Despite the recent announcement of a delay to the ban on ICE cars from 2030 to 2035, the recently published Zero Emission Vehicle (ZEV) Mandate means that whilst petrol and diesel cars will remain on sale until 2035, 80% of all cars made must be zero emission by 2030. Paul Daly, audit partner at UHY Manchester, shares his opinion about the impact of this decision on the UK automotive industry.

On 25 October 2023, the government released the 46 page results of their stakeholder consultation on the zero emissions vehicle (ZEV) mandate. Despite the headline grabbing comment by Rishi Sunak that internal combustion engine (ICE) vehicles will only be banned now from 2035 (previously 2030), the reality is that the ZEV mandate will still turbocharge the conversion to ZEV cars long before that.

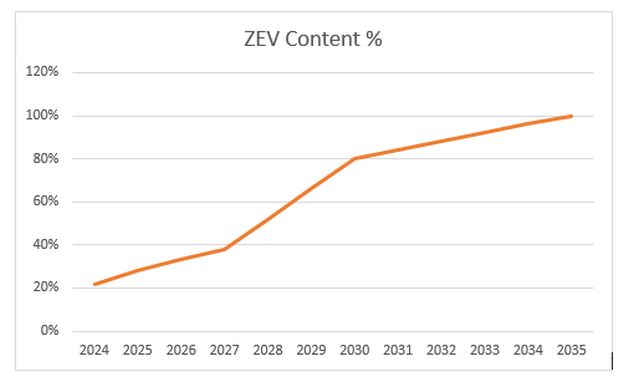

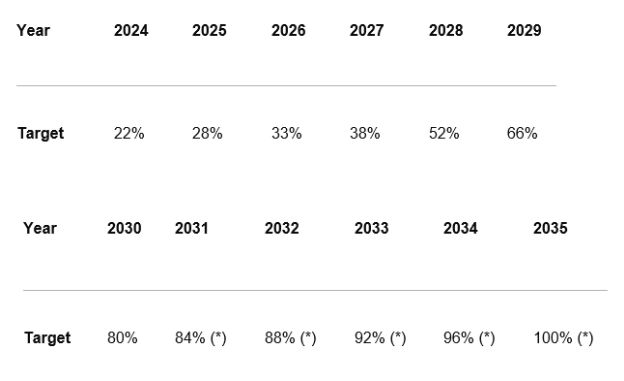

Targets will be set at 22% content in 2024 (current run rate Sep 23 YTD for BEV 16.4%) with a gradual uplift to 38% by 2027, before accelerating rapidly to hit 80% by 2030. The growth rate then slows again to just 4% per annum for the final 5 years to 2035.

It makes no sense to me to set the targets in this manner. Why not have a gradual increase in acceleration of the requirement to the announced date of 2035? However, following the consultation these limits appear to be set (for now at least) so what will be the consequences?

- The recent dramatic slide in EV residual values shows that, in

the absence of more government incentives, the ultimate consumer

demand is far from being in a position of outstripping current

levels of supply. Oversupply of these vehicles appears inevitable

and Q4 of each year could be a blood bath as manufacturers fight

with each other to secure ZEV registrations.

- Infrastructure challenges, high interest rates, high energy

prices and residual value / obsolescence risk appear to be medium

to long term issues and still prevalent in 2027 when the target

increases go into warp drive.

- With the exception of Tesla, most manufacturers that are very EV focused are new entrants. I'm sure the traditional manufacturers must be shaking their heads in wonder whilst the new entrants are rubbing their hands in glee at the prospects of opening up the UK market to their new products (or enjoying the revenues from credit swapping with traditional ICE manufacturers to help them meet their overall targets). Supply of new vehicles into the UK are likely to remain somewhat constrained unless there is a genuine increase in demand for ZEV products from consumers. Manufacturers will need to balance the ZEV target book each year and one route to that is to restrict sales of ICE vehicles by pricing them accordingly.

Overall, the ZEV mandate is clearly going to deliver a huge amount of change over the next 7 years. Whilst its environmental aims are laudable, I fear there will be a number of unintended consequences, not least of which will be the further decline of the automotive manufacturing base in the UK.

The data

Each year, vehicle manufacturers are set a target as a percentage of their total annual sales that must be zero emission. The regulation will require that for each non-ZEV sold, the manufacturer must have a ZEV allowance, the unit in which compliance will be measured. Manufacturers will receive enough allowances that if they meet their target, they will not need additional allowances. If a manufacturer sells more ZEVs than their target, they will have a surplus of allowances they can sell, bank, or convert their excess allowances. If a manufacturer sells fewer ZEVs than their target, they can buy, borrow, use banked allowances or convert CO2 emissions allowances to meet their obligation or make a final compliance payment.

(*) Target will be set out in future legislation later in the decade.

Source : Zero emission vehicle (ZEV) mandate consultation: summary of responses and joint government response - GOV.UK (www.gov.uk)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.