Recently, the Central Board of Direct Taxes (CBDT) issued a circular1 (Circular) clarifying the scope of the indirect transfer provisions (Vodafone Law) to address certain queries raised by stakeholders primarily focussed on fund structures.

The indirect transfer provisions were introduced vide the Finance Act, 2012, to negate the effect of the ruling of the Hon'ble Supreme Court in the Vodafone case2. Under the indirect transfer provisions, gains earned by a non-resident on the transfer of shares or interest in a foreign company or entity (Target) that derives "substantial value" from assets situated in India, are liable to tax in India.

The queries and clarifications primarily relate to the following aspects of law:

Definition of "substantial value"

A share or interest is deemed to derive its value substantially from assets situated in India if on the specified date, the value of such assets:

- exceeds INR 100 million; and

- represents at least 50% of value of all the assets owned by the Target.

Valuation Date

The "specified date" for the purposes of determining whether the Target derives "substantial value" from India is:

- the last date of the accounting period of the Target, prior to the date of transfer; or

- the date of transfer, if the book value of the assets of the Target as on the date of the transfer exceeds the book value of the assets of the Target as on the last day of the accounting period prior to the transfer, by 15%.

Exemptions

The indirect transfer provisions are not attracted in the following cases:

- where the transferor is a small shareholder (Small Shareholder) defined as a seller (along with its related parties), who does not have a right of management or control in the Target and the entity holding Indian assets (where the Target holds Indian assets indirectly) and does not hold more than 5% of the total voting power/ share capital/ interest (directly or indirectly) in the entity holding Indian assets; and

- transfer of shares of a foreign company, which derives substantial value from assets situated in India, as a result of amalgamation/ demerger of the foreign company, subject to fulfilment of certain conditions.

Clarifications regarding scope of the provisions

The CBDT constituted a working group, and on the basis of their comments, issued the Circular (in a question – answer format) dealing with various scenarios, the key aspects of which are captured below.

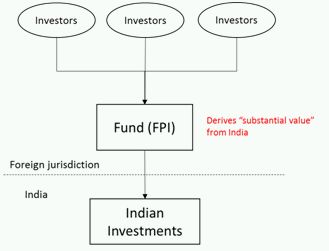

Illustration A: Fund set up as a pooling vehicle and registered as a Foreign Portfolio Investor (FPI) for undertaking investment in Indian securities

The Circular clarifies that, if in the above structure, the Fund redeems the units held by the Investors in the Fund, the indirect transfer provisions will apply unless the Investors are Small Shareholders.

A representation was also made that an exemption should be provided at the FPI level, in order to avoid double taxation which may arise because of levy of tax at two stages:

- on sale / transfer of the securities held in the Indian companies; and

- on redemption / transfer of the units held by the investors in the FPI.

However, the Circular clarifies that the Small Shareholder exemption is already available to small investors and is the only relevant exemption in this scenario.

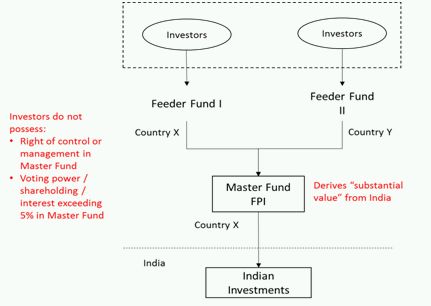

Illustration B: Master – Feeder Fund Structure

In relation to master-feeder fund structures, as depicted in the above illustration, the Circular clarifies that the indirect transfer provisions will not get attracted in the hands of Investors on transfer of their interest in the Feeder Funds if they are Small Shareholders.

However, the Circular is silent on the applicability of the indirect transfer provisions on transfer or redemption of interest held by the Feeder Funds in the Master Fund.

Illustration C: Nominee/ distributor structures

In relation to nominee/ distributor structures, as depicted in the above illustration, the Circular clarifies that the indirect transfer provisions will not get attracted in the hands of Investors on transfer of their interest in the nominee/ distributor where they are Small Shareholders in the nominee/ distributors.

However, the Circular remains silent on the applicability of the indirect transfer provisions in a situation where the nominee/ distributor being the registered unit holder/ shareholder in the Fund, transfers such units/ shares in the Fund. Thus, the issue as to whether the nominee will be looked through for the purposes of determining whether the Investors are Small Shareholders in the Fund is not specifically addressed.

