Executive Overview

We are pleased to publish our survey report on employers' response to the removal of subsidy on the pump price of Premium Motor Spirit (PMS) (otherwise called Petrol or Fuel), announced by President Ahmed Bola Tinubu at the swearing-in ceremony of his administration on May 29, 2023. The survey was conducted in June, a month after the announcement to gauge employer's response as well as provide insights for informed decision making.

We have also covered market developments subsequent to the survey to draw a holistic view of the market for informed decision making.

Although there had been past attempts and discussions on removal of fuel subsidy, the May 29 pronouncement has turned out to be different because it has fully eliminated subsidy, unlike past instances of partial removal. The development took most, if not all employers by surprise. Virtually caught offguard, most employers were uncertain of their response, especially given business challenges within prevailing economic circumstances. This is evidenced by the fact that 81% of respondents were yet to implement any palliative one month into the subsidy removal. We, however, expect this number to have reduced significantly as of the time of this report, given subsequent developments and demands from employees/labour unions post the survey.

Participants Demography

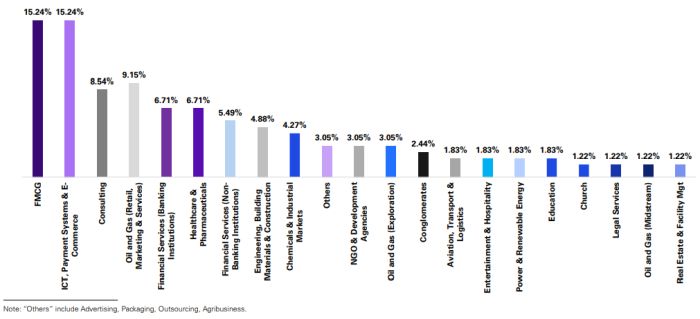

We received about 200 submissions from respondents. However, after quality assurance review, we have prepared this report based on 164 submissions. About 55% of the submissions comprise FMCG; ICT, Payment Systems & E-Commerce; Consulting; Oil and Gas (Retail, Marketing & Services); and Financial Services (Banking Institutions) companies, as shown below. We also noted that 97% of the respondents are private sector organisations, while the balance of 3% are public sector entities.

![]()

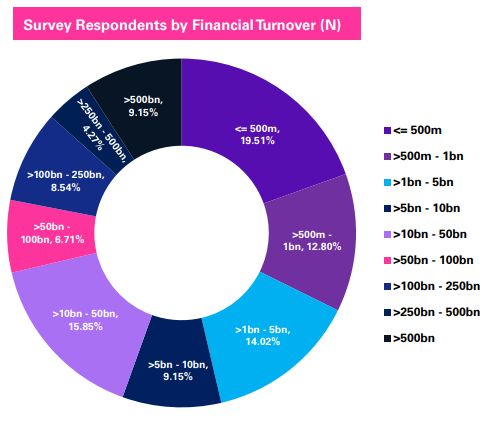

Financial Turnover of Respondents: In terms of size, the survey respondents are well-distributed between small and large entities. About 22% of the respondents have revenue of more than ₦100 billion, while about 9% have revenue of above ₦500 billion. Also, about 71% have turnover size of ₦50 billion and below, as presented in the chart below:

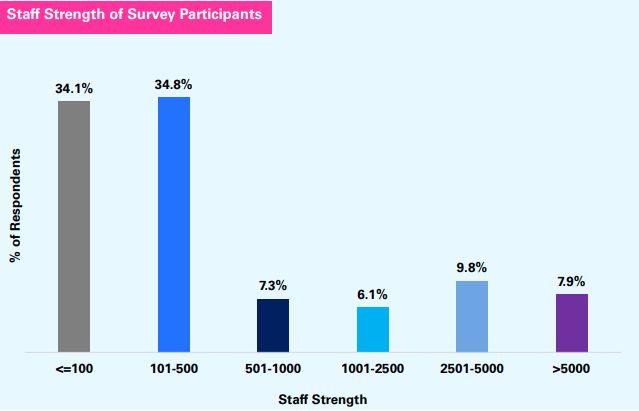

Staff Strength of Respondents (Temporary and Permanent)

About 18% of respondents have staff strength of at least 2,500, while about 69% have strength of 500 employees and below. Further details are presented in the chart below:

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.