On 17 March 2016, the South African Revenue Service ("SARS") issued an interesting binding private ruling ("BPR 227") concerning a share subscription transaction which was followed by two share buyback transactions.

BPR 227 deals with an area that National Treasury and SARS have identified as a problem, namely where a shareholder disposes of its shares through means of a share buyback as opposed to selling the shares outright to a third party. Before dealing with BPR 227 we will explain the background to this issue, the steps taken by National Treasury and SARS to deal with this issue and why BPR 227 was treated differently.

Published SARS rulings are necessarily summaries of the facts and circumstances. Consequently, BPR 227 (and this article discussing it) should be treated with care.

The background

In commercial terms, there is a very important distinction between a subscription for shares and a purchase of shares. When a company raises capital for itself, investors give money (new consideration) directly to the company. In return, the company issues new shares to the investors. A subscription therefore involves the issue of new shares by the company and the proceeds of the subscription go to the company.

At other times, a would-be investor can acquire shares buying previously-issued shares from an existing shareholder, in which case the company will not usually receive anything. A purchase therefore involves the acquisition of shares that have already been issued. The proceeds of the sale belong to the seller of the shares.

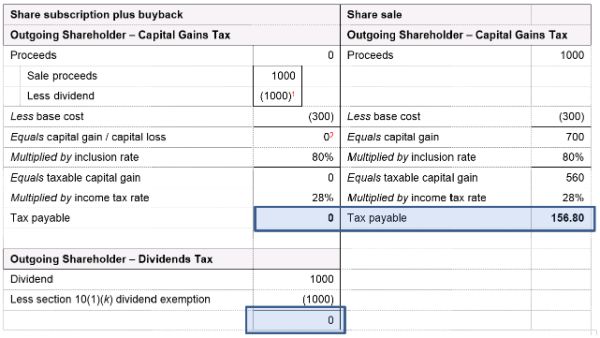

The distinction between purchase of existing shares and subscription for an issue of new shares is important for capital gains tax and dividends tax purposes. The example below illustrates this distinction.

Share sale versus share subscription and share buyback

The outgoing shareholder can avoid capital gains tax partially or completely by opting to sell its shares back to the Target Company rather than selling its shares to the incoming shareholder. The tax benefit associated with this approach is illustrated in the table below.

However, it is anticipated that a portion of the share buyback consideration (i.e. at least the subscription price for the shares) would amount to a reduction in contributed tax capital and thus not constitute a dividend.

Budget 2016

Recognising the loss to the fiscus of the share issue-buyback combination, National Treasury included a reference to these transactions deep inside the 2016 budget review document. The budget review elaborates on some of the proposals contained in the Minister of Finance's budget speech, clarifies certain matters and presents additional technical proposals. The budget review dedicated the following paragraph to this issue:

"Avoidance schemes in respect of share disposals

One of the schemes used to avoid the tax consequences of share disposals involves the company buying back the shares from the seller and issuing new shares to the buyer. The seller receives payment in the form of dividends, which may be exempt from normal tax and dividends tax, and the amount paid by the buyer may qualify as contributed tax capital. Such a transaction is, in substance, a share sale that should be subject to tax. The wide-spread use of these arrangements merits a review to determine if additional countermeasures are required." (our emphasis).

The budget review does not explain on what type of "additional countermeasures" will be considered. Thus, these additional countermeasures could seek to remove the dividends tax exemption or possibly amend the way proceeds are calculated for capital gains tax purposes.

Taxpayers will have to wait until the publication of this year's tax amendment legislation to determine whether the proposed review will result in additional countermeasures. For now, it is opportune to speak briefly about the existing countermeasures that are in place to deal with these arrangements.

Mandatory disclosure of reportable arrangements

The main purpose of mandatory disclosure rules is to provide early information regarding tax planning schemes and to identify the promoters and users of those schemes. On 16 March 2015, the Commissioner for SARS issued a public notice ("the 2015 notice") setting out a list of reportable arrangements.

If an arrangement is a "reportable arrangement", full disclosure of the details of the arrangement must be made to SARS. The 2015 notice took effect from 16 March 2015 and replaces all previous notices. The 2015 notice introduced a category of reportable arrangements relating to share buy-backs which are linked to a share subscription. The reportable arrangement reads as follows:

"2.2. An arrangement in terms of which—

- a company buys back shares on or after the date of publication of this notice from one or more shareholders for an aggregate amount exceeding R10 million; and

- that company issued or is required to issue any shares within 12 months of entering into that arrangement or of the date of any buy-back in terms of that arrangement;"

On 3 February 2016, the Commissioner issued a further notice which replaced, with effect from its date of publication, all previous notices. The 2016 notice repeats the reportable arrangement contained in the 2015 notice.

A basic design principle underpinning mandatory disclosure requirements is that they should be clear and easy to understand in order to provide taxpayers with certainty about what is required by the regime. Lack of clarity and certainty can lead to failure to disclose (and the imposition of penalties), which may increase resistance to such rules from the business community.

