- in India

- Supreme Court upholds the judgment of the Delhi High Court in DIT v. E-Funds IT Solution and Ors

- Rules that a fixed place PE is only created where the foreign entity has a physical location in the source state at its disposal, and over which it exercises control, and through which the business is conducted;

- If the services rendered by the entity in the source state are not provided to customers located in that state, there cannot be a service PE;

- MAP procedure and agreement are relevant, but cannot be primary basis for determination of a PE. Further they cannot be used as a precedent for subsequent years;

The Supreme Court of India ("Supreme Court") has upheld the ruling of the Delhi High Court in DIT v. E-Funds IT Solution1 (our Hotline on the ruling of the Delhi High Court is available here). By upholding the ruling, the Supreme Court in ADIT v. E-Funds IT Solution Inc2 has affirmed the application of internationally accepted principles in relation to the determination of a Permanent Establishment ("PE"), and has thus conclusively brought India's position in line with the standards approved by the Organization for Economic Co-operation and Development ("OECD") and the like.

BACKGROUND

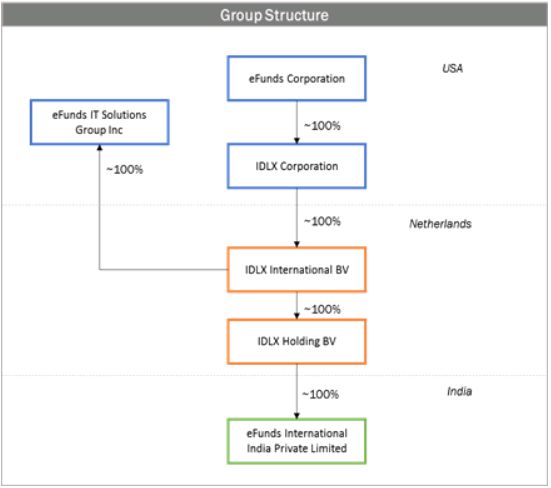

E-Funds Corporation ("E-Funds US") is a company incorporated in the United States of America and part of a group which is engaged in the business of electronic payments, ATM management service, decision support & risk management and similar professional services. The group structure relevant to the ruling is provided below:

E-Funds US and its group company, E-Funds IT Solutions Group Inc ("E-Funds IT US") entered into contracts with their clients in the US, for the provision of Information Technology Enabled Services ("ITES"). These contracts were assigned or sub-contracted to e-Funds International India Private Limited ("E-Funds India"), an indirect subsidiary of E-Funds US in India, for execution. Under the terms of the agreements between E-Funds India and the two US entities, E-Funds India provided support services to E-Funds US and E-Funds IT US, which in turn enabled them to render services to their clients. The Assessing Officer ("AO"), relying upon the Functions, Assets and Risks Analysis ("FAR Analysis") performed in relation to E-Funds US and E-Funds India, observed that:

- E-Funds US allowed E-Funds India to use its technology and infrastructure for provision of IT enabled services for free;

- E-Funds US even undertook marketing activities for E-Funds India and the latter did not bear any significant risks in the overall services;

In light of this, the AO concluded that:

- E-Funds India was a fixed place PE of E-Funds US and E-Funds IT US in India since the US entities had a fixed place in India through which they were carrying on their own business.

- Thus, the income attributable to E-Funds US and E-Funds IT US, which was not included in the income earned by E-Funds India, was to be taxed in India.

This view was upheld by the Commissioner of Income Tax (Appeals) ("CIT(A)") who concluded that in addition to a fixed place PE, there also existed a service PE and an agency PE. On appeal, the findings of CIT(A) in relation to the existence of fixed place PE and a service PE were affirmed by the Income Tax Appellate Tribunal ("Tribunal"). The Tribunal did not rule on the existence of an agency PE as arguments on that ground had not been furthered by the Income Tax Department ("Revenue"). The findings of all the above authorities were set aside by the Delhi High Court ("High Court"), which ruled that E-Funds India did not constitute a PE of E-Funds US or E-Funds IT US in India. Aggrieved by the ruling of the High Court, the Revenue preferred an appeal before the Supreme Court.

