This briefing sets out the headline themes and changes that premium-listed companies should be aware of for the 2024 AGM season, together with a list of further useful resources.

AGMs

Disapplication of Pre-emption Rights

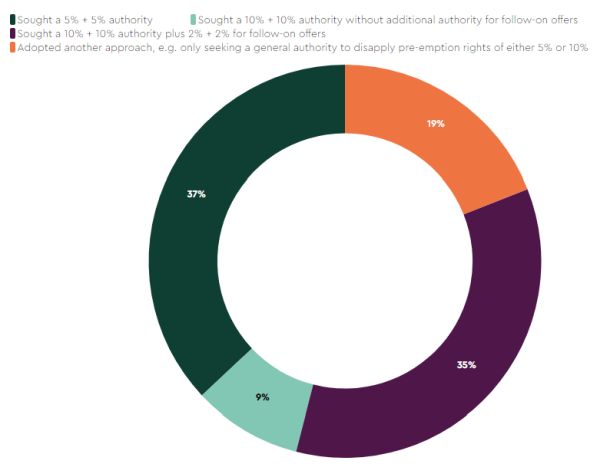

- Following the publication of the Pre-emption Group's revised Statement of Principles in November 2022 (further details of which are set out in our briefing), practice has been mixed in terms of the thresholds of authority that companies have sought. The Pre-emption Group published its first monitoring report earlier this month, which noted that 98.3% of FTSE 350 companies that held an AGM between November 2022 and July 2023 had all disapplication resolutions passed by shareholders.

- Given the low levels of shareholder dissent even where enhanced authority was sought, we expect we may see an increase in companies seeking the higher disapplication thresholds in 2024, although for companies with overseas shareholders who do not accept UK norms, we expect it is likely they will continue not to seek the new higher thresholds rather than taking the risk of ending up with no authority for any share issues or buybacks.

- The approach taken by FTSE 350 companies who have published their AGM notices since mid-December 2022 is set out below:

Please click here to view the interactive chart- To the extent companies do make use of an authority to disapply pre-emption rights in line with the revised Statement of Principles, they should bear in mind the conditions set out in Part 2B of the Statement of Principles, which include the publication of a post‑transaction report in the prescribed form. This information should then also be included in the next annual report following the relevant issue.

- The Pre-emption Group has also emphasised that the 2022 Statement of Principles now constitutes best practice and companies should aim to align their requests accordingly, even if they do not seek the full amount of enhanced authority. Consequently, companies should no longer be referring to the 2015 Statement of Principles and the provisions set out therein, including the restriction of authority to disapply pre-emption rights to 7.5% in a rolling three-year period.

UPDATED GUIDANCE

Institutional Investor Guidelines

Since the publication of our Listed Company Update in October 2023, Glass Lewis, ISS and the PLSA have each issued updated voting guidelines. The key changes are set out below.

Glass Lewis UK Proxy Voting Guidelines

- A new recommendation for a minimum shareholding requirement to be set for the duration of an executive's tenure and for a specific period of time post-employment (typically two years).

- Clarification that Glass Lewis will typically recommend voting against the re‑election of directors who failed to attend either at least 75% of board meetings or an aggregate of 75% of board and applicable committee meetings (where an acceptable explanation is not given).

- Expansion of the policy on interlocking directorships to specify that it applies to both public and private companies and noting that other types of interlocks may be evaluated, such as interlocks with close family members of executives.

- Expansion of the policy on cyber risk oversight, including guidance as to the expectations around communications by companies that have been materially impacted by a cyberattack.

- An outline of Glass Lewis' expectations in relation to the level of disclosure made by companies with respect to peer benchmarking when setting remuneration.

- Updates to reflect that the reporting requirements with respect to board diversity under FCA Listing Rules now apply to all standard and premium-listed companies.

- Clarification that a 3% holding constitutes a 'significant shareholding' in the context of assessing whether a director is independent.

- Updating the guidance on authorising issues of equity to align with the Investment Association's Share Capital Management Guidelines published in February 2023, by noting that any allotment in excess of one-third of a company's existing share capital may be applied to all forms of fully pre-emptive offers rather than only to rights issues, as was previously the case

PLSA Stakeholder and Voting Guidelines

- A new section on social factors (such as health and safety in supply chains, modern slavery, product quality and safety, customer privacy and data security, community engagement and impact on local businesses), as a result of recent global events which have led to an increased focus on such factors – the PLSA recommends that investors start engaging with this topic and promoting best practices for companies to follow.

- An expanded ESG section which (i) highlights important developments from 2023 and areas to look out for in 2024; and (ii) includes recommendations in relation to biodiversity.

- In view of the ongoing cost-of-living crisis, a continuing recommendation to exercise restraint in executive pay decisions and to vote against a remuneration policy which fails to meet the PLSA guidelines, which include matters such as pension payments for new appointments not being in line with the rate applied to the workforce.

