- in Africa

- with readers working within the Banking & Credit industries

- within Compliance topic(s)

In the current regulatory environment, where ever increasing obligations are imposed on regulated firms, it is often difficult to digest these detailed requirements and assess both their impact on your business and the action you must take to ensure your firm remains fully compliant.

The Central Bank of Ireland (the "Central Bank") has issued two key publications in recent weeks in relation to their supervisory and enforcement plans for the markets industry in 2015. We have set out a summary of each of these below.

Our experienced Regulatory Risk Management and Compliance Team provides a number of services relating to the Central Bank's supervision and enforcement activity, including:

- Undertaking a "pre-review" to assist firms in preparing for a review or inspection by the Central Bank

- Preparing individuals for interview by the Central Bank either as part of the PRISM engagement or fitness and probity processes

- Reviewing business plans, policies and procedures and other key documentation to identify any gaps with Central Bank requirements

- Providing "skilled person" reports as requested by the Central Bank

- Providing a critical oversight of the preparation of a "skilled person report" prepared by other professional services firms

- Assisting clients throughout a Central Bank inspection applying a pragmatic approach

- Delivering training sessions and interactive workshops in relation to regulatory requirements, supervision and enforcement by the Central Bank

- Assisting firms to deal with the Central Bank's administrative sanction process

1. Themed Inspections 2015

On 26 February, the Central Bank published its programme of themed inspections for 2015. This sets out the Central Bank's supervisory priorities in the context of Markets supervision for this year. This programme builds on the supervisory work of previous years and also anticipates areas of emerging risk.

In addition to the Central Bank's supervisory engagement under the Probability Risk and Impact SysteM ("PRISM"), the themed inspections are another key supervisory tool used by the Central Bank to assess firms' compliance with their regulatory obligations.

The programme introduces a number of new themes that were not previously included in the 2014 programme of themed inspections and we would note that in general the themes are more specific / focused than last year's themes.

The following themes are listed for 2015:

- Cyber security / operational risk - Inspection of controls and procedures around system security and access

- Integrity of regulatory returns - Review of firms' regulatory reporting

- Treatment of pricing errors for the calculation of fund NAVs - Examination of the processes for the treatment of pricing errors and the payment of compensation

- Depository oversight - Review of depositary oversight of investment funds including the depositary's annual report to investors

- Proprietary trading - Reviewing the governance and control environment for MiFID firms trading on their own account

- Conduct of business - Review of selected MiFID conduct of business requirements

- Suspicious transaction reports ("STRs") - Follow-up on previous themed-inspection from 2013 related to market discipline in filing STRs

- Person Discharging Managerial Responsibilities ("PDMRs") - Review of policies and practices in relation to notification of relevant trading activity by persons discharging managerial responsibility in listed firms

- Risk management in UCITS - Examination of the on-going application of risk management processes employed by UCITS

The only themes that are repeated since the 2014 themed inspections are conduct of business requirements and the integrity of regulatory returns.

The Director of Markets Supervision, Gareth Murphy said:

"Investor protection, market integrity and financial stability are at the core of the Central Bank's mandate. By announcing these themed-inspections, we are highlighting areas where investment firms, funds and market participants may need to raise standards. Following these inspections, we will communicate our assessment of regulatory standards in these areas and, where necessary, we will ensure that specific remedial actions are taken."

When speaking about the Central Bank's engagement with industry participants at the 4th Annual Funds Congress, Gareth Murphy said:

"In a world where regulation has changed at breakneck speed and where supervisory approaches have developed beyond recognition over the last five years, it has never been more important for supervisors to engage with industry.

First and foremost, such engagement aims to set out the expectations of supervisors to raise standards, encourage compliance and reduce uncertainty. For example, after having conducted supervisory assessments of firms (so-called 'full risk assessments'), we issue letters setting out our assessment of the areas of weakness and we indicate which remedial actions must be undertaken. To ensure that the outcomes we seek are clear and comprehensible, we take the time to meet the boards of firms to explain our reasoning. Whilst firms may not always be happy with the mitigation plans that we impose [as you would expect], this engagement ensures that there is always a clear understanding of why we insist upon them.

Second, active engagement with our firms allows us to gather market intelligence and ensure that we are keeping abreast of market developments especially in a world where the financial services activity may be challenging the perimeter of regulation. This informs ongoing supervision and our contribution to new policy initiatives that may be brewing..."

