Foreword

Innovation is a key feature of any vibrant marketplace

Whatever the industry, experience tells us that successful new ideas, or even old ideas revisited, can quickly become norms once market participation really starts to buy-in. The real estate sector is certain to emerge from the turmoil of the last three years by being more creative and innovative in the way investors use property. It is no longer an asset to be held and traded on the assumption that prices will continue to rise – owners have to be smart and make property work for them. The opportunities for innovation provided by the changing real estate landscape are the focus of this fifth edition of our Real Estate Executive Report.

During the course of last year Deloitte has itself been innovative through the merger with Drivers Jonas, to create Drivers Jonas Deloitte. With Drivers Jonas Deloitte now firmly integrated into our real estate practice, and with our focus on growing our Corporate Finance practice, I, together with Nick Shepherd, Managing Partner of Drivers Jonas Deloitte and our newly appointed real estate Corporate Finance Advisory Partner Nick Sanderson, discuss the opportunities and challenges facing us, as well as our vision for the Deloitte real estate group and the industry in general.

We are of course keen to showcase the in-depth knowledge that our new colleagues have brought to our organisation. I have asked Anthony Duggan, Research Director, Drivers Jonas Deloitte, and Ian Stewart, Deloitte Chief Economist to expand on our predictions for the UK commercial property market over the next 18 months. After successfully identifying the opportunities around prime property in the early part of 2009 the search for similar excitement today is much trickier, and we look at themes such as the potential for double-dip, the importance of rental income as a value driver and the occupiers' position of strength in the current environment.

Unsurprisingly, given the timing of the legislation, the concept of REITs got off to a rocky start. However, as the market returns to safer ground, use of the REIT rules is becoming more popular and new types of structures are emerging. We look at the opportunities for a continuing increase in the number of REITs and the type of assets which they hold.

The term 'pension deficit' is an all too common element of headlines in the financial press. Reduced equity returns in recent years have impacted pension liabilities, and, alongside adverse economic conditions, has led to a dual pressure on companies to preserve working capital whilst at the same time reducing pension deficits. Historically, addressing one element inevitably means sacrificing the other, but new and innovative group structures can use property to address the deficit whilst allowing the group to retain ownership. We look at how you can make your property work as a tool to make this happen.

Finally, we are all aware of the recent Government announcements of tightened public expenditure budgets over the coming four year period. We discuss how this is changing the way Local Authorities use their property portfolios. We hope you find this report useful and welcome your feedback.

Real Estate and Deloitte – An interview with our Real Estate Leadership

Three senior real estate partners at Deloitte, Mark Goodey, real estate leader for Deloitte, Nick Shepherd, managing partner of Drivers Jonas Deloitte and Nick Sanderson, head of real estate corporate finance advisory services, talk to James Whitmore, Deputy Editor of PropertyWeek, about the ambitious expansion of the real estate business and their thoughts on where the real estate industry is going from here.

Whitmore: Mark, it's amazing that in the depths of the recession you've expanded the real estate business so much. First there was the merger in March 2010 with Drivers Jonas, and then the hiring in July of investment banker, Nick Sanderson. What was the thinking behind it?

Goodey: If you look at the core of our traditional business, audit and tax, we have significant relationships with most of the large property companies, the large REITs and much of the private sector. Therefore, while we will continue to provide high value services to these businesses, we saw an opportunity to expand our business into new areas where traditionally the financial services practice has not had a significant presence. Challenging markets present opportunities to execute transactions which may not be available or possible at different times in market cycles.

Looking at that as a proposition, the Drivers Jonas merger was the culmination of an exercise reviewing opportunities in parallel but related industry segments with different, but complementary skills, to our existing real estate business.

Similarly the opportunity for us to build another business segment around acting in an investment banking/independent corporate finance adviser role was another very attractive proposition.

Whitmore: Nick [Shepherd], this is the first merger between a professional services firm and a property services firm. How have your staff reacted?

