The UAE Corporate Tax (CT) law has been made applicable with effect from the financial year beginning on or after 1 June 2023. One of the important requirements of UAE CT Law was obtaining a CT Registration number. Based on an earlier FAQ issued by the Ministry of Finance, it was provided that companies can register before they file their first tax return.

However, Federal Tax Authorities have issued Federal Tax Authority Decision No 3. of 2024, specifying timelines for making an application for CT Registration, which will be effective from 1 March 2024.

Timeline for the Tax Registration Property

Resident Juridical Persons (Companies, LLC, Foundations, etc.)

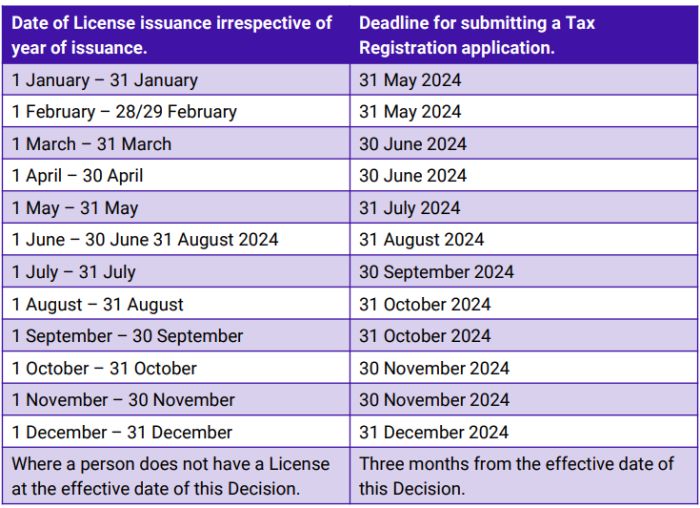

Resident juridical entities established or recognized prior to March 2024, would be required to submit the registration application on or before the following dates:

In the case of multiple licenses, the date of issuance of the earliest license needs to be considered for ascertaining the due dates for making an application for registration.

A resident juridical person incorporated or recognized on or after the effective date of this Decision would be required to obtain Tax Registration within three months from the date of incorporation, establishment or recognition.

Foreign Companies with a Place of Effective Management (POEM) in the UAE would be required to obtain registration in the UAE within three months from the end of the financial year.

Non-Resident Juridical Persons (Branch office, Permanent Establishment (PE) of Non-Resident, Non-Resident holding immovable property, etc.)

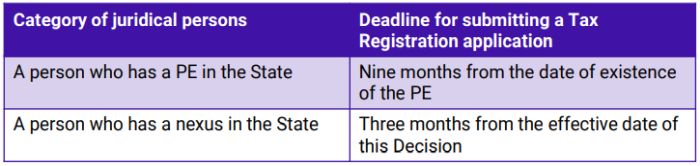

Non-Resident juridical entities established or recognized prior to March 2024 would be required to make an application for registration on or before the following dates:

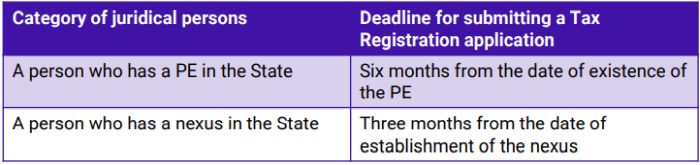

Non-Resident juridical persons established or recognized after 1 March 2024 would be required to obtain Tax Registration as follows:

Natural Persons (Professionals, Individuals conducting business, etc.)

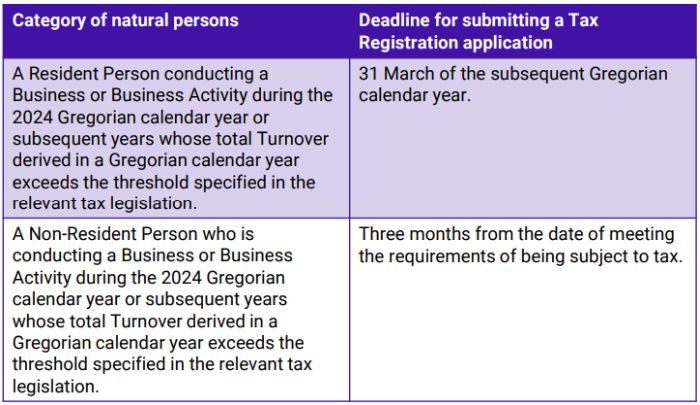

The natural persons conducting Business or Business Activity in the State shall be required to submit a Tax Registration application on or before the following date:

Penalties

Late submission of the CT Registration application would be liable to a penalty of AED 10,000 as per Cabinet Decision No. 75 of 2023.

Our Comments

It is important to note that the timelines provided are for making an application for CT Registration and not for obtaining a CT Registration. It would also be pertinent to note that timelines are also provided for Foreign Companies having a PE, Nexus and POEM in the UAE and hence it would be imperative for the groups to evaluate the exposure on these accounts in the UAE and accordingly start the registration process to avoid any penal implications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.