KEY FACTS:

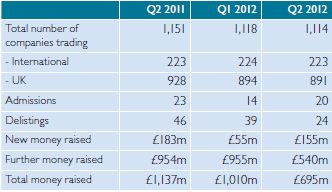

- Number of companies trading on AIM as at 30 June 2012 – 1,114

- Total funds raised on AIM in three months to 30 June 2012 – £695m

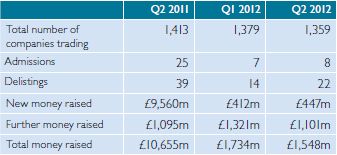

- Number of companies trading on Main Market as at 30 June 2012 – 1,359

- Total funds raised on Main Market in three months to 30 June 2012 – £1,548m

MARKET COMMENTARY

AIM

- Number of listed companies has decreased in Q2 2012.

- The number of admissions in Q2 2012 has decreased to 20 from 23 in Q2 2011.

- Number of companies on AIM is at a similar level as at March 2005.

- Average market cap of an AIM company decreased to £54.5m in June 2012 from £61.1m at the end of March 2012. This has decreased from £65.6m at the end of June 2011.

Market movements

- FTSE AIM All-Share Index decreased 15.1% in Q2 2012 to 675.1 (14.7% increase in Q1 2012).

Summary statistics

Main Market

- There has been an increase in new money raised from £412.4m in Q1 2012 to £446.5m in Q2 2012.

- The number of companies has fallen from 1,379 at 31 March 2012 to 1,359 at 30 June 2012.

- The amount of further money raised has decreased from £1,321.1m in Q1 2012 to £1,101.3m in Q2 2012.

Market movements

- FTSE All-Share decreased 3.7% in Q2 2012 (5.1% increase in Q1 2012).

Summary statistics

CONCLUSIONS

Money raised from AIM admissions increased almost threefold in Q2 2012 compared to the previous quarter. The amount of money raised from further issues was over 30% lower than both of the previous quarters. The AIM All-Share Index decreased 15.1% during the quarter. Total number of admissions in the year to 30 June 2012 was 34 which compares with 38 admissions achieved for the half year to 30 June 2011 and 90 admissions for the full year to 31 December 2011.

On the Main Market, the money raised from admissions was 8% higher and further money raised was 17% lower compared to the previous quarter. However, the new money raised and therefore the total money raised was significantly less than the equivalent period in 2011 due to the exceptional contribution made by Glencore International plc's listing in May 2011. The FTSE All-Share Index decreased by 3.7% during the quarter. During Q2 2012 markets slowed down as fears regarding banking and sovereign debt problems re-emerged in the eurozone. There is anecdotal evidence of a higher level of interest from new issuers but success of such IPOs will much depend on investor sentiment becoming more positive than is currently being witnessed.

* Figures in the tables and graphs above are derived from the monthly market statistics published by the London Stock Exchange.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.