Shepherd: The benefits that come with a very large business like this – the opportunities for training, personal development, career opportunities, the big firm mentality - are attractive to a lot of people. Of course, you do have individuals who feel that a big firm environment is very different to where we were as a 600-person firm. But that 600-person firm 10 years before, was a 200-person firm – and that was very different as well.

All mergers take time and even now, with the integration at a very early stage, it is clear to us the opportunities that will arise where teams are working on projects together. Where that has happened to date, people have been very excited.

Whitmore: So how does Drivers Jonas Deloitte fit in with the existing real estate team at Deloitte?

Shepherd: Essentially we are all part of Deloitte and the Drivers Jonas Deloitte brand is our market-facing trading name. There isn't a "he's representing Drivers Jonas Deloitte and he's representing Deloitte" mentality. We are all Deloitte and working together as one.

When we're outward-facing to the marketplace – where Deloitte is not seen to be a leasing agent or an investment agent – then the Drivers Jonas Deloitte brand is very important and, similarly, in areas like planning, which tends to be very self-contained, the Drivers Jonas Deloitte name is more recognised than the Deloitte name. Whitmore: OK, the two teams focus on different areas, but, of course, you merged to enable the two to work together?

Shepherd: Yes, there are numerous places where it all joins up. One would be strategic advice to clients in the public or corporate sector, where real estate advice is often just one piece in a wider engagement addressing IT and HR strategies, and so on.

Secondly, in the insolvency area, where there are property companies or companies with a large property component to them, there is a natural interface. For example, where we have Law of Property Act (LPA) receiverships – and generally two receivers are appointed – one of those could be Nick Edwards, who is from the Deloitte insolvency side, and the other could be a Drivers Jonas Deloitte property expert such as Tony Guthrie.

A third example is capital allowances. We can drive better value out of investment, development and leasing deals for clients by combining the expertise of Deloitte's specialist capital allowances tax team with our construction, cost consultancy and transaction teams.

Goodey: We have a number of projects where individuals and teams from across the two groups with different areas of expertise are coming together to complete the work. Just a few months ago we wouldn't have been in such a position and this is where we can demonstrate to the market a real strength of our business combination.

Whitmore: A key consideration was that the benefits of merging had to outweigh the conflicts of interest that would arise and reduce the amount of work. Has that been the case?

Shepherd: You have to look at a timescale for that because a conflict of interest, when it occurs, happens immediately, while we always anticipated that the synergy benefits of the merger would emerge and grow over time. One of the principal rules-based conflicts that we faced was in respect of Securities and Exchange Commission (SEC) regulated clients, where there are some very strict rules. We have had to put in procedures to ensure that these are adhered to.

Goodey: All professional services firms have to be wary of conflicts of interest and we take this aspect of our business very seriously. To the extent that these have arisen as a result of the merger, we have addressed these with our clients to find the happy medium for how we interact with them going forward. What we are able to do now is to offer them a much wider choice, and they can decide which services they will look to Deloitte to provide from the wide range of financial and asset based real services that we offer.

Whitmore: Where specifically are the teams working together?

Shepherd: The first example is structuring a sale and leaseback of a healthcare portfolio, where we are bringing together our investment and valuation skills with Deloitte's broader corporate finance skills of structuring, financing and tax.

The second is advising on the merger of three NHS trusts, where we are bringing our real estate competence to a much broader assignment involving Deloitte's wider mergers and acquisitions (M&A) expertise.

Whitmore: The merger with Drivers Jonas was unusual but so too was the hiring of a real estate investment banker. What was the motivation for you joining in July? Was the merger a few months earlier a factor?

Sanderson: It was a very positive factor because my heart is in real estate and being part of an organisation that is absolutely committed to real estate was very important to me. I don't think the change from an investment bank to Deloitte is as big as some people think. Ultimately, my heritage is with Arthur Andersen, so I have a good understanding of how professional services firms work. The role you play in an investment bank is ultimately about delivering the firm to your client and that is the proposition we are looking to offer our clients here.

