New digital technologies are allowing insurers to leverage information technology beyond traditional automating of standard process flows and to engage customers, partners and employees in more meaningful and effective ways. Customer information becomes an insurer's most valuable asset in the digital world and its strategy has to address what it will capture, when, where and how. And then how to enrich it, analyse it and use it to drive value.

The social internet allows customers, partners and employees to easily share information and collaborate. This significantly changes the balance of power. Gone are the days when the insurer was at the centre of all interactions and clients were mostly passive with limited access to information. This shift creates significant opportunities for insurers to interact with clients in more meaningful and effective ways to gain a competitive advantage in an industry where insurers are grappling with the difficulties of attracting a more significant market share. But it also poses several important risks too.

Digital technology is driving profound economic and social change around the world. Technology solutions encapsulate the internet, all mobile devices, e-commerce, social media, data analytics, cloud computing, video content and contactless payments. However, a digital strategy is not just about distributing products through electronic channels; it has the potential to drive a complete change to the way an insurer operates, interacts with customers and uses information to be more relevant and personal. Understanding your customer is the key benefit of a digital strategy.

The last fifteen years have seen more economic and societal change driven by digital technology than any equivalent period in recorded history – on the one hand entire industries have been transformed and on the other major companies have been driven out of business. Right now, European and American insurance companies are experiencing the changes that digital technology enables on a daily basis as traditional strongholds are being penetrated by on-line only competitors. That's not to say that local insurers are resting on their laurels. Elements of digital strategy are already starting to manifest in South Africa. For example, personal location data and realtime traffic information is being used by some local insurers to inform navigation or re-price insurance premiums based on how and where people live and drive.

The customer's experience and convenience is the primary driver of success and knowing what the customers' key motivations or needs are, through the optimal use of all the data available, is the insurers' competitive advantage. If it is not relevant, personal, simple, intuitive and available through the customers' preferred channel at the time they want it, success will have its challenges. While the appetite to be customer-centric is compelling, it conflicts with a corporate mindset that emphasises near-term priorities and the delivery of short-term shareholder value.

"The social internet allows customers, partners and employees to easily share information and collaborate. This significantly changes the balance of power."

The time required to gather customer perspectives, refine propositions and take them to market spans more than a few quarters. However, those insurers focussed on long-term sustainable value creation for their customers will be rewarded by investors. Globally, the most successful insurers have transformed how they do business, placing their customers at the heart of everything they do, including strategic decision-making, business and operating model design and product delivery and service techniques. They leverage opportunities to win over customers at every interaction. By doing so they:

- Are more innovative and productive, through greater collaboration and information sharing within their own business and with partners like intermediaries;

- Improve customer experience, creating greater propensity to buy additional products where these are appropriate for customers' needs;

- Increase efficiency through rationalisation and elimination of redundant processes and products, aligning propositions with changing customer needs; and

- Enjoy greater brand loyalty, customer persistency and increased referrals.

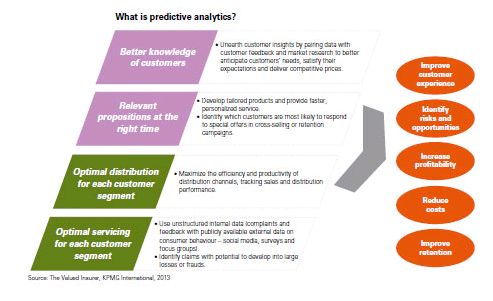

As the need for convenience increases and insurance products become increasingly viewed as a commodity, opportunities for face-to-face sales will decline, making it more difficult for an insurer to know its customers. It will be crucial to leverage segmented customer data and use big data / predictive analytics to differentiate propositions. Big data refers to the analysis of large quantities of raw customer data extracted from the digital trail left behind when customers make use of the internet or social media tools for buying, researching or communicating and using the data to model the propensity of those customers to buy certain products in future based on their characters or situations.

It is often said that ninety percent of the data in the world today has been created in the last two years and every day we are estimated to create 2.5 quintillion bytes of data.

This data is all around us in tweets, posts to social media sites, digital pictures and videos, purchase transaction records and cell phone GPS signals. By accessing big data, insurers can identify trends in sentiments about their products and changes in customer behaviour. The goal is to harness this for sustainable profitable growth. Big data is greatly enhancing the effectiveness of the insurance value chain by allowing insurers to create highly specific segmentations and to tailor products to match the needs of their customers. This includes how current and future customers will want to interact with the insurer to purchase products and services, obtain information/servicing, update information, transact, pay premiums and submit claims in the digital world. In simple terms, the more you know about a customer, the better placed you are to offer products and services that they will have a higher propensity to buy.

The benefit is that insurers, intermediaries and customers spend less time on low-value adding tasks and more on high value ones. This is by no means a new concept for insurers who have been collecting data for years and using it to price the risks associated with a policyholder. Making use of more sophisticated big data techniques externalises the use of the data to promotions and advertising.

Using big data will become a competitive differentiator for existing insurers and it will open up a new market to insurers who are willing to embrace the change and have the savvy to capture new technologies to unlock this value.

In a developing economy, big data has significant potential as long as the right conditions are in place. Cell phones are widely used across Africa for transactional banking including the sale of insurance policies and the collection of premiums. On-line marketing and sales are increasing and insurance is being sold at cash machines. All the while, data is accumulating until it becomes big enough to mine. The advantage of developing economies having newer and therefore more sophisticated IT systems which can store and analyse big data without significant modification, should not be under-estimated. The South African banking system is a good example of an industry that has benefited from having newer systems than its European counterparts, and ranks highly in the world for sophistication.

The challenges associated with big data are by no means insignificant:

- Many insurers do not have the technical know-how to make optimal use of big data. Change management practices may need to be enhanced to ensure that those driving the strategy of the company understand the extent of the potential value to be gained;

- Having multiple or older systems may impede an insurer's ability to collate data into a single format so that it can be analysed optimally to create the value that big data can bring. New technology, both hardware and software, will be required unless existing systems can be modified; and

- Big data relies on personal and therefore potentially sensitive information. Many countries have a multitude of data protection laws governing what data may be used, how it may be collected, what it can be used for, how long it may be retained and how and to what extent it must be secured. Risk management policies which achieve compliance and allow for the optimal use of the data are becoming increasingly important. Again, insurers are not strangers to the collection of personal information and the next logical step would be to enhance rating data they already have with this other "situational" data to really unlock value.

Big data / data analytical techniques make use of statistics, modelling and data mining to extract information from data, using it to analyse current and historical facts and predict trends and behaviour patterns:

In conclusion, inactivity is not an option. It is clear that the benefits are significant and the call to action is compelling but the mind-set change will be difficult for many. Customers will become your advocates. New technology and media present opportunities not threats to a positive customer outcome. Clear processes must be put in place along every route to customer interactions against the backdrop of a customer –focussed operating model.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.