- New guidance on dual class structures, with the PLSA noting the growth in such structures and the potential relaxation of the FCA Listing Rules and recommending that investors should consider voting against the governance committee chair if a company has a dual class share structure without a sunset clause of seven years or less from the date of the IPO.

- An increased focus on AI (as defined below) and cybersecurity, including new recommendations to vote against the annual report and the re-election of a director, the audit chair and/or auditors in certain circumstances.

Artificial Intelligence

- In line with some of the changes seen in institutional investor voting guidelines, we expect to see increasing focus on how boards manage the use of artificial intelligence ("AI"), with the Corporate Governance Institute having published a press release in October 2023 recommending that boards develop a governance framework for the developing technology around AI as well as policies and procedures to manage AI risks and opportunities.

- The FRC Lab has also published an insight report on AI, emerging tech and governance, in which it noted that the FRC intends to publish case studies that explore the intersection of AI and tech with guidance and frameworks. The FRC Lab also aims to analyse how companies include AI in annual reports and consider emerging good practices.

- In the FRC's Annual Review of Corporate Governance Reporting (see further information in Section 4 below), it was noted that roughly 49% of companies mentioned AI in their reports, with some including the accelerated progression of AI as an emerging risk, but that it did not see any discussion of board oversight of AI. The FRC stated in this report that board should have a clear view of the responsible development and use of AI within the company and the governance around it, which would require boards to increase their knowledge on AI.

- While we have not yet seen similar developments in the UK market, there have recently been a number of shareholder proposals in the US in relation to certain technology and entertainment companies (including Apple and Disney) calling for the inclusion of resolutions at their annual general meetings for disclosure in relation to those companies' use of AI in their business operations and the board's role in overseeing its usage, including any ethical guidelines adopted with respect to the use of AI. While Apple shareholders rejected the proposal (which had been supported by some of Apple's major UK investors) at the company's annual general meeting in February, these developments reflect a trend of increasing focus of certain investors on AI transparency, particularly in relation to technology companies.

REMUNERATION

Investment Association Letter to Remuneration Committee Chairs

On 23 February 2024, the Investment Association (the "IA") published a letter to remuneration committee chairs to provide an update on its Principles of Remuneration (the "Principles") and its views on key issues for the 2024 AGM season. The Principles were expected to have been updated in November last year. However, the IA has confirmed that it will be carrying out a more fundamental review of the Principles this year to reflect feedback received during 2023 with a view to simplifying the rules, aiming to support a competitive listing environment and deliver the right outcomes for both shareholders and their underlying clients.

Ahead of publication of the updated Principles, the IA has confirmed its priorities include continuing its conversations with members on remuneration practices in the UK as well as a focus on:

- how companies are responding and adapting to the inflationary environment (with an expectation that companies will continue to exercise caution with respect to executive salary increases);

- remuneration committees demonstrating how remuneration outcomes are appropriate given performance achieved during the year; and

- how remuneration committees have set targets for 2024.

Glass Lewis 2024 Voting Guidelines – Long-Term Incentives

Glass Lewis has expanded its guidelines in relation to long-term incentive plans to clarify the elements it believes are features of the most well-structured long-term incentive plans:

- Awards subject to an extended vesting or holding period whereby awards are only released at least five years after they were granted.

- No re-testing or lowering of performance conditions after grant.

- At least two performance metrics, with at least one relative performance metric comparing the company's performance to a relevant peer group or index.

- Performance metrics that cannot be easily manipulated by management.

- Stretching targets that incentivise executives to strive for outstanding performance.

- Individual limits expressed as a percentage of base salary.

ANNUAL REPORTS

Structured Digital Reporting

In December 2023, the FRC Lab published an insight report to assist companies with producing high-quality structured digital reports, as required under DTR 4. The FRC Lab analysed a sample of UK filings in making its comments and recommendations, as well as data from the FCA and feedback from companies and service providers. The report:

- highlights areas for improvement and better practice;

- notes that companies are responsible for the quality of the report even when the tagging process is outsourced – companies should improve their understanding of the tagging requirements to enable appropriate review of work carried out by any service providers more effectively;

- suggests that companies may want to make an FCA-validated version of the structured report available on the company's website with an inline viewer, in addition to the zip file;

- refers to FCA guidance on submission to the FCA (including on file naming and structure, and the filing process); and

- reminds companies that they are required to upload their report to the National Storage Mechanism within four months after the end of the reporting period.

Disapplication of Pre-emption Rights

As noted in Section 1 above, companies should note that, if they do make use of an authority to disapply pre-emption rights in line with the revised Statement of Principles, they will need to include the information set out in the post-transaction report in the next annual report following the relevant issue.

