The New Turkish Commercial Code which entered into force on 1 July 2012 introduces novelties regarding financial assistance. By contrast, the previous Turkish Commercial Code (the Previous TCC) contained no clauses limiting or prohibiting subsidiaries (to the extent they are not public companies) from providing financial assistance to their parent companies by way of giving loans and/or securities for debts of their parent companies.

Abuse of Power

The New Turkish Commercial Code (the New TCC) introduces certain principles relating to assistance that subsidiary companies provide to their controlling companies for the purposes of facilitating transactions undertaken by such controlling companies (the Subsidiary Assistance).

However the New TCC also provides a relaxation procedure as an exception to its prohibition on providing Subsidiary Assistance. According to the relaxation procedure, the controlling company will not be deemed liable if it compensates for the loss of the subsidiary or provides equivalent claim rights within the same financial calendar year.

Despite the restriction applicable to controlled subsidiaries, the New TCC sets forth a different regime for wholly owned subsidiaries. Under the New TCC, the board of directors of the controlling company, as long as its specified and factual policies require, is entitled to give instructions regarding the management of its subsidiary provided that it holds, directly or indirectly, 100% of the shares and voting rights of its subsidiary. In this case, even if such instructions might result in loss for the subsidiary, the management and other bodies of the subsidiary must comply with such instructions. However, instructions clearly exceeding the subsidiary's solvency, jeopardizes its existence, or results in the loss of significant assets of the subsidiary, shall not be given.

Legal Consequences of Abuse of Power

Any of the subsidiary's shareholders have the right to request compensation for damages if the controlling company does not cover the loss of the subsidiary, or does not provide an equivalent form of compensation within the same financial calendar year. In such case, the transaction supported by the Subsidiary Assistance shall remain enforceable, however, the controlling company's board of directors will be liable against the creditors of the subsidiary together with the controlling company.

In case the parent company does not compensate the losses incurred by the subsidiary, the shareholders and creditors of the subsidiary are entitled to recourse to the parent company and to the board members of the parent company for compensation of losses. The dissenting shareholders of the Subsidiary may resort to courts in order for their shares to be purchased or their loss to be indemnified by the controlling company upon certain conditions.

Financial Assistance Under Acquisition Financings

Article 380 of the New TCC sets forth that a target company may not advance funds, provide loans, security or guarantee to a third party to facilitate the acquisition of its own shares. The methods stipulated under the New TCC to grant interest to third parties are not exhaustively listed and any direct or indirect attempt to facilitate such interest may fall into the territory of this prohibition.

Exceptions

Transactions carried out by banks or financial institutions in performance of their ordinary course of business; and share acquisitions by the employees of the company or the employees of a subsidiary are exempted from the prohibition to provide financial assistance in acquisition of a company's own shares.

There is no agreed interpretation of the scope of the exemption granted to banks or financial institutions in performance of their ordinary course of business. Some scholars claim that this wording is meant to exempt all transactions whereby banks or financial institutions give loans that are secured by the collaterals provided by the target company itself for the purposes of acquisition of its own shares. Whereas some scholars stress that the exemption would apply only to cases where the banks provide financing to third parties to enable them to purchase the shares of the bank itself. It is more likely that the latter scenario would be applicable based on the interpretation of the prohibition in accordance with the underlying EU Directive issued in 1976.

Legal Consequences of Financial Assistance

In case the target company conducts any act to violate this prohibition, the relevant transaction security shall be deemed void. The wording of this provision leads to the conclusion that the share purchase transaction for acquisition of the shares of the target company shall still be enforceable but any security given by the target company shall be null and void..

Position of Transactions Carried Out in the Era of the Previous TCC

As the Previous TCC does not include any specific provisions on financial assistance and abuse of power, these matters were covered by the general provisions under Turkish law governing the so-called concept of "undertaking the performance of a third party." Accordingly, the Law on Implementation of the New TCC immunized the transactions performed during the Previous TCC era from the financial assistance prohibitions stipulated under the New TCC. The financial assistance prohibition shall only be applicable to the transactions that took place after 1 July 2012. However, in case there is a need to provide additional collaterals to secure the transaction that was completed when the Previous TCC was in force, then such prohibitions will be applicable to those additional collaterals.

Potential Gateways

- Limited Liability Companies: There are no restrictions under the New TCC in relation to the financial assistance provided by a limited liability company.

- Upstream Merger: The Target could be merged with the acquisition vehicle following the completion of the share acquisition. Accordingly, the assets of the Target will be acquired by the acquisition vehicle and the creditors of the acquisition financing will be able to enjoy the entire security package whereby the merger transaction itself would offer protective measures for the benefit of the shareholders or creditors of the Target.

- Mezzanine financings: Mezzanine financings may be an alternative to overcome relevant restrictions to the extent that the acquirer, as the borrower of the acquisition facility, will only be required to provide security over the shares of the Target which belongs to the acquirer itself.

- Combined tranches involving different types of facilities: In the event that the Target becomes party to such a facilities agreement composed of different types of facilities for different purposes, it can provide security for the facilities made available thereunder other than the acquisition facility. On top of being a borrower, if the Target becomes a guarantor and guarantees the obligations of other group entities, it is very likely that a default under the acquisition facility would trigger cross-default under other facilities that are either borrowed or guaranteed by the Target company. Consequently, this would indirectly enable the creditors to foreclose upon the Target's security package.

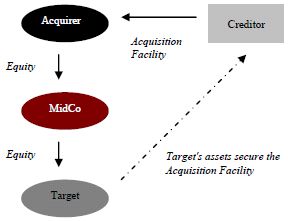

- Layered acquisitions

structures: In this scenario, another company is

introduced to or involved in the transaction to disguise the Target

aimed to be acquired or the organization of the relevant group

requires an indirect acquisition of the Target's shares from a

higher level.

Once the acquirer purchases the shares of the MidCo, it will indirectly own the Target which enables it provide collateral to secure the loan extended to the acquirer to finance the acquisition of the MidCo.

Having said that, neither the gateway in relation to the layered acquisition structures nor the combined tranches alternative mentioned above have been blessed by the courts or agreed amongst a wider group of scholars yet.

Prospects

The EU Directive regulating the financial assistance prohibition was issued in 1976 but the amendments made to such directive in 2006 adopted a more reasonable approach on the implementation of the financial assistance rules1. However, the New TCC adopted the primary regulation of the EU which restricts both public and private companies to provide financial assistance without introducing any gateways to whitewash the prohibition.

Therefore Article 380 of the New TCC needs to be amended in order to attain to the economic order of the world by bringing distinctions between private and public companies as well as providing explicit guidelines to a controlled financial assistance mechanism.

Originally published December 2013

Footnote

1 For instance, financial assistance must be facilitated under fair market conditions; the company willing to acquire the target company must be financially consistent; the financial assistance to be provided must not depreciate the value of the target company; both target company and the acquiring company must calculatingly approve the financial assistance; and the target company must reserve an amount which is equal to the prospective financial assistance provided.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.