MARKET WATCH: GLOBAL MARKETS LOSE MOMENTUM AMID UNCERTAINTY

by Philip Lawlor

Philip Lawlor comments on the impact of the end of US QE2.

Having surged 26% in the eight months between July 2010 and February 2011, global equity markets have subsequently been consolidating as they confront a period of uncertainty.

One of the major considerations for markets over the short term is gauging the impact of the June cessation of the second round of US quantitative easing (QE2). Looking back, we can observe that the announcement that the US Federal Reserve would instigate QE2 acted as a major catalyst behind the rally in equity markets. The Fed deliberately targeted the wealth generation effects (via equity market gains) as a key component of its policy to rebuild consumer and corporate confidence and reduce the unemployment rate. In many ways QE2 worked like clockwork.

Unfortunately, while QE2 did produce rapid 'sugar high' results in the US, it has progressively been seen as creating a negative feedback loop for the global economy.

Inflationary pressures

The primary concern is that the generation of excess liquidity exacerbated both the quantum of the move in commodity prices and the scale of decline in the dollar. This in turn has contributed to a surge in global inflationary pressures, primarily in developing economies, where food constitutes about 40% of living costs.

Indeed, the rise in basic food costs has been seen as a catalyst behind the uprisings in North Africa. To counter the rise in inflation, developing economies, including China, have continued to raise interest rates, denting confidence over their growth trajectory. In the UK (and latterly the US), rising import costs have seen real income growth turn negative, resulting in a loss in economic momentum. Hence, QE2 is perceived as initially stimulating growth but eventually undermining it.

In the UK, the Bank of England's Monetary Policy Committee has consistently taken the view (in the face of staunch criticism) that demand shortfall is a greater risk than rising inflationary expectations in the second half of 2011. This stance looks prescient as it is becoming increasingly clear that the UK economy is too fragile to absorb higher rates.

Rising input costs are also posing questions over the sustainability of corporate margins that are close to prior peak levels. One of the main bedrocks of equity markets has been the strength of corporate balance sheets and free cash flow generation that have produced a pick-up in dividend payouts, stock buy-backs and merger and acquisition activity.

Solvency headwinds

The euro has benefited from positive interest rate differentials relative to the dollar. Unfortunately, the combination of an appreciating currency, rising interest rates and rising bond yields is creating significant 'solvency' headwinds for peripheral Eurozone economies. Debt restructuring is still very much on the agenda.

Markets are evidently confronting mounting uncertainties over the immediate future. Until we get clarification on the consequences of the withdrawal of QE2 liquidity and the direction of global inflation and growth, equity markets are likely to exhibit increased volatility with more downside than upside risk.

UK MARKET COMMENTARY: KEY CHALLENGES MUST BE ADDRESSED

By Azhic Basirov,

Since the beginning of the year the market has continued to lack momentum and concerns over issues ranging from continuing banking and sovereign debt problems in Europe to upheavals in the Middle East have beleaguered the market.

Highs and lows on AIM

The number of AIM admissions in the first quarter of 2011 was 15, which is roughly the same as the figure for the first quarter of 2010 and much lower than the 35 admissions in the last quarter of 2010. The total number of companies on AIM has continued to decline with the figure standing at 1,174 at the end of March 2011. The level of primary fundraising in the first quarter was subdued with only £77m being raised, compared to the £242m raised in the first quarter of 2010 and £542m raised in the last quarter of 2010.

By contrast, the level of secondary fundraisings remained strong with some £1.6bn raised in the first quarter of 2011, compared to the £694m raised in the first quarter of 2010, but lower than the £2.56bn raised in the last quarter of 2010. There were 25 delistings in the first quarter, a figure lower than comparable figures for both the first and the last quarters of 2010, which were 51 and 40 respectively. The reduction has been concentrated, mainly, at the smaller end of the market capitalisation range. This continuing reduction in the number of companies coupled with the dearth of new issues continues to impact the activity level of the advisers servicing AIM.