A number of questions were raised in the course of the proceedings and some of the key questions contained in the judgment are provided below.

ISSUES BEFORE THE SUPREME COURT

- Whether E-Funds India constituted a fixed place PE of E-Funds US and E-Funds IT US in India, under the India – US Tax Treaty?

- Whether employees seconded by E-Funds US to E-Funds India constituted a service PE of E-Funds US in India, under the India – US Tax Treaty?

- Whether E-Funds India constituted an agency PE of E-Funds US and E-Funds IT US in India, under the India – US Tax Treaty?

- Whether admissions made in the course of the Mutual Agreement Procedure under the India – US Tax Treaty could be used to justify the creation of PE?

RULING OF THE COURT

The Supreme Court, after hearing all contentions put forth by the parties, arrived at the following conclusions:

1. Determination of Fixed Place PE:

The Supreme Court relied on its previous decision in Formula One World Championship Ltd vs. CIT3 to hold that a fixed place would constitute a PE of a non-resident only when such fixed place was "at the disposal" of that non-resident. A fixed place would be treated as being "at the disposal" of a non-resident enterprise when that enterprise has right to use the said place and has control thereupon. Merely having access to such a place, for the purposes of business, would not suffice. Control should be of a considerable amount and usually control would be present where the foreign entity can employ the place of business at its discretion.

In the present case, the Supreme Court noted that neither E-Funds US nor E-Funds IT US had a physical premise in India at its disposal nor did they have control over use of E-Funds India's premises for their business.

It further observed that the finding of the lower authorities regarding the existence of a PE, was based mainly on the fact that the business of the US entities was being outsourced to a 100% subsidiary in India and this resulted in a PE. On this aspect, the Supreme Court affirmed the observations of the High Court to the effect that a subsidiary of a foreign parent carrying on business in the source State does not by itself create a PE in the source State. The High Court had observed that close association between the entities or interactions or transactions between them were not appropriate tests to determine the existence of a PE. It had further held that neither the assigning of a contract nor sub-contracting, nor provision of intangible software free of cost would be relevant in determining a PE. Moreover, even if the foreign entities had reduced their expenditure by transferring the business to the Indian subsidiary, it would not by itself create a fixed place PE.

All of these observations were affirmed by the Supreme Court, which noted that it was "fundamentally erroneous" to say that merely by contracting with a 100% subsidiary, a PE would be created. In any event, E-Funds India had only rendered back office support services to both US entities, and as such, it could not be said that the business of either US entity had been carried on through E-Funds India.

On that basis, the Supreme Court held that the outsourcing of work by E-Funds US and E-Funds IT US to India would not result in the creation of a fixed place PE of E-Funds US or E-Funds IT US in India.

2. Determination of Service PE

Article 5(2)(l) of the India – US Tax Treaty provides that a service PE would be constituted in India where a US enterprise furnished services within India through employees or other personnel. The Revenue had argued that personnel engaged by E-Funds India for the provision of support services to E-Funds US and E-Funds IT US were de facto working under the control of the US entities, and as such, constituted a service PE of the US entities in India.

On facts, the Court observed that none of the customers of E-Funds US or E-Funds IT US were located in India, or receiving services in India. As such, the primary requirement that services be furnished "within India" had not been satisfied. On that basis, the Court did not go into the question of control over the personnel engaged by E-Funds India. In any event, E-Funds India merely undertook auxiliary operations that facilitated the provisioning of the main service (i.e. ITES) by E-Funds US and E-Funds IT US abroad. As such it could not be stated that a service PE had been created in India in terms of the India – US Tax Treaty.

3. Determination of Agency PE

On the question of whether a E-Funds India could be said to constitute the agency PE of E-Funds US and E-Funds IT US, the Supreme Court agreed with the view of the High Court that since the Revenue had not raised the argument of agency PE before the Tribunal or the High Court, it could not be raised at the level of the Supreme Court. In any event, it was observed that an agency PE could only be constituted in terms of Article 5(4) of the India – US Tax Treaty. Since the tests under Article 5(4) had not been satisfied with respect to E-Funds India, no agency PE could be said to have been constituted.

