The Finance Bill 2011 was published today, giving effect to the measures announced by the Minister on Budget day and introducing some previously unannounced measures.

The tax highlights............

- No change to 12.5% rate of corporation tax.

- Confirmation of the changes announced in the Budget in relation to income tax, Universal Social Charge and PRSI.

- Changes to the Section 110 taxation regime, including both a broadening of the definition of qualifying assets and a restriction on the deductibility of certain interest payments.

- Changes to preliminary tax payment dates for income tax and capital acquisitions tax.

- Changes to interest deductibility provisions for certain intra group transactions.

- Property based capital allowances restrictions subject to Commencement Order following the preparation of an economic impact assessment.

- The Bill introduces legislation to give effect to the previously announced Employment and Investment Incentive scheme.

- Provisions to give effect in the tax system to the Civil Partnership legislation and the tax treatment of bank bonuses to follow in later stages of the Bill.

Taxation of individuals

Many of the Finance Bill measures copper-fasten the announcements previously made in the Budget. However, some notable new legislation is proposed which had not previously been announced.

Change to pay & file deadline for self-assessed taxpayers

The pay and file deadline for self-assessed taxpayers of 31 October has been brought forward to 30 September for the 2011 year of assessment onwards. Self-assessed taxpayers must now pay preliminary tax due for 2011 by 30 September 2011, and 2011 tax returns must be filed with any 2011 balance of tax payable by 30 September 2012. The 14 day extension granted in recent years to taxpayers who pay and file using Revenue's On-line System (ROS) will continue to apply.

Student contribution charge

The current third level Student Services Charge of €1,500 is being replaced with a new Student Contribution Charge of €2,000. However, existing tax relief for thirdlevel tuition is being amended to provide that the first €2,000 in fees will not qualify for tax relief for students in full-time education. For part-time students, the first €1,000 in fees will not qualify. Where families have two or more children in third level education on a full-time basis and where both are liable to the Student Contribution Charge, tax relief at 20% will be available on the aggregate paid above €2,000.

Future changes

The Minister also confirmed that the changes required in the tax system to give effect to the Civil Partnership legislation, as well as the tax treatment of bank bonuses in relevant financial institutions will be considered at later stages in the process of passing the Bill.

It is also anticipated that further announcements will be made regarding the collection mechanism to be applied for PRSI charges on share option gains.

Recap on measures announced in the Budget

The Finance Bill copper-fastens many of the changes announced in last December's Budget including those which were the subject of financial resolutions passed into law in December.

The most significant of those measures now consolidated with the Bill are:

- Universal Social Charge: The new Universal Social Charge (USC) will replace both the health and income levies. The highest USC rate of 7% will apply on all income over €16,016.

- PRSI: The employee PRSI earning ceiling of €75,076 has been removed. Furthermore, PRSI relief on employee pension contributions has been abolished and a 50% restriction will now apply to employer PRSI relief on those same contributions.

- Tax credits and reliefs: As expected following both the National Recovery Plan and the Budget, the standard rate bands and main credits have been reduced by 10% for 2011. A number of credits have also been curtailed.

- Ex-gratia termination payments: The Finance Bill confirms a cap of €200,000 on tax free ex-gratia termination payments made on or after 1 January 2011.

- Share awards:

-

- PAYE withholdings will be required for shares awards, which are also now within the charge to PRSI and USC;

- PRSI and USC charges will apply to Revenue approved profit sharing schemes and SAYE schemes;

- Approved Share Option Schemes were abolished with effect from 24 November 2010;

- Relief for new shares purchased on issue by employees after 7 December 2010 has been abolished.

Pensions

The Bill gives legislative effect to pension measures that were announced in the Budget and to some financial resolutions that had issued shortly thereafter.

Reduction of the Standard Fund Threshold

The upper limit for tax relieved pension funds for individuals, the Standard Fund Threshold, is now €2.3m. A penal rate of tax applies to the excess above the limit.

Individuals have until 7 June 2011 to agree a higher Personal Fund Threshold with the Revenue Commissioners if the value of their pension benefits already exceeds the €2.3m limit at 7 December 2010.

Individuals that had already agreed higher Personal Fund Thresholds (above €5m) under the original legislation of 2005 can still use that higher limit.

In valuing Defined Benefit pension plans for the purposes of this legislation the Bill provides that the same multiplier must be used, both to value the pension for threshold purposes and also to value the pension at retirement.