Anecdotal evidence from AIM advisers suggests that whilst most advisers have a pipeline of new IPOs under development, not many of them expect the IPO activity to pick up until later in the current year. The dominant feature of the new issues on AIM has been the resource and commodity-related sectors that continue to attract the attention of the majority of investors.

The main market

The number of new admissions in the first quarter was 13, a figure similar to that in the first quarter of 2010 and lower than the 24 achieved in the last quarter of 2010. The level of funds raised for primary issues was £1.23bn in the quarter, also lower than comparable figures for both the first and the last quarters of 2010, which were £1.62bn and £2.67bn respectively. At the time of writing, Glencore had successfully completed its $60bn IPO on the London market, one of the largest IPOs in recent times on the London market. The main market seems to be attracting larger companies from a number of overseas locations, particularly those from the resource and commodity-related sections, as evidenced by the recent press comments on OGX, a Brazilian oil and gas company, and its key shareholder Mr Batista, to duallist the company on the London market.

What's in store later this year?

The ongoing reshaping of the banking sector, concerns over European national governments' budget deficits, inflation, anticipated interest rate rises later in the year and instability in the Middle Eastern countries affecting energy prices will be the key factors influencing analysts' views and the future direction of the markets. The level of optimism that was evident in the latter part of last year seems to have levelled off for the time being. For now, the direction of the market remains uncertain until some of the key challenges are addressed and investor confidence in backing new propositions returns.

ANNUAL AIM SURVEY: COMPANIES EYE FUNDRAISING AND ACQUISITIONS

by Philip Quigley

Philip Quigley looks at the feel-good factor among UK-based AIM-listed companies.

The appetite for further fundraising and acquisitions among UK-based AIM companies remains undiminished by the economic difficulties of the past couple of years, according to our latest annual survey of AIM company decision-makers.

Most of the 120 companies surveyed believe that AIM is meeting their needs as an effective growth market and are happy where they are – although two-thirds think the number of companies listed on the market will continue to fall.

Business confidence

Our poll reflects more than eight in ten (83%) of respondents were positive about the outlook for their own business in the year ahead. Only 3% of respondents are negative in their outlook, which is a large improvement from two years ago when 21% were not confident about the coming year.

Just under two-thirds (65%) of our AIM companies say trading has improved over the last year, and a slightly higher number (67%) said they expected trading to improve over the next year.

Acquisition aspirations

Two-thirds (67%) of respondents are considering making an acquisition, slightly down on last year; however, AIM-listed companies appear to be accelerating plans for potential acquisitions, and there appears to be more confidence in completing acquisitions in the near term compared to last year.

22% anticipate making an acquisition within the next six months, up from 18% last year, and more than a quarter (26%) said they would make an acquisition within 12 months (up from 22%).

Fundraising plans

More than two-thirds (68%) of AIM companies in the survey said they plan further fundraising. Of these, 42% plan on further fundraising within the next 12 months.

Attitudes to further fundraising have remained remarkably stable over the past three years, demonstrating AIM's resilience as a market for growth companies during challenging economic conditions.

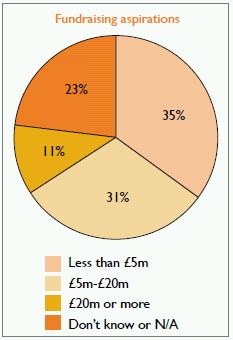

Of those looking to raise capital, 35% anticipate raising less than £5m, and 31% between £5m and £20m, with one in ten looking at major transformational fundraising in the £20m to £50m or above category.

Further analysis of anticipated fundraising relative to market capitalisation reveals the extent of anticipated 'top-up' or emergency funding on the one hand and transformational deals, most likely acquisitions, on the other.

Just over half (56%) of the smallest companies in the survey (those with market capitalisation of less than £5m) that are looking to raise funds, plan to raise less than £5m. However, 20% have ambitious plans to raise sums equal to or well above their market cap.

For the largest companies in the survey (those with market cap above £50m) the number expecting to raise more than their market value is lower, at around 8%, with 30% looking to raise between £20m and £50m.

