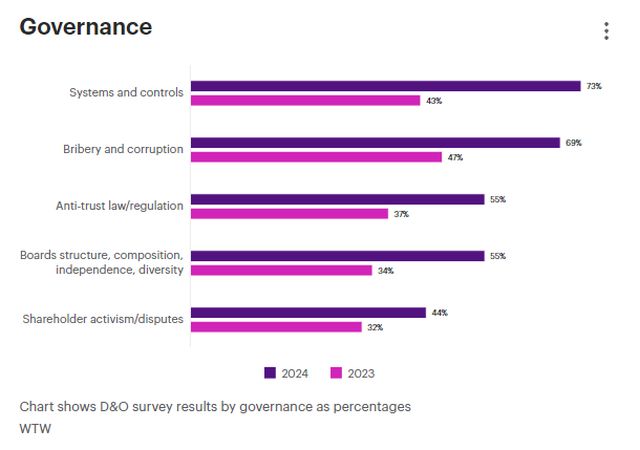

The primary focus in recent years has been on 'E' (environmental) risks, particularly climate-related risks, but ESG is far more wide-reaching, and encompasses a range of issues under the 'S' (social) umbrella – for example, workplace culture, diversity, equity and inclusion (DEI) and community impact – and the 'G' (governance) umbrella, which ensures the board of directors is identifying, analysing, putting into action and reporting on the 'E' and 'S' issues.

In response to the increasing attention paid to ESG factors, the questions in last year's survey were reorganised to fit within an ESG framework. Given that the level of attention has only increased in the past twelve months (and, indeed, political uncertainty and polarisation of views in some jurisdictions to varying degrees), we have maintained this structure for this year's survey.

For comparative purposes, our review of the responses on ESG-related factors in last year's survey can be accessed here : ESG - How does this give rise to liability for Directors and Officers?

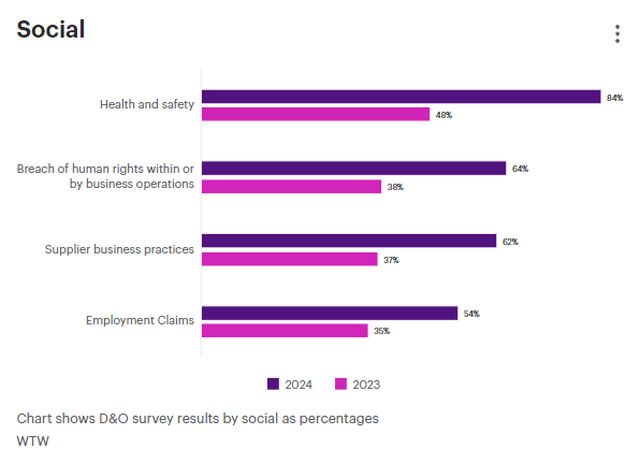

Social risks on the rise

While there are variations between results when looked through a jurisdiction or industry lens, this year's survey shows that, overall, all ESG-related risks are of more concern to D&Os than they have been in the past but social risks, health and safety (H&S), human rights, supplier business practices and employment claims – have particularly grown in importance, with each risk perceived as much higher than in previous years. Notably, H&S risks are now considered the number one concern, perhaps linked to a rise in employment litigation (the survey shows concern about such claims has also risen).

There are many reasons why 'S' issues have become increasingly important in recent years, including (i) changing consumer attitudes, with consumers expressing more interest and concern about how companies' operations impact society; (ii) more attention on social issues as a result of highly publicised cases involving inequality and human rights; (iii) regulatory pressure to improve corporate behaviour and increase board accountability for their impact on their workforce and the broader community; and (iv) increasing demand from investors, who want to know how social factors are incorporated into investment decisions. There is also greater awareness of studies which have indicated that a company which invests in good, responsible social practices results in better financial performance.

"The social risk uptick is very interesting to see and an area we have been focusing in on for underwriting. Whilst social risks are not our number one driver of claims we have seen Directors facing increased pressures around social risk. Requirements to report on social initiatives potentially increases D&Os exposure."

