Background

With the introduction of the circular on 'Resolution of Stressed Assets – Revised Framework' dated 12 February 2018 (RBI/2017-18/131 DBR.No.BP.BC.101/21.04.048/2017-18) (New Restructuring Framework), the Reserve Bank of India (RBI) officially kicked off an entirely new phase in its efforts to reform a banking system ridden with non-performing assets (NPAs). Up until now, the RBI's strategy had been heavily focussed on restructuring as the optimal solution – initially through the completely voluntary mechanism of Corporate Debt Restructuring (CDR), and later through the mandatory mechanism of the Joint Lenders' Forum (JLF) mechanism and several restructuring options that were offered to lenders under its umbrella. The Strategic Debt Restructuring (SDR) and Outside Strategic Debt Restructuring (OSDR) schemes aimed at replacing the promoter as a negative incentive to promote credit discipline, while the Scheme for Strategic Structuring of Stressed Assets (S4A) sought to strike a balance, providing the lenders with more customisable restructuring options with or without replacing the promoters at their discretion. The Flexible Structuring of Existing Long Term Project Loans (5:25 Scheme) was sought to address the stress associated with project financing and sought to give lenders more flexibility in dealing with the long commercial gestation periods that are typical to project finance as well as the asset-liability mismatch emanating at the time of origination of such loans. However, in spite of all the options, restructuring yielded up very few cases of successful recovery among the high-value defaults which comprised the bulk of NPAs in the system and the NPA profile of the banks was mounting up. In this environment, the Insolvency and Bankruptcy Code 2016 (IBC) became a sudden game-changer, providing a tightly time-bound statutory mechanism in which a company's debts would either be resolved to the satisfaction of a majority of its creditors, or the company wound up, in a matter of around six months. Since its inception in late 2016, it has yielded impressive results, with the RBI itself instructing banks to mandatorily refer the highest value NPAs to the relevant National Company Tribunal (NCLT) for the corporate insolvency resolution process (CIRP) under the IBC. With the introduction of the New Restructuring Framework, the RBI has now withdrawn all existing modes of restructuring (including CDR, SDR, OSDR, S4A, the 5:25 Scheme and the JLF mechanism altogether), leaving only a generic restructuring option which has to be successfully worked out in six months, or the mandatory invocation of the CIRP.

Salient Features of the New Restructuring Framework

- Identification of stressed assets and reporting requirements: Stressed assets continue to be categorised based on the earlier special mention accounts (SMA) categorisation. It is now mandatory for lenders to report all SMAs with an aggregate exposure of at least INR 5 crores to the Central Repository of Information on Large Credits (CRILC) on a monthly basis from the coming financial year, i.e., 1 April 2018. Additionally, defaults by borrowers having an aggregate exposure of at least INR 5 crores must be reported to CRILC on a weekly basis, beginning from 23 February 2018.

- Implementation of the

resolution plan: The New

Restructuring Framework mandates all lenders to have a

board-approved policy for the resolution of distressed assets. The

New Restructuring Framework preambles that Immediately upon default

by a borrower, the lenders must, either on their own or jointly

with other lenders, formulate a resolution plan (RP) to cure the

default.

An RP would be considered to be 'implemented' when:

- the corporate debtor is no longer in default with any lender;

- all documents relating to the RP have been executed and security (if any) created pursuant to the same; and

- in the event a new capital structure or changes in the terms and conditions of the loans have been contemplated, they must reflect in the books of the lenders and the corporate debtors.

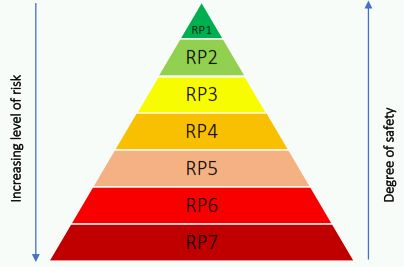

- Requirement of

independent credit evaluation (ICE):

The New Restructuring Framework makes obtaining ICE for accounts

where resolution is proposed and the aggregate exposure exceeds INR

100 crores (Large Accounts) of residual debt by credit rating

agencies. Accounts with aggregate exposure of INR 500 crores and

above require two ICEs from separate credit rating agencies. Each

ICE must be of at least RP4 as per the new rating system introduced

by the New Restructuring Framework, which correlates to increased

levels of risk as illustrated below:

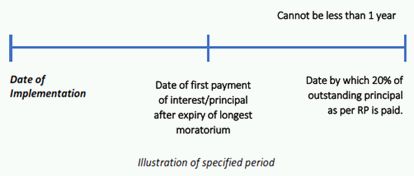

- Time Bound Resolution

Process: Under the New Restructuring

Framework, accounts with an aggregate exposure of INR 2000 crores

and above which are in default as on date, the RP must be

implemented within 180 days from 1 March 2018 (Reference Date).

