- within International Law, Environment and Antitrust/Competition Law topic(s)

Fraud can cost an organisation hundreds of thousands if not millions of Rands if not detected early enough. One method that organisations need to look out for is fraud perpetrated by the change of banking details. This type of fraud usually happens when perpetrators assume the identity of a legitimate supplier and divert the payment of invoices into their own account. This can happen when a legitimate document and/or email is forged, altered or manipulated with the intention of going through the normal payment system of an organisation.

This scam can be perpetrated by external parties as well as collusion between external and internal parties in an organisation. The fraudster/s (sometimes an organised syndicate) normally obtains the sensitive information, such as a company invoice, through the interception of emails or post, or sometimes through an insider within the organisation. It is seldom detected upfront, being detected only when the legitimate supplier raises their outstanding payment.

The fraudsters often make use of a surrogate bank account (belonging to "runners" who are paid for the use of their bank accounts) to receive the payment. The funds are then withdrawn in cash or transferred into other bank accounts as soon as possible. By the time the bona fide supplier awaiting payment informs the organisation of non-payment, the funds have been withdrawn and there is little or no trace of the fraudster. The fraudsters are sometimes apprehended but not always prosecuted, as they plead often ignorance and/or blackmail. This can cause organisations to lose vast amounts of money if the right controls are not implemented.

Here are 2 examples of fraud that was recently investigated by the ENSafrica forensics department:

- The fraudster pays a runner in order to utilise his bank

account. The fraudster then obtains information on payments to an

organisation's service providers (either through interception

of emails or interception of post or collusion with an employee),

and discovers that a service provider is due payment for a large

invoice. The fraudster then makes enquiries regarding the change of

banking details on the organisations vendor system (either this is

known already to the fraudster or he acquires the information from

an employee).

In order to change the banking details of the service provider to that of his, the fraudster will need to produce certain documents such as a bank confirmation letter and a letter on the service provider's letterhead confirming the change in banking details.

The fraudster then forges the two documents and provides these to the organisation either physically to an employee at the organisation or via email. The details are duly amended upon reliance of these documents.

The payment is then effected to the amended bank account and the fraudster is in receipt of the funds. In this instance, the organisation lost R250 000.00. - The fraudster intercepts email correspondence between the

organisation and the service provider regarding the payment of

invoices by registering a fake domain and creates a

fraudulent email address that impersonates the service

provider's personnel and attempts to alter the banking details

of the service provider to that of his by entering into a

conversation with the organisation regarding the change of banking

details of the service provider.

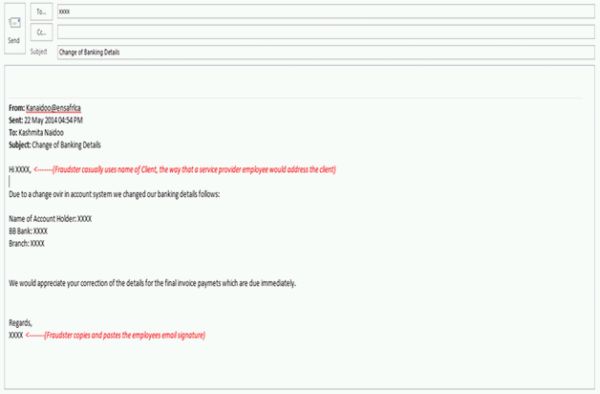

Below is a typical email sent to organisations in response to the service provider's request to the organisation to submit final invoices for payment:

Afterwards, a follow up email is sent which puts pressure on the payer, in order to meet payment deadlines and obtain early payment discounts. In this instance, the organisation lost R510 000.00.

Below are some red flags organisations should watch out for:

- Check email correspondence carefully for misspelled words and incorrect grammar (In the example above, there is the missing word "as" before the word "follows", "over" is spelled "ovir" and "payments" is spelled "paymets".

- Check email addresses carefully for incorrect extensions, such as .com instead of .co.za

- Check domains of email addresses for addresses that differ from a legitimate one, even by one letter that can be easily missed. E.g. Legitimate email address: kanaidoo@ENSafrica.com Fraudulent email address: kanaidoo@eENSafrlca.com (Notice how the "i" in the domain "ENSafrica" has been changed to "l" in the fraudulent email address).

- A copy and pasted email signature (determinable by the picture quality in most cases and by comparison to previous legit emails received from the service provider).

- Check contact telephone numbers. A pay as you go contact number without a landline number as the contact is often a tell-tale indicator of syndicate involvement.

There are certain conditions in organisations that can make them susceptible to "fraud perpetrated by the change of banking details such as:

- Allowing junior employees to effect changes of sensitive information without senior approval.

- The use of temp staff on high risk areas of the organisation.

- The absence of or inappropriate policies and procedures.

- Inadequate communication and training within the organisation of these policies and procedures

- Inadequate security controls. Ensure the latest security updates are installed and that the anti-virus/anti-spyware software is running.

- Inadequate integrity due diligence performed on new hires.

- No segregation of duties between processing and approval.

Organisations can take the following steps to minimise their risk of fraud perpetrated by the change of banking details:

- Follow up with a service provider regarding receipt of payment.

- Standardise change of banking details documentation (watermarked/officially stamped/ sequentially numbered with a control register and only obtainable from a senior employee in your organisation).

- Original, signed invoices should be obtained directly from the service provider where possible.

- A printout out of the system payment details should be attached to the original invoice and the bank account details should be matched and signed off by senior officials of the organisation prior to payment being effected.

- All amendments to banking details should be verified with the service provider and bank in question. Contact the service provider on the number that you have listed for them and not the number on the document, and ask to speak to someone that you are familiar with and whose voice you recognise. Remember that fraudsters pay very specific attention to detail, and if you call a number listed on a fraudulent document, more often than not there is a person waiting at the other end of the line to confirm the fraudulent details.

- Insist on a confirmation that the name of the account holder on the banking system corresponds with the bank account number.

- Strategically place security cameras in certain areas of your organisation that require customer/client contact.

- Send out regular (monthly) correspondence to your service providers to inform them that your banking details have not changed.

- Do not publish any bank account details on the internet.

- Do not disclose any sensitive information to any parties who are not entitled to receive it.

- Shred sensitive documents that contain banking details-do not just throw them away.

- Implement appropriate policies and procedures which detail the above change procedures to be followed.

- Report the matter to the authorities (SAPS) for investigation, and when fraudsters are arrested provide the police with all the necessary support for prosecution.

- Enforce your zero tolerance policy against fraud by setting an example.

Fraud perpetrated by the change of banking details is a real and highly prevalent threat, and in order to minimise your organisation's risk of the payment of fictitious service providers, organisations need to continuously ensure that they are aware of the conditions existing within their organisation that makes them susceptible to these types of fraud, and ensure that the necessary precautions are taken to prevent its occurrence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.