In a recent piece in this series, our colleagues showed that funds set hurdle rates differently depending on the asset class. Funds also use different approaches for calculating hurdle rates.

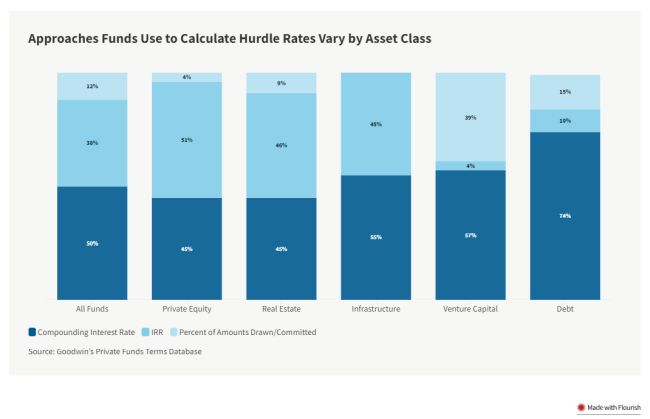

Funds typically use one of three main approaches to calculate the hurdle: compounding interest rate, internal rate of return (IRR), or percent of amounts drawn or committed.

When all funds are considered together, the compounding interest rate approach is the most popular. An analysis of Goodwin's Private Funds Terms Database shows that 50% of funds overall use this approach, while 38% use IRR, and 12% use percent of amounts drawn or committed.

The picture changes when funds are grouped by asset class. For private equity, real estate, and infrastructure funds, the split between those using the compounding interest rate and the IRR approaches is close to even. A small percentage of these funds use the percent of amounts drawn or committed approach.

Many fund managers that prefer the IRR approach note that funds report performance in terms of IRR, and it is therefore easier to report the hurdle rate in terms of IRR. In fact, because IRRs contain a compounding element, there is often little difference between the compounding interest rate and IRR approaches when cashflows are modelled.

Certain asset classes, however, do show a bias towards certain approaches. Given underlying loan investments, it is easy to see why debt funds are the most likely to use the compounding interest rate (74%). Venture capital funds also favour the compounding interest rate formulation (57%) — but unlike other asset classes, many venture funds (39%) use the percentage of amounts drawn or committed, often in the form of a multiple on invested capital (MOIC). This may reflect how there can be greater uncertainty over timing for venture capital exits, and so managers may suffer if the hurdle is structured as a compounding interest rate if exits take longer, and investors may conversely pay a greater share of initial profits in the event of an early win that satisfies an accruing hurdle.

It is also worth noting that there can be differences in how funds apply the compounding interest rate approach, depending on how fund provisions are drafted. Historically, funds applied a rate of interest to any outstanding commitment (amounts drawn from investors that have not yet been paid back). Most managers have now moved away from this because funds that have returned large amounts of profits could find themselves restarting a preferred return calculation if a small amount is drawn for a late-stage follow-on investment or to fund expenses. The "cumulative cash flow" method has therefore become the preferred approach, where the compounding interest rate accrues on amounts that bring the funds cashflow below zero (i.e. the extent to which aggregate drawdowns exceed aggregate distributions). When drawn capital has been returned and profits distributed, preferred return can only accrue if future drawdowns are enough to bring the cumulative cashflow back below zero.

Once the hurdle and catch up have been paid, both the hurdle rate and basis lose their significance because, due to the catch up, the profit share between the manager and the investors applies to all profits, not just those above the hurdle. But at the beginning of a fund's life, when managers are going to market, hurdle rates are a crucial element of investor diligence on a fund's economics.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.