Docetaxel, a taxane type anticancer drug, developed by Sanofi-Aventis and marketed under the brand name of Taxotere, lost its molecule patent protections in US and major European jurisdictions last month. Docetaxel is considered the largest oncology product ever developed with global market value at $3 billion in 2009. It is also arguably predicted that Docetaxel will lead the taxane market for the next decade since Docetaxel represents the reaching of a plateau stage in taxane development and further R&D in taxanes is unlikely to be cost effective. The loss of protection on the molecule patent will inevitably attract significant generic activity in the months and years to come. This month's Drug in Focus will analyse the patent landscape surrounding Docetaxel based on information disclosed in GenericsWeb's Core Pipeline Selector report.

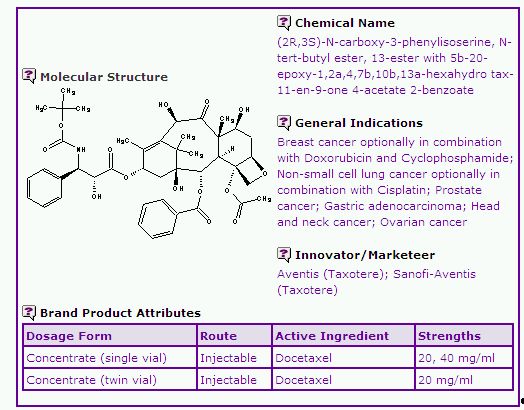

Table 1: Docetaxel General Information

The Docetaxel General Information (Table 1) extracted from the Pipeline Selector report discloses general product information in relation to Taxotere. Docetaxel can be considered a relatively versatile anticancer drug, being indicated for breast cancer, non-small cell lung cancer, prostate cancer, gastric adenocarcinoma, head and neck cancer and ovarian cancer, in some cases in combination with other anticancer agents. The Taxotere products are supplied in single vial and double vial systems for intravascular injection. The single vial system contains Docetaxel as the active ingredient, polysorbate and about 50% absolute ethanol in one vial, while the double vial system has Docetaxel and polysorbate in one vial, and 13% ethanol in water for injection as diluent in a separate vial. The double vial system is available in most major markets including the US, Europe, Canada and Australia while the single vial system is only available in the European continent.

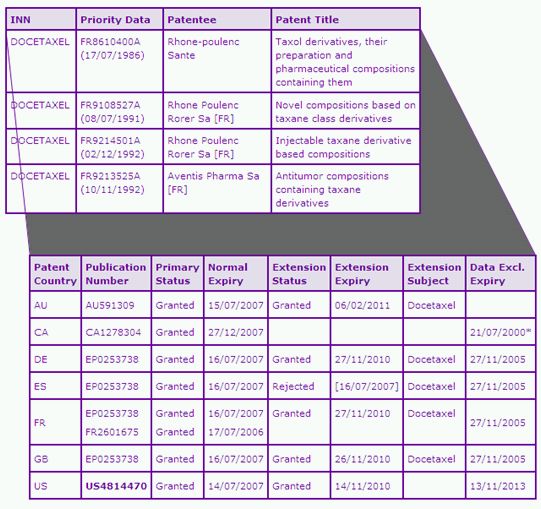

Table 2: Docetaxel Key Patent Indicator

The Docetaxel Key Patent Indicator (KPI) (Table 2) identifies four patent families as being of significant commercial relevance to the Taxotere products. The patent family with priority number FR8610400A protects the Docetaxel molecule per se. The patent expiry data for this family shows that the Docetaxel molecule firstly lost protection in Spain in 2007 due to a rejection of a Supplementary Protection Certificate (SPC) application. Canadian patent protection for the Docetaxel molecule also ended in 2007 as the normal term expired, and there is no patent term extension provisions in Canada. In contrast, the US and other major European equivalents have longer patent protection due to granted PTE or SPCs in these jurisdictions. Patent, US4814470 expired last month after the term of the 6 month paediatric extension, in addition to the USC section 156 PTE of 1035 days. SPCs on the European equivalents in this family also expired last month in major territories. Similarly, a section 70 PTE in Australia allows the Docetaxel molecule patent to be in force until February 2011 due to a later TGA approval date.

