A regular briefing for the alternative asset management industry.

At the end of last year, ESMA, the pan-EU supervisor, published its final report on the vital regulatory technical standards that will underpin the revised European Long Term Investment Fund regulation – the regulatory wrapper that offers a full retail marketing passport to its manager. The changes that have already been made to the primary legislation are generally welcome. The good news is that ESMA's proposed implementing rules, which respond to the industry's feedback on an earlier draft, should confirm that the ELTIF is a viable vehicle for sponsors targeting high net worth individual investors – despite some important remaining limitations.

Retailisation – which for most alternative asset managers still means accessing wealthy individual investors, rather than the mass retail market – remains a firm trend in the private markets. Fishing in this potentially vast pool of capital is attractive to sponsors, while investors are keen to get access to the higher returns that private markets have delivered in recent years.

Policy makers are also keen: UK and EU regulators have taken various steps to increase access to private markets, which they hope will help to fund vital infrastructure and fuel growth. Revisions to the ELTIF, a fund structure launched in 2015 but with disappointing uptake, is one of the policy interventions intended to help.

Some of the liberalisations to the regime laid out in the new primary rules – which were agreed in 2022 and finalised last year – are already very helpful. For instance, the portfolio composition rules are much less restrictive, funds of funds are now permitted, and borrowing limits have been eased.

However, one of the ELTIF's limitation is the lack of clarity about its ability to support an evergreen, open-ended structure. That made it a hard sell to individual investors, and compares unfavourably with other available structures, such as the so-called "Part II" structures available in Luxembourg. Although restrictions on redemptions will remain, ELTIF 2.0 – and, in particular, the proposed new RTS – will make them easier. That will undoubtedly make the structure a more viable option.

Under the revised ELTIF rules, redemptions can be offered on a quarterly basis, with the possibility of more frequent redemptions in limited circumstances and with appropriate justification. That should work for most sponsors: while some semi-liquid funds have been offering monthly redemptions, quarterly is still the dominant model – and, importantly, the proposed rules leave open the possibility of monthly subscriptions for incoming investors.

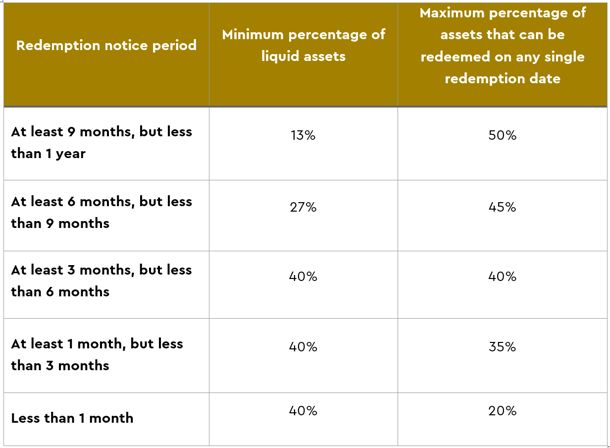

More problematic for some funds, though, will be the proposed minimum notice periods for redemptions. In general, ESMA proposes that investors should be required to give at least twelve months' notice before redeeming units. Shorter notice periods are possible, subject to maximum redemptions on any single redemption date, but they will require the ELTIF to maintain a certain percentage of liquid assets. ESMA's proposed minimum liquid assets and maximum redemptions are as follows:

If an ELTIF manager wants to provide for a notice period of less than three months, it will have to justify that to its local regulator, including how that notice period is consistent with the table above and in the interests of investors.

Another issue is that "liquid assets" for this purpose are essentially investments that would be eligible investments for a UCITS fund. Many of the Luxembourg Part II funds aimed at the high-net-worth market have typically included investments in their liquidity pool that would not qualify under that test. That restriction could be a drag on returns for the ELTIF compared to available alternatives.

In addition, Luxembourg Part II funds with 5% quarterly redemption caps and 2-3 month notice periods are typically only holding around 15% of their portfolio in liquid investments. That is much lower than the equivalent ELTIF requirement which – under ESMA's proposals – will be driven by the short notice period rather than by the cap on redemptions. Part II funds are, therefore, likely to continue to dominate for investors who can access them, perhaps even as parallel structures to an ELTIF that is marketed more broadly.

More problematic for some funds, though, will be the proposed minimum redemption notice periods ... ESMA proposes that investors should be required to give at least twelve months' notice before redeeming units.

A separate concern for managers is the ELTIF's requirement for a minimum holding period – which limits how quickly an investor can exit, and which is not a typical feature of other available structures. The requirement for a minimum holding period remains in ELTIF 2.0, although ESMA suggests allowing managers to select the holding period that is best adjusted to the ELTIF in question, provided it can be justified to the local regulator and is compatible with the fund's valuation procedures and redemption policy. To some extent, therefore, the viability of the ELTIF will depend on whether the regulators – generally the CSSF in Luxembourg and the Central Bank of Ireland – apply that guidance in a sensible way so that minimum holding periods of a year or less are permitted.

The European Commission must now decide whether to adopt ESMA's proposed rules, which means that further changes are possible. After adoption by the Commission, there is then a further period during which the Parliament and the Council can object. In view of the European elections this year, it seems likely that the various institutions will want to get these rules finalised sooner rather than later. That means that sponsors looking to raise semi-liquid structures for the retail market this year will want to take another look at the revised ELTIF, even if they have rejected it in the past.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.