- within Government, Public Sector, Tax and International Law topic(s)

- with readers working within the Aerospace & Defence, Banking & Credit and Media & Information industries

Law no. 6745 on Promoting Investments on Project Basis and Amending Some Laws and Decree Laws1 was promulgated on 7th of September. The Law features 82 articles on various topics including minor additions to some laws and decree laws, but undoubtedly the most significant article of the Law is Article 80, which is a provision regarding investment incentives. This has been a widely debated article throughout the drafting process of the proposal, and was altered numerous times before getting shaped into its final form. In brief, the Article provides a wide range of powers to Council of Ministers for the Council to take the necessary steps about granting the determined incentives to investment projects.

With this provision, the new investment incentives scheme is designed to encourage investments with the potential to reduce dependency on the importation of intermediate goods vital to the country's strategic sectors. Moreover, amongst the primary objectives of the new investment incentives scheme are to reduce the current account deficit; to boost investment support for lesser developed regions; to increase the level of support instruments; to promote clustering activities; and to support investments that will create the transfer of technology.

The Article presents the different types of incentives that may be granted by the Council to the investors fulfilling the mentioned conditions. The conditions, however, are not particularly specific and can be subject to interpretation. It is suggested that the investment projects that are subsidized by the Ministry of Economy and are R&D-rich or have high added value can be granted the incentives. However, the investment must also satisfy the current and future needs of Turkey in terms of the goals set by the economic development plans and the annual programs, ensure the supply security, reduce the foreign dependency, and achieve the technological evolvement. While these criteria do not point towards a certain sector, energy sector is apparently highly relatable.

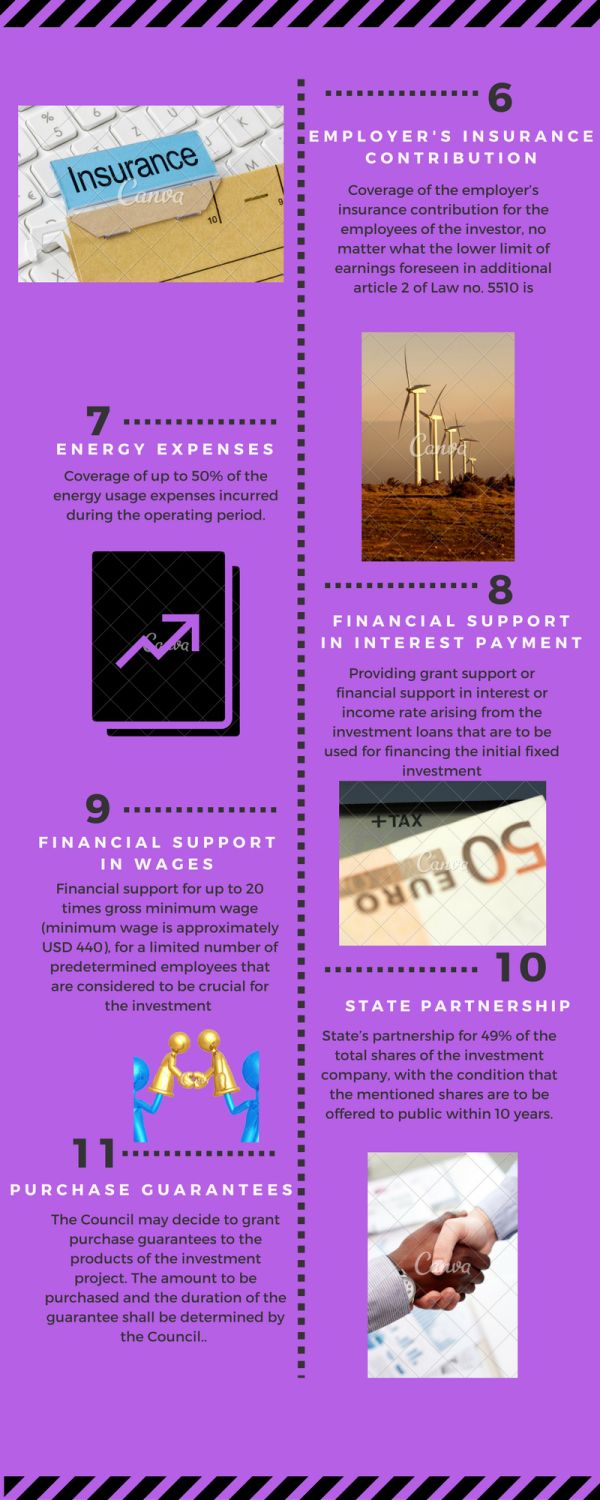

The Article contains the forms of incentives that may be granted to the fulfilling investment projects by the Council. The incentives are as follows:

- Up to 100% discount in corporate tax and up to 200% investment contribution rate, or full exemption from corporate tax limited to the income generated from the investment for up to ten years after the investment project becomes functional;

- Benefiting from income tax withholding;

- Exemption from customs duties;

- If the investment is conducted on public property, granting of easements or right of tenancy for up to 49 years without any rent obligations, and possibly transfer of ownership free of charge if the investment is completed and 5 years of employment is provided as expected;

- Coverage of the employer's insurance contribution for the employees of the investor, no matter what the lower limit of earnings foreseen in additional article 2 of Law no. 5510 is;

- Coverage of up to 50% of the energy usage expenses incurred during the operating period;

- Providing grant support or financial support in interest or income rate arising from the investment loans that are to be used for financing the initial fixed investment;

- Financial support for up to 20 times gross minimum wage (minimum wage is approximately USD 440), for a limited number of predetermined employees that are considered to be crucial for the investment;

- State's partnership for 49% of the total shares of the investment company, with the condition that the mentioned shares are to be offered to public within 10 years.

The abovementioned incentives may be granted jointly or severally.

The article suggests that these incentives will be funded by the budget of the Ministry of Economy.

The Law brings forward another beneficial promotion for the investors; the Council may decide to grant purchase guarantees to the products of the investment project. The amount to be purchased and the duration of the guarantee shall be determined by the Council.

Paragraph four of the Article is one on the most controversial rules of the Law, as it may completely alter the previous necessities and requirement in various practises. The Law rules that any provision regarding to allowances, permits, licenses, allotments, registrations or other restrictive clauses may be altered by granting of necessary exemptions directly by the Council. Moreover, in order to ease or accelerate the investments, relevant administrative and legal procedures may be adjusted by the Council. In other words, the Council is granted the ability to create a special legal environment just for the project in question.

The Article also rules that any necessary infrastructural investments deemed required by the Council shall be initiated following a decision by the Council.

The procedures and principles of the incentive process shall be determined by the Council. In addition, in case the agreed investment project is not concluded as foreseen, all the taxes and other financial grants shall be refunded to the treasury with default interest. On the other hand, no tax penalty shall be imposed on the investor.

Finally, the Law allows all the exemption, incentive and grants to carry on to the assignee if the investment project is transferred to another entity.

The Law is now in force and the incentive decisions of the Council are possibly soon to arrive. While the new incentives appear to aim to promote foreign investment, it is unknown whether if the resulting effects will be dramatically high in terms of enhancing the growth rate or achieving the foreseen outcomes. The program will surely benefit the investors and create an incentive to invest in various fields in Turkey, but there is yet no way to be certain if the means are appropriate to attain the purpose.

Footnote

1. Official Gazette No. 29824 07.09.2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.