Carbon reporting to date – Seeing the wood for the trees

1. Executive summary

Organisations are facing increasing pressure from investors, customers and indeed employees, to measure, report and reduce their carbon footprint. Additionally, the associated cost savings in today's highly competitive environment are hard to ignore.

Lord Adair Turner, Chairman of the Financial Services Authority, is quoted on the Carbon Disclosure Project ("CDP") website1 as saying that: "The first step towards managing carbon emissions is to measure them because in business what gets measured gets managed."

In September 2009 the Department for the Environment, Food and Rural Affairs ("Defra") published guidance on how to measure and report GHG emissions (referred to as "carbon" or a company's "carbon footprint" in this report). Currently, this guidance is voluntary but there is an indication that reporting could become mandatory from 2012.2 So what are companies already reporting and to what extent do they already comply with this guidance?

This report examines how a sample of 100 UK listed companies publicly report their greenhouse gas ("GHG") emissions or their 'corporate carbon footprint', compared to the guidance issued by Defra.

Our survey shows a high degree of variation in carbon reporting practices and many companies, particularly those outside the top tier of FTSE companies, could do better. Highlights include:

- 57% of companies reported carbon information to some degree and all but one company in Tier 1 did so.3

- 37% of companies 'formally reported'4 numerical data on their carbon footprint;

- 20% of companies 'formally reported' a specific target in relation to carbon reduction;

- Only 9% of companies disclosed that information on carbon had been reported in line with the Defra guidance; and

- Only 8% of companies stated that their reported information had been assured by a third party.

In going beyond the recommendations of the various national and international reporting frameworks in place, some companies reporting their carbon footprint have presented extensive information in a way they consider more meaningful to their stakeholders. However, this does not aid comparison between reports. Further, in the absence of prescriptive guidance, this can result in extensive disclosure within a corporate responsibility or equivalent standalone report, without providing what we would consider to be the key highlights within the annual report. But there are some clear leaders in the field who embed carbon disclosures into their annual reporting framework, reflecting an attitude that this information is a core component of overall performance.

But even with this in mind, only a handful of companies in our sample came within striking distance of complying with all of Defra's recommendations, indicating that a significant overhaul of existing carbon reporting practices will be required if these guidelines become mandatory.

Carbon data needs to be useful – and used – as part of an organisation's energy & carbon management strategy.

Key findings

The wide variety of both formal and informal carbon reporting practices identified does not facilitate comparison between companies or industry sectors, making it difficult to evaluate the relative performance of companies in monitoring and reducing their carbon footprint; a primary goal of the government in publishing the Defra guidance.

Few companies made disclosures explaining year-onyear movements in sufficient depth to enable readers to gain a real understanding of a company's performance in the year in reducing their carbon footprint, or the appropriateness of targets set.

Many companies failed to make basic disclosures around the reporting methodology used, or accounting principles applied, highlighting a lack of transparency around measurement principles and reporting of carbon footprints.

Restatements of previously reported information noted correction of non-material errors, or updates to comply with revised calculation guidance. Carbon reporting is in its infancy relative to the financial reporting frameworks in existence, and there are additional complexities around measurement of carbon data. This heightens the risk of errors in published information.

Seeing the wood for the trees

As we look forward, the quality of carbon data reported will come under closer scrutiny, with a regulatory framework for reporting, and the audit regime that this entails, impacting UK companies within the CRC Energy Efficiency Scheme for the first time this year. For these organisations, the financial cost of consuming energy in the UK has further increased following the revisions to the CRC made by the Government in the Comprehensive Spending Review in October 2010. Moreover, with the publication of rankings under the CRC, the reputational cost of failing to manage the corporate carbon footprint, or failing to report it faithfully, remains significant. Senior executives should focus on the quality and accuracy of information they are using to make strategic decisions around energy and carbon management. Carbon data needs to be useful – and used – as part of this strategy. The missed opportunities, and risks, that arise from 'getting it wrong' will increase.