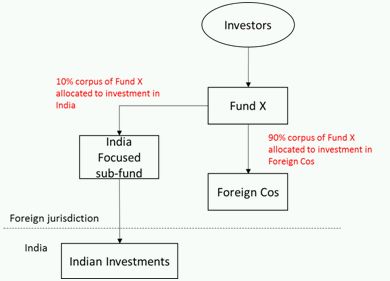

Illustration D: Investment via an India focussed sub-fund

In relation to investment via an India focussed sub-fund, as depicted in the illustration above, the Circular clarifies that the indirect transfer provisions will be attracted in relation to transfer of shares/ interest held by Fund X in sub-fund, irrespective of shareholding of ultimate Investors.

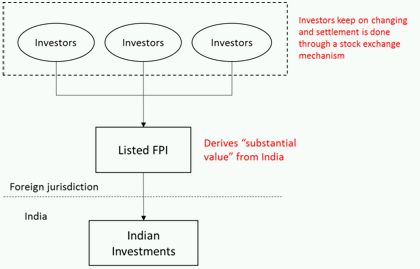

Illustration E: Offshore Listed FPI

In relation to investments made by an offshore listed fund as depicted above, in which the investors may keep changing on a daily basis, the Circular clarifies that the indirect transfer provisions will be attracted in the hands of Investors unless they are Small Shareholders.

Offshore Mergers:

Illustration F: Amalgamation of a foreign company (Fund P) deriving substantial value from assets in India, with another foreign company (Fund Q), as a result of which the shareholders of Fund P become the shareholders of Fund Q.

The Circular clarifies that currently, in case of amalgamation of a foreign company, deriving substantial value from assets situated in India, the exemption is only available to the amalgamating foreign company and does not extend to the shareholders of the amalgamating company. Thus, the transfer at shareholder level, will attract the indirect transfer provisions.

Illustration G: Amalgamation of a foreign non-corporate entity that derives substantial value from India, with another foreign non-corporate entity.

The Circular clarifies that currently the exemption is available only in case of amalgamation of corporate entities. In absence of any specific provisions, amalgamation of a foreign non-corporate entity deriving substantial value from assets situated in India, will attract the indirect transfer provisions.

Specified Date:

Illustration H: Target derives substantial value from India on the last day of its accounting period prior to transfer of its shares, but does not derive substantial value from India as on the date of the transfer itself. Book value of assets of the Target as on the date of transfer, does not exceed by 15% the book value of its assets as on the last of day of its accounting period, prior to the date of transfer.

The Circular clarifies that in such a situation, the indirect transfer provisions will apply even if the Target does not derive substantial value from India as on the date of the transfer of its shares. If only the valuation as on the transfer date is considered, that would result in an abuse of law.

Other Representations:

In addition to the queries / clarifications stated above, following representations were also made:

- Increase in INR 100 million threshold for determining whether the Target derives substantial value from assets situated in India;

- Increase in 5% threshold for availing the Small Shareholders exemption;

- Exclusion for FPIs regulated and listed on recognized stock exchanges from the indirect transfer provisions;

- Extension of exemption currently available on internal restructuring (mergers/ demergers) of corporate entities, to non-corporate entities as well;

- Specified date for the purpose of determining the applicability of indirect transfer provisions to be considered as date of transfer of assets, and not the last date of the accounting period prior to the date of transfer;

- Practical challenges for the Indian public limited companies listed on a recognized stock exchange in India in complying with the reporting requirements under the indirect transfer provisions, given the volume and frequency of investments made by offshore funds, investors in which may keep changing frequently; and

- Relief be provided to FPIs from withholding tax requirements, or increase in threshold for enforcing the withholding tax requirement, given their operational structures and challenges in complying with the provisions.

However, the CBDT in the Circular, has broadly stated that the current provisions are reasonable and appropriate, and relaxation of the same would not be feasible.

KCO Comments:

The key takeaway from the clarifications provided by the CBDT, is that while interpreting the indirect transfer provisions, one must comply with the strict letter of the law, and the provisions should not be interpreted in a manner wider than what is specifically stated, even if there are practical challenges.

One must note that most of the concerns raised by the stakeholders can be best addressed by legislative amendments to the substantive provisions and that the government could not have resolved those through a clarificatory circular or delegated rule making authority. Thus, it is hoped that the government in its upcoming budget (to be presented in February 2017), while recognising the fairness of some of these demands, introduces appropriate amendments to ensure a non-adversarial and a clearer tax regime. Such a move would go a long way in bolstering the investor confidence and may provide a fillip to the Indian securities market.

Footnotes

1 Circular No 41 of 2016

2 Vodafone International Holdings BV v Union of India [2012] 341 ITR 1

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com