Introduction

A settlor, when establishing a trust, will typically draw from the following categories of potential trustees:

- individuals who they know and trust, who are familiar with the settlor's affairs and who typically have a relevant professional background (eg lawyer, accountant, family business etc);

- professional trust companies, whether bank-owned, private equity-backed or independent, who provide trust services to clients as their business; and

- private trust companies, that is, companies incorporated purely for the purposes of acting as trustee of a particular trust or trusts.

The purpose of this note is to look at this last category in more detail.

What is a private trust company?

Commonly known as a "PTC", a private trust company is a company whose sole purpose is to act as trustee in relation to a specific trust or trusts. In Jersey it is now also possible to use a foundation for this purpose instead of a company. Foundations are corporate entities like companies but do not have any owners, and this can have advantages over the more traditional company option.

Who owns the private trust company?

Shares in a PTC can be owned by the settlor or his family. That said, ownership will generally be recommended to be through a purpose trust (or possibly a foundation) - direct ownership may be unattractive for reasons relating to taxation, confidentiality or asset protection. It would also require thought to be given to the devolution of the shares in the PTC on the death of the shareholder. Therefore it is often desirable to "orphan" the structure so that its ownership is not attributable to any one person and this is where the purpose trust becomes useful.

A purpose trust in this context means a trust that is established to further non-charitable purposes. In the present case this is likely to centre around the provision of trusteeship services to a particular group of trusts. While in the past charitable purpose trusts were also used for this purpose, the current view among many practitioners is that this raises questions as to whether there can be said to be any genuinely charitable intent, and so non-charitable purpose trusts are generally preferred.

The purpose trust will have a trustee but will also need to have an enforcer, whose role it is to ensure that the trustee carries out the purposes of the trust. This is because the trust does not have beneficiaries who would otherwise be able to hold the trustee to account. The enforcer must be a separate entity from the trustee but there is no requirement for it to be licensed by the Jersey Financial Services Commission (the "JFSC"). For example, a settlor or his or her professional adviser could act as the enforcer.

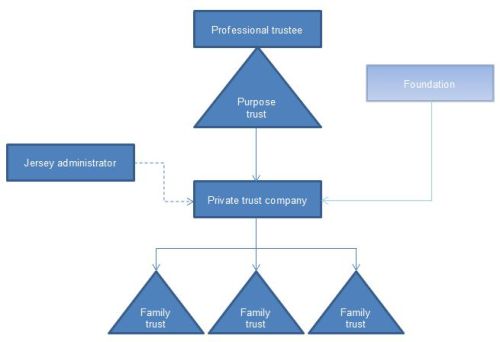

A typical holding structure is illustrated in the diagram below, which shows a foundation as a possible alternative to the more traditional purpose trust option and the PTC being administered by a Jersey-regulated entity.

Why would you use a private trust company?

PTCs are valuable in a number of situations, for example acting as trustee of a Jersey property unit trust (commonly known as a "JPUT") for real estate ventures, but in a private wealth context they are most commonly incorporated for the purposes of acting as trustee of a trust or trusts set up for the benefit of a particular family. Whereas most professional trust companies will not allow individual family members to act as directors of the trustee (because the trustee provides services to a range of other clients as well), the principal advantage of a PTC is that this is indeed possible. The PTC acts as trustee only for that family's set of trusts and so it is possible to have family members sitting on the board of the PTC.

A related advantage over a professional trust company is that the latter will often be wary of allowing the trust assets to become too heavily weighted in one asset. There are ways of drafting trust instruments so as to provide the professional trustee with comfort on this front, but a PTC is often used where, for example, the trust's principle asset will be shares in the family business and it is intended that the shares be held in the trust for the foreseeable future.

For a settlor, the attraction is often the additional element of control that a PTC can provide. Control is often an issue where the settlor is from a jurisdiction unfamiliar with the trust concept; settlors are, understandably, often unwilling to give away control of the assets to strangers in another jurisdiction. With a PTC, the settlor and/or his or her family could serve as directors and/or be the shareholder or shareholders of the PTC or otherwise be provided with a mechanism for being able to appoint and dismiss the directors to the PTC.

