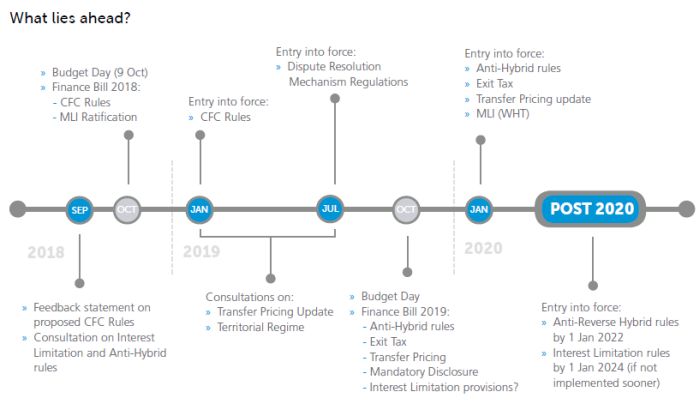

On 5 September 2018, the Minister for Finance and Public Expenditure and Reform published Ireland's Corporation Tax Roadmap. The Roadmap details corporate tax reform to date and sets out the next steps required to implement changes at EU level under the Anti-Tax Avoidance Directives ("ATAD"), the recommendations set out in the Review of Ireland's Corporation Tax Code presented by the independent expert Séamus Coffey in June 2017 (the "Coffey Review") and the OECD's Base Erosion and Profit Shifting project ("BEPS"). The Roadmap also confirms the expected timelines for the implementation of these changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.