Emma Pereira

Product Leader, International Management Liability, Beazley

Why companies are engaging in 'green hushing'

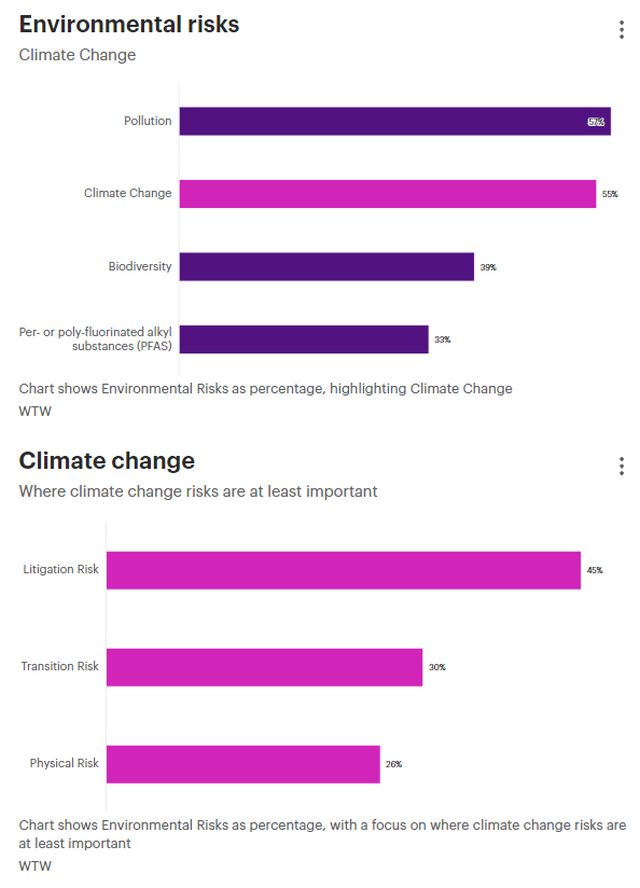

Whilst 'S' issues are of concern across the board, the survey shows that larger companies are more concerned with 'E' issues than smaller companies, likely reflecting the greater regulatory burdens these companies face. Unsurprisingly, the energy and utilities sector ranks climate change risks the highest and is the only sector which has it within its top seven risks.

One of the more notable developments in the last year relating to ESG is the increase in 'anti-ESG sentiment'. For example, we have witnessed some states in the US taking 'anti-ESG' measures, including divestment policies and 'anti-boycott laws', limiting the state's business with companies that take into account ESG factors in their operations. It has been suggested that this may lead to companies engaging in 'green hushing' downplaying their ESG efforts to avoid backlash.

One of the more notable developments in the last year relating to ESG is the increase in "anti-ESG sentiment".

On the flip side, a number of other states in the US have enacted legislation encouraging or requiring fiduciaries of state pension plans to take ESG factors into account when such factors may be financially material and disclose how they are doing so. Bills have also been introduced calling for the mandatory divestment of public funds from certain industries like fossil fuels, firearms and nuclear power. These bills have generally not been passed into law and have faced significant opposition, particularly as they remove the discretion of fiduciaries to assess materiality. The approach proposed or enacted by different US states is, for the most part, determined along party political lines but there are variations and nuances between them all.

While other jurisdictions have not witnessed a similar backlash yet (or, at least, not to the same degree), in the UK at least, 'green issues' may be thought to have been de-prioritised of late in some quarters. This certainly appears to be reflected in the fact that last year climate change was the identified in the Survey as the number one risk for directors of GB organisations. However, climate change does not appear at all in the top 7 of risks in the latest survey. This may be misleading however. The overall proportion of respondents from GB companies which indicated that climate change was either very or extremely significant last year was 44%. This year it was 52%. So, the percentage has gone up but nonetheless, the percentage has gone up more for other risks, hence climate change in GB is much lower down the ranking.

In sum, there is currently a very complex patchwork of current and upcoming regulations at both the state and federal levels in the US applicable to ESG. This makes for an incredibly difficult and ever-changing landscape for D&Os to navigate, and the political overlay adds volatility and unpredictability as to the direction and speed of travel. This is particularly so for D&Os of multi-nationals as the situation becomes more complex still when one factors in current and upcoming regulations in other jurisdictions.

"It is indeed surprising that climate change is not included among the top seven risks overall, considering the significant challenges that companies are facing in navigating their climate transition plans and disclosure requirements. These challenges involve balancing conflicting priorities and complying with increased regulatory scrutiny regarding sustainability disclosures. However, the survey results suggest that climate change is not an immediate priority for most directors and officers. One possible explanation is that the impact of heightened regulation, climate-related litigation, and the pressure to fulfil climate transition plans will be more pronounced in the medium-term (5-10 years). Other surveys, such as the 2024 World Economic Forum Global Risks report, support this viewpoint. Although environmental risks may not be highly ranked in the short term (2 years), the risks associated with climate change dominate the top four rankings in the long-term (10 years). This demonstrates that while climate change may not be an immediate concern for most D&Os now, it is undoubtedly a significant consideration from a long-term perspective."

