"Let us not go over the old

ground,

but rather prepare for what is to come."

Cicero (106 BC - 43 BC)

Introduction

After five years of implementation of the most recent support mechanism, Turkey dramatically changed the procedures of supporting renewable energy in power generation. Based on Law No: 53461 (YEKDEM Law) and the YEKDEM Regulation,2 the mechanism guaranteed the qualified plants the pre-set cash flow determined by the legislation regardless of their planning, balancing or the existing spot market prices. The plants were automatically granted the cash calculated by their metered generation multiplied by corresponding per unit support price.

Considering the costs of the increased level of supported generation on the overall system and the importance of balancing requirement, the new scheme still promises, albeit indirectly, the guaranteed prices for qualified plants but introduces the balancing requirement for which the plants will eventually incur costs depending on their hourly generation planning capabilities, i.e. skills.

In this study, we seek to clarify the impact of the new scheme on the existing qualified plants after a comparison between the older and the newly introduced schemes. Balancing responsibility will inevitably be touched upon since the plants are now responsible for balancing.

Previous scheme

The existing YEKDEM Law has undergone fundamental amendments in 2010 and the current legal background for renewable support mechanism was laid down through these amendments.

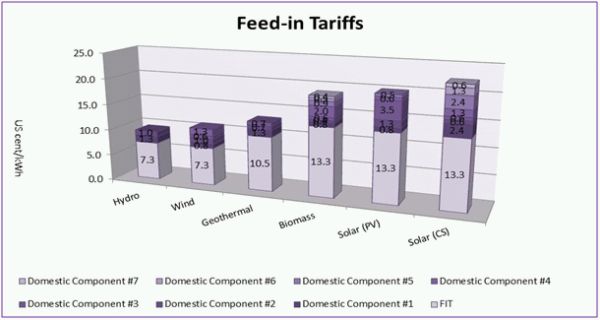

Based on this legislation, the incentives for the use of renewables in power generation include Feed-in tariffs, purchase guarantees, connection priorities, lowered license fees, license exemptions in exceptional circumstances and various practical conveniences in project preparation and land acquisition. The legislation includes a differentiated feed-in tariff scheme for different types that eventually provide the investors with predictable returns on their investment. The guaranteed prices are applicable for ten years after commissioning.

The uniqueness of this scheme is that the qualified plants are eligible for extra feed-in tariffs if certain equipment used in the plants is manufactured in Turkey. There is a separate regulation that lays down the principles and procures of documenting the fact that the equipment is domestically manufactured3. The duration for domestic component addition is five years after commissioning.

Generation companies willing to benefit from the support mechanism should apply to the Energy Market Regulatory Authority (EMRA) by October 31, in case they would like to register to the system for the following calendar year. After the review and the evaluation of the applications, the appropriate applicants are notified within the first ten days of November; the final list for the upcoming calendar year is announced by EMRA no later than November 30.

Certain rules governed the implementation of the support scheme. First of all, it was operated on a yearly basis, and the plants who participated within the so called YEKDEM portfolio were not allowed to exit the system or to sell on other platforms other than the portfolio. In return, the entire generation counted by their meters was purchased by the system operator at YEKDEM prices leaving the plants without price, volume and currency risks. These plants were also exempt from balancing responsibility so were not obliged to forecast their future generation as well.

The incentive scheme introduced in 2010 has attracted little interest during the first years. However, eligible plants increasingly started to approach the mechanism due to two facts: First, the reference electricity prices emerged from the day-ahead market (PTF) stagnated. Second, US currency started to appreciate against the Turkish Lira. Thus, the spread between the feed-in tariffs and the spot day-ahead prices widened in the course of 2014 and 2015. The below graph depicts the PTF and the feed-in tariff levels for geothermal, wind/hydro and solar comparatively.

As depicted in the graph, in 2015 the average PTF revolved around US$51, whereas the feed-in tariffs has a constant value of US$73 for hydro and wind and US$133 for solar. The spread represents the extra revenue generated from participating within the YEKDEM portfolio. For 2016, YEKDEM final portfolio has been announced by EMRA in 08.12.2015, and the total volume has reached 15.000 MW.

Concerns on the burden that such a volume would ultimately usher in turn out to be among the hottest topics in the Turkish power market in the course of the last two years. Considering that the peak load is expected to be around 45.000 MW in 2016 and 15.000 MW renewable portfolio without balancing responsibility and with substantially higher guaranteed prices,4 the concerns appeared at the policy-making side should have been no surprise.

Amended scheme

The amendments regarding YEKDEM were published into regulation on 29 April 2016, and they became applicable for the 2016 portfolio as well. The fundamental changes are as follows:

- YEKDEM portfolio is abolished.