The standard multiplier is to be 20 times the annual pension promise.

Restriction of pension tax free lump sum

Where the rules of a Revenue approved pension scheme permit a portion of the pension to be taken as a lump sum the following will be the tax treatment of that allowable lump sum:

- The first €200,000 will be exempt from tax

- The next €375,000 will be liable at 20% and this amount will be ring fenced so that personal allowances/ deductions/ charges etc cannot be used to reduce the tax

- Sums above €575,000 (25% of the €2.3m threshold above) will be treated as emoluments of the individual and be liable to marginal rate Income Tax etc.

Approved Retirement Fund (ARF) rules

From the passing of the Bill the ARF options will, in addition to those individuals who already qualify, now become available to all members of Defined Contribution (DC) pension schemes. This will include DC members who had already retired but who had chosen the option to temporarily defer the purchase of their annuity under an initiative of December 2008. Individuals who elect for the ARF options must satisfy the lower of the following new minimum set aside rules:

- Invest the first €120,000 or so in a Minimum Retirement Fund or

- Have other annual pension income of around €18,000 already in payment. If the €18,000 pension test can be satisfied after the retirement but before age 75 the Minimum Retirement Fund can then be used as an ARF.

- There are certain transitional measures on Minimum Retirement Funds rules for those who availed of the option to defer the purchase of annuity or for those who retire before the passing of the Bill.

The Bill confirms the increase in the imputed distribution that must be made from ARFs. The rate of annual imputed distribution from 31 December 2010 will be 5% of the value of the ARF at the end of each year.

Reduction in the annual earnings limit for individual pension contributions

The Bill provides that from 1 January 2011 the maximum earnings limit for individual pension contributions will be €115,000. This applies even where the pension contribution is referable to 2010 earnings under the 'throw back' provisions. Universal Social Charge (USC) and PRSI

Contributions made by individuals to pension plans will not qualify for relief from the USC.

The Budget had announced changes to PRSI relief for Employees and Employers in respect of pension contributions and these were contained in Social Welfare legislation that was enacted in December 2010.

Business taxation

Start-up companies

The Bill confirms that the exemption for start up companies from corporation tax and capital gains tax relief is to be extended to companies which commence a new trade in 2011. The Bill also amends the relief to now link the amount of relief available to the amount of employer's PRSI paid by a company in an accounting period subject to a maximum of €5,000 per employee and an overall limit of €40,000. Where the amount of qualifying employers PRSI is lower than the reduction in corporation tax, relief will only be available for that lower amount. It should be noted that relief is not available where the trade to be carried on by the new company would, if carried on by an associated company of the new company, have formed part of an existing trade of that associated company.

This change applies in respect of accounting periods commencing on or after 1 January 2011

Interest Deductibility

Trade Interest

The Bill denies a trading deduction for interest on funds borrowed from a connected company where those funds are used to acquire assets (other than trading stock and qualifying intangible assets) from another connected company.

However, relief for interest continues to be available in cases where funds borrowed from a connected company are used to acquire a trade which was previously carried on by a company not within the charge to corporation tax. In such cases, relief is given up to the amount of the profits or gains of the acquired trade which are taxable as trading income in Ireland. Anti-avoidance provisions also exist to counteract schemes or arrangements designed to circumvent the connected party borrowings test.

This provision applies to loans made on or after 21 January 2011 other than any such loans made in accordance with a binding agreement made before that date. Existing loan arrangements should not be impacted by these changes.

Non Trade Interest

The Bill also introduces significant changes to the provisions of Section 247 governing the deductibility of interest available to companies on loans applied in lending to or acquiring shares in other companies. The section applies to any loans made on or after 21 January 2011 other than any such loans made in accordance with a binding written agreement made before that date. Existing loan arrangements should not therefore be impacted.

The changes made are complex and are targeted at particular intra-group arrangements.

The following is a summary of the main amendments:

- Where the company seeking Section 247 interest relief on-lends the funds or uses the funds to subscribe for shares in other companies, a deduction is only available if the money is used by the recipient for the purposes of a trade, for certain property rental purposes or for the purposes of holding stocks, shares or securities in trading or rental companies.

- The company seeking interest relief must have a material interest in the company that ultimately uses the borrowed money and these companies must have a common director.

