- within Technology topic(s)

A Platform Fund ("P-Fund") is an investment fund established as a limited liability company or limited partnership, forming part of an umbrella type platform (the "Platform").

The Platform facilitates the appointment of a separate Investment Manager (if required) on a fund by fund basis but uses standard form documents and the same Fund Service Providers to the extent possible in order to (a) reduce time and costs associated with the fund formation process; and (b) increase operational efficiency by promoting familiarity with, and consistency of, fund documentation.

Although the same Platform may be used by multiple Investment Managers, a single Investment Manager may also establish a dedicated Platform as a cost-efficient means for establishing a bouquet of ring-fenced investment portfolios, each with different investment strategies or risk profiles.

Structure

Each Platform provides for the establishment of a P-Fund as either:

i a limited liability company ("Company") established under the Companies (Jersey) Law 1991, as amended (the "Companies Law"); or

ii a limited partnership ("Partnership") established under the Limited Partnerships (Jersey) Law 1994, as amended (the "Partnerships Law").

Each Platform is dedicated to P-Funds formed as either Companies (a "Company Platform") or Partnerships (a "Partnership Platform"). In both cases, a Platform is comprised of an Incorporated Cell Company ("ICC") established under the Companies Law, with each Incorporated Cell ("IC") established by the ICC comprising a P-Fund in the case of a Company Platform, or the general partner of a P-Fund in the case of a Partnership Platform.

Unlike the traditional segregated portfolio or protected cell which is available in most offshore jurisdictions, an IC as available in Jersey comprises a company under the Companies Law, being a legal entity which is separate from the ICC by which it is established, and further separate from any other IC established by the ICC. This provides for the ring-fencing of assets and liabilities of each IC in a separate corporate entity (comprising either a P-Fund or the general partner of a P-Fund), as opposed to by way of a fiction of law in the case of a segregated portfolio or protected cell (which gives rise to potential foreign recognition and enforcement issues, which may lead to cross-cell liability).

Key structural features of a P-Fund:

i Each P-Fund comprises a company under the Companies Law or partnership under the Partnerships Law and forms part of a Platform of P-Funds established by an ICC from time to time;

ii Each P-Fund on the same Platform appoints its own Investment Manager (to the extent required), which may be the same or different to the Investment Manager of any other P-Fund on the Platform;

iii Each P-Fund on the same Platform appoints the same preselected Fund Service Providers (to the extent required), namely the Administrator, Custodian (or Prime Broker in the case of a hedge fund) and Auditor, and any additional Fund Service Provider specified in the Appendix;

iv Each P-Fund is governed by its constitutional documents, comprising its Memorandum of Association and Articles of Association in the case of a P-Fund which is a Company or Limited Partnership Agreement in the case of a P-Fund which is a Partnership (in either case, "Constitutional Documents"). As far as possible, the Constitutional Documents of each P-Fund are broadly drafted and the same for each P-Fund on the same Platform;

v A global or generic standard form Prospectus is adopted by all P-Funds on the same Platform. The Prospectus is broadly drafted to accommodate the investment objectives and strategies of an almost unlimited range of funds, including alternative investment funds such as hedge funds, private equity funds, venture capital funds, property funds, film funds and art funds;

vi A P-Fund issues securities which comprise participating shares in the case of a Company or participating partnership interests in the case of a Partnership (in either case, "securities"). Each P-Fund may be open-ended (securities may be redeemed or withdrawn at the option of the holder thereof) or closed-ended (securities may not be redeemed or withdrawn at the option of the holder thereof). An open-ended P-Fund may be subject to an initial lock-up which ties investors in for a specific period, and further subject to redemption or withdrawal restrictions with reference to the number, percentage or value of securities which may be redeemed on any redemption or withdrawal date. A closedended P-Fund would be appropriate for illiquid portfolios, such as property held by a property fund. The capital structure contemplated by the standard form Prospectus provides structural flexibility by permitting single or multiple classes of securities (including side-pocket securities if required) and further permits series accounting for hedge funds;