Whitmore: Your background is in M&A, capital raising and investment banking. What will be you focusing on now?

Sanderson: We will focus on M&A advisory, capital raising and providing strategic advice. Capital raising in this context can range from helping corporates with sale and leasebacks and joint ventures, to marrying up entrepreneurs who have a fantastic business plan but need someone to help them source the capital. Strategic advice can be around scenarios which may or may not lead to a transaction. That can range from working with fund managers, private property companies and corporate owners of real estate, as they reappraise their existing real estate holdings and financing/management structures. We will also be working closely with our restructuring colleagues on opportunities emerging from the ongoing deleveraging of the sector.

Our offering is underpinned by delivering independent and objective real estate advice and this can be provided in an integrated or standalone basis as our clients prefer. But we are not looking to foist services on clients. What we are saying is 'if you are looking at a real estate transaction, in many cases we can do pretty much everything', from the pure corporate finance advice through to the tax structuring and direct property asset work, and, in the nature of the current market, where deals take longer to put together, are more complicated and sourcing the capital is much harder, having somebody who can pull it all together is resonating with clients.

Whitmore: How will you be working with Drivers Jonas Deloitte?

Sanderson: On the transactional side there is a good fit. Their investment team has very strong relationships with a lot of the institutional buyers of real estate whereas my relationships and experience sit more in the public market and private equity arenas. For those transactions where we want to access various pools of capital, it makes perfect sense for us to work together closely, as it does in situations which require a genuine in-depth understanding of a sub-sector, such as student accommodation or self-storage. We have an edge, that's pretty clear.

Whitmore: Nick [Shepherd], where is Drivers Jonas Deloitte looking to grow?

Shepherd: There are still plenty more pieces of the jigsaw to add on. One of our priorities is building a cost-consultancy business, which Drivers Jonas never had. We're looking to build a 50 or 60 person team from scratch in a three-to-four year period. We have identified the key leaders of the team, whom we are in the process of recruiting.

Cost consultancy relates very closely to other parts of the business. There's a very large forensic and disputes resolution business that sits within corporate finance which could derive significant benefit from in-house cost consultancy experts. There's a big capital programmes team which desperately needs large-scale cost-consultancy-type work. The Middle Eastern firm is also particularly keen to have that work because there are a lot of very large schemes and disputes out there.

We were never leaders in the shopping centre sector and that's another area we're looking to build. Being at a firm like Deloitte – the size and power that it's got – we've found it a great deal easier to bring in senior people than we did in our Drivers Jonas days. In the last couple of months we've brought in directors and partners from major practices such as CB Richard Ellis, Cushman & Wakefield, DTZ and Davis Langdon.

Whitmore: Overseas expansion is a huge opportunity for you. Are you looking at this now or is that something for further along?

Goodey: Both. It's worth remembering that Deloitte is a group of member firms, so how particular businesses expand is the responsibility of the leadership teams in each jurisdiction. Having said that, this merger has excited the teams across the global Deloitte network, a number of who are also looking at growing in this area. As a first step, Deloitte recently appointed Robin Williamson, formerly managing director of DTZ's Middle Eastern business, as managing director of the real estate advisory service in our Middle East firm. I am also speaking with the real estate teams in the US and Canada who want to learn more about what we do, with a view to how we can help them roll out in the US and Canada, and similarly the Australian firm, who are expanding their real estate capability.

Shepherd: We recently attended a meeting of our EMEA group – the whole topic of real estate and what we do was a big part of the agenda. Each firm is looking at how far they want to go down the track, how close it is to their businesses. In the Czech Republic, for example, they have already started building out a team; in Spain they've brought in a property expert from one of the major firms to do the same. The Dutch and Belgian firms already have big real estate teams. And the Commonwealth of Independent States (CIS) has a small team of valuers. So the pockets of expertise are there: the next phase for each of these firms is how the momentum on this expansion is maintained.