Beatriz Araujo

UK Branch, Head of D&O, Financial Lines, Specialties, Zurich

Insurance Company

D&Os are at the heart of shaping corporate culture and reporting on ESG issues, getting it wrong or failing to adequately prioritise these issues can lead to significant consequences

The regulatory space, in particular, is driving the risk for D&Os. There are additional reporting obligations in many jurisdictions. For example, the UK has brought in specific climate-related disclosure rules (which are a mix of mandatory or comply or explain depending on the size of the company and whether it is listed) and is consulting on DEI issues and, in the EU, there is the Corporate Sustainability Reporting Directive (CSRD), which expands the scope of the companies which are required to make sustainability disclosures and includes more stringent and harmonised reporting obligations. Australia has climate reporting proposals on the table and, in the US, specific disclosure guidelines were adopted by the SEC on 6 March 2024. Of note, the adopted version is a much-diluted version of the proposals originally on the table. Nonetheless, we expect there to be some pushback on the guidelines given the current US sentiment towards climate (and broader ESG) issues.

The regulatory space is driving the risk for D&Os. There are additional reporting obligations in many jurisdictions.

Increased scrutiny of non-financial disclosures

There is also greater scrutiny of non-financial disclosures, in addition to a raft of new regulations which could result in regulatory action if they are breached. In the UK, for example, the FCA announced a new regime (PS23/26) to increase trust in the market through sustainability disclosure and labelling. The regime has (i) a new anti-greenwashing rule, in force from 31 May 2024, which makes UK-based firms ensure that sustainability claims are accurate, clear, and fair; (ii) four new labels for investment products; and (iii) rules on proper marketing and information about the sustainability of financial products and services, to protect consumers and improve investor confidence. Similarly, in the EU, Members of the European Parliament (MEPs) recently announced that they have adopted a directive to protect consumers from deceptive marketing practices. The directive, amongst other things, adds some harmful marketing behaviours linked to greenwashing to the EU list of prohibited commercial practices. In Australia, regulators have recently had a particular focus on misleading conduct in relation to sustainable finance, including greenwashing, which we expect to be an ongoing trend in 2024. Interestingly, regulators there have utilised existing legislative instruments as a means of enforcement, rather than seeking to introduce a new regime.

Cracking down on ESG breaches

Breaching ESG rules and disclosure laws could lead to regulatory investigations and enforcement proceedings against companies and their D&Os. We are already seeing claims against companies in the US - for example, the SEC imposed a US $19 million fine on a bank-owned asset manager for misleading ESG disclosures and, in Australia, ASIC issued infringement notices and took a number of sustainable finance cases to court, including three serious instances of greenwashing and issued a number of greenwashing infringement notices.

Shareholders in the US have already filed a number of actions disputing companies' ESG initiatives, which have been largely unsuccessful to date.

Of course, regulatory investigations and actions can lead to securities class actions and shareholder derivative suits. Shareholders in the US have already filed a number of actions disputing companies' ESG initiatives, which have been largely unsuccessful to date. A particular focus of those actions is failures in relation to DEI.

In 2023, shareholders increasingly sought to use the derivative action process to hold directors accountable for climate-related risks and the UK saw some interesting cases an environmental charity brought an action against an oil industry company, in which the claimants were arguing directors should be personally liable for failing to implement an energy transition strategy aligned with the 2015 Paris Agreement and a UK company law, climate litigation, and pension law case, in which the claimants alleged mismanagement of the fund on several grounds, including over-investment in fossil fuel assets. Whilst these cases failed at the permission stage, we can expect similar litigation from climate-focused non-governmental organisations (NGOs), activists, and investors in due course and, certainly, the courts' examination of directors' duties in an ESG context will be studied closely.

Having said all of this, to date, the majority of climate-related litigation and regulatory action has not been (at least publicly) focused on directors. The majority of the action seems to have been focused on the companies in question (and, indeed, on governments) rather than on the directors themselves. Nonetheless, this remains an area of potential concern for the financial lines insurance market and we continue to see significant interest from underwriters on how these matters will develop.

ESG is an enormous, fast-moving area and can be extremely challenging for D&Os to find a course through, particularly with the current political sentiment. A recent example of the difficulties of anticipating how matters will develop can be seen in the EU where the Corporate Sustainability Due Diligence Directive has failed to be passed (as of 28 February 2024).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.