- within Law Department Performance, Strategy and Tax topic(s)

Introduction

There are two broad categories of mutual funds in Ireland. The first category comprises undertakings for collective investment in transferable securities ("UCITS"). These are funds established under the regulations implementing the European Union's ("EU") UCITS Directive and can take one of three forms; unit trusts, investment companies with variable capital and common contractual funds.

The second category of mutual funds in Ireland ("non-UCITS") can take one of four forms; unit trusts established under the Unit Trusts Act, 1990, investment companies with variable capital established under the Companies Act, 1990, common contractual funds established under the Investment Funds, Companies and Miscellaneous Provisions Act, 2005 and investment limited partnerships established under the Investment Limited Partnerships Act, 1994.

The main differences between UCITS and non-UCITS funds relate to the way in which the funds are marketed to investors and the proposed investment policies of the funds. Once a UCITS fund is approved in one EU country, application may be made to have the fund registered for marketing to the public in any other EU country. The UCITS Directive requires that such registration be forthcoming in that country within ten working days of the date of application. It is not necessary to obtain any further authorisation.

In contrast, the marketing of a non-UCITS fund is subject to the relevant domestic law of each country and promoters do not enjoy the automatic right to market a non-UCITS fund to the public across the EU. Given the divergences in the law relating to public offerings in EU member states it may be very difficult, if not impracticable, to register an open-ended non-UCITS fund for retail sale in another EU member state. However, in many countries it is possible to market non-UCITS funds by private placement to institutional investors. It may also be possible to market a closed-ended fund to retail investors in some EU member states provided that its prospectus complies with the requirements of the Prospectus Directive.

Why choose Ireland as a Fund Domicile?

Ireland is a global hub for investment funds:1

- over 4700 funds, with net assets of over ¤970 billion, are domiciled in Ireland;

- over 380 leading asset managers from over 50 countries have chosen Ireland as a domicile for their investment funds;

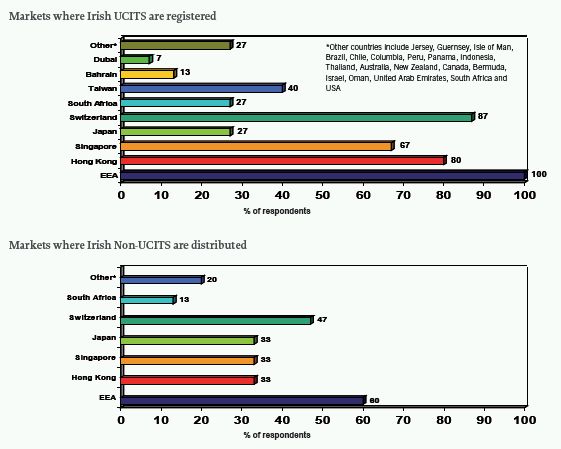

- those funds are now distributed to investors in over 70 countries (including EEA member states, the US, Hong Kong, Singapore, Japan, China and GCC countries);

- Ireland is a leading domicile for the establishment of UCITS funds. UCITS funds with over ¤765 billion in assets account for over 80% of the net assets of Irish domiciled funds;

- in Europe, Ireland is a leading domicile for money market funds and ETFs. Irish domiciled money market funds hold assets in excess of ¤357 billion and Irish domiciled ETFs represent approximately 32% of the total European ETF market; and

- Ireland is the largest hedge fund administration centre in the world. Ireland services alternative investment assets representing approximately 43% of global and 63% of European hedge fund assets.

See Appendix for further details.

Ireland provides a ready-made infrastructure for investment funds and is:

- a "one-stop shop", which is home to over 50 top-tier fund service providers;

- a Eurozone, EU, OECD and FATF member; and

- in an optimum timezone, which ensures global service coverage.

