- within Employment and HR, Family and Matrimonial, Media, Telecoms, IT and Entertainment topic(s)

- in India

Introduction

A mere mention of the word "bonus" can bring a smile to an employee . But the burden of cost and legislative compliances that the payment of bonus carries with it, has always spelt double trouble for employers. The payment of bonus is governed by the Payment of Bonus Act, 1965 (henceforth referred to as 'the Act'). Certain crucial criteria's of the Act were recently amended to make way for The Payment of Bonus Amendment Act, 2015 (henceforth referred to as the 'the Amendment Act'). The Amendment Act, on account of these changes, can be viewed as an employee friendly legislation but at the same time it has posed substantial interpretational and legislative complications for employers to decipher.

The changes pronounced in the Amendment Act are retrospective in nature and the lack of clarification from the Ministry of Labour on these changes has made deciphering the Amendment Act a problem for employers. A retrospective application of any employee welfare legislation is complicated for employers and makes doing business difficult than it already is. The Amendment Act brings about no change in the applicability criteria of the Act which makes this legislation challenging for smaller companies and start-ups. This month's insight is a capsule re-fresher on the Bonus Legislations that have a wide reaching impact across sectors and industries.

Applicability

The Act applies to every factory or establishment that employs 20 or more workers. Here, emphasis must be laid on the fact that the state governments are empowered to make the payment of bonus applicable to any factory or establishment that employs more than 10 workers. An example of such is the state of Maharashtra where the state levied bonus applicability has prevailed since 1983. The Maharashtra state government has made the payment of bonus applicable to any establishment that employs 10 or more workers. However, the Act cannot be made applicable to a factory or establishment that employs below 10 workers. It must be noted that establishments covered under the Act shall continue to pay bonus even if the number of employees falls below 10 at a later date.

Employee Eligibility: Revisions

For an employee to be eligible to receive bonus, the following conditions must be satisfied:

- The employee must have worked in the establishment for a period not less than 30 days; and

- The salary or wages paid to the employee must not exceed INR 21,000 per month.

The erstwhile limit of INR 10,000 has been changed to INR 21,000 under the Payment of Bonus Amendment Act, 2015.

The Amendment Act shall cover a larger number of employees who under the erstwhile Act were not mandatorily eligible for a bonus.

Salary: A maze of multiple interpretations

Challenges in interpreting the definition

Salary has been defined in Section 2(21) of the Act. The term salary expressly excludes remuneration for overtime work. Items such as allowances, bonuses and perquisites too are excluded from what would comprise of as salary for the purposes of payment of bonus. Here, employers may opine that the definition of salary, with its long list of seven specified exclusions, is subject to multiple interpretations, making it ambiguous. A conservative interpretation of the applicability provisions suggest that salary shall mean the basic salary plus dearness allowance. On the other hand, an aggressive interpretation of the definition of salary may lead to all items of salary being included for the purposes of calculation of bonus, except the seven exceptions.

It has conceptually agreed that any allowance that helps to cope up with the increased cost of living is considered as a dearness allowance. Employers may choose alternate terms, for example special allowance, to refer to such allowances for the purposes of their payroll processing. In such cases, it is in the spirit of the Act to consider the said allowance as a part of the salary for the purposes of applicability. This can be numerically illustrated as follows:

- Basic Salary of Employee Mr. A = INR 19,900 per month

- Special Allowance (paid to help cope with the increased cost of living) = INR 15,500 per month

A rigid interpretation of the Act shall result in it being applicable by virtue of the basic salary being less than INR 21,000 per month.

But if special allowances are conceptually identified as dearness allowances, the salary of Mr. A shall be INR 19,900 + INR 15,500 = INR 35,400 per month, thus exempting the company from paying him any legally mandated bonus.

When it comes to the payment of bonus, it has been agreed that such payments are inherently performance related. Employers in order to express their appreciation, may bring about an increase in the quantum of certain special allowances that are enjoyed by employees. This enables employees to enjoy higher salaries without changing their existing basic salary package. However, it will be a microscopic debate if the employer were asked to demarcate the following increments in allowances:

- Increments to reward performance; and

- Increments to help cope with increased cost of living.

Employees performing comparatively better than their counterparts may enjoy a higher performance bonus, an example of this can be found in the cases of sales and marketing executives. A numerical illustration has been given below on how payment of bonus becomes a compliance burden despite the employer's best intentions.

Company A is the manufacturer of reverse osmosis water purifiers. The company sees the National Capital Region (NCR) as a lucrative market, owing to the water salinity in that region. Mr. X and Mr. Y are sales executives at the same designation. Their salary package is given below:

- Basic salary: INR 10,000 per month

- Dearness allowance: INR 5,000 per month

- Performance bonus: INR 1,000 per unit sold

Mr. Y, an underperforming employee is unable to sell any units of the purifier, thus keeping his monthly take away salary at INR 15,000.

On the other hand Mr. X is highly motivated and is an efficient employee who manages to sell 100 units of the purifier. Hence, the take away salary for Mr. X was INR 115,000.

Despite the contrast in the level of performance, the employer shall be mandated by the Act to pay bonus to both the employees. The regulations and framework for the payment of bonus are not based on employee's efficiency and performance ability. Hence, even in the case of an under performing employees, the employer will have pay a minimum bonus as per the Act. However, if an employee is found to incite or participate in riots, fraud or sabotage, he shall be ineligible for bonus.

Monthly-Quarterly bonus payment - lack of clarity

Employers would like clarification on whether bonuses should be paid on a monthly or quarterly basis. The payment of monthly or quarterly bonus enables:

- Employees to have a higher in hand monthly salary; and

- The company to dispense of its liability of payment of bonus on a convenient monthly/quarterly basis.

