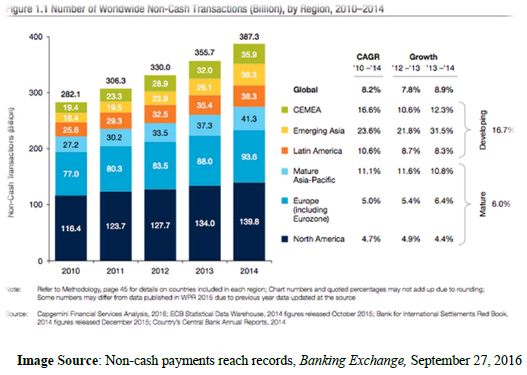

Commercial transactions, since the tail end of the last century, have been progressing towards the digital medium. Online retail, digital payments and availing of a plethora of services over the Internet was an inevitability, considering its rise and spread in the last 30-odd years. And non-traditional (i.e. cashless) payment methods have witnessed a meteoric rise over the last few years. According to the World Payments Report, 20171, cashless transaction volumes grew 11.2% in 2014-2015 to reach a worldwide figure of 433.1 billion USD! This was fuelled largely by emerging Asian markets, including China, India and Hong Kong, contributing 43.4% of the global market transaction volume. Global payments volume was also driven by the emerging markets, which contributed 30% of the total, and grew at a whopping rate of 21.6% in the past year, as compared to only 6.8% growth of mature established markets.

An electronic transaction is the sale or purchase of goods or services, conducted over computer-mediated networks; in which the goods and services are ordered over those networks, but the payment and the ultimate delivery of the good or service may be conducted on or off-line2.

However, along with the advent of digital transactions has come the curse of digital fraud. Customers newly introduced to cashless transactions and digital banking are often ignorant to basic precautions taken when transacting online, such as creating strong and secure passwords and PINs, not disclosing sensitive bank account information to third parties, avoiding accessing the Internet through public Wi-Fi networks, installing anti-virus and/or firewall protection, etc. Even banks and financial organizations are often seen to be woefully ill-equipped, in terms of having a secure data encryption system in place, adequate firewall protection, or secure storage of sensitive customer data. As a result, many people have fallen prey to hacking and digital fraud, with their accounts being compromised leading to significant losses. Credit card theft is also on the rise as petty criminals too become wise to the ways of profiting from cyber-crime.

The Government of India's flagship project "Digital India", envisions bringing government and public services, including the banking sector online, as far as possible, to increase convenience and accessibility to basic financial management for the majority of the population. Towards this, they have launched a number of schemes, such as Bharat Interface for Money (popularly known as BHIM), Unified Payments Interface (popularly known as the 'UPI'), Aadhar Enabled Payment System (popularly known as AEPS), etc.3 However, as has been seen with the recent massive hack of sensitive information of a number of banks4, customer confidence in online banking and digital transactions remains low.

To assuage customer uncertainty as well as to provide relevant useful operating guidelines to banks, the Reserve Bank of India (hereinafter referred to as 'RBI') has issued Circular DBR.No.Leg.BC.78/09.07.005/2017-185 on the subject of Customer Protection- Limiting Liability of Customers in Unauthorised Electronic Banking Transactions. This circular has revised the directions given to banks regarding the extent of customer liability in the case of unauthorized and/or fraudulent transactions given vide earlier Circular DBOD.Leg.BC.86/09.07.007/2001-02 dated April 8, 20026, and it's directives also supersede certain instructions contained in the RBI's Master Circular DBR.No.FSD.BC.18/24.01.009/2015-16 dated July 1, 20157, in light of the increased thrust on financial inclusion and customer protection measures, and the recent surge in customer grievances relating to unauthorized transactions conducted via their accounts or cards.

RBI Circular DBR.No.Leg.BC.78/09.07.005/2017-18: A Brief Overview

Objectives and Infrastructural Directives

The objective behind issuing revised directions regarding customer liability in cases of unauthorized transactions is that the systems and procedures in banks must be designed to make customers feel safe and increase their confidence in carrying out electronic banking transactions. The broad guidelines to ensure this are that banks must put in place:

- Appropriate systems and procedures ensure the safety and security of electronic banking transactions

- A robust and dynamic fraud detection and prevention mechanism

- A mechanism to assess the risks of unauthorized transactions and measure the liabilities arising therefrom

- Appropriate measures to mitigate such risks, and

- A system of continually and repeatedly advising customers on how to protect themselves from electronic banking and payments related fraud.

Banks are also directed to have their customers mandatorily register their mobile numbers for SMS alerts and, optionally, for email alerts regarding transactions made via their accounts or cards. Banks must also advise customers to report unauthorized transactions and stolen credit, debit or cash cards at the earliest, and informed that the longer they take to notify the bank, the greater the risk of loss/liability to the customer or bank. In order to assist customers to report loss or unauthorized transactions, banks must implement easily accessible and immediately responsive 24x7 notification systems, such as via website, SMS, phone banking, email, reporting to a home branch and a dedicated toll-free helpline. The time and date of every such notification must be recorded for the purpose of determining future liability (if any). The circular's direction also states that a bank is not obligated to provide any further facility than ATM cash withdrawals to any customer who does not provide her/his mobile number.

Limited Liability of the Customer

The circular lays down that the customer shall be entitled to zero liability in cases of:

- Contributory fraud/negligence/deficiency of the bank

- Third party breach, where the deficiency lies neither with the bank, nor with the customer, but lies elsewhere in the system, and the customer notifies the bank within 3 working days of receiving the communication from the bank regarding the unauthorized transaction.