Ireland has a beneficial tax code:

- regulated funds are generally not subject to Irish tax of any kind;

- no Irish withholding taxes on distributions to, or redemptions of units by, non-Irish investors;

- no annual subscription tax for funds (unlike Luxembourg with its taxe d'abonnement);

- the lowest headline corporate tax rate in the OECD; and

- funds may have access to Ireland's extensive tax treaty network with 60 countries.

Ireland has a legal and regulatory environment that is tailor-made for the funds industry:

- a common law jurisdiction;

- a pragmatic regulatory framework, developed in partnership with the funds industry; and

- strong government commitment to Ireland as a centre of excellence for investment funds.

Ireland continues to innovate:

- it was at the forefront of implementing UCITS III product changes;

- there is now a 24 hour approval process for sophisticated qualifying investor fund ("QIF") products;

- the Central Bank has established a unit dedicated to Shari'ah funds;

- Ireland has signed bilateral memoranda of understanding with 19 jurisdictions including China, Dubai, Hong Kong, Isle of Man, Jersey, South Africa, Switzerland, Taiwan, UAE and USA and cooperates with all EU member states through the EU legislative framework; and

- new legislation has been introduced which provides for the re-domiciliation or migration of funds to Ireland from jurisdictions (such as Cayman, Bermuda and BVI) on a tax efficient basis for the investors in those funds.

Fund Structures in Ireland

A fund may be established in Ireland as a single fund or as an umbrella fund comprising one or more sub-funds, each with a different investment objective and policy. A sub-fund may comprise different classes of units. Typically classes of units are issued to allow for different fee arrangements, different subscription amounts or different currencies within the same sub-fund.

There are a number of factors which impact on the choice of fund structure such as the investment policy of the fund and the profile and location of investors. In addition, some structures, such as investment limited partnerships, are only available to non-UCITS funds.

Investment Company

A fund which is structured as a variable capital investment company must be incorporated as a public limited company. One of the distinguishing features of a fund structured as a variable capital company is that it has separate legal personality. The day-to-day management and control of the company is provided by a board of directors, with ultimate control resting with the shareholders. Provided that this day-to-day management and control (i.e. the heart and mind of the company) can be shown to be in Ireland, an investment company can obtain a certificate of Irish tax residency from the Irish tax authorities.

As a result of changes introduced by the Investment Funds, Companies and Miscellaneous Provisions Act, 2005, Irish investment companies organised as umbrella funds can segregate liability between their sub-funds as a matter of law and may cross invest in sub-funds within the same umbrella.

Unit Trust

Unit trusts that are not established as UCITS are governed by the Unit Trusts Act, 1990. A unit trust is constituted by a trust deed entered into between a management company and a trustee. The assets of the trust are held by the trustee but the beneficial ownership of the assets remains with the unit trust's unitholders. A unit trust does not have a legal personality separate from the trustee and the management company and contracts in relation to the trust are entered into by the management company on behalf of the trust or a particular sub-fund of the trust. There is segregation of liability between sub-funds of an Irish unit trust.

Common Contractual Fund

The common contractual fund or CCF was established in Ireland in 2003 and may be established as a UCITS fund or a non-UCITS fund. The CCF was specifically developed to facilitate the pooling of pension fund assets in a tax efficient manner. This structure is particularly attractive to pension funds that wish to pool their assets.

The CCF is an unincorporated body established by a management company under which the participants by contractual arrangements participate and share in the property of the fund as co-owners. As a co-owner, each investor in the CCF holds an undivided co-ownership interest as a tenant in common with other investors. The CCF is constituted under contract law by the execution of a deed of constitution between a management company and a custodian. As an unincorporated body a CCF does not have separate legal personality.

The CCF is a tax transparent structure under Irish law. In order to facilitate the tax transparency, the CCF should have certain key characteristics. These characteristics include (i) no meetings of investors; (ii) units should not be freely transferable but may be redeemable and (iii) no redemption charge may be levied. The CCF's income must also be distributed annually in proportion to each investor's holding in the CCF.