Corporate Governance Disclosures

Since the publication of the FRC's Annual Review of Corporate Reporting (which was covered in our October 2023 Listed Company Update), the FRC has also published its Annual Review of Corporate Governance Reporting. Recommendations include:

- Code compliance: Reporting on compliance with the UK Corporate Governance Code (the "Code") can be improved by ensuring that, where a company has not fully complied with the Code, it is clear which specific Provisions of the Code have not been complied with and meaningful explanation is provided for any non-compliance.

- Purpose, culture and values: Companies should set out both the practice and policy underpinning culture along with objectives and progress towards milestones, ensure that good supporting information is provided when explaining the company's purpose and values and clearly state how corporate purpose, values and strategy align with corporate culture.

- Stakeholder engagement: Disclosures should be improved by addressing the nature of the engagement, reflecting on feedback received and how this has led to high-quality outcomes, and its impact on board decisions. Companies should report on shareholders' key priorities and, in relation to workforce engagement, why it considers the chosen engagement method to be effective.

- Environment: Companies should improve their level of compliance across all recommended TCFD disclosures and are reminded that good reporting includes disclosure of governance structures and processes in place to manage climate-related risks and their oversight by the board and management.

- Diversity: Companies should define their business strategy clearly and link this to their diversity strategy. Reporting should include progress made on achieving set targets and improvements year-on-year. Diversity reporting should go beyond gender and ethnicity-related disclosures.

- Board evaluation: Companies should report on actions and outcomes.

- Audit and risk: Companies should be more specific in disclosing how audit committees have assessed the independence and effectiveness of the external audit process and report on their findings. Companies should focus on the most significant risks and report on changes to these risks during the year. Overall reporting on monitoring and reviewing risk management and internal control systems still needs improvement.

- Remuneration: Narratives on how remuneration is aligned with the company's corporate purpose and values should be clear and transparent. Disclosures should include consideration of the impact of windfall gains and the use of any discretionary powers. In relation to bonuses and LTIPs, annual reports should explain the rationale for each performance metric. There is scope to improve reporting of workforce engagement on remuneration.

- Cyber risk: Boards should understand cyber risks within the organisation and how they are managed.

Diversity Disclosures

As noted in our 2023 briefing on AGMs and annual reports, the Listing Rules and Disclosure Guidance and Transparency Rules were updated last year to include new provisions on diversity. These rules apply to reporting periods beginning on or after 1 April 2022. Although the FCA encouraged early compliance, for some companies, this will be the first year they are required to comply with the rules.

FTSE 350 companies should also bear in mind the new objectives set out in the March 2023 Parker Review update report (as further detailed in our October 2023 Listed Company Update). On 11 March 2024, the Parker Review Committee published a further update report, which includes the results of its latest survey on the ethnic diversity of boards and senior management of FTSE 350 companies as well as a section aimed at helping companies address the extended recommendations from the March 2023 report.

On 27 February 2024, the FTSE Women Leaders Review also published a report on the progress that is being made towards the target of 40% women on boards and leadership teams by the end of 2025 across the FTSE 350 and 50 of the largest private companies in the UK. The report notes that:

- 42% of FTSE 350 boards and 35% of FTSE 350 leadership teams are now women, with 72 FTSE 100 companies and 163 FTSE 250 companies having met or exceeded the 40% women on boards target at least two years ahead of the deadline.

- While over half of FTSE 350 companies have met, or are on their way to meeting, the goal of 40% women in leadership, the report notes that there is still progress to be made, with appointment to leadership roles leaning in favour of men with more than six out of every ten leadership vacancies in 2023 being awarded to a man.

- There has been continued positive progress towards the appointment of women in four key roles (the Chair, SID, CEO and Finance Director), although progress in the Chair and CEO roles has remained largely flat and there was a slight reduction in the number of women Finance Directors this year.

Glass Lewis has published a report, Charting Diversity Progress under the Revised UK Listing Rules, providing a statistical overview of diversity performance across the FTSE 350 and including examples of what Glass Lewis considers to be best-in-class disclosures. Of particular note is that, from 2024, Glass Lewis Proxy Papers will include a section highlighting whether FTSE 350 companies have disclosed their senior management ethnicity targets, in line with the Parker Review.

FRC Minimum Standard

As noted in our October 2023 Listed Company Update, in May 2023 the FRC published a minimum standard for audit committees (the "Minimum Standard"). The Minimum Standard applies to FTSE 350 companies for now, although the Revised Code (as defined below) will expand this to all Code companies. This year Audit Committees of FTSE 350 companies should ensure that they comply with the requirements of the Minimum Standard, in particular, reporting against the annual report content set out in Paragraph 24.

FRC Areas of Supervisory Focus for 2024/25

In December 2023, the FRC announced its areas of supervisory focus for 2024/25, including priority sectors, for corporate reporting reviews and audit quality inspections. The priority sectors for selection of company accounts and audits are: (i) construction and materials, (ii) food producers, (iii) gas, water and multi-utilities, (iv) industrial metals and mining and (v) retail. Its areas of focus include risks related to the current economic environment and climate-related risks, including TCFD disclosures.

