Reforming the UK's Non-Domicile tax regime is an objective contained within the Labour Party's policy platform. An incoming Labour Government is a distinct possibility at the next General Election, which is due to be held no later than 28th January 2025, but is widely expected to be held during 2024.

Labour have regularly discussed the intention to scrap the current Non-Domicile regime in favour of a modernised scheme for people genuinely living in the UK for short periods.

So, what do High-Net-Worth-Individuals ("HNWIs") coming to the UK need to be aware of, and what structuring opportunities do they currently have open to them?

In this article, we take a brief look at how Offshore Trusts can be utilised to protect and grow the non-UK wealth of non-UK HNWIs coming to the UK to live and work. We'll consider:

- An Overview of the Non-Domicile Regime

- What is an Offshore Trust?

- Offshore Trust Solutions for Non-Domiciled Individuals

- How Dixcart can Support Offshore Trust Planning?

1. An Overview of the UK Non-Domicile Regime

Domicile is a foundational Common Law concept recognised within countries such as Australia, Canada, India, USA and the UK. Domicile goes beyond nationality, residence or ethnicity and is defined by where the individual is considered to have their permanent home or have a substantial connection to.

An individual can only have one Domicile at any one time, which has relevance in determining the territorial law applicable to various matters such as those relating to areas of taxation, for example, UK Inheritance Tax.

A UK Domiciliary is subject to UK taxes on their worldwide assets, income and capital gains on an Arising Basis; a system of taxation found in many other countries. In the UK, a person can acquire a UK Domicile in five broad ways, but the three most common are:

Non-Domiciled individuals that move to the UK will remain Non-Domiciled for so long as they have not acquired a Domicile of Choice or become Deemed Domicile.

Whilst the individual remains Non-Domiciled, there is no exposure to UK Inheritance Tax ("IHT") on non-UK situs assets. Further, those who have a Non-Domiciled tax status can opt to be taxed on a Remittance Basis, which may provide tax efficiencies depending on the individual's circumstances and in accordance with professional tax advice received.

As such, those Non-Domiciled persons have an opportunity to utilise a respected tax neutral jurisdiction, like the Isle of Man, to structure their non-UK affairs in an efficient manner and optimise any potential returns.

As noted previously, the current Non-Domicile regime is likely to be subject to reforms in the medium to long term. For the time being, however, the tried and tested structuring options are available for Non-Domiciled persons to utilise and may be pertinent under any shortened or revised system going forward.

A mainstay of pre-arrival planning for Non-Domiciled HNWIs is the Offshore Trust.

2. What is an Offshore Trust?

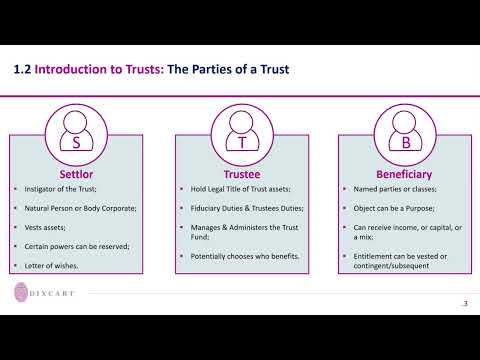

A Trust is a fiduciary arrangement whereby an individual (the "Settlor") transfers legal, but not beneficial or equitable, ownership of property/assets to a person or persons (the "Trustee") to hold for the benefit of their chosen beneficiary or a class of beneficiaries (the "Beneficiaries").

The term, Offshore Trust, refers to a Trust that is settled and managed in a separate jurisdiction from the Settlor's home country. In the instance of an Offshore Trust for a UK Non-Domiciled individual, this involves the settlement of a non-UK jurisdiction Trust and the appointment of non-UK Trustees. This renders the Trust subject to a foreign legislative, regulatory and/or tax regime, normally providing the Settlor and the Beneficiaries of the Trust with efficiencies.