Going forward, this timeline of 180 days would apply to all future

defaults in accounts of this exposure. If the RP is not implemented

within this period, the lenders are required to singly or jointly

initiate the CIRP within a further period of 15 days. Further, in

respect of large accounts, when an RP that involves restructuring

or change in ownership and is implemented within 180 days, then the

account must not be in default during the 'specified

period', which is the time period from the date of

implementation of plan up to the date by which at least 20% of the

outstanding principal debt as per the RP is repaid. The specified

period also extends to a period of at least one year from the date

of expiry of longest moratorium under the RP and commencement of

payment of interest and principal.

If there has been any default during the specified period, then the lenders are required to initiate CIRP within 15 days from the date of default.

The RBI has also stated that over a period of the next two years, it would adopt a similar policy to resolve all accounts from between INR 100 crore till INR 2000 crore as well. - Applicability: The New Restructuring Framework applies to all accounts from now onwards, including any account in respect of which restructuring under any previous scheme (including CDR, SDR, outside SDR and S4A) was invoked but not implemented.

Restructuring Norms – Key Highlights

- Upgrade in asset classification: Upgrade of the account's asset classification is now linked to the 'specified period'. Upon restructuring, the account would immediately be downgraded to an NPA and would be upgraded only if the specified period is reached without any default.

- Prudential Norms: Accounts of above INR 100 crore are required to be credit rated by a credit rating agency accredited with the RBI for at least investment grade (BBB- or better), while accounts of above INR 500 crore require two such ratings from separate credit rating agencies. The RBI has also clarified that if any reason more ratings than the minimum number are obtained, then each such rating must be at least investment grade in order for the account to be eligible for upgrade.

- Change in ownership: The New Restructuring Framework recognises change of control and transfer or acquisition of 26% of the paid-up share capital of the borrower entity to a new promoter as a means of restructuring and upgrading the account's asset classification. However, in addition to the above, the acquirer cannot be a person who is disqualified under Section 29A of the IBC, and the account must not be in default during the specified period in order to be eligible for the asset classification upgrade.

- Equity issue price during restructuring: The New Restructuring Framework provides separate valuation mechanisms for when, pursuant to an RP: (i) the lenders are issued shares for conversion of debt, and (ii) the lenders sell shares so acquired. For valuations which are arrived at on the basis of book value, if the audited balance sheet of the immediately preceding financial year is not available, the total book value would be deemed to be INR 1 (Indian Rupee One). The exemptions provided by the Securities Exchange Board of India (SEBI) from the applicability of the SEBI (Issue of Capital and Disclosure Requirements) (ICDR) Regulations 2009 and the SEBI (Substantial Acquisition of Shares and Takeovers) (SAST) Regulations 2011 for shares allotted or sold pursuant to a scheme of restructuring would continue to be available for shares issued or sold to a new promoter pursuant to an RP.

Comment

The New Restructuring Framework appears to be intended to supplement the IBC and designate CIRP as the optimal resolution mechanism for all high value loans in default. A key feature of the New Regulatory Framework is that it does not make it mandatory for all lenders to participate in the process of working out a unified RP which would become binding on all lenders upon receiving a majority assent. This would mean that unless the lenders unanimously consent to an RP and are able to implement it within the fairly aggressive timelines, the borrower would necessarily be subjected to the CIRP. While this move will definitely upset the status quo in the loan market over the next six months as banks rush to implement the timelines, it recognises the fact that the IBC has in its short history achieved much more than all the previous restructuring schemes put together, which did not see much success due to its voluntary nature and conflicting interests. In the longer run, the New Restructuring Framework would go a long way in instilling stringent credit discipline among both borrowers and lenders and potentially alter borrowing and lending patterns at a macroeconomic level.

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com