Introduction

In terms of infrastructure delivery, governments across the globe face two main challenges. The first is well known and has been widely debated – the need to cut the massive fiscal deficits accumulated in part because of the extraordinary measures they took to stabilise the financial system and prevent the Great Recession turning into a new Great Depression. They succeeded, but at some cost – fiscal deficits among the Group of Seven (G7) wealthiest nations this year will amount to 9.5 per cent of their combined gross domestic product (GDP), or more than $3 trillion. This will take the total volume of government debt to 120 per cent of GDP, exceeding that prevailing in the aftermath of the Second World War.1

However, the second challenge has received much less attention over the past few years, despite having the potential to cause even more severe problems for all major economies if it is not addressed. This is the need for massive investment in infrastructure over the medium to long term, to ensure that countries grow at a rate needed to deliver gains in health, wealth and wellbeing for the citizens, and also to prevent a collapse of key services and utilities if they are starved of investment.

This report seeks to highlight the scale of the challenge, but at the same time to point to an innovative new direction that governments can take to simultaneously tackle the deficit and develop new vehicles to ensure that the needs of infrastructure are met. At the heart of the solution is the sale of government-owned assets and, more importantly, innovative partnerships between the public and private sectors to enable major infrastructure to be built despite the scale of the financial crisis.

The global trend of privatisations and asset sales is usually thought of as belonging to the 1980s and 1990s, but it continued into the past decade and is expected to continue over the coming years. However, there are already signs that the nature and types of sell-offs have changed in three key ways. The first is that the baton of privatisation or – in the case of the US – monetisation of public assets has been passed from the Anglo-Saxon economies to those in continental Europe. The second is that the pace of divestment has slowed. The third is a trend among those governments most active in asset sales towards a greater focus on non-core areas that include everything from parking to filmmaking and information provision.

This report looks at how governments can marry that last trend with an increasing desire among investors for infrastructure assets that can attract greater investment in key infrastructure areas. At the heart of this is the need for governments to think less about how they can directly invest in and build much-needed new infrastructure, and more about how they can work better with the private sector to encourage companies and investors to get in at the ground floor of the project rather than wait until the final brick has been laid and the last coat of paint has dried. We have coined a new acronym, IBIS (incubate, build, intermediate and sell), to describe the way governments could approach infrastructure delivery. This report explains how this new idea can be made to work. It would be a new road for governments, but one that could end up bridging the infrastructure investment gap.

The Infrastructure Gap

Any country seeking to compete on the world stage must have a highquality of national infrastructure. It boosts economic growth, increases competitiveness in the global economy and raises the productivity of the workforce. It also protects against future infrastructure failures that would both undercut economic growth and deliver hardship to households and businesses. As a report for the UK think tank Policy Exchange concluded last year: 'The importance of infrastructure cannot be underestimated.'2

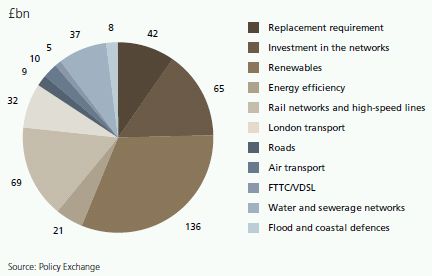

Policy Exchange carried out a detailed analysis of the state of infrastructure in the UK and calculated how much investment would be needed over the current decade. Although it only looked at Britain, the themes of its findings can be applied easily to other leading economies. It concluded that the UK needed a total of £454bn of new investment into transport, energy, water and communications over that period. However, it said the true figure could be nearer to £500bn or £50bn a year over the next ten years. Nor did it include areas such as schools, hospitals and public sector IT, which will need ongoing investment in their physical assets. Even their most conservative estimate implies an increase of 50 per cent on last year's public sector net investment of some £30bn.3

The previous British government also highlighted the need to focus on long-term spending. In a keynote document published alongside the 2010 Budget, the UK Treasury said the demand for investment in economic infrastructure in the UK was expected to be in the range of £40bn-£50bn a year until 2030, 'and possibly beyond'. 'This is significantly above historic levels', it added.4

The American Society of Civil Engineers says the US needs $2.2 trillion of investment over the next five years to deal with the country's 'crumbling infrastructure'. The list is topped by a bill for $930bn for upgrading US roads and bridges, followed by $265bn for transit systems and $255bn for drinking water and sewerage.5

There are several keys areas where there is a consensus on the requirement for greater investment, including energy, public utilities, transport and telecoms. All sectors are faced with the need both to renew ageing existing infrastructure and to invest to deal with anticipated future pressures deriving from social, demographic and climate changes. To take energy as an example: this includes the generation, distribution and supply of electricity and gas. Earlier this year, Alistair Buchanan, the chief executive of Ofgem, the UK's energy regulator, said the sector required new investment of 'up to £200bn'.6 He hinted that there was a danger of the lights going out if radical reform was not undertaken. He told The Guardian newspaper: 'To wait a few more years [without doing anything] could cause us trouble. We would get down to historically low levels of margins of plant, to when you are starting to ask if you have enough power stations.'7

However, although investment is needed in electricity generation and distribution in the form of new power stations and networks, there is the overarching demand for investment in decarbonising the energy system to tackle the threat from climate change. Policy Exchange estimated that £136bn needed to be invested in renewable energy generation and a further £21bn into energy efficiency by 2020. In its report, the UK Treasury said: 'There needs to be a significant increase in investment in the energy sector and the use of new low carbon technologies.'