Further afield, some of our people have travelled to China and Korea with some of Mark's colleagues, as the Far East firms are very keen to get a footprint in the real estate market.

Whitmore: Back in the UK, Drivers Jonas has long had a strong reputation in the public sector field. How are the cuts in the public sector going to affect you?

Shepherd: It was a significant factor in our merger strategy. One of our key drivers was, in retrospect, our overreliance on the public sector and a recognition that the public sector was going to shrink as a client base. In the Drivers Jonas world it was very difficult to switch from a predominantly public sector client base to one predominantly in the corporate sector. One of the great advantages of coming to Deloitte is its amazing footprint within the corporate and financial worlds.

What has happened in the public sector is even more dramatic than I had any sense of last Autumn and so it validates that part of the rationale for the merger much more.

Goodey: One of the reasons Deloitte was so interested in Drivers Jonas was because of our strength in the public sector and that remains the case. It's those public sector areas, where we have been able to join up quickly and effectively where the client has seen the opportunity most quickly. So it definately works both ways.

Whitmore: You are very strong in the construction and development consultancy sector, but that market has been decimated. Do you see it returning?

Shepherd: Actually, that's probably our strongest business area at the moment. It's one where there are lots of opportunities, the best of which is our appointment by the London Organising Committee of the Olympic and Paralympic Games (LOCOG).

We won a £1.5 million project management job doing Olympic overlay work for a number of the venues. That has come partly because we've been working on the Games for a long time, but, more importantly because Deloitte is the official professional services provider to the London 2012 Olympic and Paralympic Games, and so has a very good relationship with LOCOG.

Whitmore: You've based your reputation on professional, non-transactional work. Is that emphasis going to remain?

Shepherd: One of the key areas of expansion has been to build up the amount of transaction activity. Growing our investment and agency teams has been key and will remain so. Those are the areas we've been recruiting in. We want to do more transactional work rather than less.

Whitmore: Mark, there is huge rivalry between the big four professional services firms. What has been the reaction from the other three to the Drivers Jonas Deloitte merger?

Goodey: There's been significant interest from clients and partners in other firms but there hasn't been an immediate rush from others to execute similar transactions.

Shepherd: I do think the whole professional services landscape is changing. We've seen Davis Langdon bought by Aecom, NB Real Estate bought by Capita Symonds, a number of legal firm mergers. What has been a pretty stable landscape is in for a lot of change. We were up there at the front end of that.

Whitmore: OK, final question. Confidence in the property market has plummeted since the summer. How are you all feeling?

Sanderson: I believe it's going to be a slow and gradual unwind. The market still remains incredibly narrow and, where there is activity, it's in a very small part of the sector and it's incredibly well bid. Until the rest of the market opens up again – and I don't see any incentive for anyone to open it up too rapidly – you will likely see a market with various mini troughs and peaks over the next few years.

UK commercial market outlook property

Anthony Duggan, Head of Research at Drivers Jonas Deloitte and Ian Stewart, Deloitte Chief Economist, set out their views on the outlook for the UK commercial property market.

The next phase for the UK property market may feel a bit like trying to wade through treacle. Compared to the 'excitement' of the last 10 years or so (featuring both the upside and the downside) we now face the reality of a much slower and more uncertain market in the face of low economic growth and tough financing conditions. However, we believe that good returns are still achievable. The last decade saw strong capital growth through significant yield compression; the next few years will be about driving rental growth for performance.

It gives us some satisfaction to say that we managed to call the last 18 months about right. Our summer 2009 Investment Trends report suggested that 'investors would look back and reflect on the first six months of 2009 as the time when prime property was cheap and the seeds of the best returns were sown'. Our January What's in Store client presentation on the UK Real Estate market outlook for 2010, suggested a year in thirds with 'strong growth, a pause and the possibility of stagnation/falls' – the recipe for the year.

Key trends

Looking ahead, it seems there are some clear signposts for the next 18 months:

- Double-dip in values approaching – particularly for secondary property leading to further polarisation between prime and secondary. In short, we expect prime property values to remain robust especially in the best locations but secondary property values to fall further.