Clearly there is a wide range of funding requirements, and still an element of fire-fighting. Many AIM companies are not particularly cash-rich, given the nature of their operations and pressure from investors, so it's not surprising that large numbers of respondents seem to be indicating their intention to raise relatively modest amounts, most likely for working capital purposes or organic expansion, or perhaps to pay for deferred consideration for previous acquisitions.

Nonetheless, significant numbers indicate that they are looking for substantial sums relative to their market cap that we would expect to be used to fund transformational deals.

The intent is clearly there for growth companies to act as we might expect and reflects rising levels of confidence. This is encouraging for AIM, which appears to be doing what it's supposed to do as a growth market.

About the survey

These results come from the fifth annual Smith & Williamson survey of UK-based, AIM-listed companies conducted at the end of 2010. 120 companies took part, representing 10% of AIM-listed companies operating in the UK and a wide range of market capitalisation values, length of time on AIM and proportion of shares in public hands. Participants were primarily FDs, CEOs, directors or similar.

|

Survey highlights

|

FINANCE: IN SEARCH OF THE THIRD SOURCE - REDISCOVERING THE RETAIL BOND MARKET

By Henrietta Podd

Henrietta Podd of Evolution Securities looks at the revival of interest in retail corporate bonds.

The retail bond market is enjoying something of a revival, thanks in part to the London Stock Exchange's new ORB trading platform. The market allows borrowers to access medium-term (five to seven-year) funding in small issue size on a regular basis from a source other than the banks and wholesale bond markets. For companies this can also boost name recognition by allowing distribution of bonds to a broad range of investors. This attracts new focus on equity as well as debt and, particularly for retail-facing businesses, acts as another touch point with their client base.

Enthusiasts of 19th century history will be familiar with the many forms of fixed income investment that financed much of the industrial revolution and colonial expansion across the world. While bonds fell out of favour with retail investors in the second half of the 20th century, low interest rates, volatile equity markets, an ageing population with a rising need for income, a shift in the savings market and an increasing need for private pension provision have encouraged a revival of fixed-rate and inflation-linked investments.

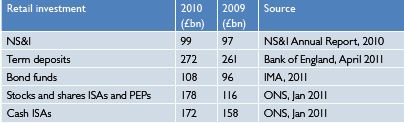

This is reflected in the growth of term bank deposits, investments with the Government's National Savings & Investments (NS&I) and retail bond funds (see table). However, retail investors are increasingly looking to invest directly in bonds for a number of reasons, including higher returns, to diversify away from the big banks and the attractions of guaranteed income with capital protection – which only direct investment in a bond can provide.

The expansion of tax-efficient savings through ISAs and SIPPs has also helped rebalance the attractions of income versus capital gain. There are £172bn of retail deposits invested in cash ISAs – some earning as little as ten basis points per annum. However, the retail investor is on the move – in 2008/09 stocks and shares ISAs (including legacy PEPs) represented 42% of total ISA funds. By Q3 of the last tax year, this was 51%. Much of this cash is looking for a better but predictable return.

The London Stock Exchange's new ORB trading platform initiative, supported by its members and based on a successful equivalent in Italy, aims to make it easier for smaller investors to buy corporate bonds and gilts.

ORB allows market-makers and brokers to post bids and offers in bonds. Registered market-makers have to make a price in a minimum size bargain at a maximum bid-offer spread. ORB also provides an observable, dealable price for retail investors and easy access to market information. This is the most transparent trading platform used by brokers to check prices and execute trades – and has the backing of a regulated exchange, recognised and respected by retail investors.

What does this revival mean for borrowers?

The UK is unusual in not having a vibrant retail bond market. In Europe, the USA and Japan liquid and active retail bond markets have been a major segment of the capital markets for many years. Traditionally, European investors have tended to take currency risk rather than credit risk – buying bonds of Triple A issuers such as the European Investment Bank but denominated in other currencies. However, as global interest rates have fallen, investors have become more adventurous, moving into longer-term investments and buying more and riskier corporate issues in search of yield.

