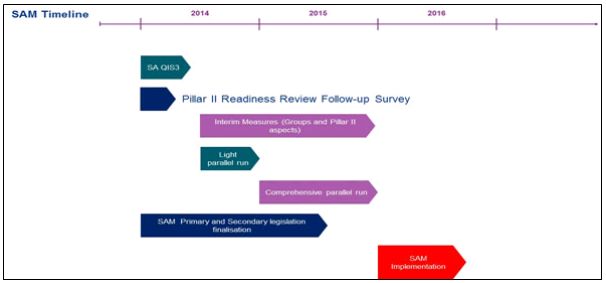

Insurance regulation as we know it will change – some say for the better, others are not so sure – when the Solvency Assessment and Management (SAM) framework comes into force on 1 January 2016.

This date was confirmed by the Financial Services Board (FSB) in their 2013 update. Their 2014 SAM update is expected shortly and no change in this date is expected. However, it is worth noting that there is a lot of work for the regulator in drafting and finalising SAM and getting it through parliament in these timeframes.

Equally, the industry has a significant amount of work ahead to implement SAM. The FSB's light and comprehensive parallel runs starting in mid-2014 and over 2015 respectively provide a good roadmap for firms to align their implementation plans to meet the 2016 implementation date.

In particular, the 2015 comprehensive parallel run essentially means that firms should treat SAM as live from 1 January 2015 – all of the reporting requirements (including the ORSA) are required by the FSB although it is anticipated that some of the governance requirements for SAM will not be enforced – at least to the extent they are different from the Insurance Laws Amendment Bill (ILAB).

The FSB initiated an economic impact study on the potential impact of SAM in mid-2013. This project is reaching its final stages and the FSB is expected to publish the key findings in 2014. There will also be a presentation of some of the key messages at the Actuarial Society's Life Assurance Seminar (5th and 9th of May in Cape Town and Johannesburg respectively).

Key activities for 2014 and 2015

The 3rd Quantitative Impact Study (QIS3):

- It is a compulsory exercise for all insurers

- Currently underway and submission is due on 30 April 2014

Light parallel runs:

- Will be performed quarterly starting from 30 June 2014

- This will effectively mean firms will re-do QIS3 for each quarter thereafter

Development of ORSA

- Ahead of the full parallel run in 2015, firms are expected to develop their Pillar 2 capabilities

- And in particular their approach to ORSA with many firms performing a dry run in 2014 ahead of the compulsory submission to the regulator in 2015

- The ORSA is an area that the FSB has targeted in the latest Pillar 2 Readiness survey due 30 April 2014.

Development of Pillar 3 reporting capabilities

- Whilst the full set of QRTs has not been finalised, a large portion of these templates have been produced

- Firms will be expected to do full reporting in the 2015 comprehensive parallel run

- Many firms will aim to automate the production of the QRTs to help meet the tight reporting deadlines for SAM

Further details on each of these activities are noted under each of the sections below

Pillar 1

Whilst the overall structure of the Pillar 1 requirements is largely finalised, the detailed requirements are being developed. The two key developments in respect of Pillar 1 are QIS3 and the changes to the IMAP that the FSB announced in December 2013.

QIS 3

QIS3 is currently underway and is compulsory for open firms, being firms which are currently underwriting new business, with the results being due by 30 April 2014. The submissions required include:

- Solo submissions covering the full Pillar 1 balance sheet

- Group consolidated results which also cover the full Pillar 1 balance sheet

- A qualitative questionnaire covering a wide range of questions on all aspects of the Pillar 1 balance sheet as well as general areas such as preparedness for SAM and the level of difficulty involved in preparing QIS3

There are a number of key changes between QIS2 and QIS3, and even between the draft QIS3 and the final technical specification, including:

- Risk free rate: insurers may now use the swap rate to discount the cash flows of liabilities that are backed by assets invested in swap based assets

- Gross and net of management actions: the requirement to produce the results of stresses both gross and net of management actions has been removed and replaced with a requirement to disclose the solvency position of the with profit funds based on draft QRTs

- Liquidity assessment: additional information has been requested to help define a good liquidity risk indicator

- Treatment of own shares: QIS3 allows insurers the option to apply the delta NAV (i.e. the change in NAV) approach to their own shares as these are held by and the risks are borne by policyholders

- Groups – clarification on alternatives to be calculated: QIS3 requires the deduction and aggregation using current capital requirements, and the alternative deduction and aggregation to be calculated. The accounting consolidation approach is optional

Internal Model Application Process (IMAP)

A number of firms are applying for internal model approval to use a customised capital model instead of the Standard Formula SCR. The FSB noted in its December 2013 newsletter that it has changed its approach based on lessons learned during the process to date. Details of the changes are yet to be published on the FSB's website but we understand that the detailed self-assessment template has been changed and that the process will be aligned to a theme based approach. The key themes that will be reviewed include governance, market risk, credit risk, validation and the use test.

The IMAP remains, by necessity, an intensive process and firms should not underestimate both the technical rigour that should be applied to the development and use of an internal model and the documentation requirements to support the use of the model. These aspects form the basis of the application for approval and will be used by the FSB to understand the model on paper (further technical reviews may also be conducted).

Pillar 2

In June 2013, the FSB published its report on the Pillar 2 readiness survey it conducted in mid-2012. The survey identified the ORSA as the key area of concern for the FSB where only 16% of the industry responded that their ORSA was "acceptable" or better – 33% of the industry responded that their ORSA was "weak". The industry's lack of understanding of the ORSA was highlighted with many firms requesting further guidance – the FSB's report on the results of this survey contains further commentary and guidance regarding the ORSA.

The FSB is currently conducting a follow up survey which is due to be completed by insurers and returned to the FSB on 30 April 2014. The focus of this survey is on the approach to the ORSA and progress made to date. The FSB will also conduct interviews with specific firms. The survey is intended to identify firms that are at risk of not meeting the Pillar 2 requirements and the results will be published in the third quarter of 2014.

Currently, many firms are focusing on their ORSA development ahead of the comprehensive parallel run in 2015 which requires firms to run their ORSA process and submit an ORSA report to the FSB.

Firms will also be looking ahead to the ILAB requirements which will mean that some changes to governance structures and processes will be required ahead of the SAM changes.

Pillar 3

There is currently a lot of activity within the FSB structures in this area. The suite of quantitative reporting templates (QRTs) is still under development. The FSB is also considering public comment received during 2013 relating to the assets (investments), and technical provisions templates for life and non-life business.

It does not appear as if the goal of having the full suite of QRTs released for public comment by the end of March 2014 will be reached. The most significant challenge currently is defining and finalising the segmentation classes, both for life and non-life business.

This, together with other practical difficulties that insurers are facing (e.g. the requirement for collective investment schemes assets to be disclosed on a 'look-through' basis) is creating significant implementation challenges for insurers that need to start working on their reporting solutions.

The qualitative (narrative) reporting requirements are also currently being drafted through various working groups consisting of industry representatives. The qualitative reporting requirements are expected to be met through a similar format as the current regulatory returns – questions which are to be answered on a yes/no basis with explanations and comments provided in certain areas. The feedback from the pillar II readiness survey and follow-up exercise will also be used as guidance.

We believe that many companies have a lot to do to meet the reporting requirements. The main areas of work are likely to focus on:

- ORSA development ahead of the comprehensive parallel run in 2015. Firms will also be looking ahead to the ILAB requirements which will mean that some changes to governance structures and processes will be required ahead of the SAM changes;

- Whether the required data is available;

- How quickly the data can be reported;

- Whether the systems and processes for reporting data have been sufficiently tested and subjected to appropriate dry-runs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.