- Restrictions on Section 247 relief are introduced to mirror the restrictions on trade interest deductions outlined above. Therefore, no relief is available on a loan from a connected company which is used to acquire certain assets from another connected company. However, relief for interest continues to be available in cases where funds borrowed from a connected company are used to acquire a trade which was previously carried on by a company not within the charge to corporation tax. In such cases, relief is given up to the amount of the profits or gains of the acquired trade which are taxable as trading income in Ireland.

- Relief under Section 247 is also restricted in circumstances where the companies which use the borrowed monies are not within the charge to Irish corporation tax and which are in receipt of interest on those funds.

- Interest on funds lent to a company which are used for the purposes of a trade will only be relieved at the rate of 12.5% going forward, rather than the rate of 25% which was previously available.

- The new provision also permits companies to elect that the recovery of capital provisions will not apply in the context of certain share for share exchanges.

Research & Development tax credit

The Finance Bill introduces a technical change to the definition of qualifying expenditure for the purposes of the R&D tax credit which excludes intangibles which qualify for relief under the IP regime.

Patent royalties

The Finance Bill confirms the announcements contained in the National Recovery Plan and the Budget in relation to tax exemption for qualifying patent royalties. Section 25 of the Bill provides that the exemption both for dividends and income earned directly from same is abolished effective from 24 November 2010.

Small and medium enterprises

The Bill introduces a new Employment and Investment Incentive and Seed Capital Scheme to replace the existing Business Expansion Scheme (BES) and Seed Capital Scheme (SCS). This new initiative was flagged at the time the National Recovery Plan and was announced in the Budget. The new scheme will only come into operation after the necessary approval from the European Commission has been received and will be subject to Commencement Order. The current BES and Seed Capital provisions will continue until such time as the Commencement Order gives effect to the new provisions.

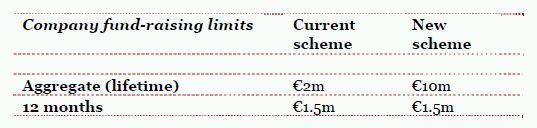

The Bill confirms the previous announcement of significant increases in the investment limits permitted under the new scheme, as follows:-

The procedural requirements outlined for the first time today appear to be more straightforward to those that currently apply. Furthermore, the minimum holding period is reduced from 5 to 3 years, which is a welcome change.

However, the maximum rate of tax relief for subscriptions for eligible shares that may be claimed initially has been reduced from 41% to 30%, in recognition of the reduced holding period. A further 11% relief may be available at the end of the holding period if the investee company has increased its number of employees since the investment was made, or the company has increased its expenditure on research and development. Relief under the new scheme will continue to be subject to the restriction on reliefs for high earners.

Financial services

Section 110

There are a number of changes proposed to Section 110. Section 110 provides for a special tax regime for "qualifying companies" engaged in specified financial transactions including securitisations. While such companies are subject to corporation tax at a rate of 25%, they are entitled to a tax deduction for certain payments, including interest on a profit participating loan (PPL).

Section 110 companies can currently only invest in financial assets and this will be extended to commodities, carbon offsets and leased plant and machinery (including aircraft). These are very welcome changes given the recent market interest in commodities such as gold and the commitment to develop the green IFSC agenda in the case of carbon credits. In addition the extension to leasing should also help strengthen Ireland's position as the preferred destination of choice for aircraft leasing.

The Finance Bill introduces new provisions to restrict the deduction for interest payments made under PPLs to circumstances where such interest is paid by a Section 110 company:

- to an Irish tax resident person,

- to a pension fund, government body or other specifically tax exempt person resident in a treaty country, provided certain conditions are met,

- to a non-resident recipient in a treaty country which generally applies tax on foreign source income, provided a deduction is not available by reference to the amount of interest received (e.g. no deduction is available where the treaty recipient is only taxed on a portion of the interest received), and

- under a quoted Eurobond or Wholesale Debt instrument, provided certain conditions are met

The new provisions also impact total return swap payments made by a Section 110 company on or after 21 January 2011. Such payments will not be tax deductible in circumstances where, under a hypothetical test, a deduction would not be available if it were a PPL interest payment.

"Grandfathering" provisions protect certain interest payments under a PPL from the changes set out above. The new provisions do not apply to any interest paid on or after 21 January 2011 in respect of securities issued before 21 January 2011, i.e. such payments will continue to be deductible. A similar grandfathering provision applies in respect of total return swap agreements made before 21 January 2011.

It is possible that there may be some changes to the legislation introduced today prior to it being passed into law as consultation between the industry and the fiscal authorities continues.