Investment Limited Partnership

An investment limited partnership is a partnership between one or more general partners and one or more limited partners, the principal business of which, as expressed in the partnership agreement, is the investment of its funds. The main distinguishing feature of the investment limited partnership is that, unlike unit trusts or variable capital companies, an investment limited partnership is not required to market its limited partnership interests to the public. An investment limited partnership may be constituted as either open or closed-ended, may be established for private or public participation and can only be established as a non-UCITS fund.

UCITS Funds

As funds established under the UCITS regime may be offered to the public throughout the EU they are subject to a more stringent regulatory regime than non-UCITS funds in terms of permitted investments and investment restrictions. All UCITS funds are required to publish and offer to potential investors a short-form simplified prospectus. The simplified prospectus includes information relating to the investment objectives and policies of the fund, details of investment risks, details of all fees and expenses and basic economic information which must be updated annually including the portfolio turnover rates and total expense ratios for the fund. The simplified prospectus did not achieve the objective of providing investors with a short document which would distil the pertinent details about a UCITS taken from its prospectus. As result, under UCITS IV the simplified prospectus has been replaced by the key investor information document ("KIID"). The rules on the length and content of, and language used in, the KIID are prescriptive. The KIID will contain summary information on the objectives and policies of the UCITS, a synthetic risk and reward indicator ("SRRI"), the costs and charges, past performance and certain practical information in relation to the UCITS. The KIID cannot exceed a doublesided A4 sheet (although for structured UCITS which are more complex three sides of A4 sized paper are permitted). While existing UCITS may choose to issue KIIDs from the UCITS IV implementation date of 1 July 2011, a transitional provision envisaged by the UCITS Directive will apply in Ireland. Accordingly, existing UCITS are not required to issue KIIDs until 1 July 2012 at the latest.

Permitted Investments

The UCITS III Product Directive and the Eligible Assets Directive have significantly increased the range of permissible investments for UCITS funds. In addition to the expanded list of permissible transferable securities that may be acquired by a UCITS, UCITS may also invest in bank deposits, money market instruments, financial derivatives and units of other funds (including certain exchange-traded funds ("ETFs")).

Other changes of note include the following:

- UCITS can now be established as fund of funds and index tracking funds;

- UCITS may invest in structured financial instruments ("SFIs") provided that they meet certain eligibility and liquidity requirements. SFIs are financial instruments designed to meet specific investment objectives and whose value is derived from underlying assets such as equities, bonds and currencies;

- UCITS can now invest in financial derivative instruments as part of the main investment objective of the fund as well as for efficient portfolio management purposes (provided that the underlying instruments are permitted investments). This has enabled UCITS to gain exposure to a variety of new asset classes such as: hedge fund indices, credit derivatives, commodity indices and allows UCITS to pursue various long/short strategies such as 130/30 long/short strategies.

UCITS are permitted invest no more than 10% of net assets in unlisted transferable securities and money market instruments. Until recently, the interpretation of the provision has been that investments in this "10% unlisted bucket", would not be permitted to comprise, for example, unregulated funds. The Central Bank of Ireland has recently reconsidered its interpretation of this provision and confirmed that a UCITS is permitted to invest up to 10% of its net assets in aggregate in any type of unlisted securities and unregulated investment funds, including hedge funds, provided the investment complies with the eligibility criteria for UCITS.

The eligibility criteria which must be met in relation to such investments are, in summary:

- the potential loss which the UCITS may incur with respect to holding the investments is limited to the amount paid for them;

- the liquidity of the investments will not compromise the ability of the UCITS to meet its redemption obligations;

- there must be a reliable valuation of the investments on a periodic basis;

- there must be regular and accurate information available to the UCITS on the investments;

- the investments must be negotiable;

- the investments must be consistent with the stated investment objectives of the UCITS; and

- the risk of the investments must be adequately captured by the risk management process of the UCITS.