- Eligible plants are expected to sell their generation on the free market including the bilateral market, the day-ahead market and the intra-day market.

- The spread between the feed-in tariff and the hourly day-ahead market price (which is apparently the PTF) is to be paid to the plants separately (or paid by the plants if PTF>FIT).

- The plants became responsible for balancing thus have to incur costs associated with imbalances.

- A tolerance co-efficient is introduced.

- Plants are subject to ancillary services requirements.

EMRA did not have a free hand in amending the YEKDEM Regulation since some of the incentives were secured by the legislation and extended by the Council of Ministers for the plants which will be commissioned until 31 December 2020.

Considering that the exemption from the balancing responsibility is not granted by legislation, EMRA set each plant responsible for their imbalances as with other power plants operating in the power market. Since the spread between the FIT prices and PTF will be paid to the plants separately, the main game changer for power plant economics is the cost of imbalances. Rules and procedures for calculating these costs are laid down in the Electricity Market Balancing and Settlement Regulation (DUY). We need to touch upon these rules in order to have a thorough understanding regarding the impact that the amendments will have on the power plants once exempt from these rules5.

DUY stipulates that all market participants are required to balance their energy given to the system, energy purchases and imports on the one hand and their energy taken from the system, energy sales and exports on the other hand on an hourly basis. Market participants are called as "balancing party" and take up responsibility before the market operator for the settlement of their imbalances6.

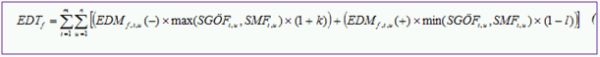

Energy imbalances are calculated based on the methodology adopted in the 110th Article of DUY. The methodology is depicted below:

In this formula:

- EDT is the cost of imbalance.

- EDM is the amount of imbalance.

- SGÖF is the day-ahead market price (PTF).

- SMF is the system marginal price (price occurred at the balancing power market).

- k and l are coefficients set by EMRA to penalize imbalances (currently 0.03).

In order to avoid a possible arbitration between the day-ahead market and the balancing market, EMRA adopted a "min-max approach" when settling the imbalances. Given the fact that plants may be in a short (lack of generation) or long (excess generation) position in real time they will be buying or selling on the balancing market where buying price would be max (PTF, SMF) and selling price would be min (PTF, SMF). That is, imbalances are being settled on a "buy expensive, sell cheap" approach. Thus, opportunity to profit from arbitrage between the day-ahead market and the balancing market is eliminated. In addition, k and l coefficients represent monetary penalties applied for the imbalances. According to Article 110 of DUY, the authority to determine these coefficients belongs to EMRA Board subject to three months' prior announcement. For the time being, k and l coefficients have been set as 0.03 which means the cost of imbalance escalates three percent of PTF or SMF depending upon the position of the power plant and the values of PTF and SMF.

Consequently, power plants eligible for YEKDEM have to plan their generation beforehand and incur costs associated with their imbalances. The below example represents how the new scheme differs from the previous scheme.

Assume that for a given hour Plant A has the variables below as given:

- PTF = 170 TL

- SMF = 200 TL

- Day-ahead market sales (GÖSM) = 190 MW

- Generation (UEVM) = 196 MW

- k = l = 0.03

- Tolerance coefficient = 0.98

Also assume that this plant is an eligible hydro plant meaning that the guaranteed price is US$73 per MW which corresponds to 2,80 * 73 = 204,4 TL (Assuming 1 US$ = 2,80 TL)

During the previous scheme, the plant would collect whatever is generated times the guaranteed price: UEVM * YEKF = 196 MW * 73 US$ * 2,80 TL = 40.062,4 TL. That was a sure cash flow during the previous scheme era.

Now there are two new parameters into the equation: The tolerance co-efficient and the cost of imbalance. Now that the YEKDEM portfolio is abolished Plant A would receive GÖSM * PTF = 190 MW * 170 TL = 32.300 TL from the day-ahead market sales. The difference between the GÖSM and UEVM is the position of the plant and in this case it is 6 MW long (190 MW sold vs. 196 MW generated). This excess generation has to be settled at the balancing market at the price minimum of PTF and SMF. Plant A would receive 6 MW * min (170 TL, 200 TL) * (1-l) = 6 MW * 170 TL * 0,97 = 989,4 TL from the excess generation. Lastly, the plant is to be paid the difference between (PTF*0,98) and YEKF for each MW generated. The amount will be 196 MW * [204,4 TL - (170 TL * 0,98)] = 196 MW * 37,8 TL = 7.408,8 TL. In the overall, Plant A will receive 32.300 TL + 989,4 TL + 7.408,8 TL = 40.698,2 TL. The difference between 40.698,2 TL and 40.062,4 TL (635,8 TL) is the net position compared to sure YEKDEM revenue. Scenarios for various alternatives are depicted in the below chart7.

