There is a branch of economic theory that inspired the 'Clean Love for Copenhagen' campaign, whereby green footprints lead to rubbish bins on the city's streets. Why? It reduced litter by 46%, as residents followed a nudge that spotlighted good social behaviour. The same theory was utilised by the UK's Revenue & Customs using the message "9 out of 10 people in Exeter pay their taxes on time", nudging an extra 15% of late payers into following the social norm and settling tax bills earlier. Staying with the public sector, it is why French schools - again employing the same theory – now use different names for technical drawing, after a study found that boys do better if the subject is called "geometry", while girls do equally well, or better, when called "drawing".

These are all unrelated examples of the use of Behavioural Insights (BI), as a means to subtly influence us to do the 'right' thing. BI is based on behavioural economics, which combines psychology with economics, and assumes people don't always make the best choice. When first introduced, this theory was a profound change to the notion made in traditional economics that people make rational decisions.

Regular readers of VFTD will know behavioural economics - and the broader subject of behavioural finance - have long been topics of interest to us; not only from an academic perspective, but also from a desire to practically apply some of the ideas within our investment process (see 'It's been emotional'). Therefore, we were delighted to learn Richard Thaler was awarded this year's Nobel Prize in economic sciences for his contributions to behavioural economics. He has certainly influenced our thinking and, for those of you wanting to gain a thought-provoking insight to this topic, we would recommend reading his book 'Misbehaving: The Making of Behavioural Economics' or 'Nudge; Improving Decisions About Health, Wealth and Happiness', a book he co-authored with Cass Sunstein. Indeed, Nudge proved so influential on former British Prime Minister, David Cameron, that it prompted him to create a Behavioural Insights Team – later to become known as the 'Nudge Unit' – soon after taking office in 2010. Tasked with deploying BI to shape the actions of the general public, the work of the unit is credited with getting job seekers back to work faster; boosting the take-up of business support schemes; reducing benefit fraud; and increasing household savings into pensions. Following the Nudge Unit's success, similar approaches have been used in Australia, Germany and Singapore, and Barack Obama's administration created its own Social and Behavioural Sciences Team. In the US, this team increased the number of veterans taking up benefits; helped disadvantaged students; and – just as in the UK – increased tax revenue declared and collected.

It is no exaggeration to say the work of Richard Thaler has influenced governments and societies around the world and it is perhaps not surprising his recent comments about the US stock market garnered so much attention. Speaking on BloombergTV in October, Thaler provided the following observation; "We seem to be living in the riskiest moment of our lives, and yet the stock market seems to be napping. I admit to not understanding it."

How can we try to understand it?

For the current environment to perplex a Nobel Prize winner, who has made a career of studying irrational and temptation-driven actions, only serves to highlight the challenge we all face. Nevertheless, we constantly strive to make sense of the investment world.

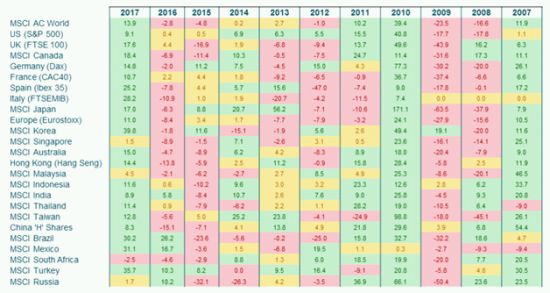

There is no doubt bullish investor sentiment is being driven by a synchronised economic recovery around the world. According to JP Morgan, more than 80% of countries are experiencing higher growth this year. All else equal, rising GDP translates into increased corporate earnings and the table below (taken from an article published by the behavioural finance team at M&G) powerfully illustrates the boom being reported.

Synchronised earnings growth – one year change in earnings per share (YTD for 2017)

Source; M&G; Datastream Oct 2017

Based on this, as M&G rightly argue, one can accept it is rational to see equity markets hitting new all-time highs. There are, however, examples of unusual financial market behaviour and the level of cross-asset correlations – at their lowest levels since the Global Financial Crisis – is a case in point. The fall has been even more marked within equity markets, with both country and global sector correlations near 16-year lows. The combination of becalmed markets and low correlations has helped to suppress volatility in multi-asset portfolios. The impact of this is now so pronounced that there is currently little difference in volatility between a global equity/bond portfolio with 20% allocated to equities and 80% to bonds, and one with 80% in equities and 20% in bonds. We have previously talked about investment 'Rules of Thumb' (see 'Faking It?') and to be operating in an environment where these polar opposite portfolios, in terms of traditional risk profile, are displaying the same level of volatility, makes us empathise with Thaler's earlier comments.

Implications for portfolios

To further highlight this volatility story, the two Bloomberg charts below plot the rise in volatility of US rates (measured using the 10 year Treasury Bond) and the corresponding fall in volatility in US equities (measured using the S&P 500 Index). This is representative of numerous markets around the world and helps explain why generic 80/20 multi-asset portfolios are behaving as they are.

For those investors who structure their portfolios using a strategic asset allocation (SAA) model, the current low asset cross correlation, low volatility environment is problematic. Traditional metrics are masking inherent risk to capital in these portfolios and we believe the 'forced buyer' nature of the management style – in which new monies are invested in line with the SAA 'benchmark' – can only amplify these risks.

We acknowledge many billions of dollars are managed using this approach and long term investment returns have been very respectable. However, with the huge experiment of QE now at an inflection point, in terms of extreme monetary support starting to reverse, we believe SAA investors could face a challenging period ahead.

Given the investment landscape today, would it not be more appropriate to manage assets free from the constraints imposed by SAA models and instead construct portfolios underscored with the discipline of asset class valuation and diversification achieved by focusing on behaviours not labels?

This is the approach adopted by Affinity – Nudge-Nudge; Think-Think.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.