The UK's Infrastructure Renewal Bill

To give some global context, rough estimates from the OECD suggest that annual investment requirements for telecommunications, road, rail, electricity and water taken together are likely to total around an average of 2.5 per cent of world GDP by 2030 – equivalent to $1.5 trillion in today's money.8

Although the urgency over the need for investment is in no doubt, the scale of the global fiscal crisis means that governments are not going to be able to underwrite as much infrastructure investment as has happened in the past. This means that more future investment than has historically been the case will need to be undertaken off the balance-sheet of government and financed by the private sector, which will need to take on more infrastructure delivery risk. Although this type of transaction (eg the Private Finance Initiative in the UK) has existed for some time, the current situation means radical thinking is needed to ensure the infrastructure finance gap can be bridged.

A Brief History of Asset Sales

The past 30 years has seen a massive sell-off of government-owned assets to the private sector, either directly to corporate buyers or indirectly via stock market flotations. Although there have been attempts to reduce state ownership of infrastructure assets since the end of the Second World War, it was during the 1980s under the leadership of Margaret Thatcher in the UK and Ronald Reagan in the US that privatisation became a global phenomenon. Industries such as steel, airlines, phone companies, public utilities and rail were sold off.

Even though much of the low‑hanging fruit has been picked, the trend has continued. However, there are signs of an important shift in the way that assets have been sold off. Governments have had to search harder and dig deeper to find assets that they believe would be better off in the private sector. Industries such as steel, oil and mining have long been sold. In many jurisdictions, services such as railways, airlines and the supply of electricity, gas, water and telephone communications have also been divested.

This has reduced both the volume and value of sales. In the UK, the sale of British Energy Group to Electricité de France for $6.1bn in 2008 was the last sale above $1bn in the UK since rail privatisation in 1994 (which raised £4.0bn or £5.12bn ($7.42bn) at present values).9

Mixed History in the US and Europe's Largest Economies

This leads on to the next trend. The UK, which led Europe – and perhaps the world – with privatisations in the 1980s and early 1990s has passed the baton onto the other major European economies, particularly France, Germany and Italy. France, for example, has in the past decade raised $3.6bn from the privatisation of France Telecom, sold Caisse Nationale des Caisses d'Epargne, a Paris bank, for $9.0bn and raised $2.5bn from the sale of a stake in Alstom. Italy has joined the party, raising $10.2bn from the public sale of shares in Enel, an electricity supply company, selling Fondo Immobili Pubblici, a real estate investment trust, to a consortium of UK and US banks for $3.9bn, and raising $1.5bn from the flotation of Telecom Italia. Perhaps the $2.6bn sale of a tobacco firm to British American Tobacco shows how deep state ownership lay in Italy. Germany has been less active but, again, the sale of a bank, Frankfurter Sparkasse, by the City of Frankfurt, and a polytechnic indicates that institutions other than central government owned large tranches of productive economic wealth.

In the US, major infrastructure has long been in private ownership, which means the scope for traditional asset sales is more limited. One of the most recent sales, rather than a concession, was the $720m sale of the office assets of General Services Administration, a federal procurement agency, in 2006.

Emergence of Non-Core Assets

Although the sale of Telecom Italia and Alstom show that Europe's leading economies are following the US and UK down the road of infrastructure privatisation, the more interesting trend is towards the sale of non-core assets. Though there are no internationally accepted definitions, most analyses categorise core infrastructure as comprising the broad areas of transport, public utilities, energy generation and telecoms. However, advanced economies have over time built up an empire of assets in other areas, often built or acquired by cities and regional governments during the economic reconstruction of the post-war era or taken onto state balance-sheets during previous economic downturns.

Anecdotal evidence shows that governments are increasingly looking to this asset base as a place to raise revenues and to bring in private sector management to deliver greater efficiencies. For example, in the past year, Germany has started the process of selling a Bavarian film-making company and a state-owned insurance company. In France, a regional government is seeking to offload its minority stake in Futuroscope, a theme park, while state-owned Groupe Caisse des Dépôts et Consignations announced this year that it was seeking a buyer for the fast-food chain Quick Restaurant, which was nationalised in 2007. The UK is considering selling the Tote (a betting organisation), the Met Office (a weather and climate change forecasting organisation) and the Student Loans Corporation, among other assets.

The trend towards the sale, or more accurately, monetisation of public assets is clearest in the US, where infrastructure in areas such as utilities and other public services has been in private hands longer than has typically been the case in Europe. The largest public-private deals in the US in the past decade have involved the construction or operation of new roads and bridges, as well as of non-core assets such as solid waste, waste water and parking (see box). In 2007, the State of Texas awarded a 50-year concession to build, own and operate State Highway 121 and three years earlier the City of Chicago raised $1.82bn from a 99‑year concession to own and operate the Skyway Toll Bridge.

To read this article in full please click here.

Footnotes

1. Fiscal Monitor. International Monetary Fund, May 2010.

2. Delivering a 21st Infrastructure for Britain. Helm D, Wardlaw J, Caldecott B. Policy Exchange, 2009.

3. Budget 2010. Annex C: The public finances. HM Treasury, March 2010.

4. National Strategy for Infrastructure. HM Treasury, March 2010.

5. Report card for America's infrastructure 2009. American Society of Civil Engineers.

6. Action Needed to Ensure Britain's Energy Supplies Remain Secure. Ofgem press release, February 2010.

7. Ofgem: UK cannot rely on energy companies to keep the lights on. The Guardian, February 2010.

8. Infrastructure to 2030 (volume 2): mapping policy for electricity, water and transport. Organisation for Economic Co-operation and Development, 2007.

9. Financial outcomes of rail privatisation in Britain. White P. Transport Reviews, volume 18, issue 2, April 1998.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.