The Income Tax Appellate Tribunal (ITAT), in the case of Emami Infrastructure Limited v ITO Ward 12 (1) Kolkata (ITA No 880/ 2014), has upheld the capital gains tax exemption to a company arising on transfer of capital assets held by the transferor to an Indian company which was wholly owned by transferor's wholly owned Indian subsidiary (Second Step Down Subsidiary).

ITAT held that such transfer of capital assets by the transferor company to its Second Step Down Subsidiary could not be regarded as 'transfer' under section 47(iv) of the Income Tax Act, 1961 (IT Act) and was, therefore, tax neutral transfer. The ITAT held that once the transaction was not 'transfer' within the meaning of section 47 of the IT Act, the question of gains/loss arising from such transaction was infructuous. Consequently, the ITAT rejected the claim of the taxpayer in relation to the capital loss claimed by it on transfer of the shares held by it to its Second Step Down Subsidiary.

Background

Section 47(iv) of the IT Act provides that transfer of capital assets held by a company to its subsidiary company would not be regarded as 'transfer' for the purpose of capital gains tax, provided: (i) the parent company or its nominees hold whole of the share capital of the subsidiary and (ii) the subsidiary is an Indian company.

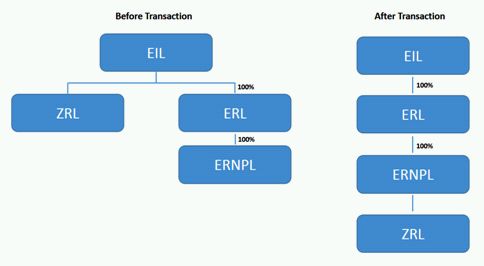

The assessee, Emami Infrastructure Limited (EIL), a listed company, held whole of the share capital of its subsidiary Emami Realty Limited (ERL), which in turn held whole of the share capital in Emami Rainbow Niketan Pvt Ltd (ERNPL). ERL also held shares in Zandu Realty Limited (ZRL), a listed company, which it had transferred to ERNPL, its Second Step Down Subsidiary. ERL claimed capital loss of INR 25,05,20,775 on the transfer of the shares held in ZRL in an off-market transfer and the Assessing Officer (AO) rejected the sale price of INR 2100 per share adopted by EIL and enhanced the income by determining the capital gains at INR 29,00,30,657 on substituting the sale consideration with the average price of the shares of ZRL on the National Stock Exchange at INR 3989 per share. The structure involved in the transaction is as follows:

Judgement

The ITAT held that the transfer of shares of ZRL by EIL to ERNPL, its Second Step Down Indian Subsidiary, would fall within section 47(iv) of the IT Act and would, therefore, be a tax neutral transfer. Since this was a tax neutral transfer, the gain/loss arising from such transfer was held to be irrelevant from an income tax perspective. Accordingly, the ITAT held that the claim of the assessee for carry forward of the capital losses arising from the transfer of shares of ZRL by EIL could not be allowed as the said transfer was tax neutral under section 47(iv) of the IT Act.

The ITAT, in coming to this conclusion, relied on the judgment of the Bombay High Court in Petrosil Oil Ltd v CIT 236 ITR 220 (Bom) and held that since the term 'subsidiary company' was not defined in the IT Act, the definition of 'subsidiary company' under the Companies Act, 1956 (Companies Act), which includes the Second Step Down Subsidiary, could be adopted for the purpose of section 47(iv) of the IT Act. The ITAT also considered the conflicting judgment of the Gujarat High Court in Kalindi Investments v CIT 256 ITR 713, but did not agree with the view adopted by Gujarat High Court. Interestingly, the Gujarat High Court had held that the definition of 'holding company' under the Companies Act could not be adopted for the purpose of section 47 of the IT Act since the language used in section 47(iv) does not use the wider definition of holding company based on control, and requires the parent or its nominees to hold whole of the share capital of the subsidiary company.

Comment

The judgment of the ITAT is a welcome ruling and supports the availability of relief from capital gains tax on transfer of capital assets from a parent company to an indirect subsidiary under section 47(iv). However, as a natural consequence of allowing the availability of such relief, the assessee could not claim capital loss that it had incurred in the present facts. Thus, where the capital assets are transferred to a direct Indian subsidiary or Second Step Down Subsidiary in India, the transferor would not be liable for capital gains. Alternatively, it would not be able to claim capital losses for such transfer of capital assets.

Interestingly, while the AO had replaced the sale consideration with the average share price on the stock exchange, the ITAT had not commented on this issue as it became academic considering that the transaction could not be regarded as a 'transfer' for the purpose of capital gains tax.

However, one may wonder if such substitution of the sale consideration by the AO for the shares of a listed company can be upheld on merits in the appellate proceedings before the High Court in the event the judgment is appealed against, given that no such enabling provision exists for transfer of 'quoted shares' in the IT Act, unlike the existing provisions of section 50CA that apply to tax a transferor of unquoted shares on deemed fair value basis.

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com