- Total returns to be largely income driven – minimal further yield compression in prospect will lead to a return to a focus on rental growth for driving returns.

- Development to remain the playground of the brave (and affluent) – development exposure is compelling from a supply side view with activity at a record low. However, the demand side remains fragile at best, with few occupiers expanding. In addition development finance remains scarce.

- The occupier is king – property is nothing without its tenant and this has rarely been truer than now. Landlords will work hard to keep their tenants in place and, in most cases, they will be successful (unless the tenant goes bust of course). The tipping point for a tenant to move is significant and an occupier will need to see a noticeable saving in property overheads, a marked difference in occupation strategy or a big positive change in headcount (with few firms in expansionary mode this looks unlikely) to commit to a move.

- The beginning of the end of the High Street – the ongoing squeeze on incomes and expected consumer retrenchment is going to hit secondary high streets hard and retailers will only be looking to locate on the best streets. Retail, so long the outperformer of the property sector, looks set for a difficult time ahead. There will be exceptions, such as the continued success of the retail/leisure shopping destinations in affluent town centres such as York and Cambridge and dominant shopping centres such as Bluewater and Westfield London

Sluggish but continued recovery

We believe that the UK economy is likely to see an erratic, sluggish but continued recovery. With Government and consumers rebuilding their balance sheets, two of the big drivers of growth in the economy in recent years are likely to move to the sidelines. Instead exports, industrial output and capital spending are likely to provide much of the impetus for growth in coming years. Although the recovery is likely to be choppy, with the Bank of England determined to underpin growth, if necessary with renewed quantitative easing, the chances of a double-dip recession are relatively low. Indeed, growth in both the second and third quarters came in appreciably in excess of market expectations. So far, at least, this has actually been quite a strong recovery. Historically, recoveries from financial crises are slow but, in the absence of major monetary policy tightening, they tend to run. We think this cycle is likely to conform to this model.

The implication for commercial property is likely to be below average volumes of leasing deals for some time, although a growing economy, albeit lethargic, should mean relatively few tenants facing insolvency and so some support to income stability. However, this will not be enough to stop further falls in secondary property values over the next 6-12 months. The market has moved through three clear stages over the last couple of years: firstly the initial downturn in values led by the credit crunch and recession, then the second wave of falls led by the downturn in rental growth.

We are now moving into the third phase where rents are turning positive but only selectively i.e. in only the best locations and top quality buildings. This growth differential is driving a clear polarisation between the perceived value of prime and secondary property.

London resilient but polarised

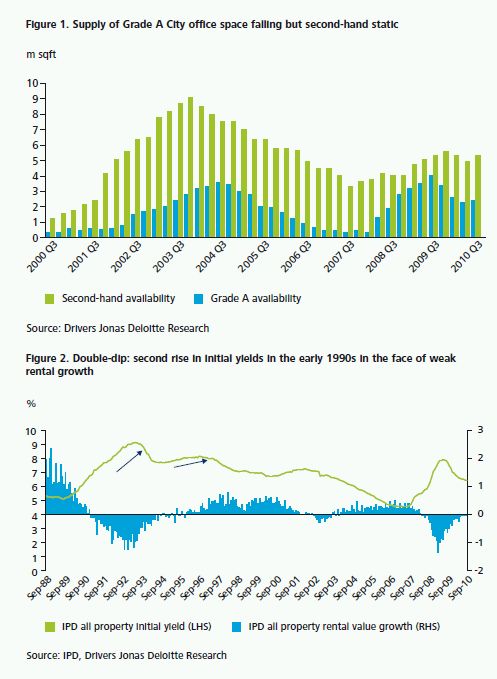

London is a part of the market showing strong resilience but even here the market is polarised. This can clearly be seen in the City office market where prime rents are rising but secondary rental growth remains allusive. The well publicised shortage in supply will drive further rental growth for the best space but while the volume of Grade A space diminishes the supply of second-hand space remains stubbornly high.