OTHER DEVELOPMENTS TO NOTE

Listing Rules Reforms

In December 2023, the FCA published its detailed proposals to reform the Listing Rules, which includes the replacement of the existing two-tier listing regime with a single segment for commercial companies with equity share listing. For premium-listed companies, this represents a relaxation of the rules under which they currently operate. The consultation paper included the first tranche of new Listing Rules, with the second tranche being published in March 2024. The consultation period in relation to its proposals regarding sponsor competence closed on 16 February 2024. For the remainder of the proposals (including in relation to the first tranche of the new rules), the consultation remains open until 22 March 2024 and, in relation to the second tranche of rules, until 2 April 2024. It is anticipated that the changes will be implemented by "the start of the second half of 2024". For more information on the proposals, and a reminder of the proposed changes in relation to the prospectus and secondary fundraising regimes, see our briefing.

UK Corporate Governance Code

On 22 January 2024, the FRC published a revised UK Corporate Governance Code (the "Revised Code") following a lengthy consultation period.

The main changes relate to internal controls:

- The Revised Code clarifies that boards will be responsible for not only establishing, but also crucially for maintaining, the effectiveness of the company's risk management and internal control framework (Principle O). This emphasises the continuing focus on these controls and processes.

- In addition to the existing responsibility of boards to monitor companies' risk management and internal control framework and review its effectiveness, Provision 29 has been expanded to require boards to provide additional detail in the company's annual report with respect to the company's risk management and internal control framework, including a new declaration of effectiveness of the material controls as at the balance sheet date.

The Revised Code remains a principles-based 'comply or explain' framework allowing companies the flexibility to depart from the Revised Code by providing a justified explanation.

The Revised Code will apply to accounting periods beginning on or after 1 January 2025, except for the new requirement for a board declaration on internal controls, which will apply to accounting periods beginning on or after 1 January 2026. For a summary of the other main changes see our briefing.

The FRC has also published updated guidance alongside the Revised Code, which incorporates the former Guidance on Board Effectiveness, Guidance on Audit Committees and Guidance on Risk Management and Related Financial and Business Reporting. The FRC has confirmed that any future updates to the guidance will be made on the first Wednesday of the month, with an updates log at the end of the guidance setting out changes.

Capital Markets Industry Taskforce ("CMIT") Open Letter on Corporate Governance

In November 2023, the CMIT, which is comprised of leading organisations representing public and private capital markets, published an open letter regarding the UK's approach to corporate governance reform. The CMIT's view is that UK listed companies should not be subject to requirements to which companies listed on other high-quality exchanges are not subject, without those incremental requirements being justified, and that the governance and stewardship regimes in the UK need to adapt again to ensure their relevance to the competitiveness of the markets they apply to. The letter sets out a number of recommendations, including:

- Establishing a new 'investor and issuer forum' bringing together industry leaders from listed company boards and the investment community to identify key challenges and issues.

- Removing the requirement in the Code that, in the event of 20% or more votes being cast against a proposed resolution, a company should explain what actions it intends to take to consult shareholders, with the Investment Association's Public Register being discontinued.

- Recasting the 'comply or explain' approach to the Code as 'apply or explain' with a corresponding shift in approach from investors to make clear that they are more accepting of nuanced explanations of divergence from a conventional application of the Code.

- Relaxation or removal of certain provisions set out in the Investment Association's Principles of Remuneration.

Non-Financial Reporting Review

As noted in our October 2023 Listed Company Update, following the call for evidence by the Department for Business and Trade (working with the Financial Reporting Council) last year, a full public consultation on the non-financial information UK companies are required to include in their annual reports is expected this year.

USEFUL LINKS AND RESOURCES

Pre-Emption Group:

Institutional investor guidelines:

- Glass Lewis 2024 UK Proxy Voting Guidelines

- ISS Proxy Voting Guidelines

- PLSA Stakeholder and Voting Guidelines

Artificial intelligence:

Remuneration:

- Investment Association Letter to Remuneration Committee Chairs

- Glass Lewis 2024 Voting Guidelines – Long-Term Incentives

Annual reporting:

Diversity:

- March 2023 Parker Review report

- March 2024 Parker Review report

- February 2024 FTSE Women Leaders Report

Listing Rules Reforms:

- FCA Consultation Paper CP23/31 – Primary Markets Effectiveness Review: Feedback to CP23/10 and detailed proposals for listing rules reforms

- UK Listing Rules Instrument 2024

Corporate Governance:

- 2024 UK Corporate Governance Code

- Corporate Governance Code Guidance

- CMIT Open Letter on Corporate Governance

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.