vii The global or generic Prospectus applicable to each P-Fund is read subject to a short fund-specific Appendix. Key operational terms of a P-Fund, and any differences between P-Funds on the same Platform, are reflected in the Appendix. Among other things, the Appendix contains detailed information on the Investment Manager and Directors of the P-Fund or general partner of the P-Fund (in either case, "Directors"), as well as the investment objective and strategy, investment and redemption or withdrawal terms (if applicable), valuation provisions, and fees of Fund Service Providers. Due to the broad nature of the Prospectus, there is almost unlimited scope to customise the terms of a P-Fund by drafting the Appendix appropriately.

An IC to be used for the purpose of a Platform is established pursuant to a special resolution of the ICC with effect on the day specified in the certificate of incorporation issued by the Registrar of Companies in relation to the IC.

Securities of a P-Fund are issued to Investors subject to the terms of the Constitutional Documents, Prospectus and Appendix of the relevant P-Fund. Management Shares of a Company (including the general partner of a P-Fund) are issued to the ICC, providing a level of voting control in relation to the key standard form documents governing the P-Fund (subject to certain safeguards protecting the interests of Investors), as well as the appointment and removal of the Directors, Investment Manager, Administrator and Custodian (or Prime Broker in the case of a hedge fund). Shares in the ICC are held by the Administrator or any other person who may be designated for such purpose.

The Directors of an IC are not required to be the same as the Directors of the ICC, although in practice or as a matter of the policy of the Administrator it is likely that the same Directors as the ICC will be appointed, plus one or more persons designated for appointment by the Investment Manager or Promoter of the P-Fund.

A P-Fund may be wound up independently of the ICC and independently of any other P-Fund established on the same Platform. A P-Fund is subject to the provisions of the Companies Law or Partnerships Law, as the case may be, much in the same way as any other Company formed under the Companies Law or Partnership formed under the Partnerships Law. In the case of a P-Fund formed as a Company, this means that the P-Fund may be structured to take advantage of statutory continuation provisions (facilitating the migration of the P-Fund inter jurisdictionally) and statutory merger provisions (facilitating the merger of portfolios).

A P-Fund may be structured so that it can migrate out of the Platform on which it is established, and be established as a fund independent of the ICC, for instance if the P-Fund reaches critical mass or wishes to change Fund Service Providers.

Regulation

A Platform may provide for P-Funds which are:

i regulated by the Jersey Financial Services Commission ("JFSC") as Expert Funds ("SFEF");

ii unregulated on the basis that they constitute Eligible Investor Funds ("SFUF"); or

iii regulated by the JFSC under light touch regulation as Very Private Structures ("SFPF").

SFEF

Each SFEF is established in Jersey as a "collective investment fund" under the Collective Investment Funds (Jersey) Law 1988, as amended (the "CIF Law") and regulated as an Expert Fund under the Expert Fund Guide (the "EF Guide") issued by the JFSC.

A SFEF may be open-ended or closed-ended.

The Investment Manager or Promoter of a SFEF must be regulated in a recognised jurisdiction, alternatively may be exempt from regulation and apply for approval by the JFSC.

Only Expert Investors as defined by the EF Guide may invest in a SFEF. A SFEF may be made available to an unlimited number of Expert Investors. The full definition of an Expert Investor is contained in Annexure "A".

Both the definition of an Expert Investor and the requirements of an Expert Fund make a SFEF an ideal vehicle for establishing an appropriately regulated alternative investment fund, including without limitation hedge funds, private equity, venture capital funds, property funds, film funds and renewable energy funds. Full details in relation to an Expert Fund are available in the EF Guide issued by the JFSC.

SFUF

A SFUF may be established in Jersey under the Collective Investment Funds (Unregulated Funds) (Jersey) Law 2008, as amended (the "Unregulated Funds Law").

A SFUF may be open-ended or closed-ended.

