- within Government and Public Sector topic(s)

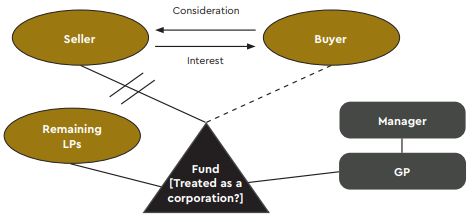

Secondaries transactions can potentially trigger adverse tax consequences for the fund and its investors under the US 'publicly traded partnership' (PTP) rules. Many GPs will refuse consent to a secondary unless they are satisfied the transaction will not result in the fund becoming a PTP.

Why do the rules matter?

- Most funds will want to be classified as a partnership for US tax purposes. When the PTP rules apply, the fund is deemed to be a corporation for US tax purposes.

- This can result in adverse tax consequences for the fund and its investors, including US tax filing and payment obligations for the fund.

- Because of these consequences, GPs want to avoid PTP status.

When do the rules apply?

- The PTP rules apply to all entities treated as partnerships for US tax purposes: (i) that are 'PTPs'; and (ii) fail a 'qualifying income' test. The qualifying income test is hard to apply, and so most GPs look to ensure the partnership itself is not a PTP.

- An unlisted partnership will be a PTP if its partnership interests are 'readily tradeable on a secondary market' (or substantial equivalent) and an exception does not apply (see opposite).

Whilst the GP will ultimately be responsible for confirming whether the PTP rules apply, in practice the Buyer and Seller usually also want to satisfy themselves the rules don't apply in order to obtain GP consent for the transaction and/or to ensure they can give any PTP warranties requested by the GP.

What are the most common PTP exceptions?

|

Exception |

Points to note |

|

Corporation |

Outside the scope of PTP rules. |

|

Lack of actual trading: 2% safe

harbour |

Excluded transfers includes: (i) block transfers (see below); (ii) certain private transfers; and (iii) certain tax neutral transfers, amongst others. |

|

Block transfers |

2% calculated based on interests outstanding immediately prior to the transfer. |

|

Private placement |

For partnerships offered and sold outside the US, the exception only applies if the offering and sale would not have been required to be registered under the Act, had the interests been offered and sold in the US. |

What contractual protections are required?

For LP-led secondaries, GPs often make consent for the transfer conditional on the Buyer and Seller warranting that the transfer will not cause the fund to become a PTP.

For GP-leds, market practice is generally that no specific warranties are required on the basis that it is for the GP to confirm whether the PTP rules could be triggered.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.