In addition to the molecule patent family, the KPI identifies two formulation patent families. It is well known that taxane compounds generally have low water solubility for clinical use. Traditionally, ethanol and surfactant, such as polyethoxylated castor oil, were used to stabilise the active ingredient in preparation of taxane formulations. The FR9108527A patent family specifically claims taxane compositions comprising surfactants and a much reduced or eliminated ethanol content. Patents in this family expire in July 2012 in Australia, Canada, and most major European countries. The normal term of three US patents, US5698582, US5714512 and US5750561 are extended to January 2013 based on paediatric extensions. The last US member US5403858 expires on 23 August 2013 but is not Orange book listed implying that it does not protect the commercial Taxotere product (however this should be verified). The FR9214501A family protects a twin vial system which contains the active ingredient concentrate in one part and a diluent containing an agent, e.g. ethanol that prevents gelling upon dilution of the concentrate in the other. Patents in this family generally expire in November 2013 except the US equivalent which expires in May 2014 after accounting for the paediatric extension.

Both of these formulation patent families appear to protect only the twin vial system and are likely to result in some difficulty in developing bioequivalent generic versions of Taxotere expiry 2-3 years after molecule patent expiry. Noteworthy is that the Pipeline Selector Litigation Alert identifies cases in relation to patents in these two families, suggesting that they are indeed problematic to generic developers, and would perhaps have been difficult to circumvent. In some cases the asserted patent claims have been found invalid or unenforceable, hence it is important to review any litigation alerts fully to understand the scope and enforceability with respect to generic products. In Europe, however, an opportunity exists to launch the single vial system upon expiry of the molecule patent, as the commercial Taxotere does not appear to be protected by any of these later key formulation patents.

A further family listed in the KPI relates to use of Docetaxel in combination with other therapeutic agents, such as topoisomerase poisons, alkylating agents, antibiotics, platinum complexes and others. Patents in this family will expire in the US in May 2015 and in November 2013 in most other countries. However caution should be exercised as there is a related European patent filing which also encompasses use of Docetaxel having an expiry date of March 2022, which seems very pertinent to some of the current approved indications for the Taxotere product. This family may therefore be problematic for generic companies seeking to launch a generic Docetaxel product with exactly the same indications as those for Taxotere and some modification of the indications may be required to avoid infringement.

Data exclusivity (DE) is another important weapon for pharmaceutical innovators to protect their R&D Investment. Information related to this can also be found in the Pipeline Selector report for Docetaxel which shows that, with the exception of some use and paediatric use exclusivity in the US, there is no current protection in major markets that would significantly constrain generic competition.

The Pipeline Selector report also discloses marketing authorisations in relation to the Docetaxel product in certain countries, both branded and generic (Table 3). It can be seen from the news articles that Actavis and other generic companies have started to sell generic Docetaxel single vial products in Europe. Limited investigation shows that these formulations contain higher levels of ethanol and therefore circumvent the key formulation patents. Several other generic manufactures also obtained market authorisations for their generic Docetaxel products in European countries. In Australia, Interpharm has obtained marketing authorisation for a generic Docetaxel product. Interestingly, no generic Docetaxel is identified as available in Canada. Presumably, the litigation case around CA2150576, CA2102777 and CA2102778 has resulted in an extended monopoly of the Taxotere product in this market. Generic Docetaxel products are not yet available in the US market however, several tentative approvals have been identified and a total of 18 Drug Master Files (DMF) in relation to Docetaxel have been filed, suggesting that this product will go generic once any outstanding litigation has been dealt with.

