John Cowie on Aim’s coming of age on the global stage.

Despite the best efforts of those across the pond to besmirch its reputation (see Quoted Business, June 2007), Aim has become something of an international star. Ironically, outside Europe, the US is home to the largest number of non-UK Aim companies with 75 as at September 2007. China follows closely behind with 54, though we sense that new admissions from the Far East will slow in coming months. Henry Tan of Nexia TS Public Accounting Corporation, our Nexia International firm based in Singapore, comments on this later in this issue.

Looking solely at the locations of Aim companies’ registered offices, one might think that there were 283 non-UK companies listed on Aim. But data from the London Stock Exchange shows that, in fact, well over 400 companies (from a total of 1,689) hail from overseas. This includes those whose primary place of operations is overseas, not merely their registered offices. That’s 25% of all Aim companies.

The rate at which Aim has attracted these businesses has accelerated rapidly. In the nine years to the end of 2004, a mere 154 overseas companies came to Aim. In the two and a half years since, more than 250 have listed. Aim really has come of age.

Overseas: Greater Risk?

Overseas companies have been largely responsible for pushing up the average value of companies on Aim. The main reason cited for this phenomenon is that investors in London, rightly or wrongly, perceive there to be a greater risk associated with a company whose operations are principally outside the UK. In order to mitigate the ‘overseas’ risk, they seek larger, more established businesses in which to invest.

A secondary factor is likely to be the cost of bringing a company to Aim. There are two elements to these costs: the (broadly) fixed-cost element comprising fees for the nominated adviser (Nomad), broker, reporting accountant, lawyer, PR firm, registrar and printer; and the variable element – the commission charged on funds raised. Fixed costs tend to be somewhat higher for overseas companies, with economies of scale playing a part in determining whether these costs remain acceptable in relation to the size of the company. The effect of an increase in fixed costs is to drive up the average size of companies paying them.

Reasons for the fixed-cost element being higher for overseas companies are many but, typically, a non-UK company will have to appoint lawyers to advise the company in both London and the non- UK jurisdiction, as well as lawyers to advise the Nomad and broker. It may also have to seek accounting advice and input both at home and in London, where the reporting accountant is likely to be based, and there may be foreign exchange issues to be dealt with. Furthermore, the fees charged by a Nomad may well exceed those charged for a similarly sized UK business to reflect logistical complexities – time zone differences, language – as well as a perception of higher risk and, potentially, more far-reaching due diligence requirements.

Split Opinions

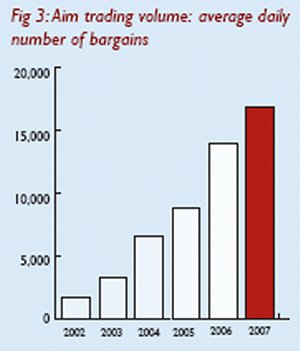

So is this globalisation a good thing? Well, it depends on who you ask. There are those who believe that Aim served the SME better when it attracted smaller businesses. It has become undeniably harder for those with a shorter track record or a less proven product to find money on Aim. But Aim itself is a bigger, more successful market than ever before. Liquidity, measured by dealing volumes, is at an all-time high (Figure 3). Predictably, given Aim’s higher risk profile, the Aim All-Share Index has suffered more than the FTSE as a result of recent market jitters. It may well be that the gradual increase in average company size will lead to Aim becoming a more stable environment in which to invest. This, in turn, may allow the ‘next tier’ Plus Markets to carve for itself the niche which Aim used to occupy. Watch this space.

|

The growing internationalisation of Aim is amply demonstrated by Smith & Williamson’s increasing involvement in overseas Aim admissions, both as Nomad and reporting accountant. In the past year, we have acted as Nomad to eight non-UK companies on their admission to Aim – and the range of companies is illuminating. Recently, we took Vycon, a flywheel energy storage system manufacturer headquartered in California, to Aim (profiled in Quoted Business, June 2007). Green Dragon Gas, a coal-bed methane business, was Aim’s largest-ever Chinese float in 2006. Speymill Deutsche Immobilien and Speymill Macau Property are property funds set up to invest in Germany and Macau, which we took to Aim, while the name Japan Residential Investment Company speaks for itself. Clean Energy Brazil is an investment fund putting money into renewable energy projects, PME African Infrastructure invests in projects in sub-Saharan Africa, and New Europe Property Investments intends to put money, initially, into Romanian commercial and residential property assets. In recent months, we have also acted as reporting accountant to AOI Medical (see back page) and Applied Intellectual Capital, both US-based. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.