4. Mutual Agreement Procedure

In the present case, the competent authorities of India and the US had initiated proceedings under the Mutual Agreement Procedure ("MAP") article of the India – US Tax Treaty4 and had entered into an agreement as to attribution of profits between the US entities and E-Funds India. The Revenue contended that the PE issue stood determined owing to certain statements made in the MAP Settlement Agreement to the effect that the US entities had PEs in India. It was argued that these statements should continue to remain applicable to the E-Funds Group as there had been no subsequent change in the factual position of the Group.

On this point, the High Court had concluded that MAP proceedings had been initiated on a without prejudice basis and that the existence of a PE was a question of law that needed to be determined purely on merits. Referring to Paragraph 3.6 of the OECD Manual on MAP Procedure, the Supreme Court observed that it was "very clear" that a MAP Settlement Agreement was time and case specific and could not be considered precedent for subsequent years. Thus, statements made in a MAP Settlement Agreement for a previous year could not be used in determining PE status for a subsequent year.

ANALYSIS

The decision of the Supreme Court has provided welcome clarity on the issue of determination of PE under international tax treaties, especially for multinationals that outsource business processes and services to related entities in India. The Revenue has been quite aggressive with the business process outsourcing industry and has in several instances over the last few years, alleged that Indian entities constitute PEs of foreign entities to whom outsourced services are being provided.

The Supreme Court has clarified that merely holding a subsidiary in India which provides services to the parent, would not constitute a fixed place PE. A subsidiary would have to conform to the principles required to be considered a PE, and only if they are satisfied, would it be considered as a PE. The Court reiterated the view taken in Formula One, and affirmed its application in cases of provision of services by subsidiaries under sub contracts, by stating that without the right to use physical premises and without control on their use, there can be no fixed place of business. This would effectively lead to the conclusion that even if the provision of services to the foreign entity related to core business activities, it would not lead to the creation of a PE, if the above test is not satisfied.

A key conclusion arrived at is that when determining a service PE, it is important to first ascertain whether services were furnished "within India". The Court held that if services are not furnished "within India", a service PE would not be established and other considerations on the establishment of a service PE would not need deliberation. Principally, a service PE is said to be created in a source State (here, India) when a non-resident enterprise (here, E-Funds US) furnishes services within that source State through employees located in that source State. Accordingly, a service PE will be created in terms of Article 5(2)(l) of the India – US Tax Treaty if a non-resident enterprise furnishes services: (i) through employees or other personnel; (ii) within India; and (iii) for a period exceeding that which is specified in the Treaty.

The present case concerned two sets of services: (a) back-office / support services furnished by E-Funds India to E-Funds US; and (b) services furnished by employees of E-Funds US deputed to E-Funds India. While services falling within category (a) should not result in the creation of a service PE of E-Funds US in India, the question of whether services falling within category (b) result in the creation of a service PE should, in light of the decision in DIT (International Taxation) v. Morgan Stanley and Co Inc,5 depend on the entity considered as having de facto control over deputed employees. In other words, a service PE would only have been created if E-Funds US was found to have been the de facto employer of the deputed employees, such that E-Funds US could be treated as having furnished services to E-Funds India through such employees. The Supreme Court did not deliberate over this, but chose instead to take a liberal view of what constitutes "within India". The Court observed that since all the customers of E-Funds US and E-Funds IT US were located outside India, no services were rendered within India by the deputed employees of E-Funds US and hence, no service PE could had been formed.

Nevertheless, the judiciary in India continues to give hope in an uncertain tax environment and the authoritative decision of the Supreme Court gives much welcomed clarity to several taxpayers who have faced and are facing absurd assessment orders containing findings as to existence of a PE.

The authors would like to thank Anuja Maniar (paralegal) for her assistance in preparing this Hotline.

Footnotes

1 [2014] 364 ITR 256 (Delhi).

2 Order dated October 24, 2017 in Civil Appeal 6082 of 2015. Available at http://supremecourtofindia.nic.in/supremecourt/2014/31382/31382_2014_Judgement_24-Oct-2017.pdf

3 (2017) SCC Online SC 474 ("Formula One").

4 Article 27, India – US Tax Treaty.

5 [2007] 292 ITR 416 (SC).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.