Although there are emerging leaders in carbon reporting, many companies need to begin to think seriously about these requirements and equip themselves to compile the type of information recommended by the Defra guidance. For a start, this should help them to focus on where they can cut emissions and save costs. Secondly, this will give them a chance to embed reporting systems, processes and controls.

Our survey highlights a number of 'best practice' disclosures to show how leading companies are reporting elements of their carbon footprint. It also includes a reporting checklist and illustrative carbon disclosures for an annual report, drawing on our findings to provide a practical guide to assist preparers with their carbon reporting.

We hope that you will find this survey a useful insight into the current state of formal reporting of carbon emissions – 'carbon reporting to date'.

2. Carbon reporting framework - what guidance is available?

The routes to accessing carbon information about UK companies are becoming increasingly extensive every year. The Carbon Disclosure Project ("CDP") obtains carbon information reported on a voluntary basis from more than 3,000 bodies internationally. CDP's questionnaire-based information request now extends to asking organisations to give their view on the opportunities that climate change affords them. Certain investor sites such as google finance pick out carbon reporting as a key performance indicator. One would expect the opportunities and/or risks resulting from climate change to be considered in corporate valuations when considering merger or acquisitions. But how much of that insight is published, and by how many companies, within a formal and reliable reporting framework?

Introduction

Carbon reporting guidelines exist both in the UK and internationally, but are still relatively early in their development. The 'GHG Protocol',5 which introduced a number of standardised methods for GHG accounting, was first published within this decade. Few jurisdictions mandate carbon footprint reporting. Entities in the scope of regulated emissions trading schemes are required to report information on regulated emissions, but these often only constitute a subset of their total carbon footprint. As such, today an accepted single global framework for carbon reporting does not exist, with the result that there is the potential for inconsistencies and a lack of comparability in reporting across different jurisdictions and different organisations. On the positive side, an increasing number of organisations have embraced the voluntary reporting indicators and guidance offered by the Carbon Disclosure Project6 and the GHG Protocol.

The Climate Disclosure Standards Board7 issued a Climate Change Reporting Framework in September 2010 which is intended to provide guidance for the integration of climate change related information into mainstream corporate reporting.

Existing reporting regulation is likely to be the thin end of the wedge. As the number of emissions trading schemes (and associated compliance cost) increases, it is likely that companies will be required to disclose sustainability and/or environmental risk as a key risk in the narrative report section within their financial statements. The Companies Act 20068 already requires large UK companies to report on material non-financial key performance indicators which include those relating to environmental matters, within the business review of their directors' report.

The Department for Business, Innovation and Skills ("BIS") has recently undertaken a consultation on the future of narrative reporting, the results of which will be published by the end of 2010. The objective is to significantly improve the quality of narrative reporting including on social and environmental issues.

The European Union's Cap and Trade Emissions Trading Scheme (the "EU ETS") has captured only the largest emitters, but the CRC Energy Efficiency Scheme ("CRC") captures a much broader spectrum of 'ordinary' companies. The first public rankings from this will be published in October 2011. Turning specifically to UK carbon disclosure frameworks, Defra published guidance on 'How to measure and report your greenhouse gas emissions' (the "Defra guidance") in September 2009. Although the guidance is currently voluntary, the Climate Change Act 2008 requires the government either to mandate carbon footprint reporting by 6 April 2012 or explain why it has not done so. Under the Climate Change Act, the UK government has set targets to reduce UK carbon dioxide ("CO2") emissions by at least 26-32 per cent by 2020). The principle behind publishing guidance for reporting is that measurement of emissions is an essential first step towards reduction.

The real challenge for any company is to provide clear,meaningful information in the annual report.