On a practical level, a PTC also ensures more privacy in relation to the trusts and allows for rapid commercial decisions to be made because the directors of the PTC will often be people who are involved in the management of the underlying assets. The constitutional documents of the PTC need not mention the names of the trust(s) that will be involved in the structure.

PTCs have advantages not just for the settlor but also for the persons who would otherwise be acting as individual trustees. Liability of directors of a PTC falls to be assessed in accordance with normal company law principles. The duties of the directors are owed to the PTC, not to the trust of which it is the trustee or the beneficiaries of that trust. Thus while the PTC itself may have significant potential liability in the event of a breach of trust claim from the beneficiaries or a third party with whom the PTC as contracted, such liability will rarely flow through to the directors.

Some judicial discussion has taken place about the liability of a director of a trust company and whether "dog-leg" claims are sustainable under Jersey law. "Dog-leg" claims are based on the notion that the duties owed by a director to a company may, in certain circumstances, be regarded in law as an asset of the trust of which the company is trustee. Whilst such claims have not been ruled out as impossible, they are certainly very difficult to construct and pursue. Insofar as there are concerns about possible personal liability on the part of directors of the PTC, this can be addressed through the provision of indemnities and/or appropriate director and officer insurance.

Another advantage that both a PTC and a professional trust company have over individual trustees is continuity of ownership. When an individual trustee retires and a successor is appointed, any assets directly held by the trustees will need to be re-registered accordingly. Changes to directors of a PTC or a professional trust company do not cause this issue and are relatively easy to arrange. That said, the problem can also be largely assuaged by having a nominee hold the relevant assets to the order of the individual trustees, or alternatively by using an intermediate holding company that in turn then holds the more substantive assets.

On a similar note, it is often easier to open bank accounts and contract with third parties where there is a single corporate trustee.

What regulatory regime applies?

Jersey has strict regulatory requirements for the conduct of trust company business, but a lighter-touch regime is available to PTCs where:

- the purpose of the PTC is solely to provide trust company business services in respect of a specific trust or trusts;

- the PTC does not solicit from or provide trust company business services to the public;

- the administration of the PTC is carried out by an entity regulated to carry out trust company business (such as a Jersey corporate services provider); and

- the name of the PTC is notified to the JFSC.

Unlike many other jurisdictions, there is no requirement in Jersey to seek express exemption from regulation, to pay any PTC fees or to capitalise the PTC in a particular way. There is also no requirement to submit to the JFSC copies of documents in relation to the trust or trusts in respect of which the PTC is to act as trustee.

As to what constitutes "administration", it is not a requirement for the Jersey service provider to supply a director to the PTC. Thus the entire board may be constituted by family members alone. However, the presence of an experienced trusts or companies practitioner on the board can complement the knowledge of the family directors. Either way, the potential to involve at least some family members in this way may be attractive to clients who wish to remain closely involved in their interests, perhaps where a family business is held in the trust.

That said, the JFSC would expect the administrator to be in a position to know about and understand the activities of the PTC even if this is achieved without it being represented on the board. Typically, therefore, the administrator would at least provide company secretarial services and operate the PTC's bank accounts. Generally the JFSC will rely upon the Jersey regulated service provider to ensure compliance with the terms of the exemption.

The private trust company business exemption under the Financial Services (Jersey) Law 1998 is equally available to Jersey foundations.

What are the disadvantages?

The main disadvantage of a PTC is the cost in establishing the PTC structure, both initially and then in terms of annual administration. On top of the creation of the family trust or trusts themselves, a company or foundation must be incorporated to act as the PTC and then administered over the following years. The cost would be further increased if a purpose trust or foundation were used to hold the shares in the PTC. That said, if a foundation were to be the PTC, there would be no need to have any layer of ownership above that, as the foundation would ownerless.

Conclusion

As a result of the cost, PTCs are likely only to be attractive where the value of the trust assets is sufficiently large that the initial and ongoing costs are in proportion and represent good value. However, the costs may be justified by the advantages of having a dedicated trustee to look after a complex structure and the control and rapidity of response that a PTC enables. In any event, a client considering using a PTC should ensure he or she has carefully assessed not only the costs of the options available but also the tax consequences.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.