With new employer duties coming into effect soon, is your company prepared for workplace pensions reform?

The Pensions Regulator's detailed guidance on workplace pensions reform has now been published. It provides clarification on how the working population is classified under the new legislation, the new employer duties and guidance on the steps an employer can take to prepare.

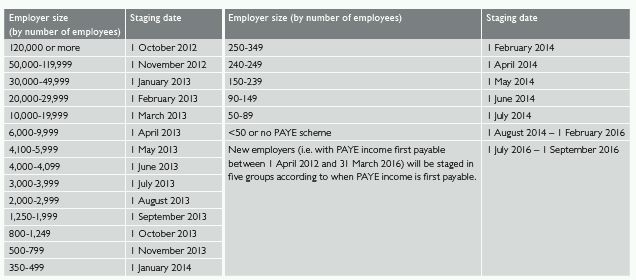

New employer duties and safeguards come into effect from 1 October 2012. Each employer will be allocated a date from when these new duties will apply, known as their 'staging date'.

The table below provides details of the relevant staging dates for different sized companies. The staging date is dependent on the number of people in the employer's largest pay as you earn (PAYE) scheme as at 1 April 2012. If you have more than one PAYE scheme then the staging date will be that of the largest employer. The number of employees in the PAYE scheme may well change between 1 April 2012 and the staging date, however the staging date will not be affected regardless of the change in size of the company.

The Pensions Regulator will contact each employer 12 months prior to the staging date to inform it of its duty to comply with the auto-enrolment laws.

Having looked at the table you may well see that your staging date is a long way off, say mid to late 2013, and think no action is required for some time. However, that is only around 24 months away and, considering you will hear from the Pensions Regulator 12 months before that, it will come round before you know it.

It's imperative now to at least consider the implications of workplace pensions reform, by taking a view of the likely make up of the workforce at your staging date and ascertaining the potential costs to the business if all eligible employees are automatically enrolled.

Careful consideration also needs to be made as to whether any existing pension arrangement meets the minimum requirements, in particular whether all eligible workers can enter the existing arrangement, and whether this has an impact on the structure and pricing of the current scheme. We believe the annual management charge for existing schemes held with insurers will be adversely affected if additional members enter the scheme as the average annual contribution is likely to be reduced.

Employers also need to start assessing how best to communicate the changes to employees. Recent market research from Legal & General identified that employees were heavily in favour of postal communication, and this will need to be well designed and written to ensure that the workforce take note of it.

These are just the first key steps employers need to think about to ensure that workplace pensions reform is successfully delivered on reaching their staging date.

In our next issue we will look in more detail at identifying the different categories of workers and the steps the employer must take for each. We also touch on whether the National Employment Savings Trust is the most appropriate arrangement for some employers to use or whether an employer-sponsored master trust or grouped personal pension plan would be the best approach.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.