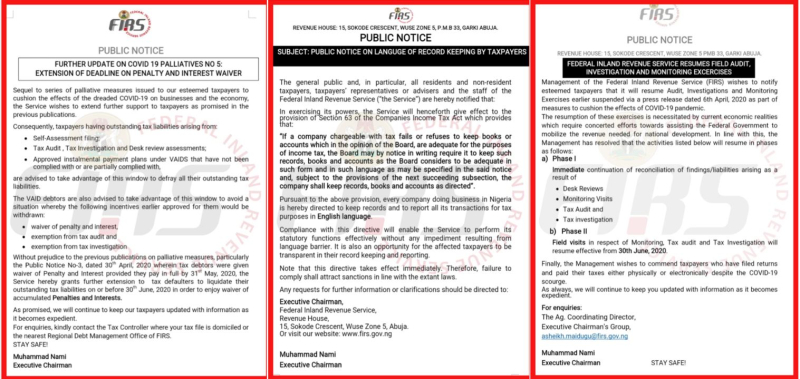

1) Resumption of Field Audit, Investigation and Monitoring Exercises

The FIRS is set to resume Audits, Investigations and Monitoring Exercises, which were earlier suspended due to the Covid-19 pandemic. The FIRS stated that the activities will resume in phases, and that field visits will commence from 30 June 2020.

2) Language of record keeping by Taxpayers

This notice is directing companies doing business in Nigeria to maintain and report transactions for tax purposes in English Language. In issuing this directive, the FIRS made reference to Section 63 of the Companies Income Tax Act (CITA), which empowers it to notify taxpayers to keep records and accounts in a manner which the Service considers adequate for tax assessment purposes.

3) Further Palliatives no. 5: Extension of deadline on Penalty and Interest waiver

This notice is in respect of waiver of penalty and interest for taxpayers who settle their outstanding tax liabilities by 30 June 2020. It is an extension to the previous exemption notice which lapsed on 31 May 2020 and was specific to tax payments arising from desk reviews, audits and investigations. In the latest notice, the waiver has been expanded to include liabilities from:

- Self-assessment fillings;

- Tax Audit, Tax investigation, and Desk review assessments; and

- Approved Installmental payment plans under VAIDS that have not been fully settled.

See the public notices here: Download FIRS public notices

Originally published 4 June, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.