More low-paid part-time workers are now eligible for automatic enrolment, including some who earn less than they can expect to receive from the State in retirement. The relationship between statutory minimum contributions and full earnings has also changed over time.

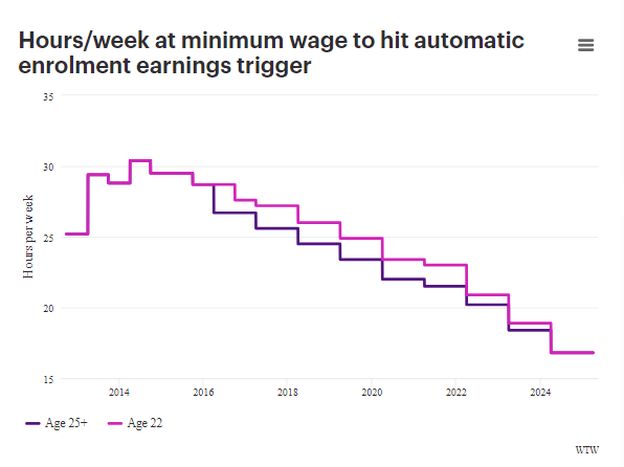

In April 2014, an employee paid the minimum wage would have to work a little over 30 hours per week to be automatically enrolled into a workplace pension (rather than just having the right to opt in) 1. From April 2024, under 17 hours will suffice. In that time, the main minimum wage rate will have increased from £6.31/hour to £11.442. Meanwhile, keeping the automatic enrolment earnings trigger at £192/week (£10,000 a year) means it has fallen in real terms.

...Including some who have lower incomes than they can expect in retirement

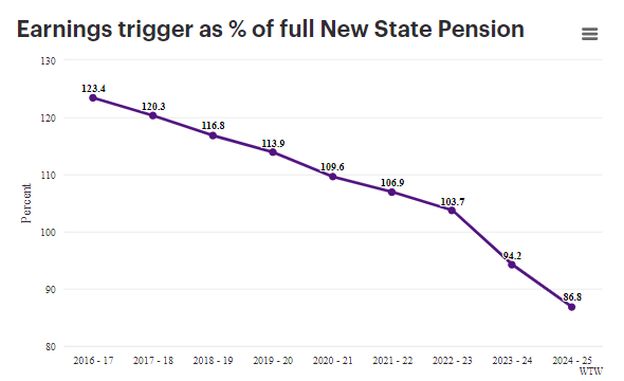

Some of the workers brought into scope are being nudged to put money aside for a time when their income should be higher than it is now: the earnings trigger will be 13% below the full New State Pension (NSP) in 2024/25, having been 23% above it when the NSP was introduced in 2016/17. If the earnings trigger remains frozen while the NSP is triple-locked, this gap will widen. State Pension levels were not discussed in the policy paper that explained the Government's decision to freeze all automatic enrolment earnings thresholds in 2024/253. Although Parliament included State Pension levels in the suggested list of factors that the Secretary of State "may consider"4, he is not required to do so.

This jars with the classic case for pension saving – that it smooths spending power over a lifetime that includes years in work and years in retirement – but is not quite as crazy as it sounds. For example, low-paid, part-time workers may:

- Have spouses/partners who are paid more, and expect their household's income to drop after retirement.

- Have two or more part-time jobs, when the earnings trigger applies on a per job basis.

- Be on the Universal Credit Taper; when combined with the basic rate income tax relief available to non-taxpayers, this means that each £1 employee pension contribution need only reduce net income by 36p – or less, if made via salary sacrifice. (A new write-up of DWP focus groups quotes one Universal Credit claimant who opted into pension saving saying: "I was happy for them to take pension contributions because it meant the government wasn't getting it"5.) On the other hand, low-income workers may face means-testing in retirement.

Ministers will also be sensitive to objections that most workers who would be excluded by a higher trigger are women (71%, if the earnings trigger were around one quarter higher, according to DWP).