1990s downturn showed a similar pattern

Interestingly, history shows us that this expected double-dip in property values is not unprecedented. Those who lived through, or have studied the previous major downturn of property values in the early 1990s will recognise a similar pattern. Although the trigger for the fall in values was different (no credit crunch) the subsequent recovery in values also stalled once the initial correction in values was complete and rental growth was slower to catch up.

However, much like the early 1990s, the forecast second dip in values should be relatively shallow and this time round is likely to be shorter in duration. Real estate continues to be supported by low interest rates and low bond yields. UK inflation has been unexpectedly high in the last two years. Nonetheless, the Bank of England sees this as a temporary phenomenon reflecting 'one-off' factors with inflation moving back to target in the medium term. Market expectations for UK interest rates have fallen markedly in the last year and the futures market is now assuming that three month rates will stay below 2.0% for at least the next two years. This, on the face of it, is positive for property performance but high margins (compared with the last few years) and a very low propensity to lend from the banks means that these low rates will not fuel the market as they did in the early 2000s. Indeed, although we have noticed a loosening in the property lending market from the zero lending stance of last year, bank finance will continue to be difficult to find for all but the best sponsors and assets.

Support for property values

Low bond yields will also give property values some support as the yield generated from real estate continues to be attractive for those looking for returns above the 'risk-free' rate. Indeed, although the flow of money towards property has slowed markedly from the flood seen late last year (where the quarterly inflow into the retail funds outpaced even the bull market of 2006/7 – see figure 3) there remains a strong appetite for exposure to the UK commercial property market. In addition, the well publicised demand from overseas buyers remains in place and looks unlikely to divert at the present time – especially with sterling well below its pre-recession highs.

So, all is not lost for property owners and investors. The reality is that there will be further price falls for parts of the UK market and, indeed, there are properties that are likely to remain un-saleable, un-lettable and over-rented for some time.

However, the better quality product is likely to continue to attract interest from both occupiers and investors and this is where the rental and capital value growth will be found.

There is also likely to be an increase in stock available as the banks continue to unwind their loan-books. We do not expect this will be done in anything but the slow and organised way we have seen to date, but the flow of assets to the market will continue from this source as well as those investors looking to take profits or reposition their portfolios.

It seems unlikely that there will be a return to the 'search for yield' attitude that personified a large proportion of the market over the last ten years and pushed down yields across geographies and building/investment quality. Instead, investors will be more risk averse and primarily looking for stability of income and the opportunity to grow this income or reposition the asset to raise the level of achievable rents. The market, for both occupiers and investors, will focus on prime assets for now and the demand for long and strong income will continue unabated. However, the lack of construction activity suggests those tenants that have to move will need to start making compromises as the supply of Grade A is eroded. Many tenants will chose not to move under this scenario but some will and this is when the wider market will start to see stronger rental and capital value performance. We believe that those positioning for this next phase in the recovery will achieve solid returns in the medium term.

REITs are back in town

The story so far ...

Real Estate Investment Trusts (REITs) have had an eventful time since they were first introduced at the top of the property market nearly four years ago. Their share prices have been on something of a roller coaster, collapsing to around 25 per cent of their pre-credit crunch high, and seeing only a small recovery in the period since. Many REITs were in danger of breaching their loan to value banking covenants and were forced to make rights issues, settle for expensive new borrowing terms with their banks or were even taken over. However, most of the REITs that have weathered the storm are now financially robust and it's business as usual, albeit in what could be best described as choppy waters.

There are currently 22 REITs owning around £40 billion of property, equating to approximately 80 per cent of all the property held by UK companies.