The circular further lays down that the customer shall be limitedly liable in cases of:

- The customer's own negligence or contributory action, such as in a case where the customer has herself/himself shared payment credentials. In such a situation, the customer will bear the entire loss until s/he has reported the unauthorized transaction to the bank. Any loss occurring after the reporting, shall be borne by the bank.

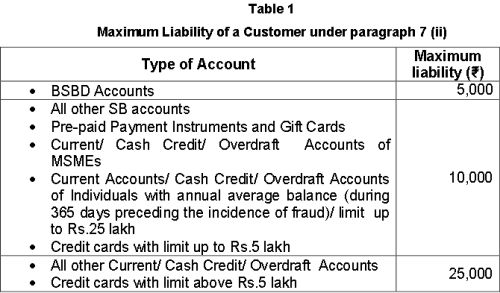

- Where the responsibility for the

unauthorized e-banking transaction lies neither with the customer

nor with the bank, but lies elsewhere in the system,

and where there is a delay of 4-7 working

days after receiving the communication from the bank

regarding the unauthorized transaction on the part of the customer

in notifying the bank of such a transaction. In such a situation,

the liability of the customer shall be limited to the transaction

value, or the amount specified in Table 1 of the circular

(reproduced below), whichever is lower.

- If the delay in reporting an unauthorized transaction, after receiving the communication from the bank regarding the unauthorized transaction, on the part of the customer exceeds 7 working days, the customer's liability shall be determined as per the bank's Board approved policy. The bank's Board approved policy must be easily and publicly accessible, and must be supplied to each individual customer at the time of opening of their accounts. The customers must be kept updated about any changes to such policy.

Timelines for Redressal

The RBI circular stipulates exact timelines within which the customer should expect her/his problem to be redressed and/or compensation to be made. These are as below:

- 10 working days - On being notified by the customer, the bank shall credit the amount involved in the unauthorized transaction to the customer's account within 10 working days from the date of such notification, without waiting for the settlement of insurance claim (if any). Banks are entitled to waive off any customer liability in cases of unauthorized electronic banking transactions, even in cases of customer's own negligence.

- 90 days - A complaint of unauthorized transaction must be resolved and any liability of the customer must be established within such time as stipulated by the bank's Board approved policy, but which in any case may not exceed 90 days from the date of receipt of the complaint, and the customer must be adequately compensated. Where the bank is unable to resolve the complaint, or determine the customer's liability (if any) within 90 days, then the compensation as outlined in the circular is to be paid to the customer.

Other Stipulations

The RBI circular also lays down that all banks must clearly define the rights and obligations of customers in cases of unauthorized transaction in specified scenarios and formulate/revise their customer relations policy with the approval of their respective Boards, and the directions laid down under the instant circular must be incorporated into any such policy. Such policy must be transparent, non-discriminatory, and lay down the methods and timelines under which the customers can expect to be compensated, and such policy must be prominently displayed, both in the bank's physical premises as well as on their website, detailing its grievance handling and escalation procedures.

The burden of proving customer liability in all cases of unauthorized transactions shall lie on the bank.

The banks shall put in place a suitable mechanism and structure for the reporting of all customer liability cases to their Boards or to one of their committees, and all such transactions shall be reviewed by the bank's internal auditors.

Conclusion

After the sudden note-ban exercise carried out by the Government on November 8, 2016, where 86% of India's circulated currency in the form of 500 and 1000 rupee notes became de-valued overnight, there was a 400-1000% rise in digital transactions carried out across the country8 as citizens suddenly found that their physical money had been rendered useless! The move was one in which most Indians finally came to terms with alternative modes of payment, such as using their cards online, netbanking and mobile wallets. With cash having lost its pedestal, and the newer generations preferring digital forms of cash-free transactions, the RBI's oversight on the risks inherent in the sphere of digital transactions is much needed, to maintain the customer's confidence and provide her/him a peace of mind.

Additional References:

The Consumer Protection Act, 1986

RBI Bulletins 2016, 2017 at https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx

https://www.worldpaymentsreport.com/

http://www.livemint.com/Money/KDDWmA7mjk3RnwY72hQ7nL/Going-digital-is-good-but-beware-of-risks.html

Footnotes

1. See https://www.worldpaymentsreport.com/sites/all/themes/wpr_theme/frontend/dist/images/other/infograph.jpg as accessed on July 26, 2017.

2. See https://stats.oecd.org/glossary/detail.asp?ID=758 as accessed on July 26, 2017.

3. See http://www.digitalindia.gov.in/di-initiatives as accessed on July 27, 2017.

4. See http://www.hindustantimes.com/business-news/this-is-how-3-2-million-debit-cards-in-india-were-compromised/story-BHsFrKK076cHYu4SRx2VjN.html as accessed on July 27, 2017.

5. See https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NOTI15D620D2C4D2CA4A33AABC928CA6204B19.PDF as accessed on July 27, 2017.

6. See https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=627&Mode=0 as accessed on July 27, 2017.

7. See https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9838&Mode=0 as accessed on July 27, 2017.

8. See http://timesofindia.indiatimes.com/business/india-business/400-1000-increase-in-digital-transactions-after-demonetisation-says-government/articleshow/55897291.cms as accessed on July 27, 2017.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.