UK investors have around 100 sterling corporate bonds from 58 borrowers (ten of which are banks) in which they can invest in small denominations traded on the ORB. There are 333 on the Italian retail exchange (319 from banks). So far this year, we have seen four new retail sterling issues – Tesco Bank, Lloyds, EIB and Provident Financial. Participants are calling for more corporate issuance to diversify away from the financial sector – straightforward vanilla bonds from UK businesses with strong management and simple business models.

Why a retail rather than a wholesale bond?

The institutional investor base is now very concentrated – the sterling bond market is dominated by 25 to 30 institutions which buy in very large amounts. Many of these are index-driven and are measured on relatively short-term trading performance. This means that the bonds they buy (a) need to qualify for the appropriate index and (b) should be liquid, i.e. can be traded in relatively large amounts at a visible bid-offer spread. Index qualification requires a minimum issue size – now £300m for the iBoxx index – and a credit rating, both of which affect liquidity, the nature of the investor base and price. Finally, the placement process is commoditised and dominated by the large investment banks, which may have little interest in relationships and the performance of the bond in the long term.

The advantage of the retail market is that it can be accessed in small amounts and through a network of retail stockbrokers and distributors who want to see the bonds perform well and who are also likely to cover the company's equity. Ultimately, the bonds will be widely held by many retail investors who will tend to buy and hold and, if they do sell bonds, sell in relatively small amounts.

As a result, the securities tend to perform well. This encourages the same investor base to buy more when the company comes to market with the next issue. Provident Financial has just closed its second retail offering within 12 months, raising £50m – double the amount of its first issue. This means the retail market can be a substantial and consistent source of funding for corporates away from the banks and wholesale bond markets.

UK retail investment (sources: as listed)

SECTOR FOCUS: ALTERNATIVE ENERGY

By Graeme Moyse

Graeme Moyse of Edison Investment Research examines the prospects for non-fossil fuel energy in the wake of recent world events.

The darling of stock markets in 2008, the alternative energy sector performed poorly during 2009 and 2010, mired by weaker oil prices, a lack of finance and fears of detrimental adjustments to incentive mechanisms. After two years of underperformance, and consequently now with less demanding valuations, the sector has shown some signs of recovery.

Recent developments suggest that this renewed optimism may be sustained. At a global level, the political unrest in North Africa and the Middle East, and nuclear problems following the tragic events in Japan, have reinforced the importance of energy supply issues. Together with legislative targets for reducing greenhouse gas emissions, security of supply issues will set the long-term growth trajectory for the alternative energy sector. We expect these twin imperatives will lead to growth rates considerably higher than for conventional sources of power.

Oil prices

The short-term impact of security of supply concerns is felt through the oil price. A high oil price, with attendant effects on fossil-fuelled power, is clearly beneficial for alternative energy, both from a perspective of relative competitiveness and revenue generation. Short-term oil prices have spiked to more than $120/b and while they may be vulnerable to a reversal of recent bullish sentiment we believe that prices will average over $100/b for this year and $90/b for next – above the levels seen in either 2009 or 2010.

Support for incentive mechanisms is more mixed, but by no means universally negative. Recent changes announced in the UK Budget have been criticised as undermining the growth potential of the solar sector in the UK, however, the introduction of a carbon price has been welcomed by many in the industry. In the US the recent extension of the blenders credit in the biofuels market and the decision to allow 15% ethanol blending in fuel for vehicles manufactured after 2001 are positive developments for the biofuels sector.

Momentum is positive

Finance remains tight, but in this area too momentum is positive. Globally, venture capital funding for solar appears to be scaling peak levels, while M&A activity has returned to parts of the UK renewable sector. Infinis recently acquired 96.8MW of onshore wind capacity from Scottish and Southern Energy for £174m, while onshore operator, Renewable Energy Generation, rejected an indicative offer for the company earlier this year.