There are no regulatory requirements imposed by the Unregulated Funds Law in relation to the Investment Manager or Promoter of a SFUF, provided its activities are not carried on in or from within Jersey.

Only Eligible Investors may invest in a SFUF. A SFUF may be made available to an unlimited number of Eligible Investors. The full definition of an Eligible Investor is contained in Annexure "B".

A SFUF is an ideal vehicle for establishing an unregulated alternative investment fund, including without limitation hedge funds, private equity, venture capital funds, property funds, film funds and renewable energy funds.

SFPF

A P-Fund may be structured as a very private structure that will not constitute a collective investment fund on the basis that it will not make a formal offer or will be established for a single purpose and will have a small number of pre-identified co-investors which will not exceed fifteen by number.

A SFPF is registered under the Control of Borrowing (Jersey) Order 1958, as amended (the "COBO Order"), only. The COBO Order does not provide for the substantive regulation of a SFPF.

A SFPF may be open-ended or closed-ended.

There are no regulatory requirements in relation to the Investment Manager or Promoter of a SFPF. A SFPF is ideal for establishing single investor vehicles as well as joint ventures and private co-investment arrangements. A SFPF may also be used in private client structures.

Listing

A P-Fund may be listed on the Channel Islands Stock Exchange ("CISX") if contemplated by its Appendix.

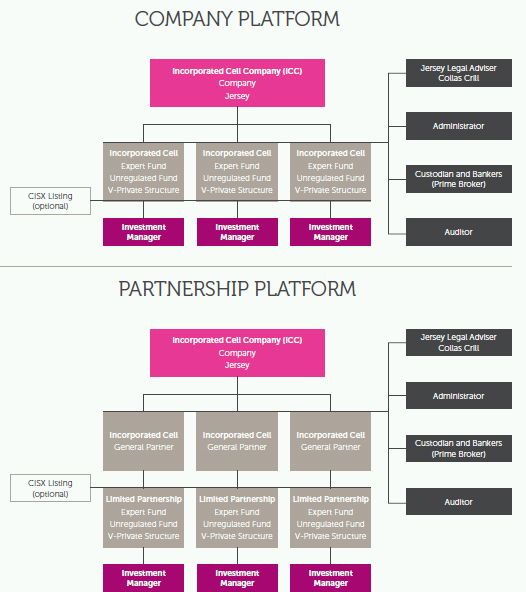

Structure charts

A structure chart for a Company Platform and Partnership Platform is included in the Schedules. Expert Funds, Unregulated Funds and Very Private Structures will each be allocated to a dedicated Platform (a SFEF, SFUF or SFPF will not be included on the same Platform).

Legal fees

P-Funds are a cost and time effective means of establishing a fund structure. Funds which are appropriate for the Platform may be established for a legal fee of £7,500 (excluding disbursements). Legal fees do not include any fees or disbursements of the Administrator engaged for the regulatory and formation process, or any other Fund Service Provider engaged by the client. The fee contemplates the Appendix of the P-Fund requiring less than ten hours of legal work. Fees for optional listing of a P-Fund on the CISX are not included.

ANNEXURE "A" EXPERT INVESTOR DEFINITION

There are ten categories of Expert Investor (an Investor needs to fall into any one category, but in practice usually category (j) below), namely:

a. a person, partnership or other unincorporated association or body corporate, whose ordinary business or professional activity includes, or it is reasonable to expect that it includes, acquiring, underwriting, managing, holding or disposing of investments whether as principal or agent, or the giving of advice on investments; or

b. an individual who has a net worth, or joint net worth with that person's spouse, greater than United States $1,000,000 (or currency equivalent), excluding that person's principal place of residence; or

c. a company, partnership, trust or other association of persons which has (or which is a wholly owned subsidiary of a body corporate which has) assets available for investment of not less than United States $1,000,000 (or currency equivalent) or every member, partner or beneficiary of which falls within the definition of Expert Investor; or

d. a Fund Service Provider to the SFEF or an Associate of a Fund Service Provider to the SFEF; or