Background to the Defra guidance

There are a number of voluntary international and national guides for measurement and reporting of carbon that have arisen over the last decade. As well as the GHG Protocol, first issued in 2001 and revised in 2004, examples include ISO 14064-1,9 the Carbon Disclosure Project ("CDP") which created a voluntary channel for publication by companies of a suite of carbon-related disclosures, and the reporting requirements of schemes such as the EU ETS or of other Climate Change Agreements.

The Defra guidance is based on the GHG Protocol, like many existing measurement tools and guidance.10 One of the goals of the Defra guidance is to encourage consistency among organisations reporting in the UK, Defra's aim being "to support UK organisations in reducing their contribution to climate change." The guidance explains how to measure carbon emissions and set targets to reduce them. The challenges for reporting organisations will be around gathering accurate carbon data as well as moving forward on a carbon reduction strategy.

The Defra guidance provides a relatively straightforward reporting framework, comprising numerical information supported by narrative explanations. If followed to the letter, it may not give the most forward-thinking companies sufficient latitude to present their carbon information in the way they consider to be most relevant to their stakeholders. Greater detail may already be provided by these companies within their corporate responsibility reports. But in our view the real challenge for any company is to provide clear, meaningful information in the annual report which is not too long, and relevant to readers for whom carbon data is not an end in itself, but integral to their understanding of the company's performance.

Some may feel that Defra's template is more extensive than needed for this purpose. Our illustrative carbon disclosures (Appendix 2) reflect a practical response to Defra's recommendations, limiting the information disclosed in the annual report to the key qualitative and quantitative information. It needs to tell a clear story. As carbon reporting practice progresses, the hope is that consistency will evolve in the presentation of carbon disclosures.

3. Objectives and basis

The main objectives of this survey were to consider how practices in carbon reporting have developed to date under the non-mandatory carbon reporting environment in place in the UK. In particular, the survey reviews:

- what type of information on carbon companies report (e.g. narrative and numerical data, basis for GHG reporting, comparative information, baselines and targets);

- how closely published information compares to the recommendations in the Defra guidance;

- where companies report this information; and

- whether this information is assured (independently audited).

Some companies provide a summary of carbon information in their annual report with far more extensive details in a sustainability/corporate responsibility ("CR") report. This is a voluntary but increasingly popular report, particularly for larger companies; 98% of the FTSE 100 published such a report in 2009/2010. Given there is currently no strict requirement for where carbon information would be disclosed, the survey was conducted by reviewing the annual reports and CR or equivalent reports for a sample of 100 listed UK companies, published in 2010. For completeness we also reviewed any carbon information that was 'easily available'11 on the websites of these companies.

Basis for survey questions

This survey's purpose is to review specifically the carbon information disclosed by companies and compare this against the guidance set out in specific frameworks in place around carbon reporting. As set out in section 2, there are a number of frameworks in existence for voluntary carbon reporting, but it is important to assess performance against specific guidance. The chosen population for the survey sample is UK listed companies, so we have formed an assessment against the Defra guidance published in September 2010.

Sample selection

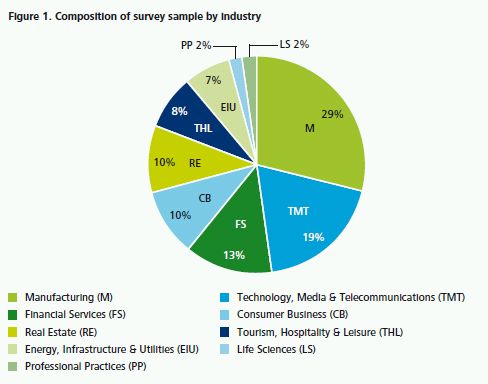

A sample of 100 listed UK companies was randomly selected. The sample was then stratified into three categories: the top 350 listed companies by market capitalisation ("Tier 1"), companies ranked from 351 – 750 ("Tier 2") and companies within the smallest 350 listed companies by market capitalisation ("Tier 3"). These three categories included 34, 33 and 33 companies respectively. The composition of this sample by industry is illustrated in Figure 1.