With an improvement in fundamentals and sentiment, valuations more attractive than in the boom years and the market still seemingly reluctant to accord value to project pipelines, we believe that it is possible to identify value. In our view, for example, onshore wind operator Renewable Energy Group could be worth 75p/share, above the indicative offer of 67.7p/share and above the share price off 55p at the time of writing.

NEW ACCOUNTING RULES FOR ACQUISITIONS

By Kern Roberts

Kern Roberts says more businesses will face the challenges of new accounting rules as acquisitions increase.

The accounting rules for corporate acquisitions for companies applying international financial reporting standards (IFRS) changed radically for accounting periods beginning on or after 1 July 2009.

Due to the low level of corporate acquisitions in the last couple of years, the full effects of these changes are yet to be felt by UK capital markets. However, acquisitions are starting to pick up, with purchases of UK businesses by other home-grown companies growing steadily throughout 2010, reaching a value of £3.8 billion in Q4 2010. This is the highest figure reported since Q1 2009 and, amazingly, a higher figure than was recorded even in Q4 2007. If this upward trend continues, the impact of the new rules for acquisition accounting will be increasingly widely felt.

The accounting changes result from a complete rewrite of IFRS 3, the accounting standard that deals with business combinations. The new standard, IFRS 3 Revised (IFRS3R), will pose significant challenges for businesses when they come to make their first corporate acquisitions under the new rules. In particular, businesses should be conscious of the following main points.

Acquisition costs

Under the revised standard, acquisition costs, which have historically been accounted for as part of the cost of the acquisition and added to the balance of goodwill, will be expensed in the income statement as incurred. Therefore, costs such as finder's fees, advisory, legal, accounting, valuation and other professional or consulting fees will result in immediate expenses for acquirers.

Contingent consideration

Contingent consideration is an important part of many business combinations and IFRS3R changes the way in which it is accounted for. From now on, contingent consideration will have to be valued at fair value at the acquisition date, regardless of whether settlement is probable, possible or remote. Furthermore, subsequent adjustments to the fair value of liabilities arising from contingent consideration will be taken through the income statement and not as a movement in goodwill.

Goodwill and non-controlling interests

The new standard offers a choice of how goodwill is calculated when the acquisition leaves a non-controlling interest in the hands of a minority shareholder. In these circumstances, goodwill can be calculated as:

- the consideration paid, less the purchaser's share of the identifiable net assets, or

- the consideration paid, plus the fair value of the non-controlling interest, less 100% of the identifiable net assets.

The latter method will result in a higher goodwill figure – with a consequential impact on any future impairment and balance sheet ratios – and will also require a process to calculate the fair value of the non-controlling interest.

Dealing with the changes

In addition, quoted businesses should be aware of two main themes arising from the revised standard. Firstly, a number of the changes are likely to result in increased income statement volatility. Secondly, there will be an increase in the number of situations where detailed valuations will be required, creating an actual cost for businesses.

Both these areas are real concerns for businesses and, increasingly, the accounting 'tail' may sometimes wag the commercial 'dog', as companies will be forced to consider the accounting treatment when determining how an acquisition should be structured.

EUROPE'S RAFT OF REGULATION FOR SMALLER QUOTED COMPANIES

By Tim Ward

Tim Ward, Quoted Companies Alliance CEO, discusses the effect of European regulations on small and mid-cap quoted companies.

Over the past two years, the European Commission has been reviewing its financial services directives, including the prospectus, market abuse and transparency directives. And let's not forget the markets in financial instruments directive (MiFID), which is generating heated debate, with draft proposals due out this July.

Throughout all of these reviews of European financial regulation, there has been a specific focus on SMEs. Access to finance for SMEs has become a big concern in the EU since the onset of the financial crisis and Internal Market Commissioner Michel Barnier's special interest in smaller businesses has been driving this focus. But, what does this mean for smaller quoted companies in the UK?

Lobbying pays off

So far, we have seen our work pay off and a positive result from the prospectus directive review, with the Commission increasing the limit for exempt offers from €2.5m to €5m and raising the exemption for offers from fewer than 100 persons to fewer than 150. In addition, it has introduced a 'proportionate prospectus' for companies with reduced market caps and SMEs (the European Securities and Market Authority is currently consulting on what this should comprise). This means that smaller quoted companies will be able to raise equity more efficiently and at less cost.