e. a person who is an employee, director, consultant or shareholder of or to a Fund Service Provider of the SFEF or an Associate of a Fund Service Provider to the SFEF, who is acquiring an investment in the SFEF as part of his remuneration or an incentive arrangement or by way of co-investment; or

f. any employee, director, partner or consultant to or of any person referred to in paragraph (a); or

g. a trustee of a family trust settled by or for the benefit of one or more persons referred to in paragraphs (e) or (f); or

h. a trustee of an employment benefit or executive incentive trust established for the benefit or persons referee to in paragraphs (e) or (f); or

i. a government, local authority, public authority or supra-national body in Jersey or elsewhere; or

j. an investor who makes a minimum initial investment or commitment of United States $100,000 (or equivalent) to the SFEF, whether through the Initial Offer or by subsequent acquisition.

ANNEXURE "B" ELIGIBLE INVESTOR DEFINITION

There are ten categories of Eligible Investor (an Investor needs to fall into any one category, but in practice usually category (a) below), namely:

a. a person who has agreed to pay consideration of not less than United States $1 million (or equivalent), for the subscription, purchase, exchange or acquisition;

b. a person whose ordinary business or professional activity includes or could be reasonably expected to include:

i. the acquisition, underwriting, management, holding or disposal of investments, whether as principal or agent, or

ii. the giving of advice on investment;

c. employee, director or shareholder of, or consultant to, a person specified in clause (b);

d. a functionary in relation to the SFUF or an associate of such a functionary;

e. a person who:

i. is an employee, director or shareholder of, or consultant to, such a functionary or associate, and

ii. in making the relevant subscription, purchase, exchange or acquisition would acquire units in the fund as remuneration, or reward, as such an employee, director or shareholder or consultant;

f. an individual whose property has a total market value of not less than United States $10 million (or equivalent) (see below *Calculating Market Value);

g. a company, partnership, limited partnership or limited liability partnership, trust, or unincorporated association, in relation to which one or both of the following requirements is met:

i. its property (or its property and that of its associates) has a total market value of not less than United States $10 million (or equivalent),

ii. every shareholder of the company, every partner of the partnership, limited partnership or limited liability partnership, every beneficiary of the trust or every member of the association (as the case requires) would, himself or herself, be an eligible investor in relation to the fund if he or she made in relation to the fund a subscription, purchase, exchange or acquisition;

h. a wholly-owned subsidiary of a company that satisfies clause (g);

i. a trustee of a trust established by a person who is specified in any of clauses (b), (c), (d), (f), (g) and (h) or is an employee, director, shareholder, or consultant, specified in clause (e)(i);

j. a trustee of a trust established for the benefit of:

i. a person who is specified in clause (b) or (c) or is an employee, director, shareholder, or consultant, specified in clause (e)(i),

ii. any one or more persons in any one or more of the following classes:

A. the spouse of a person specified in sub-clause (i),

B. the issue of such a person,

C. the dependants of such a person, or

iii. a person specified in sub-clause (i) and any one or more persons in any one or more of the following classes:

A. his or her spouse,

B. his or her issue,

C. his or her dependants; or

iv a person who in making the subscription, purchase, exchange or acquisition is acting as or for a public sector body.

*Calculating Market Value

To calculate the total market value of an individual's property for the purposes of sub paragraph (f) above:

a. add the market value of the movable and immovable property (in Jersey and elsewhere) of the individual (determined as if there were no liability in respect of any of that property) to the market value of the movable and immovable property (in Jersey and elsewhere) of the individual's spouse (determined as if there were no liability in respect of any of that property);

b. deduct any liability that is secured over that property of the individual by mortgage, charge or other security or encumbrance;

c. deduct any liability that is secured over that property of the individual's spouse by mortgage, charge or other security or encumbrance;

d. deduct any liability of the individual that is not secured as referred to in clause (b); and

e. deduct any liability of the individual's spouse that is not secured as referred to in clause (c).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.