In the past few weeks, the Central Bank of Nigeria (CBN) appears to have taken several steps to defend the continuous devaluation or rather rapid free fall of the Naira since its floatation in June 2023. Through a mix of regulatory actions, the CBN has issued at least ten circulars / guidelines since 1 January 2024 primarily aimed at sanitising the FX ecosystem.

In what is widely considered to be an intensified effort to reduce the pressure on the Naira which has suffered an over 100% devaluation since last year,1 the CBN through the Nigerian Communications Commission (NCC) has reportedly ordered mobile network operators (MNOs) and internet service providers (ISPs) to block the domains of several global crypto exchanges on the grounds of alleged forex market manipulation which the CBN and other government agents have variously referred to as the blatant fixing of the exchange rate for Nigeria.2 We note however, that despite these allegations at this time there have been no publicly reported formal legal proceedings instituted against these institutions.

There have also been reports of arrests and the planned imposition of fines in record amounts of up to US$10 billion to be levied against at least one crypto exchange.

In this client alert, we discuss the recent market developments and how crypto exchanges, and related businesses can navigate the currently rough Nigerian regulatory waters.

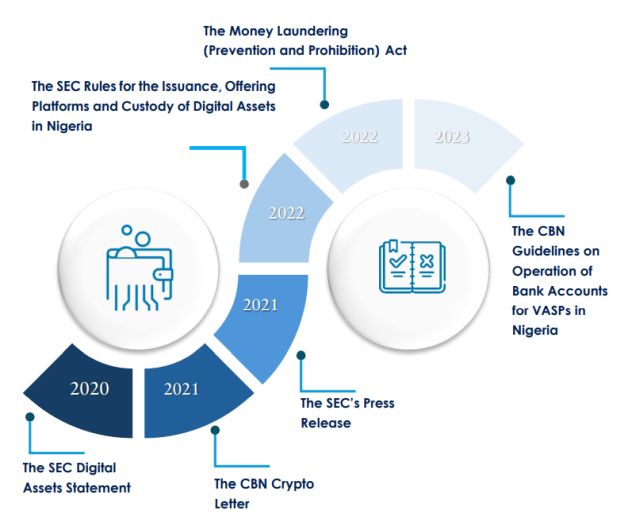

The Chronology of Cryptocurrency Regulation in Nigeria

The SEC Digital Assets Statement 2020

On 14 September 2020, the Securities and Exchange Commission (SEC) published its first categorical statement on the classification and treatment of digital assets in Nigeria (the "SEC Digital Assets Statement").

The SEC's position is that unless otherwise proven, digital assets will be treated as securities. As a result, the SEC Digital Assets Statement mandates the filing of an initial assessment and thereafter a registration where the digital assets in relation to which an initial assessment filing was made qualify as securities.

-

The CBN Crypto Letter 2021

On 5 February 2021, the CBN in a letter addressed to all deposit money banks (DMBs), non-bank financial institutions (NBFIs) and other financial institutions (OFIs) (the "CBN Crypto Letter"), reminded DMBs, NBFIs and OFIs that they are prohibited from dealing in cryptocurrencies and/or facilitating payments for cryptocurrency exchanges. As a result, bank accounts identified as belonging to cryptocurrency exchanges, custodians or used in facilitating cryptocurrency transactions were closed.

From a practical standpoint, the CBN Crypto Letter which effectively prohibited cryptocurrency transactions from passing through the Nigerian banking system operationally rendered the SEC Statement redundant given that Nigerians could no longer (at least indiscreetly) use their bank accounts, debit cards or wallets to undertake cryptocurrency transactions. -

The SEC's Press Release 2021

On 11 February 2021, the SEC issued a press release (the "SEC Press Release") to clarify the perceived conflict between the SEC Digital Assets Statement and the CBN Crypto Letter promising to engage with the CBN on the matter.

To put things in perspective, the CBN and the SEC are two independent regulators with distinct regulatory mandates, albeit with the CBN having a wider reach as the apex regulator of financial institutions. However, given the critical role of the Nigerian banking system in cryptocurrency transactions, the SEC Press Release provided that it would put on hold the admittance into the SEC Regulatory Incubation Framework of all persons and products affected by the CBN Crypto Letter until such persons are able to operate bank accounts within the Nigerian banking system. -

The SEC Rules for the Issuance, Offering Platforms and Custody of Digital Assets in Nigeria 2022

By a regulation issued on 11 May 2022, the SEC issued its rules for the Issuance, Offering Platforms and Custody of Digital Assets in Nigeria ("SEC Digital Asset Rules"). Amongst other things, the SEC Digital Asset Rules prescribe the various licensing and operational rules for digital assets in Nigeria and require Virtual Asset Service Providers (VASPs) to be registered with the SEC.3

Despite the existence of the SEC Digital Asset Rules since 2022, the CBN's stance on cryptocurrency effectively prevented VASPs from obtaining licenses from the SEC or at least made the requirement to obtain a license less attractive. For many crypto exchanges, there was limited commercial value in obtaining a license from the SEC if cryptocurrency transactions could not pass through the Nigerian banking system. -

The Money Laundering (Prevention and Prohibition) Act 2022

The Money Laundering (Prevention and Prohibition) Act 2022 (the "AML Act") was signed into law on 12 May 2022. Amongst other things, the AML Act expanded the definition of financial institutions to include virtual asset service providers and the definition of funds to include virtual assets in order to subject VASPs to various AML compliance obligations such as customer due diligence (CDD) and the filing of suspicious transaction reports and cash transaction reports. -

The CBN Guidelines on Operation of Bank Accounts for VASPs in Nigeria 2023

On 22 December 2023, the CBN through the Guidelines on Operation of Bank Accounts for VASPs in Nigeria 2023 (the "CBN VASP Guidelines") lifted the ban on banks and other financial institutions from operating bank accounts for VASPs although banks and other financial institutions are still prohibited from holding, trading and/or transacting in virtual currencies on their own account.

Amongst other things, one of the key objectives of the CBN VASP Guidelines was to provide for effective monitoring of the activities of VASPs within the Nigerian banking system by operationalising the SEC's licensing regime for VASPs, which until the issuance of the CBN VASP Guidelines, was effectively redundant.

It was therefore expected that VASPs such as crypto exchanges and custodians would be in a better place to decide on whether to obtain a license from the SEC.

Footnotes

1. The Naira traded at approx. N641/$US1 as of 19 June 2023 and N1538/$1 as of 1 March 2024 in the official market.

2. These allegations have been made publicly on numerous occasions including by the Governor of the CBN on 27 February 2024 during a press conference.

3. A virtual asset service provider (VASP) is defined under the SEC Digital Asset Rules to mean any entity that conducts one or more of the following activities or operations for or on behalf of another person: (a) exchange between virtual assets and fiat currencies; (b) exchange between one or more forms of virtual assets; (c) transfer of virtual assets; (d) safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets; and (e) participation in and provision of financial services related to an issuer's offer and/or sale of a virtual asset.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.