You can read more about Offshore Trusts here.

The Trustees, often professionals, own and manage the Trust assets in accordance with the Settlor's wishes and ordinarily for a specific purpose such as family wealth preservation, asset protection or tax optimisation. The Trust Deed details the arrangement and parties, acting as the constitutional document of the Trust.

You can read more about choosing your Professional Trustees here.

Importantly, Trusts are not incorporated entities i.e. they do not possess limited liability or separate legal personality like a company or corporation. For instance, it is the Trustees, and not the Trust, that can sue or be sued, contract with third parties and/or create charges.

3. Offshore Trust Solutions for Non-Domiciled Individuals

According to suitably qualified tax professionals, it is often advisable for High-Net-Worth, Non-Domiciled individuals to defer their UK tax Residency to allow for appropriate wealth planning to be implemented. Ideally, this means that any pre-arrival planning needs to take place prior to the start of the first tax year of UK Residence.

The concept of Clean Capital is particularly important with regards to the Non-Domiciled individuals' pre-arrival planning. Among other things, Clean Capital describes income and gains received whilst non-UK Resident that can be remitted to the UK post tax residency without a tax charge. After the foreign Domiciliary becomes UK Resident, foreign income and gains arising are not considered Clean Capital and may be taxable on remittance to the UK.

In practice, the individual has a number of options open to them regarding the protection and investment of their non-UK assets, one of the most flexible that we regularly assist clients with, is the establishment of a Protected Trust, which can play an integral role in both pre-arrival planning and for those nearing deemed domicile status.

Protected Trusts

Introduced in 2017, a Protected Trust is a Trust settled by a Non-Domiciled individual before becoming Tax Resident in a new country. The main aim of such a Trust is to protect the foreign Domiciliary's overseas assets from the tax regime of their new country of Tax Residence.

This structure normally involves the incorporation of an underlying Holding or Investment Company to undertake the active management of those settled assets.

It is common for the Trust to be settled with a nominal amount of cash initially, and for the remainder of the Clean Capital to be loaned to the Trustee by the Non-Domiciled individual. Thereby allowing the Trust Fund to be invested in non-UK situs assets and the foreign Domiciliary to receive loan repayments of Clean Capital without a tax charge on remittance. This is also true of any growth or income derived from these assets, which is also considered Clean Capital.

Further, provided that UK-source income is avoided, income and gains within the Protected Trust can compound free of tax, whilst the Trust falls under the Protected Settlement Regime. In principle, this will continue for so long as the Settlor remains Non-Domiciled, and the Trust Fund is not tainted.

If you would like to find out more about the nature and scope of Trusts, and common pitfalls, we have created a series of helpful notes on Isle of Man Trusts for your reference:

- Offshore Trusts: An Introduction (1 of 3)

- Offshore Trusts: Types and Uses (2 of 3)

- Offshore Trusts: Misunderstandings, Pitfalls and Solutions (3 of 3)

There is also this companion video presentation:

4. How Dixcart can Support Offshore Trust Planning

The Dixcart Group have been serving international clients for over 50 years and the Group remains proudly, privately owned by the same family. Our office in the Isle of Man has been in operation for over 30 years, reflecting our expertise and experience as professional Trustees and Corporate Service Providers.

The Isle of Man is a highly regarded OECD whitelisted jurisdiction with a long running track record in fiduciary and professional services. The Island is a centre of excellence for Private Client structuring and is particularly well suited to establishing Protected Trusts for people moving between jurisdictions, including moving to the UK.

At Dixcart Isle of Man, we specialise in services for HNWIs seeking to establish Trusts. Our approach to business is focused on maintaining high-quality, long-term client relationships, prioritising bespoke service over the quantity of clients we have.

Our Isle of Man team comprises of qualified Trust professionals and experienced senior staff, who are tax aware and always on hand to offer comprehensive support in actioning your Trust planning at every stage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.