- within Finance and Banking, Family and Matrimonial and Environment topic(s)

- with readers working within the Technology, Utilities and Law Firm industries

1. INTRODUCTION

For over a decade now, Indian banks and non-bank entities have been issuing prepaid payment instruments ("PPls") after obtaining necessary approvals from the Reserve Bank of India (the "RBI") under the Payment and Settlement Systems Act, 2007 (the "PSS Act").

These entities have been operating within the framework of the RBl's "Policy Guidelines for Issuance and Operation of Pre-paid Payment Instruments in India", issued on April 27, 2009, and amended through a master circular dated July 1, 2016 (the "PPI Policy Guidelines").1

Taking into account the developments in the field and the progress made by PPI issuers, the RBI issued the "Master Direction on Issuance and Operation of Prepaid Payment Instruments"" (the "PPI Master Directions")2 on October 11, 2017, bringing in a new regime, replacing the PPI Policy Guidelines.

2. THE PPI MASTER DIRECTIONS

The PPI Master Directions intend to facilitate harmonization and interoperability of PPls and provide a framework for the authorization, regulation and supervision of entities operating payment systems for the issuance of PPls. The overall purpose is to foster competition and encourage innovation, while taking into account the security of transactions and systems, as well as customer protection and convenience.

The PPI Master Directions have introduced certain key amendments, which we highlight below.

3. KEY AMENDMENTS

3.1 Interoperability

At the outset, we should point out that the PPI Policy Guidelines were silent on the interoperability of PPls. By interoperability, we mean the ability of customers to use a set of payment instruments seamlessly with other users within the segment based on adoption of common standards by all providers of these services so as to make them inter-operable.

The PPI Master Directions propose to enable interoperability in phases. In the first phase, PPI issuers shall make all Know Your-Customer ("KYC") compliant PPls, issued in the form of wallets, interoperable amongst themselves through the Unified Payments Interface (the "UPI"), by April 11, 2018. In subsequent phases, interoperability shall be enabled between wallets and bank accounts through the UPI.

The interoperability for PPls issued in the form of debit or credit cards shall be enabled in due course.

The operational guidelines for the above will be issued separately.

3.2 Capital requirements to issue PPls

Under the PPI Master Directions, non-bank entities must have a minimum positive net worth of INR 5 crore (approximately USO 770,000) as per the latest audited balance sheet of the entity at the time of submitting the application.

Existing non-bank PP/ Issuers must have a minimum positive net worth of INR 15 crore (approximately USO 2.29 million) as on March 31, 2020 (audited balance sheet)3 and Non-bank entities having foreign investment must meet the capital requirements under the existing consolidated policy on foreign direct investment.

Previously, under the PPI Policy Guidelines, banks had to comply with the capital adequacy requirements prescribed by the RBI and these requirements remain unchanged. It's worth pointing out that previously, all other entities (other than banks and non-banking financial companies (NBFCs)) had to have a minimum paid-up capital of INR 5 crore (approximately USO 770,000) and a minimum positive net worth of INR 1 crore (approximately USO 154,000) at all times.

3.3 Other eligibility requirements

All entities, regulated by any of the financial sector regulators and seeking approval or authorization from the RBI under the PSS Act, must apply to the Department of Payment and Settlement Systems, RBI, Central Office, Mumbai, along with a 'No Objection Certificate' from their respective regulator, within 45 days of obtaining clearance.4 The memorandum of association of the applicant non-bank entity must cover the proposed activity of operating as a PPI issuer.

Previously, the PPI Policy Guidelines were silent on this aspect.

3.4 Types of PPls allowed

(a) Semi Closed PPls

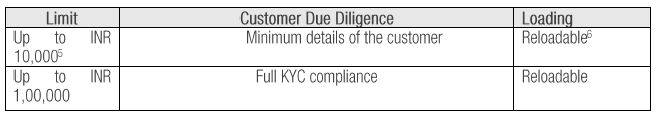

Semi-closed PPls issued by banks and non-banks under the PPI Master Directions must have the following features, depending on the applicable limits.

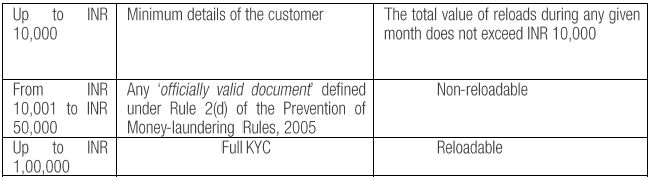

PPI issuers are required to convert their existing semi-closed and open system PPls issued to them (under the various categories permitted earlier) into any type of PPI permitted under the PPI Master Directions. This conversion must be completed on or before December 31, 2017. Previously, the PPI Policy Guidelines allowed the following types of semi-closed PPls.