So has the REIT industry already reached maturity? The answer is 'no'. REITs are vastly more tax efficient for investors than taxable UK companies (and indeed many offshore fund structures), because there is only a single layer of tax on profits of their property investment business, at the shareholder level. Very importantly, they also give access to a much wider range of investors globally. It is no accident that the overseas shareholder base of the current REITs rocketed to around 50 per cent after they became REITs. This global reach is essential for capital hungry, acquisitive property vehicles whose only alternative is debt finance that is now more expensive and difficult to come by.

These advantages in themselves bring new entrants to the REIT regime, including some conversions of offshore structures that are running out of tax shelter for rental profits.

These offshore structures cease to be efficient for tax exempt shareholders, such as pension funds, once they start paying tax on rental at vehicle level.

Over the past year there has been a strong resurgence of interest in the REIT regime. We have witnessed, and indeed advised on, the three most recent new entrants Hansteen Holdings plc, Metric Property Investments and London & Stamford Property plc, some of which were ground-breaking in their own ways.

Into the future

But the story doesn't end there. There are a large number of other potential new REITs in the pipeline. Many of these will themselves break new ground. We are, for example, considering institutional REITs, private equity owned REITs and REITs that provide 'debt finance'.

There are also vast amounts of property and propertyrelated assets that may come under the investment umbrella of REITs at some point.

For a start, there is over £3 trillion of residential property in the UK, and yet there are no residential REITs. Indeed, one of the Labour Government's main objectives when introducing the REIT regime was to assist the residential property sector, by encouraging new capital to help improve the quantity and quality of housing. It also hoped that having large scale REIT landlords, rather than buy-to-let landlords, owning residential property would improve the way the rental sector is run.

However, the residential business model, with its low net rental yield and the need to 'trade' its property portfolio to supplement that yield, is not ideally suited to the REIT regime – which is founded on property investment and which penalises situations where there is insufficient rental yield to meet the interest cover ratio.

A relaxation of the REIT rules to accommodate the residential business model would therefore be welcome, as would a repeal of the stamp duty land tax rules that penalise the bulk buying of property. However, the issues with residential property run somewhat deeper. UK institutions are still not familiar enough with residential property as an asset class, nor confident that it will give them the return they require. In addition, assembling residential portfolios with sufficient critical mass is problematic given the small lot size.

Recently, the Coalition Government published its latest document on encouraging investment in the private rented sector. There were many disappointments, most notably in relation to stamp duty on bulk purchases and regarding VAT, but these were not surprising given current fiscal constraints. However, every cloud has its silver lining, which in this case is the Government's willingness to take forward discussions in relation to facilitating entry to the REIT regime, particularly in the context of encouraging residential REITs.

Another major source of property and property-related assets could be the banks. As is the case for banks in many other countries, UK banks are widely considered to be over exposed to property, both in terms of property on their balance sheets and property-related assets, such as loans. The banks have spent the first couple of years post-credit crunch trying to understand the enormity and nature of their exposures and are only now entering a phase where they are deciding what to do. To date, there have been a few joint ventures between banks and REITs, where the REIT takes an equity stake in the distressed borrower and utilises its property expertise to help maximise everybody's returns. Surely there is more of this to come. The banks are also starting to think about setting up their own REITs, which they can seed with suitable property from their balance sheet and then divest their stake in the REIT over a period of time.

The REITs themselves are also very keen to be able to acquire distressed loans from banks. Through their property expertise, they would be able to maximise returns for the REIT and the bank, helping recapitalise the banks. However, unlike in the US, property loans are not treated as 'good' assets for the REIT exemption, despite distressed loans being a proxy for the underlying property, so any gains or income arising from the loan will be treated as taxable in the REIT's hands. A change in the REIT legislation is essential to make this a reality. In a similar vein, there have been calls for the UK to be allowed to have mortgage REITs, as in the US – although following the credit crunch, the reputation of that sector has become somewhat tarnished.

In addition, the Government may well have far more property on its books than it wants. REITs could be a natural home for this excess property and perhaps the major REITs could satisfy the Government's future needs for modern, efficient, flexible property as a quid pro quo. Like the banks, perhaps the Government could also contemplate setting up its own REITs, holding regional or sector specific portfolios, from which it could divest in tranches over a period of time. The implications of the recently announced Comprehensive Spending Review will become clearer over time.