DIRT

As indicated in the Budget, the Finance Bill provides for a 2% increase in the rate of Deposit Interest Retention Tax ("DIRT") applying to deposits, with the rate increasing from 25% to 27% (and in the case of certain longer term savings products from 28% to 30%) with effect from 1 January 2011.

Exit tax

The Finance Bill also gives effect to a 2% increase in the rate of exit tax applying to profits and/or gains from investments in both domestic and foreign life assurance policies and investment funds. The increased rates of 27% (for payments made annually or more frequently) and 30% (for payments made less frequently than annually) apply with respect to payments, including deemed payments, made from 1 January 2011. The 2% increase also extends to profits and gains from investments in personal portfolio life policies and personal portfolio investment undertakings.

Environmental taxation

Home improvements As announced in the Budget, a new scheme to promote employment and energy efficiency in homes is introduced in the Finance Bill. The scheme is designed to encourage individuals who are not the landlords of the property concerned to make their homes more energy efficient. Relief is granted in the form of an income tax credit at the standard rate for expenditure of up to €10,000 in the case of a single person, or €20,000 in the case of married couples who are jointly assessed. The tax relief is granted by way of repayment in the following tax year.

The scheme will be operated primarily by the Sustainable Energy Authority of Ireland, in conjunction with the Revenue Commissioners, and a fund of €30m will be available for this scheme in a single tax year. This section will be brought into operation by way of a Ministerial Order.

Energy efficient equipment

As previously outlined in the Budget, the scheme of 100% upfront capital allowances (tax depreciation) for energy efficient equipment has been extended by the Finance Bill for a further three years to 31 December 2014. Companies which qualify for these accelerated allowances benefit from cashflow savings as tax relief for this spend can be claimed in the first year of use rather than over the normal eight year capital allowance period for other items of plant.

Solid fuel carbon tax

Finance Act 2010 outlined that a carbon tax charge will apply to the supply of solid fuel in Ireland. A number of exceptions were included whereby, if fuels were supplied for a use which did not constitute "combustion", the carbon tax charge would not apply.

The current Bill provides that tax is not charged on solid fuel supplied to a manufacturer of a solid fuel product, where the fuel is used as a raw material in manufacturing the solid fuel product. Manufacture in these circumstances is defined as

"the reconstituting or processing of a solid fuel to produce a solid fuel that has characteristics that are distinct from the solid fuel from which it was produced ... but does not include extraction, washing, drying, breaking or grinding".

In these circumstances, tax is charged when the manufactured solid fuel product is first supplied in the State. The supplier of the manufactured product is liable to pay the tax charged.

Relevant Contracts Tax (RCT)

The current paper-based RCT system will be replaced by an electronic system. The new electronic system will have three RCT rates: 0%, 20% and 35%.

The rate that is applied to a subcontractor will depend on the subcontractor's compliance record. Subcontractors who satisfy the current criteria for a C2 card will qualify for the 0% rate. The standard 20% RCT rate will apply to subcontractors who are registered with Revenue and have a good compliance record. The 35% rate will apply to all other subcontractors.

Principal contractors will apply online for confirmation of the RCT rate to apply to a subcontractor.

No repayments of RCT will be made during the year. Interim credit for tax suffered will be allowed by way of offset against other open tax liabilities.

Property based tax incentives

The Finance Bill amends the restrictions announced in the Budget in relation to property based tax incentives. More importantly, the Finance Bill makes the restrictions subject to a commencement provision which means that the measures will only take effect from the beginning of the tax year following the preparation and publication of an economic impact assessment. In practical terms, this means that the restrictions can only apply from 1 January 2012 at the earliest.

Commenting on the Finance Bill, the Minister stated that in light of the wide range of concerns that has been expressed regarding the potential effects on the real economy, and on employment in particular, the Government decided that such an assessment should be undertaken in advance of the commencement of the provisions.

The following is a summary of the key measures proposed in relation to property based tax incentives:

- Capital allowances claimed by individuals and companies on rental properties may only be offset against rental income from the specific property concerned.

- In the case of 7 and 10 year schemes, any unused capital allowances may not be carried forward beyond the 7 or 10 year write off period for the property concerned.

- In the case of schemes where the capital allowances are claimed over a period exceeding 10 years but less than 25 years, the write off period is reduced to 7 years and any unused allowances may not be carried forward beyond the 7 year write off period.