Continuing to allow inflation to bring more low-paid workers within the scope of automatic enrolment may strengthen calls for it to include an "emergency savings" component, especially when a recent study pointed to a correlation between pension contributions newly due under automatic enrolment and borrowing6. The effect on take-home pay will also increase (by almost £5/week, for people paying minimum contributions and not affected by Universal Credit) if the Government implements its "ambition" of making everyone's earnings pensionable from the first pound.

The changing relationship between qualifying earnings and full earnings

For now, though, the lower qualifying earnings threshold remains frozen, at £120/week (£6,240 per year). So does the upper threshold, at £967 (£50,270).

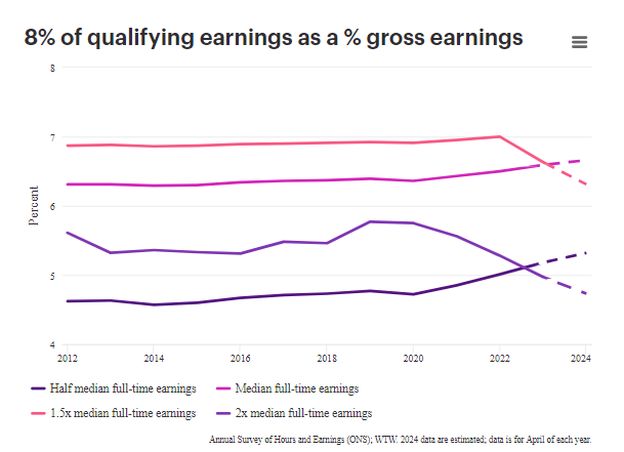

Freezing both thresholds while earnings grow makes statutory minimum contributions (8% of qualifying earnings, including at least 3% from the employer) a slightly higher percentage of total earnings for low earners and a lower percentage for high earners. Precisely how big a change this will be depends on how much higher median earnings are in April 2024 compared with a year earlier; the chart shows what the effect would be if they grow by 5% over the year7.

Until recently, 8% of qualifying earnings was always a bigger fraction of 1.5 times median earnings than of median earnings, and a bigger fraction of twice median earnings than of half median earnings. 2024/25 should see gaps open up in the opposite direction.

The upper limit of the qualifying earnings band is currently aligned with the National Insurance Upper Earnings Limit and the threshold at which people in England, Wales and Northern Ireland start to pay the 40% rate of income tax. The Government's review document says that this threshold "aims to distinguish the automatic enrolment target group of low to moderate earners and the statutory minimum contributions from earners in a higher tax band...[who]... might reasonably be expected to have access to a pension scheme that offers more than the minimum and are more likely to make personal arrangements for additional saving." Freezing the higher rate tax threshold at its 2021/22 level, which is thought to have sucked an extra 2.2 million people into higher rate tax by 2024/25, seems not to have affected that assessment. While the requirement to hold a discrete review each year makes it hard to signpost future intentions, there is no sign that the Government would take a different view if, as the Office for Budget Responsibility projects, the number of extra higher rate taxpayers created by the freeze hits 3 million in 2028/298.

Large employers typically do not calculate pension contributions based on qualifying earnings: only 6% of employers in WTW's 2022 DC Pensions and Savings Survey did so. For higher rate taxpayers, this decision could become increasingly valuable if current policy on the upper threshold continues.

Footnotes

Footnotes

1. Broadly speaking, employers with 160 or more workers were subject to automatic enrolment rules in April 2014; the duties have since been rolled out to all employers.

2. In April 2014 and April 2024, everyone eligible for automatic enrolment would qualify for these hourly rates. For some of the intervening period, people under 25 could be paid a lower rate.

3. "Review of the Automatic Enrolment Earnings Trigger and Qualifying Earnings Band for 2024/25: Supporting Analysis," DWP, February 2024.

4. "s14(4)(c) of the Pensions Act 2008," as amended in 2011 and 2014.

5. "Low earners and workplace pension saving – a qualitative study," DWP, February 2024

6. "NBER Working Paper of Economic Research Working Paper 32100," February 2024

7. This is an illustration, not a forecast. For comparison, average weekly earnings were 5.6% higher in December 2023 than a year earlier, but the two measures will respond differently to changes in factors such as the composition of employment.

8. Chart 3A from "Economic and Fiscal Outlook," OBR, November 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.