Table 3: Regulatory data for Docetaxel

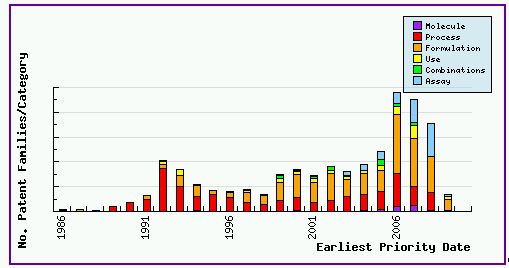

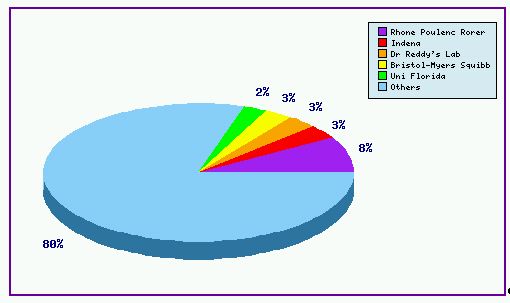

Figure 1 shows the patent filing trend for patents in relation to Docetaxel, based on a comprehensive set of patent publications for the Docetaxel product as found in the corresponding pipeline developer report. This clearly shows that the number of patent families filed has dramatically increased since 1996 – the launch of the Taxotere product. This is a typical pattern showing a substantial number of generic players are interested in Docetaxel and started their R&D on the drug as early as the launch of the Taxotere product. This can be further confirmed with Figure 2, where the innovator still takes the number one position on the top applicant list in regards to Docetaxel patent applications – but only filing 8% of patents relevant to the drug. Figure 1 also indicates that the patenting activity relating to this drug heavily focuses on formulations, with around 40% of the total patent families falling into this category. Presumably, those generic players also consider that the formulation in the Taxotere product is a tough part to circumvent and invest in their own IP to protect their efforts and set barriers to other generic competitors in this field. Readers should be aware that this number of patents may also include patents in relation to Paclitaxel, due to the fact that these two popular taxane drugs are jointly the subject of many patents. Generic players are therefore strongly advised that a significant amount of attention should be paid to identifying and evaluating such patents to ensure that their product does comprise of any protected formulation or active ingredient at the time of commercialisation. This can be achieved by subscribing to GenericsWeb's Pipeline Developer report for a comprehensive review of the patent landscape surrounding the Docetaxel product.

Figure 1: Docetaxel Patent Filing Trends

Figure 2: Docetaxel Top Patent Applicants

In summary, the market for Taxotere has been reasonably well protected by the innovator with a proactive patenting strategy. However, data exclusivity and molecule patent protection for Docetaxel in most of territories has now expired or will expire in the near future and the markets are showing signs of generic competition for at least part of the Taxotere product suite in some countries. With much taxane formulation technology in the public domain prior to the launch of Taxotere, the innovator relies mainly on the twin vial formulation patent protection to safeguard part of its market share for Docetaxel, as well as some protection of specific indications. In markets where only the twin vial system is authorised, this protection may represent and additional 2-3 years of monopoly unless the patents are successfully challenged.

This molecule demonstrates that the proactive use of comprehensive patent information will lead to higher returns from generic development by being first to market after molecule patent expiry. The rewards of being informed are much more satisfying than the cost of making an IP mistake, or simply being one of many other generics on the market. Generic developers are therefore strongly advised that a comprehensive search of the patent landscape around any product, particularly one as complex as Docetaxel is a crucial step before any technical development takes place.

This evaluation is based on the Pipeline Selector Core report, which can be extended to cover over 40 countries for a nominal fee. GenericsWeb Pipeline Selector reports are available for any active ingredient upon request. Comprehensive data for patent families relating to Docetaxel, based on professional patent searching, may be accessed by subscribing to the GenericsWeb Pipeline Developer report which include twelve monthly updates to keep you abreast of recently published patents and applications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.