In addition to specific themed inspections, which will be undertaken at an industry level, the Central Bank may also undertake inspections and hold review meetings with individual firms. These may arise for a number of reasons; for example as part of PRISM engagement with firms, through reporting of a breach or issue to the Central Bank, where an issue has been identified through the firm's regulatory returns or otherwise. The Central Bank has said that inspections and review meetings form a crucial part of their supervision process and has issued an overview of the process for these inspections and review meetings as follows:

2. Enforcement Priorities

On 9 February 2015, the Central Bank published its annual list of Enforcement Priorities for 2015. These priorities

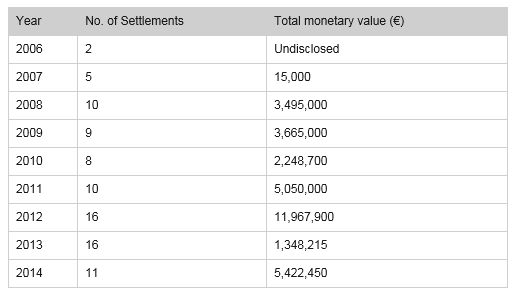

It is worth noting that in 2014, the Central Bank entered into 11 enforcement settlements with regulated financial service providers in 2014 resulting in the imposition of overall fines in excess of €5 million (see further details in the summary table below).

Enforcement priorities are published to ensure transparency by the Central Bank and to enable the Central Bank to target its resources on enforcement in key areas to protect consumers and safeguard the stability of the financial system and economy.

Director of Enforcement, Derville Rowland, said:

"The Central Bank's statement of enforcement priorities focuses on areas of particular importance in support of our overarching objective of safeguarding stability and protecting consumers. In addition, the publication of this statement reflects our commitment to being open and transparent in the work we do...The publication of our enforcement priorities highlights for firms the need for them to review their business practices and to ensure that they can at all times demonstrate the highest standards of compliance."

The enforcement activity of the Central Bank will not be limited to these pre-defined priorities. The Central Bank will also take re-active enforcement actions when serious issues emerge as a result of the it's ongoing supervisory work or other sources such as through whistleblowers.

The specific Enforcement Priorities for the markets industry are MiFID conduct of business rules and client assets requirements. These were also enforcement priorities in 2014.

The Enforcement Priorities for 2015 that will apply across all sectors are, and some of which mirror 2014 priorities, are:

- Prudential requirements - The Central Bank continues to put the adherence to prudential requirements as a cornerstone of its enforcement strategy and priorities for all sectors. We will focus on in particular, while not being limited to, prudential requirements for credit unions, large exposure rules for credit institutions and markets, those applying to retail intermediaries, reserving and capital adequacy and insurance

- Systems and controls - The Central Bank views the existence and proper functioning of a firm's systems and controls as being fundamental to ensuring its compliance with its regulatory requirements. Robust systems and controls are essential safeguards to ensure compliance and protect and reinforce a firm's culture of compliance with regulatory requirements. Strong systems and controls and risk management systems also prevent inadvertent harm to consumers as well as defend against deliberate acts of misconduct

- Provision of timely, complete and accurate information to the Central Bank - A number of enforcement cases in 2014 concerned the provision of incomplete/inaccurate regulatory information to the Central Bank by firms. The Central Bank considers this a very serious issue, as the effective prudential supervision of firms is contingent upon the accuracy and completeness of the information available to the Central Bank. The submission of timely and accurate information to the Central Bank will remain a cross sector focus area for 2015

- Appropriate governance and oversight of outsourced activities - In 2014, governance failures relating in particular to outsourcing featured in two significant enforcement cases taken by the Central Bank. These cases related to firms from different industry sectors thereby highlight that governance arrangements with regard to outsourcing are an issue across the regulated sectors. As firms continue to outsource functions to reduce costs and focus on core business, the Central Bank reminds firms that outsourcing is no defence to regulatory failings. The Central Bank expects full compliance with all applicable regulatory requirements and appropriate oversight and supervision by firms of the outsourced activity

- Anti-Money Laundering / Counter Terrorism Financing compliance - The Central Bank has, in recent years, taken enforcement cases in relation to breaches of the anti-money laundering requirements. The Central Bank expects compliance by all credit and financial firms with the regulatory requirements in order to ensure that effective procedures are in place to counter the threats of money laundering and financing of terrorism

- Fitness and probity obligations – The Central Bank has not set out the precise detail of what it will focus on in this regard but this may include looking at frameworks in place in firm to meet the obligations and the extent to which firms comply with their own internal procedures in this regard.

The settlement agreements reached to date, across all industry sectors, are summarised below:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.