A UCITS fund may not borrow money, grant loans or act as guarantor on behalf of third parties although it may borrow up to 10% of the net asset value of the fund on a temporary basis, for example to meet redemption requests.

Investment Restrictions

A UCITS fund is subject to the following investment restrictions:

- a UCITS fund may invest no more than 10% of its net assets in unlisted securities;

- a UCITS fund is precluded from investing more than 10% of its assets in any one issuer. Where the fund invests more than 5% of its assets in any issuer the maximum amount of such holdings in excess of 5% is limited to 40% of the net asset value of the fund;

- a UCITS fund may invest up to 35% of its net assets in any one security issued by a government or public international body;

- a UCITS fund may invest up to 100% of its assets in transferable securities and money market instruments issued or guaranteed by an EU member state, its local authorities, a non-EU member state or public international body of which one or more EU member states are members provided that equivalent protections are in place to that of a UCITS, and provided further that the fund holds securities from at least six different issues with securities from any one issue not exceeding 30% of the net assets of the fund;

- a UCITS fund may not invest more than 20% of its net assets in any one collective investment scheme and the schemes in which a UCITS fund invests must be UCITS or non-UCITS schemes with the essential characteristics of a UCITS. Furthermore, investment in non-UCITS may not, in aggregate, exceed 30% of net assets;

- the risk exposure of a UCITS fund to a counterparty to an OTC derivative may not exceed 5% of net assets. This limit can be raised to 10% in certain circumstances;

- not more than 20% of the net assets of a UCITS fund may be invested in deposits made with the same credit institution. Deposits with any one credit institution held as ancillary liquidity must not, subject to exceptions, exceed 10% of net assets;

- a UCITS may not borrow except for temporary convenience purposes. Such borrowing is limited to 10% of the net asset value of a fund;

- a UCITS fund may not acquire any units carrying voting rights which would enable it to exercise a significant influence over the management of the issuer.

Non-UCITS Funds

The non-UCITS regime imposes varying investment and borrowing restrictions depending on whether the fund is established for retail investors, professional investors or qualifying investors. The sub-categories of non-UCITS funds and the restrictions applying to them are as follows:

Retail Funds

There is no minimum subscription requirement for a non-UCITS retail fund. Generally, retail funds will be obliged to ensure that they maintain an adequate spread of investments and the diversification limits for a non-UCITS retail fund are substantially similar to those of a UCITS fund. Therefore, (i) not more than 10% of the net assets of a fund may be invested in securities which are not traded on an approved regulated market; (ii) no more than 10% of the net assets of a fund may be invested in securities issued by the same issuer; and (iii) a fund may not hold more than 10% of any class of security issued by a single issuer.

The Central Bank may authorise a fund to invest up to 100% of its assets in different transferable securities issued or guaranteed by government, municipal or public international bodies. Generally a retail fund may not keep more than 10% of its net assets on deposit with any one institution and this limit is increased to 30% for certain deposits issued or guaranteed by credit institutions. Borrowings cannot exceed 25% of a fund's net assets but, in contrast to a UCITS fund, borrowings can be effected for investment purposes as well as to meet redemption requests. All non-UCITS funds are precluded from acquiring a significant influence over the management of any issuing body.

Professional Investor Funds ("PIF")

A PIF has a minimum subscription requirement of ¤100,000. The Central Bank will grant to PIFs on a caseby- case basis derogations from the investment restrictions imposed in relation to retail funds. Typically all of the investment restrictions applicable to a retail fund are doubled for a PIF. For example, a PIF may invest up to 20% of its net assets in the securities of any one issuer. The Central Bank will generally permit borrowings of up to 100% of the net assets of a PIF.