Turning now to new sources of capital

As in the US, there is a desire, particularly from the institutions, for the UK to have the option to establish private REITs. Major institutions would like to be able to club together to invest in property via the tax efficient REIT wrapper. However, they would like to do this in the first instance via a private REIT, so they don't suffer share price volatility, but with the ability to exit from their investment in due course by listing the REIT on a stock exchange. So far the Government has been resistant to change in this respect, despite the fact that it would not cost it any money to relax the rules. One day perhaps we will get there, but for now we have to use structured alternatives to achieve a similar result.

Lastly, there is a push from the property industry for European-based REITs to be tax exempt on all property income and gains arising throughout Europe. Without this, a REIT is not necessarily a tax efficient vehicle for European property investment. For example, a UK REIT is exempt from UK tax on its property income and gains regardless of whether that property is located in the UK, continental Europe, or elsewhere. However, this is of limited benefit whilst the overseas jurisdiction in which the property is located continues to tax income and gains from that property locally.

Nirvana from a REIT perspective would be for REITs to be exempt from tax both in the REIT's home country and the jurisdiction where the property is located. The REIT can of course easily levy tax on behalf of its home country via a withholding tax on dividends it pays to its shareholders. The conundrum, however, is how does the REIT levy tax to recompense the country where the property is located? It is after all a universally accepted principle that the country in which a property is located has primary taxing rights. It is this latter point that poses one of the greatest difficulties, especially as there might be fiscal winners and losers amongst the European countries.

... and finally

Now it's back on its feet, the REIT sector is once again going through exciting times with a large pipeline of new entrants waiting in the wings. However, merely having more REITs around to buy and sell the same old properties that are in the current REIT's hands, achieves little. There are currently 22 REITs owning around £40 billion of property, equating to approximately 80 per cent of all the property held by UK companies.

Hopefully, new sources of property and new sources of capital, combined with the REIT sector lobbying Government for some essential legislative changes, will bear fruit and propel the REIT sector to new heights

There are currently 22 REITs owning around £40 billion of property, equating to approximately 80 per cent of all the property held by UK companies.

Pensions – Making your real estate work for you

That perennial pensions dilemma continues to persist; what should companies do with their defined benefit pension schemes?

The aggregate pension deficit of the UK's top 100 companies recently passed £100 billion. Whilst stocks have rebounded from the FTSE 100 lows of March 2009, increasing liabilities mean that market recoveries have made little inroad on the scale of the deficits that companies have to fund.

Understandably, the strategy for managing pensions receives significant board level attention. It has a major impact on many key areas of corporate activity including deficit financing, cost and cash flow management, governance, and employee reward and retention.

This focus has been further sharpened by a raft of changes to pension arrangements in the UK, including Government proposals and the recent HM Revenue and Customs (HMRC)/HM Treasury announcement on 14 October 2010 on the restriction of pensions tax relief, which will have effect from April 2011.

Companies generally have three key objectives with their pension schemes:

- reducing inherent pensions risk;

- reducing cash funding requirements; and

- maintaining member confidence in the funding of their plans.

The cost of defined benefit pensions has both increased and become more volatile in recent years.

For these reasons, together with increased longevity, legislative changes and the growing influence of The Pensions Regulator, there has been a significant shift in the provision of defined benefit pension schemes to defined contribution arrangements, to transfer risk from the employer to employees and reduce scheme costs.

Many UK companies, however, retain material legacy pension liabilities that represent a significant operational and financial risk to the business.

The challenge for these companies is to address the deficit and reduce risk, in a way that is affordable and does not adversely impact financial performance.

This has led to a focus on alternative funding strategies and a number of high profile companies implementing solutions to fund large amounts of their deficits using a range of assets, most notably property.

To read Part 2 of this article please click on the Next Page link below

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.