- Section 23 type relief may only be offset against rental income from the property in relation to which the relief is being claimed and any unutilised Section 23 relief will be lost at the end of the 10 year holding period.

- If a Section 23 property is sold within the holding period, the new owner will not be entitled to claim any Section 23 relief notwithstanding the claw back suffered by the vendor.

Stamp duty

Residential property

The Bill introduces the significant changes announced in the Budget in relation to stamp duty on acquisitions of residential property. The rate of stamp duty on residential property is reduced from the current rates of up to 9% to a rate of just 1% (with any excess above €1m chargeable at 2%).

The Bill also confirms the abolition of existing reliefs and exemptions for acquisitions of residential property, including first time buyer relief, relief for purchases of new property by any owner-occupier, relief for the transfer of a site to a child, the exemption for purchases not exceeding €127k and the 50% relief for transfers of residential property between relatives.

The new stamp duty rates will apply to any conveyances, transfers or leases executed on or after 8 December 2010, while transitional measures will ensure that any purchaser, who has contracted to buy residential property before 8 December 2010 and completes the purchase before 1 July 2011, will not be adversely affected by the new rules.

The Bill also includes a one-off retrospective relief for the acquisition of residential property by the parent of an incapacitated person, or the trustee of a trust established for that person, where the property is to be occupied as the incapacitated person's principal place of residence. Any such purchase in the period 1 January 2010 to 7 December 2010 will be treated as a purchase by a first-time buyer, i.e. fully relieved from any duty.

Health insurance levy

The Bill contains two amendments in relation to the levy payable by health insurance providers. The levy has been increased for all renewals and new contracts entered into from 1 January 2011 to €66 (from €55) for each insured person aged less than 18 years and €205 (from €185) for each insured person aged 18 years or over. The due dates for payment of the levy have also been brought forward from 30 September 2011 and 31 January 2012, to 21 September 2011 and 21 January 2012 respectively.

Capital acquisitions tax (CAT)

The Bill brings forward the pay and file date for gift and inheritance tax from 31 October to 30 September. This amendment applies to returns filed and tax paid on or after 21 January 2011.

The Bill also gives effect to the reduction in the gift/inheritance tax thresholds as announced in the Budget. The reduced thresholds are as follows:-

Customs & Excise

Introduction of tax-geared penalties for Excise

The Finance Bill introduces new tax-geared penalties for excise offences which result in a tax underpayment. This brings excise law into line with other taxes. The level of penalty depends on the offence, whether that offence was deliberate or careless and the level of co-operation with the Customs Authorities.

The Bill also extends to excise law the concept of prompted and unprompted qualifying disclosures which mitigate the levels of penalties.

Introduction of administrative penalties for Customs

The Bill introduces for the first time administrative penalties for customs where a trader fails to comply with specific obligations under the EU Customs Code. These penalties range from €100 to €2,000 per infringement.

These penalties are payable to the Minister for Finance and cannot be appealed under the normal customs appeals mechanism.

Betting Licences and Betting Duties

The following changes will come into force on a date to be determined by the Minister for Finance.

Betting Licences

The Bill introduces a licensing requirement for remote bookmakers (i.e. bookmaking by internet, telephone or any means of electronic or telegraphy communication) and for remote betting intermediaries (i.e. the provision of facilities for persons to make bets with others by remote means).

The initial licence for remote bookmakers and remote betting intermediaries will be €5,000. However, the annual renewal of the licence will, for remote bookmakers, be based on annual turnover and will range from €5,000 to €100,000. Similarly, the annual renewal of licences for remote betting intermediaries will be based on annual commission earnings and will also range from €5,000 to €100,000.

Betting Duties

The current 1% rate of betting duty is now extended to be payable by remote bookmakers and shall apply to bets made, laid or otherwise entered into with remote bookmakers. Also, a new duty known as "betting intermediary duty" is payable by remote betting intermediaries and shall apply at a rate of 15% of commission charges. (Commission charges are defined as the amount that persons in the State are charged to make bets using the facility of the remote betting intermediary).

Confirmation of Budget 2011 Excise Changes

Mineral Oil Tax

The Finance Bill confirms the excise duty increases imposed on petrol and auto-diesel by Budget 2011 effective from 8 December 2010.

Vehicle Registration Tax

The Bill confirms the VRT changes set out in Budget 2011 relating to the extension of the car scrappage scheme, the continued VRT relief for plug-in hybrid electric vehicles, the new VRT reliefs for flexible fuel vehicles and hybrid electric vehicles and the increase in VRT on commercial vehicles. The Bill also confirms the continued VRT exemption for electric vehicles but restricts the relief to a maximum of €5,000 from 1 May 2011.

