In a nutshell

- A new Financial Reporting Standard for Public Benefit Entities (FRSPBE) is proposed. This is the final part of ASB's proposals for the replacement of UK GAAP.

- It would supplement the proposed Financial Reporting Standard for Medium-sized Entities (FRSME) published by the ASB in October 2010.

- It addresses common transactions in the Public Benefit Entity (PBE) sector.

- The new regime may come into force by mid 2013 in line with the FRSME.

- Revised SORPs are likely to be issued.

On 18 March 2011 the UK Accounting Standards Board (ASB) issued Financial Reporting Exposure Draft 45 ('the FRED') which sets out proposals for a Financial Reporting Standard for Public Benefit Entities. The FRED was developed following considerable support from respondents to the suggestion which was set out in the ASB's August 2009 Consultation.

From proposals made, FREDs 43 and 44, issued by the ASB in October 2010, envisage a tiered reporting structure with publicly accountable entities using full IFRSs, small private entities continuing to use the FRSSE and those in between following the draft FRSME. Further details can be found in the October 2010 ukGAAP alert (http://www.deloitte.co.uk/auditpublications).

The FRSME, which is based on the IASB's IFRS for SMEs, was written with the 'for profit' sector in mind but PBEs have different objectives. The FRED has been developed to fill in the gaps, addressing some common transactions that are specific to the PBE sector. Its aim is to reduce the risk that PBEs interpret inconsistently the FRSME. The FRED also contains a consequential amendment which will, in effect, insert the requirements of FRS 30 Heritage Assets into the FRSME for all entities using that standard. T

he FRSPBE would be mandatory for PBEs that apply the FRSME, and would constitute best practice guidance for PBEs in other tiers.

Public Benefit Entities

In addition to defining PBEs, the FRED provides application guidance to help entities determine whether they are in scope of the proposed standard. For example it confirms that such an entity does not necessarily have to benefit the public as a whole and that mutual insurance companies and other mutual co-operative entities that provide economic benefits directly and proportionately to their owners or members are not PBEs.

The proposed new regime

In August 2009, the ASB issued a consultation paper 'Policy Proposal – The Future of UK GAAP' which outlined proposals to eliminate standalone UK accounting standards for all but small companies and to introduce a new single standard based on the IFRS for SMEs (IFRS for Small and Medium-sized Entities). The ASB set out a three tiered reporting structure. The ASB's October 2010 proposals kept the three tiered structure but introduced two sub-tiers (Tiers 1s and 2s) in response to feedback. The proposed structure is illustrated below.

- Relief from applying full IFRSs is proposed for small publicly accountable entities that are prudentially regulated (as defined in company law). To qualify for this relief, such an entity must satisfy all three of the Companies Act's size criteria for a small company or small group.

- The FRSPBE would be mandatory for entities falling within scope of the FRSME. Entities will be within scope if they meet all of the following criteria:

- they meet the definition of a PBE;

- they prepare financial statements that are intended to give a true and fair view of the financial position and income and expenditure for a period; and

- they prepare financial statements in accordance with the FRSME.

For those in Tiers 1, 1s and 3, the FRSPBE should be considered best practice guidance, although in those tiers, the standards would take precedence over the FRSPBE.

Which issues are addressed in the FRED?

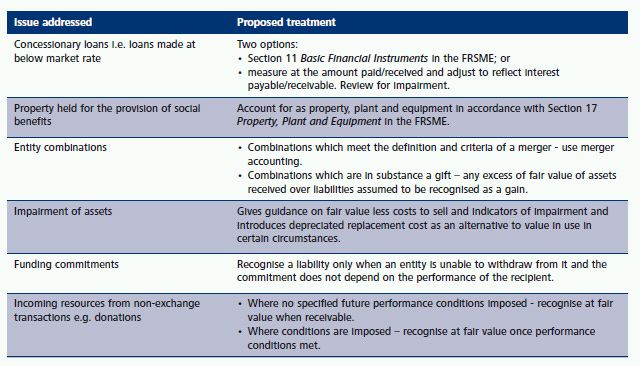

The FRED addresses the following common issues for PBEs, which are not covered in the draft FRSME. Many of the proposed treatments are consistent with current practice.

What about SORPs?

Most Statements of Recommended Practice (SORPs) developed for PBEs will stay, although it is expected they will be updated following the publication of the FRSPBE. If there is any conflict between SORPs and the requirements of the FRSME and FRSPBE, the standards will take precedence and disclosure detailing the departure from the SORP would be triggered.

When will the FRSPBE be effective?

FRED 45 is open for consultation until 31 July 2011. This is later than that for the ASB's FREDs on the future of reporting in the UK and Ireland which close on 30 April 2011. The timing of adoption of the FRSPBE is driven by FREDs 43 and 44. If they are supported by respondents, the earliest date for mandatory adoption of the complete package, taking into account an 18 month period between publication of the final standard and mandatory adoption, could be periods beginning on or after 1 July 2013 (as illustrated below). It is proposed that entities will be free to adopt the new regime at an earlier date provided that any relevant SORP has been updated.

Initial observations

The document is relatively short and provides a set of principles to be applied in determining the appropriate treatment for certain transactions specific to public benefit entities. Some questions to be considered carefully when responding to the proposals include:

- There are choices offered in certain areas e.g. concessionary loans. Are the options appropriate?

- Some entities will be faced with complying with company law, the FRSME, the FRSPBE and a SORP. Is there scope for reducing the number of documents?

- The International Public Sector Accounting Standards Board (IPSASB) has already written standards for public sector entities. To what extent does the FRED consider this work?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.