![]()

(b) Other PPls

The PPI Master Directions only provide for 2 other types of PPls, which are gift instruments and mass transit systems. Previously, under the PPI Policy Guidelines, several types of other PPls were allowed, which included co-branded or pre-paid gift instruments, PPls to government organizations for the onward issuance to beneficiaries of government sponsored schemes and PPls to financial institutions for the credit of one-time or periodic payments by these organizations to their customers.

3.5 KYC compliance

Under the PPI Policy Guidelines, semi-closed PPls were required to complete customer due diligence to the extent of the money maintained in the PPI. Only PPls with up to INR 1,00,000 were required to be issued with full KYC compliance.

Under the new regime, full KYC compliance is mandated for all semi-closed PPls. This will be achieved in a phased manner. Semi-closed PPls of up to INR 10,000 can be issued after obtaining minimum details of the PPI holder. However, these PPls must be converted into KYC-compliant semi-closed PPls, within 12 months from the date of their issue.

3.6 Cross border transactions

Previously, the use of PPls for cross border transactions was not permitted under the PPI Policy Guidelines. Now, however, KYC-compliant, reloadable PPls issued by banks can be used in cross-border outward transactions (only for permissible current account transactions under the Foreign Exchange Management Act, 1999, such as the purchase of goods and services), subject to the adherence to norms governing such transacotins.7

Bank and non-bank PPI issuers, appointed as Indian agents of an authorised overseas principal, can issue PPls to beneficiaries of inward remittances under the 'Money Transfer Service Scheme' of the RBI.

3.7 Security, fraud prevention and risk management

Under the PPI Master Directions, PPI issuers are required to put in place an information security policy approved by their board of directors, for the safety and security of the payment systems operated by them. They are also required to review those security measures on an ongoing basis, but at least once a year, and in any event, after any security incident or breach, and before or after a major change to their infrastructure or procedures.

PPI issuers are also required to have a comprehensive framework to address safety and security concerns, risk mitigation and fraud prevention.

Previously, under the PPI Policy Guidelines, PPI issuers were required to have adequate information and data security infrastructure and systems for the prevention and detection of fraud.

4. INDUSLAW VIEW

The PPI Master Directions have streamlined the types of semi-closed PPls that PPI issuers can offer, and have also mandated that both types of semi-closed PPls complete the full KYC compliance process, albeit in a phased manner.

This, on one hand, will increase accountability, but on the other hand, may cause significant practical difficulties for PPI issuers, resulting in a slowdown of the PPI market, at least in the short term.

Another significant introduction under the PPI Master Directions is the clarification that interoperability will be enabled in a phased manner. Since the operational guidelines for the interoperability of PPls are yet to be released by the RBI, the overall impact of the PPI Master Directions remains uncertain. Once these guidelines have been released, we will provide a further update in due course.

Footnotes

1 "Master Circular Policy Guidelines on Issuance and Operation of Pre-paid Payment Instruments in India", available at https://www.rbi.orq.in/Scripts/NotificationUseraspx?ld=1051O&Mode=O

2 "Master Direction on Issuance and Operation of Prepaid Payment Instruments", available at https://rbi.org.in/Scripts/BSViewMasDirections.aspx?id=11142.

3 This must be reported to the RBI, along with a certificate from a chartered account, in the prescribed format, by September 30, 2020, failing which the entity may not be permitted to carry out this business. Thereafter, the minimum positive net worth of INR 15 crore shall be maintained at all times. Until then, existing PPI issuers must continue to maintain the capital requirements applicable to them at the time of their authorization.

4 A certificate of authorization shall remain valid for a period of 5 years from issue, and shall remain subject to review and cancellation.

5 These PPls shall be converted into KYC compliant semi-closed PPls (as the PP/sup to INR 1,00,000 after completing KYC of the PP/ holde0 within a period of 12 months from the date of issue of PPI, failing which no further credit shall be allowed in such PPls. However, the PPI holder will be allowed to use the balance available in the PPI.

6 The amount loaded in such PPls during any month shall not exceed INR 10,000 and the total amount loaded during the financial year shall not exceed INR 1,00,000.

7 PPOs cannot be used for any cross border outward fund transfer and/or for making remittances under the Liberalized Remittance Scheme.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.