Air travel tax

The Bill confirms that a new single air travel tax of €3 will be levied on passengers departing Irish airports from 1 March 2011. (This replaces the previous two-tier system introduced on 30 March 2009 of €10 for flights to destinations over 300km and €2 for lesser flights.)

VAT

The Finance Bill proposes the introduction of a number of amendments to the VAT Act, as highlighted below.

Premises providers

A premises provider who allows non-established vendors operate from his premises must notify the Revenue in relation to such vendors who operate from the premises for periods of less than 28 consecutive days (previously 7 consecutive days)

Public bodies & local authorities

Where public bodies (including local authorities) sell residential property or burial plots which were acquired prior to 1 July 2010 they may recover a proportion of any input VAT incurred upon acquisition in accordance with the Capital Goods Scheme.

Scrap Metal

The supply of scrap metal within the State will be subject to VAT on the reversecharge basis, i.e. VAT will be accounted for by the person who deals in or receives scrap metal from other taxable persons.

Public postal services

VAT exemption in relation to the 'universal service' is extended to designated commercial providers of that service.

Online bookmakers and intermediaries

VAT exemption is extended to certain online bookmakers and online betting intermediaries who will be subject to excise duty. This extension of VAT exemption is subject to commencement by Ministerial Order.

New penalties

Statutory penalties are now extended to the following:

- Failure to file VIES returns

- Failure to create and issue (where required) a Capital Goods Record

- Failure to notify the Revenue Commissioners that a VAT 13B authorisation should cease

- Failure to provide certain documentation upon the assignment/surrender of legacy lease

Correction of errors

In consolidating the VAT Act in November 2010 a number of errors in the then VAT Act, 1972 were identified. These are now being corrected.

Miscellaneous

False claims for tax relief

New measures have been introduced granting Revenue additional powers in respect of false claims for tax relief or tax credits made by or on behalf of taxpayers. The measures allow Revenue to impose a penalty of €3,000 in addition to seeking recovery of any tax refunded plus interest.

Tax administration changes

The Bill also contains provisions to:

- facilitate additional methods for the payment of tax such as by credit card or debit card; and

- strengthen taxpayer confidentiality by prohibiting unauthorised disclosure by Revenue of personal and commercial information provided by taxpayers. This is a welcome provision particularly in the area of R&D claims.

Mandatory Disclosure Regime

The mandatory disclosure legislation introduced in Finance Act 2010 has been subject to further amendment by the Bill. The changes relate to the commencement date for the mandatory disclosure regime and the requirement on promoters to provide a client list. The commencement date has been changed from 3 April 2010 to 17 January 2011 and, in accordance with the mandatory disclosure regulations signed by the Minister for Finance earlier this week, the first disclosures will need to be made not later than 15 April 2011. Thereafter, the statutory deadlines set down in the regulations will apply.

Publication of Tax Defaulters

The Bill amends Revenue's power with regard to the publication of the names of tax defaulters. Revenue may now publish the name of a taxpayer and the amount of tax due where a settlement amount has been agreed with the taxpayer but not paid the agreed settlement amount. Revenue may also publish the amount of tax due by a defaulter where, in a Revenue audit or investigation a taxpayer does not agree a settlement amount involving tax, interest and penalties but a liability to tax is determined by the Appeal Commissioners and a tax-geared penalty is determined by the Courts, these amounts whether paid or not may also be published. The threshold amount which applies from 1 January 2010 is increased from €30,000 to €33,000, as provided for in the Taxes (Publication of Names of Tax Defaulters Order) 2010 published in late December 2010.

Other measures

- Section 70 of the Bill proposes to amend Revenue's power of attachment in respect of outstanding debt owed to Revenue. A notice of attachment in respect of emoluments can now be issued by Revenue and this notice may provide for the attachment of such emoluments to be spread over a period of time.

- The Bill also provides that the use or supply of computer programmes or electronic components to deliberately change electronic data without maintaining the original information is an offence. Similar changes are introduced to deal with the situation where business records are deliberately altered to suppress transactions.

- Provision is made within section 74 of the Bill to remove an obligation on the Collector General to provide a physical receipt for tax paid and to facilitate electronic receipts where possible, for example through ROS.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.