4. Summary of results

5. Results

5.1 The basics

Carbon data could be located for 57% of companies surveyed, with only one in the top tier of FTSE companies not reporting any carbon information. 19 companies (58%) in Tier 2 and 5 companies (15%) in the bottom tier published carbon footprint information.

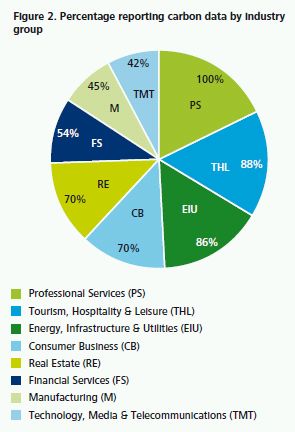

The analysis by industry (see Figure 2) reveals that all professional services companies surveyed and more than 86% of companies in the energy, infrastructure and utilities sector, and the tourism, hospitality and leisure industries reported carbon data, whilst 58% of companies surveyed in the technology, media and telecommunications industry and 55% of manufacturing companies did not report any carbon data. However, as the sample size for some industry groups was relatively small, it is hard to draw industryspecific conclusions.

Where companies were reporting carbon data:

- 84% reported information on their carbon footprint in their annual report, most frequently in the Corporate Responsibility ("CR") section of the narrative commentary

- nine companies produced a standalone CR report containing carbon data but did not include any of this information in their annual report; and

- no companies only reported carbon data on their website.

The rest of this section focuses on carbon information presented formally either within a company's annual report or in a standalone report. Where companies disclosed information in both their annual report and in a separate standalone report, our results are based on the report containing the most information on carbon. We take a brief look in Section 6 specifically at the information contained in companies' annual reports in relation to the requirements of Companies Act 2006. In Section 7, we specifically consider the information that companies in our sample reported on their website.

5.2 Presentation of core information

The number of pages dedicated to the reporting of carbon data varied from a single sentence through to separate sections within CR reports of up to 9 pages in length, but with no companies outside of the top tier reporting more than 2 pages of carbon information. The discrepancy between the carbon reporting practices between tiers noted in 5.1 above is further reflected in the analysis of the type of information reported. Figure 3 illustrates the percentage in each tier formally reporting narrative and numerical data.

Presentation of information

The template provided in the Defra guidance presents carbon footprint data in tabular format.

In our sample, 29 companies presented their carbon data in tabular format, with a number of companies preferring to present this information in graphical format. In some cases this arguably provides a clearer illustration of the company's carbon footprint for readers of the report. The extract from Wm Morrison Supermarkets PLC CSR Review 2009/10 in Figure 4 enables a reader to quickly assess the extent of carbon reductions over time and the composition of the company's carbon footprint.

Geographical breakdown

The Defra guidance also recommends presentation of carbon data broken down by country. Two companies provided a geographical breakdown by region (rather than country) in their reports. The geographical breakdown disclosed in HSBC Holdings PLC Sustainability Report 2009 is shown in Figure 5.

Assurance

There is no current requirement for companies to obtain any level of assurance over carbon data reported;15 however companies may choose to obtain assurance around their carbon disclosures and to disclose the fact that the data is assured, thereby increasing stakeholder confidence in its quality. Only 8 companies in our sample clearly stated that they had obtained independent assurance of the corporate responsibility data, including carbon data. 5 of the 8 companies. disclosed an assurance opinion making reference to a specific assurance standard, being either ISAE300016 or AA1000 (AS).17 The other 3 companies did not disclose the assurance opinion given but stated that the information had been assured by an independent party. This suggests that the data to comply with the Defra guidance is already being collected for a wider number of companies than those companies with Defracompliant disclosures, but perhaps companies are choosing to present this information to stakeholders in what they consider to be a more user-friendly format. It can be argued that breakdowns, for example the disclosures made by Glaxo Smith Kline PLC and Vodafone Group PLC shown in Figure 6, may provide clearer information to the readers of their reports, but may not facilitate a comparison of carbon footprints and their composition between companies.

