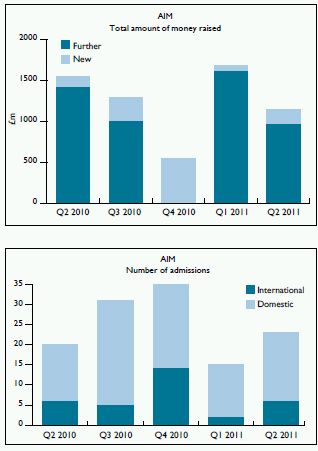

- Total funds raised on AIM in 3 months to 30 June 2011 – £1,136.9m

- Number of companies trading on Main Market as at 30 June 2011 – 1,413

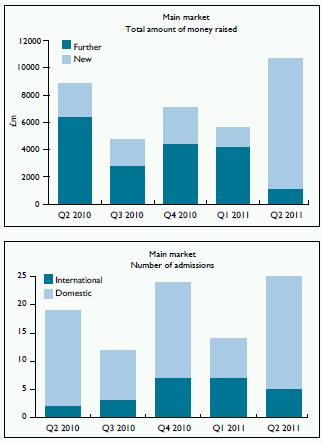

- Total funds raised on Main Market in 3 months to 30 June 2011 – £10,654.6m

MARKET COMMENTARY

AIM

- Number of listed companies continues to decline since January 2008.

- The number of new issues in Q2 2011 has increased to 23 from 20 in Q2 2010.

- Number of companies on AIM is at a similar level as April 2005.

- Average market cap of an AIM company decreased to £65.6m in June 2011 from £69.8m at the end of March 2011. This has increased from £47.7m at the end of June 2010.

Market movements

- FTSE AIM All-Share Index decreased 4.81% in Q2 2011 to 858 (3.45% decrease in Q1 2011).

Summary statistics

Main Market

- There has been an increase in new money raised in Q2 2011 from £1,228m in Q1 2011 to £9,559.7m, largely due to £6,193.5m raised on the flotation of Glencore International plc.

- The number of companies has fallen from 1,416 at 31 March 2011 to 1,413 at 30 June 2011.

- The amount of further money raised has decreased from £4,144.6m in Q1 2011 to £1,094.9m in Q2 2011.

Market movements

- FTSE All-Share rose 0.95% in Q2 2011 (0.16% increase in Q1 2011).

Summary statistics

CONCLUSIONS

Q2 2011 saw less funds raised on the AIM market than Q1 2011 or Q2 2010. The total number of companies on AIM also declined quarter-on-quarter.

On the Main Market, the number of new admissions and new money raised increased, with Glencore International plc, the commodities giant, completing one of the largest flotations in the history of the Main Market. Despite the increase in total money raised the total number of companies remained almost static.

The market continues to have appetite for select resource and commodity-based businesses and remains cautious in providing new money for the other business sectors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.