As seen from the chart, the cash flow of the plants, under the new scheme, are being affected by the relative values of PTF and SMF, by the amount of imbalance, by k, l and the tolerance coefficients determined by EMRA. TC=1 column in the previous chart shows, ceteris paribus, the net position for the power plant if EMRA sets the coefficient at 1.

Another exercise might be run for a short position. Assume that PTF is 175 TL and SMF is 200 TL. The quantity sold at the day-ahead market is 190 MW and the realized generation 178 MW which means 12 MW short position (6.3% imbalance).

Plant B would receive GÖSM * PTF = 190 MW * 175 TL = 33,250 TL from the day-ahead market. The difference between the GÖSM and UEVM is the position of the plant and in this case it is 12 MW short (190 MW sold vs. 178 MW generated). This deficit has to be settled at the balancing market at the price maximum of PTF and SMF. Plant B would pay 12 MW * max (175.200) * (1+k) = 12 MW * 200 TL * 1.03 = 2,472 TL for the lacking generation. Lastly, the plant is to be paid the difference between (PTF * 0.98) and YEKF for each MW generated. The amount will be 178 MW * [204.4 TL - (175 TL * 0.98)] = 178 MW * 32.9 TL = 5,856.2 TL. In the overall the plant will receive 33,250 TL – 2,472 TL + 5,856.2 TL = 36,634.2 TL. The difference between 36,634.2 TL and 36,383.2 TL (251.0 TL) is the net position compared to sure YEKDEM revenue.

As seen from the chart, the net position is highly sensitive to the tolerance coefficient set by EMRA. As an initial value, it is set as 0.98; however any upward change in this coefficient will likely to have substantial negative impact on the plant economy.

Conclusion

There are at least four additional points that are noteworthy regarding the new scheme:

- First, intra-day market is operational in Turkey since July 2015 and it provides further fine-tuning for the plants to smooth out their imbalances.

- Second, DUY allows power plants to participate in balancing groups to better mitigate individual imbalances. This provides an opportunity for individual plants for reducing their imbalance costs.

- Third, spread between YEKF and PTF to be paid to plants separately is a double-edged process. If PTF turns out to be greater than YEKF, the plants shall pay the spread to the system operator.

- Last but not least, the calculation of the spread is based on PTF regardless of the actual sales price of the plant. That is, assuming that the plant is able to sell power at a price higher than PTF on the bilateral market, excess revenues become possible.

The core of the new system introduced by EMRA is the balancing responsibility. This will incur new costs for the power plants thus power plants with intermittent generation have to manage their production on an hourly basis or seek ways to participate in a balancing group. The flip side of the coin is the extra spread generated by the tolerance coefficient. One can easily observe the sensitivity of the net position of the plants to the tolerance coefficient by playing out with the TC column on the sample excel sheet. Thus, EMRA's decision on the coefficient for the future calendar years will be highly determinative on the cash flows of the plants. TC=1 would mean, for instance, the absence of the extra spread and excel sheet speaks for itself regarding the net position of the plants in such a scenario.

Last but not least, intermittency is not the same for different types of power plants participating in YEKDEM. For instance, it is reasonable to argue that hydro-power plants with reservoir or geothermal power plants are less vulnerable compared to solar and wind. Thus, a constant tolerance coefficient will likely to leave some plants with extra costs incurred due to imbalances, while some plants with less intermittency will be handed over extra revenues.

This revolutionary change in the YEKDEM mechanism is likely to usher in hot debates as the consequences for the power plants economics materialize during the course of this year. Based on the realized figures, EMRA probably will re-evaluate the tolerance coefficient for 2017. Meanwhile, more fundamental changes have been proposed as legislation more recently, and the system for incentivizing renewable based power generation is likely to be entirely different from that of today, most probably starting from 2020.

Footnotes

1. Law on Utilization of Renewable Energy Resources for the Purpose of Generating Electrical Energy

2. Regulation on the Documentation and Supporting of the Renewable Energy Resources

3. Regulation on the Domestic Manufacture of Equipment Used in Renewable Power Plants

4. Please note these costs are passed through final consumers through retail license-holders.

5. It should be noted that these projects have been financed by the banks assuming that no costs for imbalances would appear on the cash flow.

6. DUY Article 6.

7. Source: AEE

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.