What is insurance benchmarking?

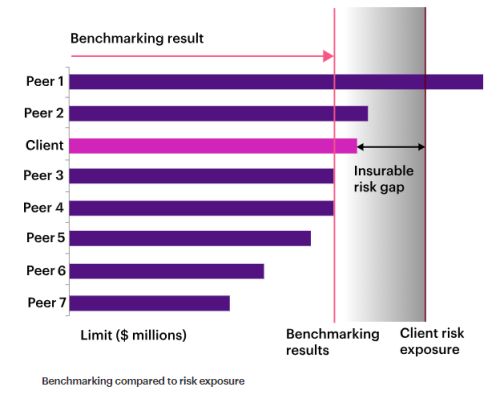

Insurance benchmarking shows a company how it's insurance programme compares to peers of similar stature in their industry, location and organisation size.

Welcome the first blog post in our 'Bridging The Gap' series, tailored for financial institutions. In this article we're delving into the critical world of liability insurance and considering how an over reliance on insurance limit benchmarking may not be sufficient for an evolving global economic landscape.

The titanic lesson: More than just a story

Remember the story of the Titanic? A century-old lesson in underestimating risk. Similarly, many financial institutions, much like the ill-fated liner, have charted their insurance course by merely glancing sideways – using benchmarking as their North Star. This method, akin to following the crowd, has too often left firms under-insured when storms hit.

Consider the case of Insurer X (name changed for confidentiality). In 2016, amid a seemingly stable financial climate, Insurer X faced a cyber-attack. Their insurance, benchmarked against peers, fell short by 60%, turning a manageable incident into a financial nightmare. Why? Because their policy limit didn't account for the rapid escalation in cyber risk costs.

21%

Potential increase in insurance recoveries if limits had been more reflective of financial institutions' unique risk profiles from the previous 10 years.

Data deep dive: What the numbers really say

WTW's proprietary data paints a telling picture. Over the last ten years, financial institutions could have mitigated losses by 21% more if their insurance limits were more reflective of their unique risk profiles. Extending our view to the tumultuous times of the financial crisis, this gap widens alarmingly to 50%. It's clear: relying entirely on benchmarking may not suffice in the face of new challenges.

Charting today's waters: Navigating current and emerging risks

As we navigate through a period marked by geopolitical tensions, fluctuating markets, and emerging cyber threats, the need for a tailored insurance strategy is more pronounced than ever.

... the need for a tailored insurance strategy is more pronounced than ever

The collection of industry wide loss data over the past decade is allowing financial institutions to have a far more detailed understanding of their risk exposure than ever before. Ensuring your approach is steered by a combination of internal risk management and industry event data will keep you afloat.

Your next port of call: Securing your institution's future

Insurance isn't just a line item on your balance sheet; it's a lifeline in today's unpredictable financial seas. For support in developing an insurance strategy fit for your risk profile get in touch with your WTW broker or the Operational Risk Solutions team.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.