Qualifying Investor Funds ("QIF")

A QIF is a scheme which is marketed only to qualifying investors. A qualifying investor is defined as:

- an investor who is a professional client within the meaning of Annex II of MiFID;

- an investor who receives an appraisal from an EU bank, a MiFID firm or a UCITS management company that the investor has the appropriate expertise, experience and knowledge to understand adequately the investment in the fund; or

- an investor who certifies that it is an informed investor by providing either a confirmation in writing that it has such experience in financial and business matters as would enable the investor to evaluate properly the merits and risks of the prospective investment or a confirmation that the investor's business involves, whether for its own account or for the account of others, the management, acquisition or disposal of property of the same kind.

The minimum subscription amount for a QIF is ¤100,000. The aggregate of an investor's investment in the various sub-funds of an umbrella are taken into account in reaching this amount.

The Central Bank's usual conditions with regard to borrowing and diversification of investments do not apply. Some, but not all, of the Central Bank's other requirements in relation to the operation of non-UCITS funds are also disapplied. A QIF is not subject to borrowing or leverage limits. It must however specify in its prospectus the extent, if any, to which borrowing or leverage will be used.

QIFs, with net assets of over ¤152 billion, account for 74% of the assets of non-UCITS funds established in Ireland.2

The Directive on Alternative Investment Fund Managers ("AIFMD") which will come into force from 2013 will present challenges to promoters managing and/or marketing alternative investment funds in Europe (see our bulletin on this, "Update on Alternative Investment Fund Managers (AIFM) Directive"). The QIF, as a regulated alternative investment fund product, should provide some interesting opportunities to those promoters whose existing structures will not work under the AIFMD regime.

Specific Categories of Non-UCITS funds

The Central Bank has issued notices which set out the parameters of investment for a variety of different fund types. Examples of some of the types of non-UCITS funds which may be established in Ireland are set out below.

Fund of Funds

A non-UCITS fund of funds, like any other non-UCITS fund, may be established as a retail fund, a PIF or a QIF. A retail fund of funds must have as its principal objective the investment in shares or units of other collective investment schemes ("target funds"). These target funds must be authorised in Ireland or in a jurisdiction which, in the opinion of the Central Bank, provides an equivalent level of investor protection to that which applies to Irish investment funds. In order to ensure that investors are adequately protected a fund of funds may not invest more than 20% of its net assets in the units of any one scheme except that this limit may be raised to 30% for one of the target funds in which the fund of funds invests. A fund of funds may invest up to 10% of its net assets in transferable securities other than units of collective investment schemes. A fund of funds is precluded from investing in the units of any other fund of funds. If a fund of funds invests in shares or units of a target fund managed by the same or a related or associated management company as the management company of the fund of funds the management company must waive any preliminary charge. Any commission received by the management company must be paid into the property of the fund of funds.

A PIF fund of funds may invest up to 40% of its net asset value in another target fund. A PIF is permitted to invest in target funds which do not provide equivalent investor protection to that obtaining in Ireland but the maximum amount which may be invested in any one unregulated target fund is limited to 20% of the net asset value. A QIF fund of funds may invest all of its assets in unregulated target funds provided that it may not invest more than 50% of its net assets in any one target fund.

Feeder Funds

A feeder fund must have as its principal objective the investment of the fund's assets in a single collective investment scheme (the "underlying scheme") which is authorised in Ireland or in another jurisdiction which provides equivalent investor protection to that applicable to Irish investment funds. On an exceptional basis and with the approval of the Central Bank, QIFs may be permitted to invest in an unregulated fund.

The management company of the underlying scheme must waive the initial charge which it is entitled to charge for its own account in relation to the acquisition of units. Commission received by the management company of the feeder fund by virtue of an investment in the units of the underlying scheme must be paid into the property of the feeder fund. The prospectus for the feeder fund must contain sufficient information relating to the underlying scheme to enable investors to make an informed judgment of the investment.