With the market abuse directive, there have been suggestions that the requirement for insider lists should be scrapped, which would get rid of an annoying administrative burden for listed companies. Likewise, with the transparency directive we have argued that the requirement for interim management statements should be dropped, as the costs of producing them seem to outweigh the benefits.

In the MiFID review, there is even a proposal to develop 'specialised SME markets' throughout Europe, which would have rules tailored to suit the needs of smaller growing businesses.

However, it is important not to get overly excited about all of this. With each review comes the prospect of unintended consequences and there is always the fear that Europe could overstep its bounds and end up imposing more or inappropriate regulation on UK markets and companies.

The end of execution-only trading?

One such fear is the proposal in the current MiFID review to abolish execution-only trading. This would have a negative effect on markets' liquidity – the ComPeer UK Wealth Management Industry Report 2010 shows that the total number of trades transacted by stockbrokers in 2009 was 22.4 million, of which 16.1 million were execution-only trades, representing 72% of the total. Execution-only trading provides a strong investor base for many smaller quoted companies, so cutting them off from this would only harm their access to capital.

All of this indicates cautious optimism and that's how we at the Quoted Companies Alliance are approaching all of these issues in Brussels. While the raft of European regulation can have its downside, it appears that a proportionate approach is being considered, and in many cases implemented, for smaller quoted companies.

ENTERPRISE INVESTMENT SCHEME: THE FUEL FOR ECONOMIC RECOVERY?

By Matt Watts

Matt Watts examines the implications of the recent EIS changes.

There have been a number of significant and favourable changes to the Enterprise Investment Scheme (EIS), which provides tax relief for individuals investing for equity in qualifying companies.

The new rules – announced in March's Budget – will substantially increase both the number of companies that can qualify for EIS investment, and also the amount individuals can invest through EIS.

In short, the Government sees EIS as playing a key role in ensuring that the UK economic recovery continues. By extending the relief to larger entities, EIS could now be an important, additional source of funding for AIM companies.

Extending the relief

The Government is extending EIS, both in terms of the criteria for investee companies that qualify, and also for those individuals investing. Unless specified otherwise, most of the announced changes will take effect for shares issued after 5 April 2012, subject to EU state aid approval. The main changes are summarized opposite.

Changes to EIS

Investee company criteria

- Number of full-time employees in the company (or group as appropriate) increased from 50 to 250

- Gross asset threshold for qualifying companies (or group as appropriate) increased to £15m immediately before the investment

- Relaxation of the requirement that qualifying companies must be carrying on their trade "wholly or mainly in the UK" – for shares issued after 5 April 2011; the company issuing the shares will be required to have a UK permanent establishment only

- Annual amount a qualifying company can raise in total under venture capital schemes (VCTs) (comprising both EIS and VCTs) increased from £2m to £10m.

Rules for investors

- Rate of EIS income tax relief for an individual increased from 20% to 30% (bringing relief in line with that available for VCTs) for shares issued after 5 April 2011

- Annual amount qualifying for income tax relief that an investor can invest under the EIS doubled from £500k to £1m.

What do these changes mean?

Clearly, the number of companies able to benefit from EIS will increase dramatically as a result of the announced changes. In particular, we anticipate that more AIM-listed companies will now also be able to qualify for EIS investment, representing an important additional source of capital for many.

For investors, the enhanced EIS tax reliefs, together with the doubling of the capital gains tax entrepreneurs' relief lifetime limit to £10m, should provide greater incentive to invest in private companies. The generous tax relief offered by EIS should ensure that individuals are generally willing to take greater risks on investing in small companies, while the extension of the size criteria for qualifying companies should also provide access to EIS for those investors wanting to back larger companies, often perceived to be lower risk. All in all, the changes are clearly seen by the Government as an important part of its policies aimed at stimulating enterprise and economic recovery.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.