The latest edition of our UK Property Handbook has just been sent out, containing the usual wealth of easy-to-digest detail on the domestic market. Here's a quick look at a few of the top-level themes...

One of the key stories this year has been the continued strength of the central London office markets; prime yields have fallen even further in both the City and West End as investors, primarily from overseas, continue to compete for available stock. For the moment, London appears to be immune to any change in sentiment, as further sources of capital are attracted by the long-term security or by the prospects of further rental growth.

Perhaps the surprise in the retail sector is how little pick-up in performance we've seen: on the face of it, positive consumer sentiment and the strength of recent retail sales data suggests retail rental growth should be more visible. But the oversupply of retail space leading to the rationalisation of many non-prime high streets is a process still underway as the relationship between online and in-store activities continues to evolve. Investors are active in the sector, and in particular have strong interest in regional shopping centres, with non-prime schemes also enjoying demand.

There are risks to occupier demand in the industrial sector too. The strength of sterling has combined with weaker economic performance from developing economies to hit export-driven producers. Activity in this sector has been driven by the warehousing schemes, where some units with long leases are producing sub-4% yields.

Meanwhile, alternative property such as hotels, student accommodation and leisure assets continue to draw in both domestic and international capital as investors look for income-yielding opportunities. You can read more about the increasing investment levels in the student housing sector here.

So, what is the broader context for this performance?

The UK economy is in decent shape. GDP growth looks set to be around 2.5% this year, well above the 2.2% 20-year average; inflation remains firmly under control and wages are enjoying a period of real growth, helping boost consumer confidence.

In the corporate sector, confidence among chief finance officers of the largest companies picked up last quarter. The latest Deloitte CFO Survey showed an increasing willingness to take on balance-sheet risk and to engage in expansionary strategies. Regional private sector activity levels are also strong.

In late 2014, the average forecast for capital growth this year was around 5.4%; the recent figures from IPF's August survey show that the consensus view has now risen to 8.5% and the August IPD results show property capital growth gradually falling away but still running at over 9.4%. Property is delivering stronger growth than expected.

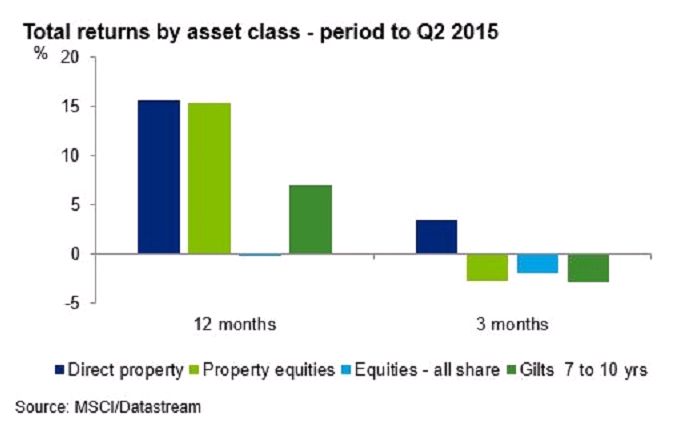

Furthermore, directly-held property's performance currently stands head and shoulders above other asset types. Over one, three, six and twelve months, total returns are ahead of those being delivered by property shares, the wider stock market and bonds.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.