The trigger for the reportable arrangement is if "... a company buys back shares on or after the date of publication of this notice ...". Since the 2016 notice replaces the 2015 notice, it means that only share buybacks that occur on or after 3 February 2016 will trigger the reportable arrangement (provided the remaining requirements are met). Thus, a share buyback that took place prior to 3 February 2016 will no longer be reportable under the 2015 notice (as that has been replaced by the 2016 notice) and it will not be reportable under the 2016 notice as the share buyback took place prior to 3 February 2016.

Also, the words "issue any shares within 12 months of entering into that arrangement ..." may lead to some uncertainty on whether "within 12 months" means 12 months before or 12 months after entering into the arrangement (or it means 12 months before and 12 months after). We think it goes both ways. Taxpayers who enter into share buyback arrangements should check whether they issued shares 12 months before or 12 months after the share buyback arrangement.

Substance over form and general anti-avoidance rule

In addition to the mandatory disclosure requirements, SARS may invoke the substance over form doctrine or the general anti-avoidance rule as existing countermeasures against these type of transactions. Much has been written about these provisions and I do not think it necessary to repeat their essential features in this article. Armed with these existing countermeasures, it remains to be seen what National Treasury and SARS has in mind with their "additional" countermeasures.

BPR 227

A binding private ruling is binding advice that sets out how a tax law applies to an applicant taxpayer in relation to a specific scheme or circumstance. A binding private ruling applies only to the applicant identified in the ruling. As stated, the published ruling only gives the readers a glimpse of the facts and circumstances contained in the applicant's ruling application.

In BPR 227, the applicant was one of three shareholders of co-applicant A, a state-owned company, which was the shareholder of Co-Applicant B. For operational and strategic reasons, the applicant intended to divest from co-applicant A to manage its investment in co-applicant B directly. The parties considered that a share subscription transaction followed by two share repurchase transactions would be the most commercially efficient manner for implementing the applicant's exit, as a shareholder, from co-applicant A.

The proposed transaction will be implemented as follows:

- The Applicant will obtain intra-day funding from Bank A.

- The Applicant will use the intra-day funding and its own funds to subscribe for equity shares in Co-Applicant B.

- Co-Applicant B will use the proceeds received from the Applicant to enter into a share repurchase transaction for a specified number of equity shares held by Co-Applicant A (first share repurchase transaction). The repurchase consideration will be settled in cash and the securities transfer tax paid.

- Co-Applicant A will use the proceeds received from Co-Applicant B to enter into a share repurchase transaction for all the shares held by the Applicant (second share repurchase transaction). The repurchase consideration will be settled in cash and the securities transfer tax paid.

- The Applicant will use the proceeds received from Co-Applicant A to repay Bank A.Steps [2] and [3] that which consists of a share subscription followed by a share buyback transactions displays the characteristics of the scheme which the 2016 budget review stated is, in substance, a share sale that should be subject to tax.

The rulings given by SARS in respect of steps [2] and [3] were as follows:

- a portion of the proceeds to be received by co-applicant A for the disposal of the shares in co-applicant B will be deemed to be of a capital nature under section 9C(2) of the Income Tax Act, 1962 ("ITA 1962");

- the balance of the proceeds to be received by co-applicant A for the disposal of the shares in co-applicant B will be regarded as a "dividend" as defined in section 1(1) of the ITA 1962 and must be included in the gross income of co-applicant A;

- the dividend to be included in the gross income of co-applicant A will be exempt from normal tax under section 10(1)(k)(i) of the ITA 1962;

- the repurchase of the equity shares held by co-applicant A in co-applicant B in terms of the first share repurchase transaction will be regarded as a disposal of assets by co-applicant A for purposes of the 8th Schedule to the ITA 1962;

- the proceeds for purposes of the 8th Schedule to the ITA 1962 will be reduced by the amount which is regarded to be a dividend and consequently included in the gross income of co-applicant A; and

- no liability for dividends tax will arise in respect of the first share repurchase transaction as co-applicant A is a resident company.

In this transaction, the applicant could have purchased co-applicant A's shares in co-applicant B. Had the applicant done so, then co-applicant A would probably have derived a capital gain from the disposal to the applicant of its shares in co-applicant B. Instead the applicant subscribed for shares in co-applicant B which used the subscription amount to buyback co-applicant A's shares. As a result, there is no dividends tax liability. A portion of the share buyback consideration amounts to a reduction in contributed tax capital and is thus not a dividend.

The published ruling is frustrating in this respect because it does not explain the commercial rationale why the parties embarked upon a share buyback as opposed to the sale of shares other than stating that the parties considered that a share subscription transaction followed by two share repurchase transactions will be the most commercially efficient manner for implementing the applicant's exit, as a shareholder, from co-applicant A.

What the published ruling does reveal, is that if parties can demonstrate a commercially motivated rationale for the particular sequence of their transactions then it is possible (with SARS' approval) to opt for the share issue – share buyback combination rather than the share sale route.

Footnotes

1 Paragraph 35(3)(a) of the 8th Schedule to the ITA 1962 allows the outgoing shareholder to reduce its sale proceeds by any amount that it included in its gross income. The outgoing shareholder will include the dividend (i.e. the share buyback consideration) from the Target Company in its gross income.

2 Generally, if a dividend is not subject to either normal tax or dividends tax it is likely that paragraph 19 of the 8th Schedule to the ITA 1962 will limit any capital loss on disposal of the shares.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.