It must be noted that there is no express disallowance for the payment of bonus on a monthly/quarterly basis.

The other two fold argument that goes against the payment of monthly/quarterly bonuses is:

- Companies cannot calculate the percentage of bonus to be paid at the beginning of the financial year.

- Any amount paid on a monthly basis shall form a part of salary, thus not being classified as bonus.

Allocable surplus, minimum bonus and maximum bonus

The Amendment

Section 12 of the Act prescribes that the bonus to be paid must be in proportion to the salary/wages of the employee. As per the Amendment Act, with effect from 1 April 2014 the following limits shall be adhered to:

The erstwhile limit of INR 3,500 has been changed to INR 7,000 under the Payment of Bonus Amendment Act, 2015

It must be noted that each state is empowered under the Minimum Wages Act, 1948 to prescribe minimum wages, which can be revised twice in a year. Hence, establishments operating in more than one state have to be wary of the challenge of adhering to different limit of minimum wages across state jurisdictions.

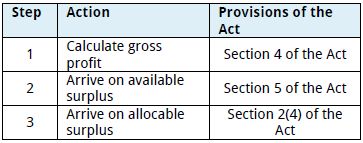

Allocable surplus

Under the Act, bonus is directly linked with profits. Allocable surplus acts as the yardstick in the payment of minimum or maximum bonus. A snapshot for arriving on allocable surplus is given below:

Minimum bonus

According to Section 10 of the Act, every eligible employee is entitled to receive an amount as minimum bonus which shall be higher than:

- 8.33% of salary or wages earned during the accounting year; or

- INR 100.

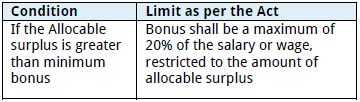

Maximum bonus (Section 11)

- The limit on maximum bonus prescribed by the Act is 20% of the salary/wage. However, the act does not spell this out explicitly.

- Employers may argue that the limit of 20% is the maximum limit. However employer's at their own discretion may pay a bonus at any rate below 20%, say 15% or 18% in the absence of any strict specification.

- However, as per the current interpretation of the law, if a practice is giving 20% of the salary is being paid as maximum bonus, the practice may be viewed by most employers as regressive.

Challenges and grey areas

The amendments with respect to employee eligibility and minimum bonus limits are retrospectively applicable from 1 April 2014. As of 13 June 2016, the Bombay High Court has stayed the retrospective operation of the Amendment Act. The Bombay High Court is not the only Court to have stayed this unfriendly retrospective pronouncement. Between January 2016 and April 2016, the High Court benches of Kerala, Karnataka, Madhya Pradesh, Allahabad, Gujrat and Punjab and Haryana too have brought about a stay on this retrospective operation. A brief summary of the challenges that may arise on the retrospective operation of the Amendment Act and other challenges that exist in the payment of bonus are discussed below:

- In India, accountancy is spread over

a period from April to March. As per the Act, an employer's are

mandated to give the bonus within eight months of the closure of

the accounting year. The challenges here are:

- Most employers may have concluded the finalisation of the allocable surplus applicable to them for Financial Year (FY) 2014-15.

- Eligible employees with salaries below INR 10,000 may have already received the bonus for FY 2014-15. The payment of bonus on a retrospective basis to employees who fall in the bracket of INR 10,000 – INR 21,000 in FY 2014-15.

- Employees may have received the usual double revision in minimum wages. The Ministry of Labour has not defined a base for the retrospective bonus calculations in these cases.

- In case of minimum wages, there continues to be an unaddressed area of doubt arising due to two separate legislations (centre and state) prescribing different limits on the same subject matter.

- There is a larger batch of employees to whom bonuses will have to be distributed due to increase in the limit from INR 10,000 to INR 21,000. This will impose a cost cum compliance burden on the employers. A retrospective re-calculation and distribution of bonus based on salary/wage structure that was effective in previous accounting periods will have to be dealt with for all present eligible employees.

- Employee attrition will be a cumbersome task to deal with. Tracing employees who have left the organisation for the purpose of payment of revised bonus applicable to the impact period will be a time-consuming task for all organizations. In the absence of any specific guidelines on untraceable employees, employers may consider transferring unclaimed bonus to the Labour welfare fund managed by the state government.

- There are disagreements in industry on whether allowances such as house rent allowance and various special allowances are a part of salary. The eligibility of employees for receiving bonus depends on the assumptions made by their employer.

- Micro, Small and Medium Enterprises

(MSMEs) and loss making companies will find it very challenging to

abide by the Amendment Act. The primary focus of any business

should be its core operations. Added compliances like these shall

increase the burden on these companies.

- Loss making start-ups have been granted a cushion of five years where they are not required to pay a bonus to their employees. However, from the sixth year, such companies

- will have to start paying a minimum bonus despite their loss making status.

- It may be viewed that to bring about ease of doing business in India, such companies should be granted a holiday from these cumbersome compliances. In cases where holidays cannot be granted, MSMEs and smaller start-ups should be granted a higher number of employees on whom the Act shall be applicable.

In Retrospect

Certain archaic prescriptions of the Act are reflective of the era of socio-communist philosophies that India's economy had adopted.

Retrospective application of any legislation is a major hurdle for businesses. Not only does it require re-work, but it also results in re-statement of vital results. Foreign companies will view such rulings as a hurdle in doing business. One of the primary agendas of the current government was to bring about ease of doing business. However, the revised limit of bonus shall place a heavy burden on the industry. Confusion shall prevail until there is a formal clarification from the Ministry of Labour on the multiple grey areas that are riddling the industry. One may hope that in the time to come, employee friendly legislations shall consider practicability and clarity in implementation from the employer's lens.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.