The Securities Financing Regulation (Regulation (EU) 2015/2365) (the SFT Regulation) came into force on 12 January 2016. Its aim is to improve the transparency of securities financing transactions (SFTs) in the shadow banking sector, giving regulators (including the European Securities and Markets Authority (ESMA) and national regulators) access to detailed information to enable them to monitor risks in that sector on an ongoing basis.

BACKGROUND:

As the EU focused on improving the structure and resilience of EU banks, concerns arose that the shadow banking sector could become more attractive due to the less-regulated environment in which it operated. The SFT Regulation developed as a result of these concerns, in particular the concerns outlined in the 2012 Liikanen Report that, although the shadow banking market performed important functions, it was overly connected to the banking sector and as such, posed a threat to long-term stability.

HOW ARE SFTS DEFINED?

The SFT Regulation divides SFTs into four categories, each of which has similar economic effects:

- securities or commodities lending and borrowing;

- buy-sell back transactions, and sell-buy back transactions (including collateral and liquidity swaps if they are not derivatives under the European Market Infrastructure Regulation (EMIR));

- repurchase and reverse repurchase transactions; and

- margin lending transactions.

"Derivatives contracts", as defined in EMIR, are out of scope.

THREE KEY FEATURES:

Reporting: All SFTs will need to be reported to trade repositories (except where one of the counterparties is a member of the European System of Central Banks (ESCB)) and counterparties will be required to keep records of their SFTs for five years after they are terminated.

Disclosure: Managers of UCITS and AIFs will need to disclose details of the use of SFTs and total return swaps (TRS) by the relevant funds on both a pre-contractual and periodic basis (further detail is set out in 'Further detail: Disclosure' below).

Reuse: Requirements in relation to risk disclosure and express consent have been imposed where MiFID financial instruments received by a counterparty under a title transfer or security collateral arrangement are to be reused (these arrangements do not need to collateralise an SFT for the reuse requirements to apply).

SCOPE:

- Reporting: The reporting obligation applies to counterparties that are banks, investment firms, UCITS and their management companies, AIFs managed by AIFMs authorised or regulated under the AIFMD, insurers and reinsurers, pension funds, central counterparties, central securities depositaries, third country entities which would require authorisation as one of the foregoing if established in the EU and non-financial counterparties (i.e. undertakings established in the EU or in a third country which are not financial counterparties). The reporting obligation applies to counterparties established in the EU, non-EU branches of counterparties established in the EU and EU branches of counterparties established outside the EU when entering into SFTs. While the reporting obligation arises only when SFTs are being entered into, the wide scope of the definition of SFTs should be borne in mind.

- Disclosure: The disclosure obligation is imposed only on UCITS management companies, UCITS investment companies and AIFMs. It applies not only in respect of their use of SFTs, but also to their use of TRS.

- Reuse: The reuse requirements apply to the same types of counterparties to whom the reporting obligation applies. The reuse requirements arise when MiFID financial instruments are received as collateral where:

-

- the reusing counterparty is established in the EU (whether or not it is acting through a third-country branch); or

- the counterparty is established in a third country and:

-

- it is effecting the reuse through an EU branch; or

- the collateral is provided to it for reuse from a counterparty established in the EU, or having a branch in the EU.

INTERACTION WITH EMIR:

The SFT Regulation has amended the definition of "'OTC derivative' or 'OTC derivative contract'" in EMIR to put in place a process for recognising equivalent non-EU markets. The result is that derivatives traded on those markets will no longer be regarded as OTC derivatives for EMIR purposes.

FURTHER DETAIL: REPORTING:

- What must be reported and to whom? Counterparties must report new, modified or terminated SFTs to a trade repository. The SFT Regulation contains provisions for the registration of EU repositories, and for the recognition of non-EU repositories. If no trade repository is available, reporting must instead be made to ESMA.

- How does this tie-in with EMIR? The reporting framework for SFTs is based on the reporting framework for derivatives under EMIR. The framework will be supervised by ESMA, which has been mandated to develop regulatory technical standards (RTS) on reporting (further detail on Level 2 measures is set out below).

- When must reporting take place? SFTs must be reported to a trade repository by the following working day.

- Delegation: Counterparties are permitted to delegate their reporting obligation subject to the following:

-

- UCITS management companies will be responsible for reporting on behalf of their UCITS, and AIFMs will be responsible for reporting on behalf of AIFs; and

- where a financial counterparty enters into an SFT with a non-financial counterparty that is an SME, the reporting obligation will rest with the financial counterparty.

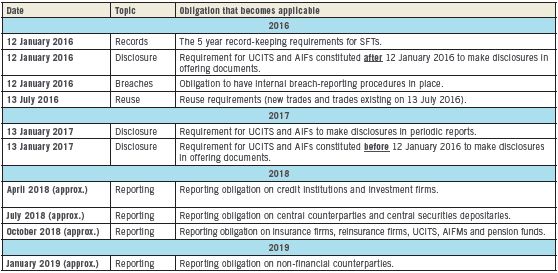

- Transitional periods: The start-date for the reporting requirement will vary depending on the type of counterparty – further details are set out in the 'Key Dates' table at the end of this briefing.

- Treatment of existing SFTs: Where an SFT is in existence at the date that a counterparty's reporting obligation commences, that SFT must be reported if, at that time, it has a remaining maturity of > 180 days or has an open maturity and remains outstanding for at least 180 days after that date. Those existing SFTs must be reported within 190 days of the date that the reporting obligation commences.

