As part of our continued commitment to the property industry, Smith & Williamson has carried out its fourth annual Property Survey to identify key trends and issues affecting the sector.

The survey included questions on finance, tax, investment and accounting issues and the majority of responses came from property investors, developers and their professional advisers from across the UK. Although clear trends are always difficult to identify, the results do highlight certain issues that are currently concerning the industry.

Planning

Planning problems continue to be of particular concern to the survey respondents. As one would expect, the results show that UK economic performance is the key to the property industry as a whole, but the survey results also point to planning regulations as a critical factor.

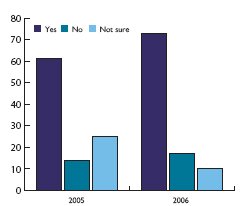

When asked what major influences may affect developers’ and investors’ decisions over the next five years, about a quarter of the respondents cited planning issues and almost three quarters of responses point to Planning Gain Supplement (PGS) as a potential disincentive for property developers, an increase of about 10% from last year (Figure 1).

Figure 1: Are the proposals for a planning gain supplement a real disincentive for property developers?

The strong interest in planning regulations may reflect the current debate regarding the PGS. The PGS (note the Government’s attempt to avoid describing this as a tax), will tax the increase in value that occurs when planning permission is granted for a particular development. This clearly gives cause for concern.

However, there is currently some confusion arising from a series of conflicting reports in the property press which indicate that the Government’s proposals for the PGS may be abandoned. One article claimed that the Government now favours a ‘roof tax’ levy on completed developments following the successful pilot of such a scheme in Milton Keynes. It was then reported that the PGS proposals would be dropped following extensive criticism that a tax reliant on a valuer’s opinion would be unworkable. However, Government sources are said to have denied plans to shelve its proposals.

Business Confidence

As in previous years, confidence in the business outlook for the UK commercial property sector over the next 12 months remains high (Figure 2). Over 90% of respondents feel reasonably confident or very confident on this front, with a small incremental increase year on year over the period that this survey has been carried out.

Figure 2: Confidence in the business outlook for the commercial property industry in the next 12 months.

However, a recent article in The Times suggests that investors in the London commercial property market may be overly optimistic. Some developers are paying high prices for office (and residential) development sites based on highly optimistic financial models. They may also be in danger of building too much speculative office space and relying on very narrow margins with only a small comfort zone. Only time will tell whether or not this optimism is well founded, but the cyclical nature of the property market should make investors wary.

Confidence in the outlook for the residential property industry also remains high. This probably reflects the continuing need for housing, particularly in the south, where the supply of affordable housing is not meeting demand.

Perhaps predictably, the ability to achieve real growth clearly remains a key business issue facing organisations, especially where success is generally measured by the ability to meet internal rates of return targets.

When asked what other major influences may affect developers’ and investors’ decisions over the next five years, almost half of the respondents answered ‘interest rates’. For some years the UK yield curve has been inverted, which means that longterm rates on Government securities have been below short-term rates. This reflects both strong demand from pension funds for long-term stable income to match their liabilities and a relative lack of supply of new paper from the Government and corporate borrowers. This has made borrowing against property attractive, where there has been strong profit growth over the past two years, and enabled companies to rebuild their balance sheets repaying existing debt rather than adding to their borrowings.

There are signs of a global slowdown over the next 12 months, which may increase the UK budget deficit while putting pressure on profits, both of which tend to increase borrowings. Even so, we would not expect long-term interest rates to rise significantly given that demand for long-term debt should still outstrip supply. Short-term UK interest rates have risen to contain inflation, but inflation is expected to peak in both the US and UK over the next three to six months and prime lending rates should follow suit.

Financial And Tax Issues

Only a third of respondents said that they would be looking to raise finance in the next 12 months, which is a decrease from last year. Perhaps of more significance is that 85% of those who are looking to raise finance stated that their preferred route is through clearing banks. This compares to last year’s 65%. Does this mean that banks are more willing to lend, and if less cautious than alternative funders, does this mean that the banks may not have learnt their lesson from the late 1980s/early 1990s?

Sources of inward investment into the UK property market remain varied. The Middle East and Far East/Asia are seen as the most likely investors into the UK market, with UK property yields remaining attractive for many (Figure 3).

Figure 3: Where inward investment in UK property is expected to come from.

The survey delivered slightly surprising results in relation to the Government’s proposals for Real Estate Investment Trusts (REITs) and whether these vehicles will enhance opportunities for investment in property (Figure 4).

Figure 4: Will the government’s proposals for REITs enhance the opportunities for investment in property?

Although over half the respondents believe that REITs will enhance opportunities, this percentage is lower than one might expect in view of the considerable press coverage we have seen. Possibly these figures reflect the size of the companies surveyed, as REITs appear to be the preserve of larger corporates. However, there are possibilities for the ‘smaller’ property companies to play a role in certain structures.

Stamp Duty Land Tax (SDLT) does not appear to have had a massive impact on the workload or results of businesses, as almost half of the respondents seemed to have little idea about the administration of SDLT. Presumably, many of our respondents are happy to leave this headache to their solicitors. We are however aware that there is a reasonably high level of SDLT planning aimed at mitigating the impact of this tax with the benefit of the savings generally shared between the vendor and purchaser.

Tax is a growing factor when making an investment decision of whether or not to sell. 91% of survey respondents confirmed this view, up from 88% in 2005 and 82% in 2004. It is possible that the buoyancy of the property market has hardened investors’ views on this, as tax on a substantial profit is likely to be a big cost in absolute cash terms, leaving less to invest in the future.

When extrapolated to the wider market, it gives cause for concern that tax is influencing investment behaviour in this way, with an impact on liquidity being the likely consequence. Perhaps the introduction of REITs is a counter to this potential brake on liquidity, as tax on disposal of properties held in these vehicles is not a factor in investment decisions.

The derivatives market is in its infancy and this is evidenced by our respondents’ views on whether it will assist in risk management. Whilst 31% felt it would assist, 67% were unsure, with the remaining 2% saying it would not. Once there is greater understanding of the potential role these products can play in managing risk in property transactions, it may help investors appreciate the benefits they can bring.

This year sees a slight increase in the numbers that appear to be adopting a more conservative approach to tax planning, following a significant increase last year (Figure 5).

Figure 5: How far those surveyed would go in planning terms to avoid a tax charge

This may be a result of the continued high publicity attack by HMRC on what many in the sector see as legitimate tax mitigation, and reflects the generally conservative attitude of many of Smith & Williamson’s clients.

Summary

John Voyez, chair of the Smith & Williamson Property Group, said responses generally confirm a reasonably healthy level of confidence in both residential and commercial property sectors. However, trends are extremely difficult to identify, and in a cyclical industry such as property, only time will tell whether such confidence is misplaced.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.