Closed-Ended Funds

A closed-ended fund must have a finite closed-ended period which is disclosed to investors. The length of time during which a fund may be closed will depend on the category of fund (retail, professional or qualifying investor fund) and on the extent to which liquidity is provided for in relation to the units or shares. Units or shares may be issued other than at their net asset value but the fund must demonstrate that the unitholders or shareholders are not prejudiced by such a provision. The units or shares will not be redeemed by the fund during the closed-ended period and the prospectus must specify the availability or otherwise of other mechanisms through which unitholders or shareholders can dispose of their units or shares during the period.

Hedge Funds

The Central Bank has specific rules for Irish funds, normally hedge funds, which appoint a prime broker. The Central Bank permits assets of QIFs and PIFs to be passed to prime brokers, provided that the Central Bank's requirements relating to both the prime broker and to the specific arrangement under which the assets of the fund are passed to the prime broker are met. The prime broker, or its parent company, must have a minimum credit rating of A1/P1, it must be regulated as a broker by a recognised regulatory authority and additionally it, or its parent company, must have shareholders' funds in excess of €200 million or the foreign currency equivalent thereof. In relation to hedge funds structured as PIFs, the maximum level of assets which may be passed to the prime broker is 140% of the fund's indebtedness to the prime broker. No such limit is applied in respect of hedge funds structured as QIFs.

Approval, Regulation and Supervision of Funds

The Central Bank is the regulatory authority responsible for the approval and supervision of all regulated investment funds in Ireland. The fund's prospectus and constitutional document (such as a trust deed or memorandum and articles of association) must be submitted to the Central Bank for prior approval (except in the case of QIFs which are subject to a different filing procedure as noted below). Any amendments to these fund documents are also subject to prior approval by the Central Bank.

All promoters, investment managers and discretionary investment advisers must be approved to act as such by the Central Bank. This approval process involves submitting to the Central Bank an application form and sufficient background information to enable the Central Bank to be satisfied that the applicant has the appropriate personnel, experience, financial resources and requisite regulatory status to perform the role.

Each fund is required to have a minimum of two Irish resident directors appointed to its board of directors (if structured as an investment company) or to the board of directors of its management company (if structured as a unit trust or CCF). The Central Bank must approve all appointments to the board of directors in advance, but will only do so once it is satisfied that the proposed director meets the "fit and proper" test i.e. that the proposed director is fit and proper in terms of (i) competence and capability, (ii) honesty, integrity, fairness and ethical behaviour and (iii) financial soundness.

The Central Bank must also be notified of all resignations from the board of directors.

Management Companies

A management company must be appointed in respect of all Irish unit trusts and common contractual funds. A fund structured as an investment company may also appoint a management company or the fund can be structured as a so-called self-managed fund.

All management companies must at all times maintain a minimum capital requirement of ¤125,000 or one quarter of its preceding year's fixed overheads, whichever is the greater. However, additional capital requirements apply to a management company of UCITS funds which manage assets in excess of ¤250 million where the management company must maintain additional capital of 0.02% of the value of the assets under management in excess of ¤250 million, subject to a maximum level of capital of ¤10 million.

The UCITS Directive provides specific rules for the structure, operating conditions and capitalisation requirements for management companies.

Timing of Fund Authorisation

With respect to all funds other than QIFs, the draft fund documentation must be filed with the Central Bank for review and the fund is typically approved by the Central Bank within five to six weeks from the date of submission of the documents, depending on the complexity of the fund. However, there is an accelerated authorisation procedure for QIFs. Under the QIF authorisation procedure, the Central Bank will approve the fund within one day of filing of the fund documents with the Central Bank provided the legal advisers to the fund provide certain confirmations to the Central Bank regarding the structure of the fund and the content of the fund documentation.

Taxation

A fund authorised by the Central Bank is not subject to Irish tax of any kind. Certain Irish resident investors are chargeable to Irish tax on transfers or redemptions of shares or payments of dividends.

Appendix

Statistics on Worldwide Distribution of Irish UCITS and non-UCITS Funds

Footnotes

1 Source: Irish Funds Industry Association ("IFIA"), April 2011

2 Source: IFIA, April 2011

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.