5.3 Basis of reporting

19 companies in our sample made reference to their report being compliant with a reporting framework, with 10 of these companies referring to the Defra guidance specifically; 6 made this statement in their Annual Report. This section analyses the carbon information formally reported in line with the Defra guidance by all companies in our sample, as more than 10 companies may be compliant with the Defra guidance in their reporting but just do not disclose this fact.

Reporting scopes

The majority of our sample reporting numerical data did provide a breakdown of their carbon footprint, although only a few companies disclosed a sub-analysis of their carbon footprint using the terminology in the Defra guidance and GHG Protocol, "Scopes 1, 2 and 3".18 Out of the 37 companies disclosing numerical data on their carbon footprint, 20 did report some data for different types of emissions falling within all three scopes; but they did not necessarily use these terms to describe their disclosures.

This suggests that the data to comply with the Defra guidance is already being collected for a wider number of companies than those companies with Defracompliant disclosures, but perhaps companies are choosing to present this information to stakeholders in what they consider to be a more user-friendly format. It can be argued that breakdowns, for example the disclosures made by Glaxo Smith Kline PLC and Vodafone Group PLC shown in Figure 6, may provide clearer information to the readers of their reports, but may not facilitate a comparison of carbon footprints and their composition between companies.

A comparison of the 2009 CDP results19 with the results of this survey for Tier 1 companies further reveals that all but 3 of the 18 Tier 1 companies reporting all scopes in the 2009 CDP questionnaire included this information within their published carbon reporting disclosures. This indicates that companies will formally disclose this data once it has been collected, even if not presented using the terminology in the Defra guidance.

Scope 3 emissions

Scope 3 emissions were least frequently disclosed. Where disclosed, the most commonly reported scope 3 emissions were from business travel with 17 out of the 20 companies disclosing scope 3 emissions reporting this information. Very few companies reported scope 3 emissions associated with their supply chains and the use of end products. Rio Tinto PLC was one company in our sample which did, reporting their three most significant sources of indirect emissions (see Figure 7, an extract from the narrative section of Rio Tinto PLC 2009 Annual Report).

It would be interesting to know how companies apply the concept of materiality or cost versus benefit in the context of Scope 3 disclosures. But for some companies Scope 3 emissions may prove to be the largest part of their carbon footprint. Glaxo Smith Kline PLC discloses in their 2009 Corporate Responsibility Report that the majority of their business's carbon comes from patient use of inhalers (see Figure 6).

This issue of not reporting carbon associated with the full supply chain, in particular carbon embedded in imports, has been more widely acknowledged recently by the Department of Environment and Climate Change ("DECC") in evaluating trends in the UK's overall carbon footprint. In September 2010, the UK government's chief environment scientist called for more openness, commenting:

"At face value UK emissions look like they have decreased 15% or 16% since 1990. But if you take in carbon embedded in our imports, our emissions have gone up about 12%. We've got to be more open about this."20

However, it is not surprising, as carbon reporting is still evolving, that companies focus first on reporting the carbon they can most easily measure.

Methodology

Our survey noted a lack of transparency in relation to the disclosure of the methodology for calculating carbon footprints. The main findings from our sample are below:

Boundary: Only 4 companies clearly defined the boundary of their reported carbon footprint, indicating whether carbon reported related to business activities over which the company had financial control or over which the company had operational control.

Exclusions: 12 out of the 37 companies disclosing numerical data on their carbon footprint disclosed information surrounding specific sources of carbon that had been excluded. But only one company disclosed an estimate of the proportion of global emissions excluded as a result of this; without such an indication, the other disclosures on excluded sources were not very meaningful.

Treatment of offsets: Only 5 companies in our sample explicitly disclosed carbon offset as part of their carbon footprint data; this could be the result of differences between the various sources of voluntary guidance available on how to treat offset activities.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.