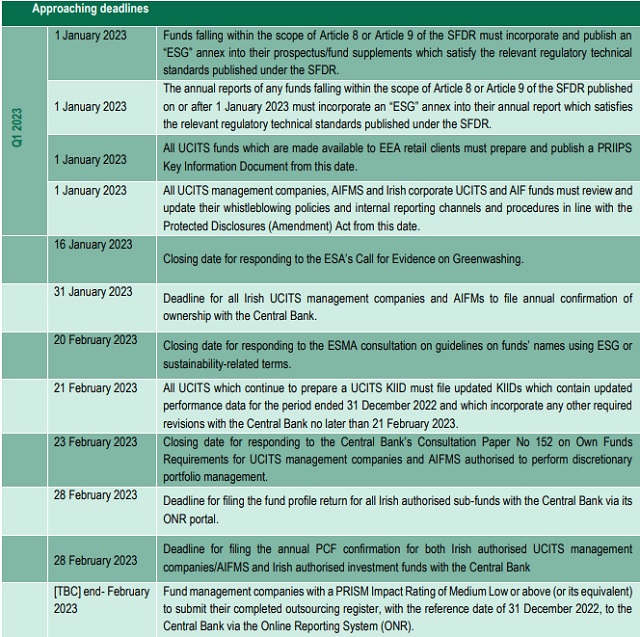

1. APPROACHING DEADLINES

2. UCITS and AIFMD

2.1 Central Bank publishes Consultation Paper 152 on Own Fund Requirements for Irish UCITS Management Companies and AIFMs authorised to provide discretionary portfolio management

Under existing rules, Irish UCITS management companies and AIFMs which are authorised to provide discretionary portfolio management services and additional non-core services (Management Companies with Extended IPM Permissions) must comply with the own funds requirements set down in the Irish UCITS Regulations and Irish AIFM Regulations respectively as well as those set down in Regulation 18(2) of the European Communities (Capital Adequacy of Investment Firms) Regulation 2006 (2006 Regulations).

Under the Central Bank of Ireland's (Central Bank) proposals, all Management Companies with Extended IPM Permissions will be subject to bespoke own fund requirements, under which any firm which does not meet conditions to be a "small and non-interconnected firm" will be required to apply the higher of:

- the own funds requirements set down in the Irish UCITS Regulations or Irish AIFM Regulations as applicable; or

- a Risk to Client K-factor own fund requirement (modelled on the Risk to Client K-factor applicable to MiFID investment firms under the Investment Firms Regulation.

Any firm which meets the conditions to be a "small and non-interconnected firm" will be subject to the own funds requirements set down in the Irish UCITS Regulations or the Irish AIFM Regulations as applicable and would no longer be required to calculate the own funds requirement under the 2006 Regulations.

The closing date for responding to the Consultation Paper is 23 February 2023.

2.2 Central Bank UCITS Q&A- 37th Edition

On 21 December 2022, the Central Bank published the 37th Edition of its UCITS Q&A.

This edition of the Q&A features three new Q&As (ID 1107, 1108 and 1109) which address the Central Bank's requirements for UCITS funds which produce a PRIIPs Key Information Document (PRIIPs KID) from 1 January 2023 to file such PRIIPs KID with the Central Bank.

It confirms that where an existing UCITS produces a PRIIPs KID, there is no requirement to file the PRIIPs KID with the Central Bank on 1 January 2023. The first reporting/submission of these PRIIPs KIDs to the Central Bank is expected to take place in 2024. Periodic updates to such PRIIPs KIDs will only be required to be filed with the Central Bank after the first reporting exercise.

It also sets down the filing obligations relating to new UCITS seeking authorisation or approval from the Central Bank which are producing a PRIIPS KID.

Further information relating to PRIIPS KID is available below under " PRIIPS".

The 37th edition of the Central Bank's UCITS Q&A is available here.

2.3 Central Bank AIFMD Q&A- 45th and 46th Editions

On 5 October 2022, the Central Bank published the 45th edition of its Q&A on AIFMD. This edition incorporates two new Q&As, ID 1154 and 1155.

ID 1154 confirms that for the purposes of the investment limit calculation of a QIAIF which invests more than 50% of "net assets" in another investment fund as detailed in the Central Bank's AIF Rulebook, the reference to "net assets" can be understood to refer to committed capital for any QIAIF which remains closed for redemptions during the capital commitment period. The Central Bank also confirms that this calculation methodology can only be applied for six months following the completion of the capital commitment period.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.