- Effect of breach: Breach of the reporting obligation will not affect the validity of the SFT or the parties' enforcement rights. Breach will also not give a counterparty the right to compensation.

FURTHER DETAIL: DISCLOSURE:

- What must be disclosed? UCITS management companies, UCITS investment companies and AIFMs must disclose the use of SFTs and TRS by the relevant fund (on an aggregated basis).

- Why must this be disclosed? The requirement to disclose stems from a concern that the use of SFTs and TRS could alter a fund's risk-reward profile. The disclosure obligation is principally aimed at enabling investors to assess and compare risk levels.

- What form will the disclosure take? Both pre-contractual and periodic disclosure will be required in the following manner:

-

- Pre-contractual disclosure: Section B of the Annex to the SFT Regulation lists the information that must be set out in a UCITS prospectus or in the disclosure document provided under Article 23 of the AIFMD. This includes a general description of the SFTs and TRS used, the rationale for their use, the overall data to be reported (such as the type of assets and the maximum and expected proportion of assets under management that can be subject to SFTs and TRS), the criteria used to select counterparties, types of acceptable collateral, the methodology for valuing collateral, details of the risks linked to the SFTs, their safe-keeping, restrictions on reuse of collateral and the policy on sharing of returns generated by the SFTs and TRS. The relevant prospectus or other disclosure document must also contain a clear statement of the SFTs and TRS that can be used, and must also include a clear statement that those SFTs and TRS are being used. While certain of these disclosure requirements may already be met, at least in part, by compliance with existing obligations under the UCITS and AIFMD regimes in Ireland, changes will need to be made to offering documents to meet them in full.

- Periodic disclosure: Section A of the Annex to the SFT Regulation lists the information that must be set out in the annual reports required under the UCITS Directive and under AIFMD, and in the six-monthly report required under the UCITS Directive. This includes global data, concentration data (i.e. the ten largest collateral issuers and the top ten counterparties of each type of SFT and TRS), aggregate transaction data for each type of SFT and TRS broken down according to various categories, data on collateral reuse, details on the safekeeping of collateral received by and granted by the fund and data on return and cost for each type of SFT and TRS.

- When will these obligations apply? While most provisions of the SFT Regulation are subject to some form of transitional period or later starting date, UCITS and AIFs constituted after 12 January 2016 must make their pre-contractual disclosures as soon as they issue the relevant offering document.

FURTHER DETAIL: REUSE:

- What do the requirements apply to? The reuse of MiFID financial instruments under security collateral arrangements and title transfer collateral arrangements within the meaning of the Financial Collateral Directive.

- What requirements have been imposed?

The new requirements are as follows:

- the counterparty receiving the assets must disclose (to the providing counterparty) the potential risks and consequences of a reuse right being granted or a title transfer collateral arrangement being entered into;

- the providing counterparty must consent in writing to the reuse of the assets, or must agree to provide collateral under a title transfer collateral arrangement; and

- the assets being reused must be reused in accordance with the terms of the collateral arrangement and those assets must also be transferred from the providing counterparty's account.

- Making disclosure and obtaining consent: Standard form industry documentation needs to be updated to contain sufficient disclosures. Express written consent from the providing counterparty will need to be incorporated into those documents.

- Enforceability of close-out netting rights: The reuse obligation will not affect national law concerning the validity or effect of a transaction.

- Interaction with other legislation: The requirements of the SFT Regulation are without prejudice to legislation (such as the AIFMD and the UCITS Directive) that contains stricter requirements and to national legislation that offers higher protection levels to counterparties.

OTHER KEY POINTS:

- Record-keeping: The SFT Regulation obliges counterparties to keep a record of all SFTs that they have concluded, amended or terminated for at least five years after the termination of the relevant SFT.

- Irish legislation: While the SFT Regulation is directly effective in all Member States, each Member State needs to put in place national rules in respect of enforcement and sanctions. The Irish legislation has not yet been published.

- Breach-reporting: Counterparties must put internal procedures in place to enable their employees to report breaches of the reporting and reuse obligations.

- Sanctions: Member States must put in place effective administrative sanctions regimes for, at a minimum, breaches of the reporting and reuse obligations. Maximum monetary fines must be at least €5,000,000/10% of annual turnover for breaches by legal persons of the reporting obligation and for any relevant breaches by individuals, and at least €15,000,000/10% of annual turnover for breaches by legal persons of the reuse obligations.

WHAT KEY LEVEL 2 MEASURES ARE EXPECTED?

- Reporting: ESMA must submit draft RTS to the European Commission by 13 January 2017 setting out the detail of what must be reported. At a minimum, that must include:

-

- the parties to the SFT (and the beneficiary, if different);

- the principal amount;

- the currency;

- regarding collateral: the assets used as collateral, their type, quality and value, how the collateral will be provided, whether the collateral will be available for reuse, whether the collateral has been reused (where it is distinguishable from other assets) and any substitution of the collateral;

- the repurchase rate, lending fee or margin lending rate, any haircut, the value date, and the maturity date;

- the first callabale date;

- the market segment; and

- as appropriate, details of cash collateral reinvestment or securities or commodities being lent or reborrowed.

- Reporting: ESMA must also submit to the European Commission, by 13 January 2017, draft implementing technical standards on the format and frequency of SFT reporting.

- Disclosure: ESMA may submit draft RTS to the European Commission specifying further content for Sections A and B to the Annex, but is not obliged to do so and no deadline has been set.

- Reuse: No Level 2 measures have been specified for the reuse requirements.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.